December 13th, 2019 - Issue #992

In This Issue

1. Trading Webinar: 7 Most Effective Trading Setups

2. Hot Market Report: Live Cattle Futures

3. Economic Calendar

Roll Over Notice: Front month for indices is now March! ESH20, NQH20 etc.

1. Trading Webinar: 7 Most Effective Trading Setups

Thu, Dec 19, 2019 10:00 AM - 11:00 AM PST

In this session, we’ll take a look at what makes a good trading setup, then we’ll look at Peter's top 7 trading setups.

SPACE is LIMITED, so reserve your space now!

For each trading setup, we’ll consider the following

- What the setup is

- Which market conditions it works best in

- Why the setup works

- Who is on the wrong and right side of the trade if it works out

- How to identify it’s working out

- How to identify if it’s not working out

- Typical Risk:Reward

What you will see is that although the setups are different, there’s lots of things in common with them. Instead of learning 7 different skills, we are taking a few skills and applying them in different scenarios.

With these 7 setups, you would certainly expect to find multiple trades per day on most market, but patience is still key because we want to get in when conditions are just right.

For those looking for new setups or those looking to improve the way they confirm/manage their existing setups – this webinar is for you.

SPACE is LIMITED, so reserve your space now!

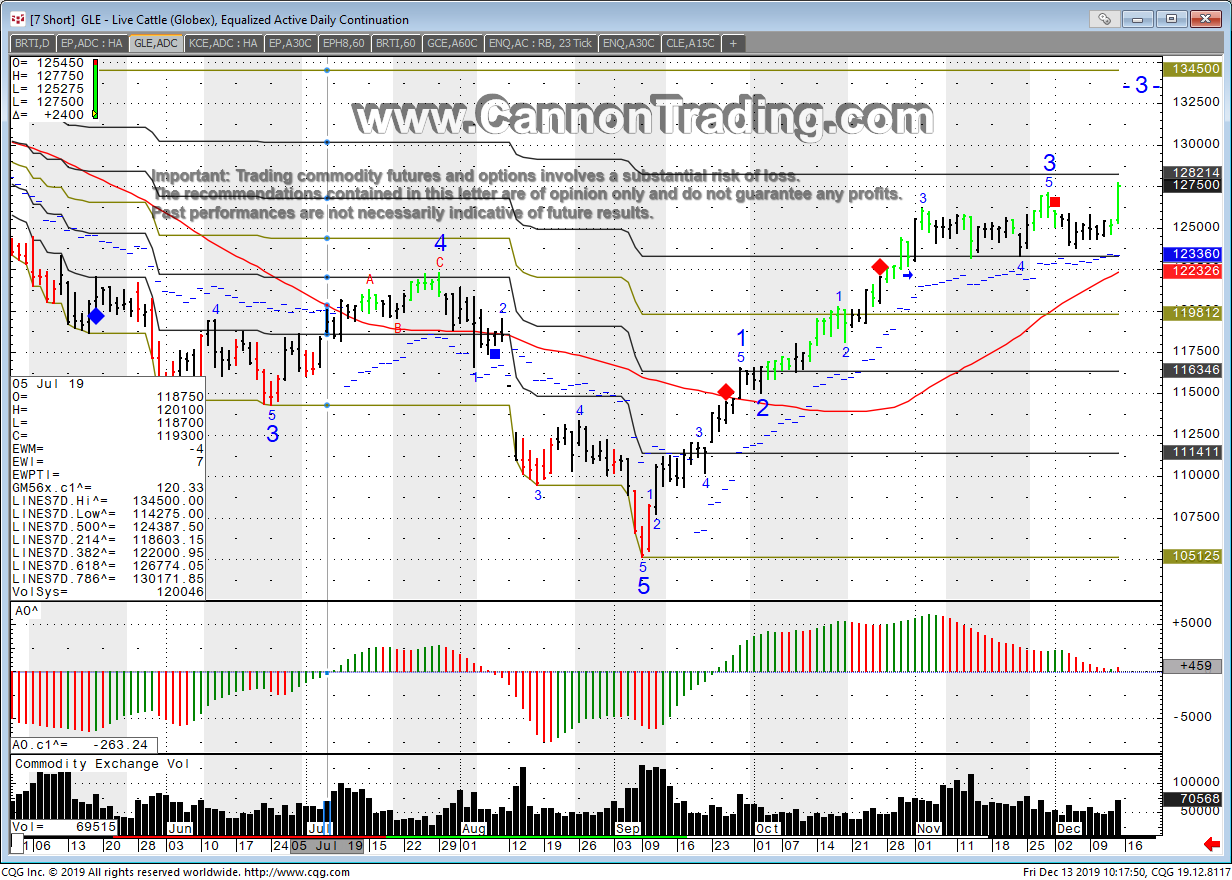

2. Hot Market Report: Live Cattle Futures

By Mark O'Brien & John Thorpe, Senior BrokersClick on image below to enlarge

This week’s commentary looks at a market that’s less impacted by the U.S. / China trade negotiations than most.

China is the world’s largest importer of beef, but their demand for U.S. beef is practically nil and the ongoing negotiations don’t look to be changing that state of affairs.

This should prompt traders to focus on the more telling seasonal tendencies for cattle this time of year – and more tellingly, this year’s irregularities. Cattle slaughters tend to be at or near their low point coming into December. Cattle feedlots are typically in the process of growing their inventory from September into November as the corn harvest introduces plentiful feed supplies and favorable pricing. It typically takes until March-April for animals to reach market weight.

In the face of this relative constancy, this year’s corn harvest is – typically close to or across the finish line – is still in progress and slowing. Right in front of the heart of winter when beef demand is strongest, beef production is down 8% year over year.

To access a free trial to the ALGOS shown in the chart visit and sign up for a free trial for 21 days with real-time data.

Live Cattle Specs

Hours: 8:30 AM to 1:05 PM Central Time ( no night market)

Margins: $2200 initial, $1500 Maint.

Point Value: full point = $400 ( Example: 127.80 to 128.80 ). Min fluctuation is 0.025 = $10 ( Example: 127.80 to 127.825)

Some of the basic fundamentals to keep in mind when you are considering a trade in the live cattle market:

1. Demand for beef and consumer preferences which continually shifts, for example, there is currently a move toward more flavor, less select cuts and more choice and prime cuts .

It remains to be seen the impact Bio”meats” will have on Beef demand.

2.The Economy and personal income also matter and impact the demand for Beef products.

3. International Trade and the value of the U.S. dollar. America's livestock industries are dependent on export markets - 20% of U.S. pork, 16% of US chicken and 10% of all beef currently is exported. China only represents 1% of current beef sales (pre Phase 1 tariff deal)

4. Maintaining healthy herds (mad cow, bovine encephalitis )

5. Many of our foreign customers are experiencing rising incomes among their population, which means they are likely to increase the protein in their diets. A limiting factor for expanded exports of U.S. livestock will be the value of the U.S. dollar. A strong dollar is generally negative for exports and analysts expect the dollar to remain strong against foreign currencies in the near future.

6. Land use. (our grazing lands have been shrinking over the past 50 years, few lands to graze , more competition for the grasslands over a smaller geographical area)

7. The cost of other proteins relative to Beef, chicken and pork.

8. Seasonality, demand is highest during the “grilling season”

Government reports “Cattle on Feed” after grazing, most beef get Wheat, Barley, Corn, Oats and Lupins(peas)in feedlots to finish them out to full adult weights.

Our brokers here at Cannon will be happy to chat about the Cattle market, other meats and grains, options, futures spreads and much more!

Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 12/13 Fri |

7:30 AM CST - Export(ex-ag) & Import(ex-oil) Prices(Nov)

7:30 AM CST - Retail Sales(Nov) 7:30 AM CST - Retail Sales Ex-Auto(Nov) 9:00 AM CST - Business Inventories(Oct) |

LT: Dec Wheat(CBT)

Dec Corn(CBT) Dec Oats(CBT) Dec Soymeal,Soyoil(CBT) Dec Cocoa(ICE) Dec Lean Hogs(CME) Dec Lean Hogs Options(CME) Jan Coffee Options(ICE) |

| 12/16 Mon |

7:30 AM CST - Empire Manufacturing(Dec)

11:00 AM CST - NOPA Crush 3:00 PM CST - Net Long-Term TIC Flows(Oct) |

LT: Dec Currencies(CME)

Dec Eurodollar(CME) Dec Mx Peso(CME) Dec US Dollar Index(ICE) Dec Eurodollar Options(CME) Dec US Dollar Options(ICE) Jan Crude Lt Options(NYM) Jan Sugar-11 Options(ICE) |

| 12/17 Tue |

7:30 AM CST - Housing Start & Building Permits(Nov)

8:15 AM CST - Industrial Prod & Capacity Util(Nov) 3:30 PM CST - API Energy Stocks |

LT: Dec Canadian Dollar(CME)

|

| 12/18 Wed |

6:00 AM CST - MBA Mortgage Index

9:30 AM CST - EIA Petroleum Status Report 2:00 PM CST - Dairy Products Sales |

LT: Dec Coffee(ICE)

Jan Platinum & Palladium Options(NYM) |

| 12/19 Thu |

7:30 AM CST - USDA Weekly Export Sales

7:30 AM CST - Initial Claims-Weekly 7:30 AM CST - Current Account Balance(Q3) 7:30 AM CST - Philadelphia Fed Index(Dec) 9:00 AM CST - Existing Home Sales(Nov) 9:00 AM CST - Leading Indicators(Nov) 9:30 AM CST - EIA Natural Gas Report 3:30 PM CST - Money Supply |

LT: Dec 10 Year Notes(CBT)

Dec Bonds(CBT) Dec S&P 500(CME) Jan Crude Lt(NYM) Dec S&P 500 Options(CME) |

| 12/20 Fri |

7:30 AM CST - Personal Income & Spending(Nov)

7:30 AM CST - PCE & Core PCE Price Index(Nov) 7:30 AM CST - GDP-Third Estimate(Q3) 7:30 AM CST - GDP Deflator-Third Estimate(Q3) 9:00 AM CST - Univ of Michigan Consumer Sentiment-Final(Dec) 2:00 PM CST - Cattle On Feed |

LT: Dec E-Mini Dow(CME)

Dec E-Mini S&P 500(CME) Dec E-Mini NASDAQ(CME) Dec Russell(CME) Dec E-Mini Dow Options(CME) Dec E-Mini S&P 500 Options(CME) Dec E-Mini NASDAQ Options(CME) Dec Russell Options(CME) Jan Canola Options(CBT) Jan Cotton Options(NYM) Jan Orange Juice Options(ICE) |

| 12/23 Mon |

9:00 AM CST - New Home Sales(Nov)

2:00 PM CST - Cold Storage 2:00 PM CST - Hogs & Pigs |

FN: Jan Crude Lt(NYM)

|

| 12/24 Tue |

CHRISTMAS EVE

7:30 AM CST - Durable Orders(Nov) 7:30 AM CST - Durable Goods-Ex Transportation(Nov) |

|

| 12/25 Wed |

CHRISTMAS DAY

|

|

| 12/26 Thu |

7:30 AM CST - Initial Claims-Weekly

10:00 AM CST - EIA Petroleum Status Report 2:00 PM CST - Dairy Products Sales 3:30 PM CST - Money Supply |

LT: Jan Copper Options(CMX)

Jan Gold & Silver Options(CMX) Jan Natural Gas Options(NYM) Jan RBOB & ULSD Options(NYM) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!