Nov 15th, 2019 - Issue #990

In This Issue

1. Options Trading 202: Selling Options and Options Spreads

2. Hot Market Report: Gold Futures Testing Long Term Support

3. Economic Calendar

Get Real Time Updates via Twitter!

1. Trading 202: Futures Options Writing

Have you ever wondered who sells the futures options that most people buy? These people are known as the option writers/sellers. Their sole objective is to collect the premium paid by the option buyer. Option writing can also be used for hedging purposes and reducing risk. An option writer has the exact opposite to gain as the option buyer. The writer has unlimited risk and a limited profit potential, which is the premium of the option minus commissions. When writing naked futures options your risk is unlimited, without the use of stops. This is why we recommend exiting positions once a market trades through an area you perceived as strong support or resistance. So why would anyone want to write an option? Here are a few reasons:

- Most futures options expire worthless and out of the money. Therefore, the option writer is collecting the premium the option buyer paid.

- There are three ways to win as an option writer. A market can go in the direction you thought, it can trade sideways and in a channel, or it can even go slowly against you but not through your strike price. The advantage is time decay.

- The writer believes the futures contract will not reach a certain strike price by the expiration date of the option. This is known as naked option selling.

- To hedge against a futures position. For example: someone who goes long cocoa at 850 can write a 900 strike price call option with about one month of time until option expiration. This allows you to collect the premium of the call option if cocoa settles below 900, based on option expiration. It also allows you to make a profit on the actual futures contract between 851 and 900. This strategy also lowers your margin on the trade and should cocoa continue lower to 800, you at least collect some premium on the option you wrote. Risk lies if cocoa continues to decline because you only collect a certain amount of premium and the futures contract has unlimited risk the lower it goes.

To read the rest of the article as well as power point presentation along with a summary table instantly, please fill out the form below.

Finish Reading Article

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Hot Market Report: Gold Futures Testing Long Term Support

By John Thorpe, Senior BrokerClick on image below to enlarge

This week’s highlighted Market is Gold. Gold is part of the Precious Metals sector along with its brothers Platinum, Palladium, Silver and Copper.. All traded on the COMEX and NYMEX exchanges.

This week’s highlighted Market is Gold. Gold is part of the Precious Metals sector along with its brothers Platinum, Palladium, Silver and Copper.. All traded on the COMEX and NYMEX exchanges.

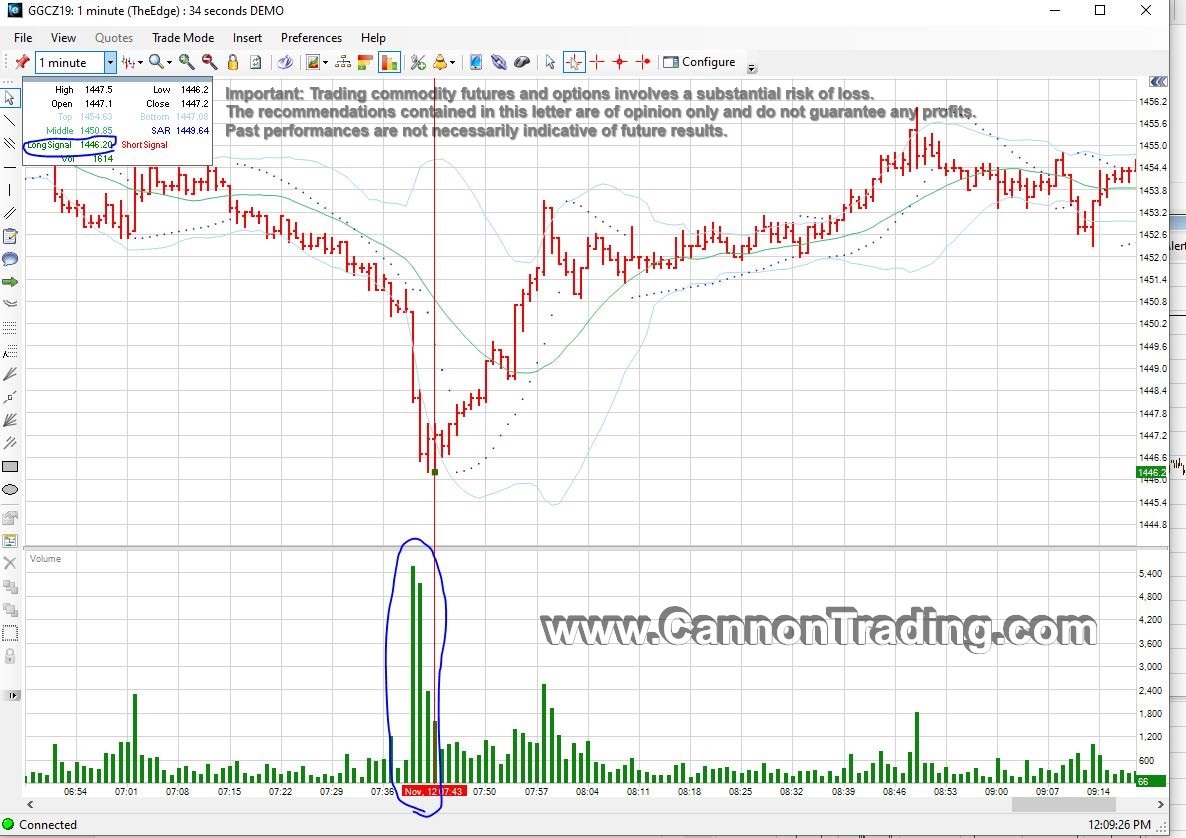

The work the Gold Market put in from June 21st to July 31st to create a solid area of support between 1398.00 per oz and 1446.00 per oz. was defended this week on Tuesday when we saw a waterfall selloff stopped dead in its tracks by a huge surge in volume (both sides of the market) during U.S. pit session trading hours. The low of the move was 1446.20 basis the December 2019 contract. This consolidation pennant from early summer appears to have created strong price support and will likely be revisited again to test it's resolve.

1 minute chart from Nov. 12th 2019 below.

This chart was prepared using E-Futures Int'l software, which you can demo for 28 days with realtime data.

Gold is a very liquid market with a relatively good volatility ( can work for you and against you....). Different behavior and

personality than stock indices. I like using breakout methods as well as "counter trend" techniques as this market "fear and greed index" is high on my list.

It goes without saying that gold is an excellent market for options, swing trading and long term trading as well with 23 hours trading, strong volume and excellent liquidity.

In addition traders can use both mini Gold and MICRO gold.

To access a free trial to the ALGOS shown in the chart, INCLUDING THE NEW LNR signal which you can see in the chart as a green square, visit and sign up for a free trial for 21 days with real-time data.

GOLD Futures Specs

Hours: 05:00 PM previous day to 4:00 PM Central Time

Margins: $4440 initial, $4000 Maint. ( as of the date of this newsletter)

Point Value: full point = $100 ( Example: 1285.0 to 1286.0 ). Min fluctuation is 0.1 = $10 ( Example: 1285.5 to 1285.6)

Settlement: Physical Delivery

Months: February, April, June, August, October,December. G,J,M,Q,V,Z *** " Monthly contracts listed for 3 consecutive months and any February, April, August, and October in the nearest 23 months and any June and December in the nearest 72 months. We recommend, Speculators should stick with these liquid contracts" "G,J,M,Q,Z"

Weekly Options:YES

Some of the basic fundamentals to keep in mind when you are considering trading gold futures for this matter:

1. Research supply side in major producing countries.

2. Follow both the jewelry demand and investment demand for silver

3. Focus in macroeconomics not microeconomics

4. Correlation to silver and platinum

5. Correlation to US Dollar prices

6. Inflationary prospects

7. Geopolitical Stability

8. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the gold market, other metals, other futures, options, futures spreads and much more!

Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 11/15 Fri |

7:30 AM CST - USDA Weekly Export Sales

7:30 AM CST - Empire State Manufacturing(Nov) 7:30 AM CST - Export(ex-ag) & Import(ex-oil) Prices(Oct) 7:30 AM CST - Retail Sales(Oct) 7:30 AM CST - Retail Sales Ex-Auto(Oct) 8:15 AM CST - Capacity Util & Industrial Prod(Oct) 9:00 AM CST - Business Inventories(Sep) 11:00 AM CST - NOPA Crush |

FN: Dec Cocoa(ICE)

LT: Nov Lumber(CME) Nov Nikkei Options(CME) Nov Eurodollar Options(CME) Dec Crude Lt Options(NYM) Dec Orange Juice Options(ICE) Dec Sugar-11 Options(ICE) |

| 11/18 Mon |

3:00 PM CST - Net Long-Term TIC Flows(Sep)

3:00 PM CST - Crop Progress |

FN: Nov Lumber(CME)

LT: Nov Eurodollar(CME) Nov Mx Peso(CME) |

| 11/19 Tue |

7:30 AM CST - Building Permits & Housing Starts(Oct)

3:30 PM CST - API Energy Stocks |

|

| 11/20 Wed |

6:00 AM CST - MBA Mortgage Index

9:30 AM CST - EIA Petroleum Status Report 2:00 PM CST - Dairy Products Sales |

FN: Dec Coffee(ICE)

LT: Dec Crude Lt(NYM) Dec Platinum & Palladium Options(NYM) |

| 11/21 Thu |

7:30 AM CST - USDA Weekly Export Sales

7:30 AM CST - Initial Claims-Weekly 7:30 AM CST - Philadelphia Fed Index(Nov) 9:00 AM CST - Existing Home Sales(Oct) 9:00 AM CST - Leading Indicators(Oct) 9:30 AM CST - EIA Natural Gas Report 3:30 PM CST - Money Supply |

LT: Nov Feeder Cattle(CME)

Nov Feeder Cattle Options(CME) |

| 11/22 Fri |

9:00 AM CST - Univ of Mich Consumer Sent-Final(Nov)

2:00 PM CST - Cattle On Feed 2:00 PM CST - Cold Storage |

FN: Dec Cotton(NYM)

Dec Crude Lt(NYM) LT: Dec 2,5,10 Year Notes Options(CBT) Dec Bonds Options(CBT) Dec Canola Options(CBT) Dec Wheat Options(CBT) Dec Corn Options(CBT) Dec Oats Options(CBT) Dec Rough Rice Options(CBT) Dec Soybeans,Soymeal,Soyoil Options(CBT) |

| 11/25 Mon |

3:00 PM CST - Crop Progress

|

LT: Dec Copper Options(CMX)

Dec Gold Options(CMX) Dec Silver Options(CMX) Dec Natural Gas Options(NYM) Dec RBOB & ULSD Options(NYM) |

| 11/26 Tue |

7:30 AM CST - Adv Intl Trade In Goods(Oct)

7:30 AM CST - Adv Retail Inventories(Oct) 7:30 AM CST - Adv Wholesale Inventories(Oct) 8:00 AM CST - FHFA Housing Price Index(Sep) 8:00 AM CST - S&P Case-Shiller Home Price Index(Sep) 9:00 AM CST - Consumer Confidence(Nov) 9:00 AM CST - New Home Sales(Oct) 3:30 PM CST - API Energy Stocks |

LT: Nov Copper(CMX)

Nov Gold(CMX) Nov Silver(CMX) Nov Platinum(NYM) Nov Palladium(NYM) Dec Natural Gas(NYM) |

| 11/27 Wed |

6:00 AM CST - MBA Mortgage Index

7:30 AM CST - Initial Claims-Weekly 7:30 AM CST - Durable Goods Ex-Transportation(Oct) 7:30 AM CST - Durable Orders(Oct) 7:30 AM CST - GDP-Second Estimate(Q3) 7:30 AM CST - GDP Deflator-Second Estimate(Q3) 7:30 AM CST - Personal Income & Spending(Oct) 9:00 AM CST - Pending Home Sales(Oct) 9:30 AM CST - EIA Petroleum Status Report 11:00 AM CST - EIA Natural Gas Report 1:00 PM CST - Fed's Beige Book(Dec) 2:00 PM CST - Dairy Products Sales |

FN: Dec Natural Gas(NYM)

|

| 11/28 Thu |

THANKSGIVING DAY

|

FN: Dec 2,5,10 Year Notes(CBT)

Dec Bonds(CBT) Dec Copper(CMX) Dec Gold & Silver(CMX) Dec Platinum & Palladium(NYM) Dec Wheat(CBT) Dec Corn(CBT) Dec Oats(CBT) Dec Soymeal,Soyoil(CBT) LT: Nov Bitcoin(CME) Nov Fed Funds(CME) Dec Black Sea Wheat(CME) Dec RBOB & ULSD(NYM) Nov Fed Funds Options(CME) Dec Lumber Options(CME) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!