May 8th, 2020 - Issue #1005

In This Issue

1. Trading 101: 5 Big Mistakes Beginners Should Avoid Making

2. Hot Market Report: Bitcoin Futures Almost Double in 2 Months

3. Economic Calendar

Get Real Time Updates via Twitter!

1. Trading 101: 5 Big Mistakes Beginners Should Avoid Making

Trading futures is a tough business, but if you are one of the very few that can succeed, this could be a lucrative business as well

Ilan Levy-Mayer | June,2017 |SmallCapPowerI have seen quite a bit since I became a broker in 1998. Some war stories to share about the markets, some crazy moves and much more in between. I was trading futures with clients on the sad Sept. 11th 2001 day when the planes hit and the markets were plunging before they were closed for almost a week. I witnessed the meat contracts making limit up and limit down moves over the years and much more…..

As a commodity broker I have observed MANY traders, many of them were new traders, and this allows me to share with you some valuable observations I hope will help you start your futures trading journey on a much smoother road than most.

Here are the FIVE CRUICIAL MISTAKES you need to avoid!

Don't wait... sign up NOW!

Read The Full Article Now

Cannon Trading respects your privacy and will never give this information to a 3rd party.2. Hot Market Report: Bitcoin Futures Almost Double in 2 Months

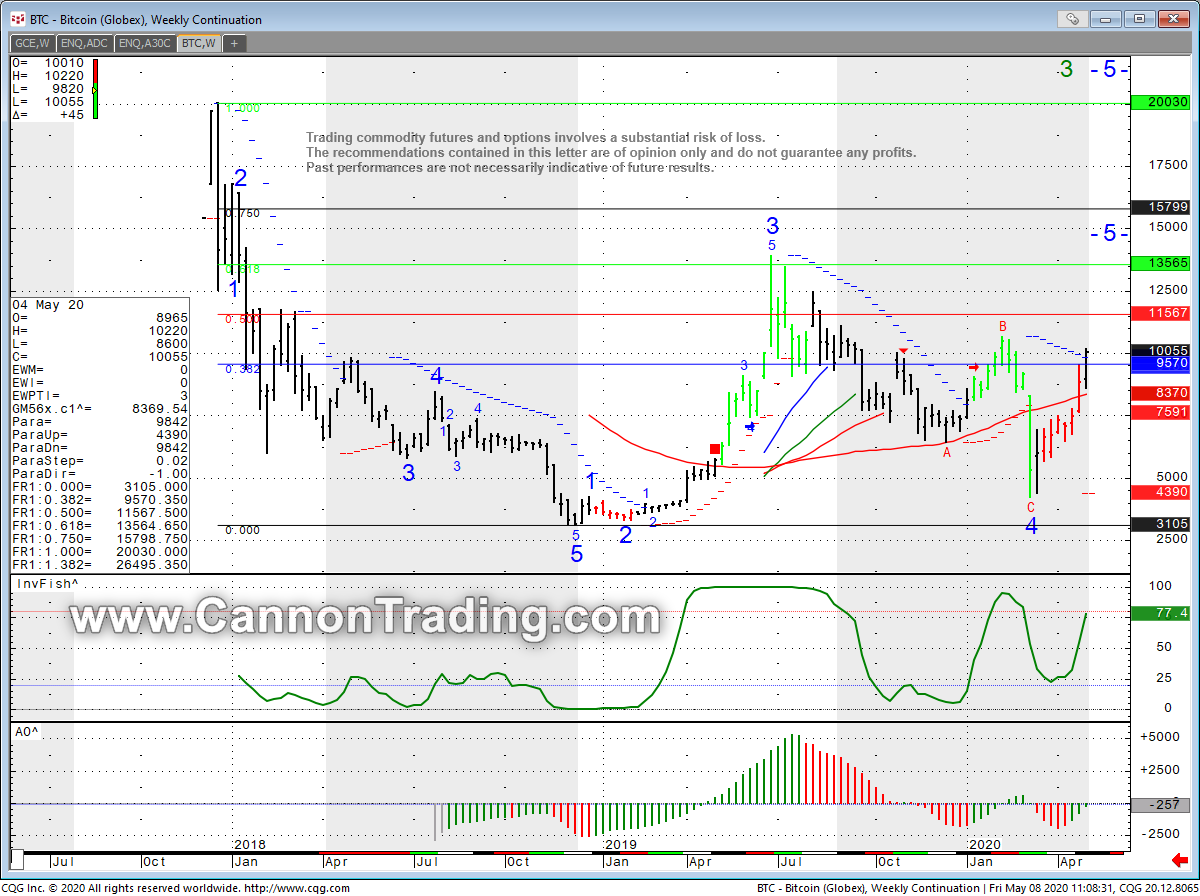

By Joe Easton, Senior BrokerClick on image below to enlarge

This week’s highlighted Market is Bitcoin Futures.

Bitcoin is categorized as a member of the Indices sector of commodities futures contracts, along with the E-mini and Micro E-mini indices, the VIX, foreign indices such as the German DAX, the U.K.’s FTSE and others. It’s considered an index because it’s based on several bitcoin spot price settlements at their respective bitcoin exchanges. The futures contract is traded on the CME exchange.

At press time, the current front month for the Bitcoin futures contract is May (month code symbol: K). The May futures contract is currently trading ±$10,065, breaking the $10,000 threshold for the first time since February.

In the news helping the rally, billionaire hedge fund manager Paul Tudor Jones called Bitcoin the “fastest horse,” in his efforts to hedge against inflation and that his Bitcoin holdings may now be as much as a low single-digit percentage of the futures contracts’ entire assets.

Stay tuned for next week to see where we open Monday morning.

Weekly chart of Bitcoin Futures for your review from this morning ( May 8th, 2020).

Bitcoin futures is usually volatile enough for both day trading and swing trading but volume is still on the lower side. Before trading Bitcoin futures you need to be approved by your broker and sign additional risk disclosures. The information in this article is for educational purposes only.

Access a free trial to our FREE platform for 28 days with real-time data.

Bitcoin Futures Specs

Hours: 05:00 PM previous day to 4:00 PM Central Time

Margins: $20000 initial, $18000 Maint. ( as of the date of this newsletter)

Point Value: Outright: 5.00 per bitcoin=$25.00

Settlement: Cash Setteled

Months: Monthly contracts listed for 6 consecutive months and 2 additional Dec contract months. If the 6 consecutive months includes Dec, list only 1 additional Dec contract month.

Weekly Options:NO

Some of the basic fundamentals to keep in mind when you are considering trading Bitcoin Futures for this matter:

1. Correlation to US dollar

2. Correlation to US Stock Market

3. US Fiscal policy

4. Relation to interest rates

5. Most important...value of the different Cryptocurrenceis

Our brokers here at Cannon will be happy to chat about Bitcoin Futures, options, futures spreads and much more!

Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 05/08 Fri |

7:30 AM CDT - Nonfarm Payrolls(Apr)

7:30 AM CDT - Ave Workweek & Hourly Earnings(Apr) 7:30 AM CDT - Unemployment Rate(Apr) 9:00 AM CDT - Wholesale Inventories(Mar) |

LT: May Orange Juice(ICE)

May Canadian Dollar Options(CME) May Currencies Options(CME) May Mx Peso Options(CME) May US Dollar Index Options(ICE) Jun Coffee Options(ICE) |

| 05/11 Mon |

3:00 PM CDT - Crop Progress

|

|

| 05/12 Tue |

7:30 AM CDT - Core CPI & CPI(Apr)

11:00 AM CDT - WADSE Report & Crop Production 3:30 PM CDT - API Energy Stocks |

|

| 05/13 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Core PPI & PPI(Apr) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales |

LT: May Cocoa(ICE)

|

| 05/14 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Export(ex-ag) & Import(ex-oil) Prices(Apr) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

LT: May Canola(CBT)

May Wheat(CBT) May Corn(CBT) May Oats(CBT) May Rough Rice(CBT) May Soybeans,Soymeal,Soyoil(CBT) May Lean Hogs(CME) May Lean Hogs Options(CME) Jun Crude Lt Options(NYM) |

| 05/15 Fri |

7:30 AM CDT - Empire State Manufacturing(May)

7:30 AM CDT - Retail Sales(Apr) 7:30 AM CDT - Retail Sales-Ex Auto(Apr) 8:15 AM CDT - Capacity Util & Industrial Prod(Apr) 9:00 AM CDT - Business Inventories(Mar) 9:00 AM CDT - Univ of Mich Consumer Sent-Prelim(May) 11:00 AM CDT - NOPA Crush 3:00 PM CDT - Net Long-Term TIC Flows(Mar) |

LT: May Lumber(CME)

May Nikkei Options(CME) May Eurodollar Options(CME) Jun Orange Juice Options(ICE) Jun Sugar-11 Options(ICE) |

| 05/18 Mon |

9:00 AM CDT - NAHB Housing Market Index(May)

3:00 PM CDT - Crop Progress |

FN: May Lumber(CME)

LT: May Eurodollar(CME) May Coffee(ICE) May Mx Peso(CME) |

| 05/19 Tue |

7:30 AM CDT - Building Permits & Housing Starts(Apr)

3:30 PM CDT - API Energy Stocks |

LT: Jun Crude Lt(NYM)

|

| 05/20 Wed |

6:00 AM CDT - MBA Mortgage Index

9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Milk Production 2:00 PM CDT - Dairy Products Sales |

LT: Jun Platinum Options(NYM)

Jun Palladium Options(NYM) |

| 05/21 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Philadelphia Fed Index(May) 9:00 AM CDT - Existing Home Sales(Apr) 9:30 AM CDT - EIA Natural Gas Report 2:00 PM CDT - Cold Storage 3:30 PM CDT - Money Supply |

FN: Jun Crude Lt(NYM)

LT: May Feeder Cattle(CME) May Feeder Cattle Options(CME) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!