October 25th, 2019 - Issue #987

In This Issue

1. Trading 101: Free, Interactive Futures Trading Tutorial

2. Hot Market Report: Natural Gas Review, Outlook and chatt

3. Economic Calendar

Get Real Time Updates via Twitter!

1. Trading 101: Free, Interactive Futures Trading Tutorial

An interactive tutorial on the basics ( and a little more) of futures trading.

Browse through the tutorial at your leisure and at your own pace. Please call us if you have any questions about implementing your strategy or requesting a live demo or have feedback

Sign up below and INSTANTLY get access to the online tutorial

Start Online Tutorial Now

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Hot Market Report: Natural Gas - Prices too Low?

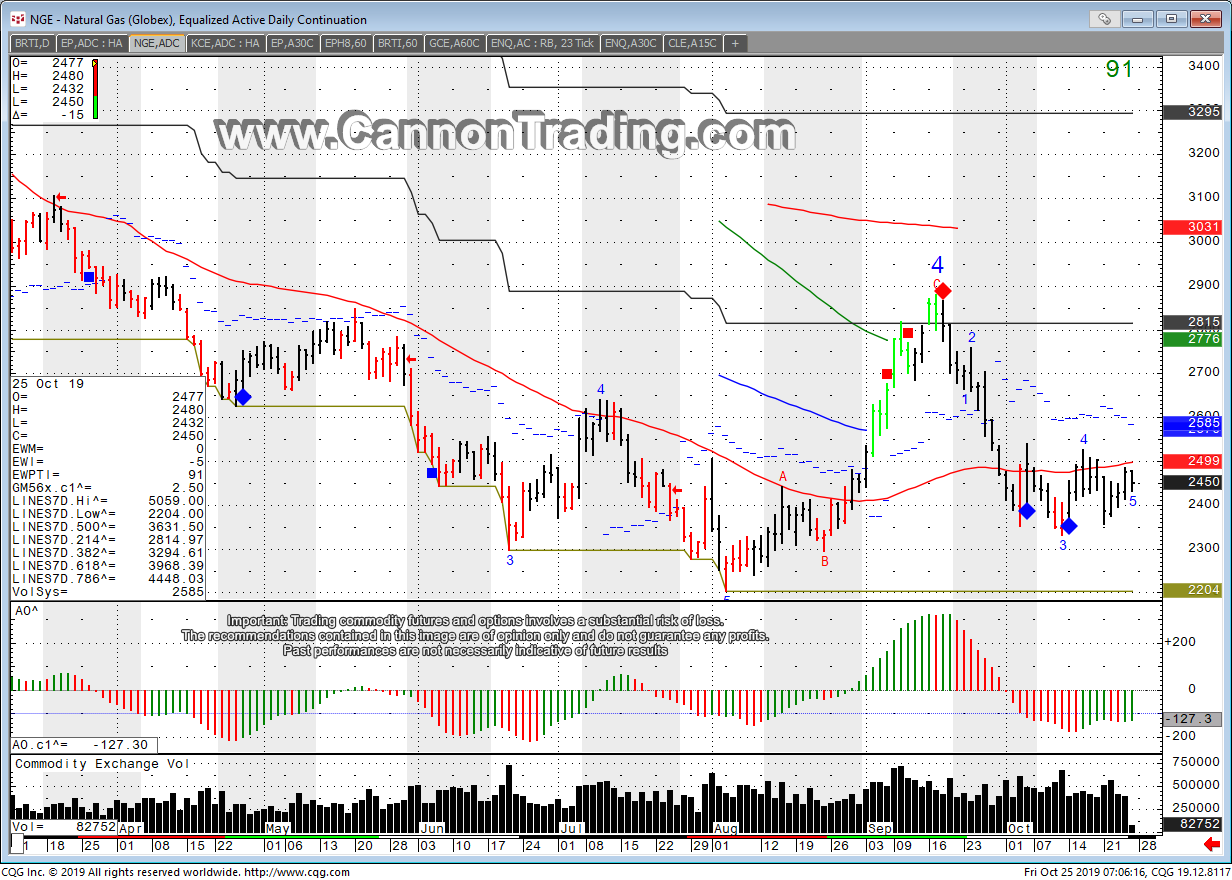

By Mark O'Brien, Senior BrokerClick on image below to enlarge

This week’s highlighted Market is Natural Gas futures. Natural Gas is part of the energy sector along with "it's cousins", Crude Oil, "RBOB - Unleaded gas" and heating oil. All traded on the NYMEX/GLOBEX exchange.

The undisputed king of the energy futures sector is crude oil. The West Texas crude futures contract traded on the CME/NYMEX is the largest energy futures contract in the world by volume. But, not far distant from it in terms of volume and over the last decade or so in importance, is natural gas. Coupled with its long-time use as a domestic cooking and heating fuel, its increased use in power generation has caused natural gas to surpass the heating oil and unleaded gas futures contracts in terms of trade volume. And because of its tendency to follow annual seasonal patterns – and occasionally sharply deviate from them – non-commercial traders have become growing participants in the natural gas futures market. These are exceptional times for natural gas futures. With the exception of a brief foray to all-time lows (Oct.–Nov. of ’15) the price of the December ‘19 contract for the leading NYMEX futures contract – Henry Hub natural gas – is trading near lows not seen since 2001. The heating season for natural gas typically begins in November. All summer the industry accumulates inventory during the summer.In depth analasys to follow next week in a special edition of our blog next week!!

Daily chart from this morning, Oct. 25th 2019).

This chart was prepared using CQG Q Trader software, which you can demo for 14 days with real time data.

To access a free trial to the ALGOS shown in the chart ( DIAMONDS included) along with other tools, visit and sign up for a free trial for 21 days with real time data.

Natural Gas Futures Specs. (this market also offers a mini Nat Gas futures contract which is half the size)

Hours: 5:00 PM to 4:00 PM the following day, Central Time

Margins: $2700 initial, $2500 maintenance ( as of the date of this newsletter)

Point Value: full point = $100 ( Example: 404.0 to 405.0 ). Min. price fluctuation is 0.1 = $10 ( Example: 404.1 to 404.2)

Settlement: Physical, deliverable commodity

Months: Monthly cycle, All Months

Weekly Options:YES

Some of the basic fundamentals to keep in mind when you are considering trading the Nat Gas market:

1. Longer term view of current market prices

2. Supply and Demand

3. Seasonality, i.e. heating and cooling cycles

4. Be aware of Thursday morning’s EIA gas storage report at 9:30 AM CDT

Our brokers here at Cannon will be happy to chat about the Natural Gas market, other energies, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 10/25 Fri |

9:00 AM CDT - Univ of Mich Consumer Sent-Final(Oct)

2:00 PM CDT - Cattle On Feed |

LT: Oct Bitcoin(CME)

Nov 2,5,10 Year Notes Options(CBT) Nov Bonds Options(CBT) Nov Canola Options(CBT) Nov Wheat Options(CBT) Nov Corn Options(CBT) Nov Oats Options(CBT) Nov Rough Rice Options(CBT) Nov Soybeans,Soymeal,Soyoil Options(CBT) |

| 10/28 Mon |

7:30 AM CDT - Adv Intl Trade In Goods(Sep)

7:30 AM CDT - Adv Retail Inventories(Sep) 7:30 AM CDT - Adv Wholesale Inventories(Sep) 3:00 PM CDT - Crop Progress |

LT: Nov Copper Options(CMX)

Nov Gold & Silver Options(CMX) Nov Natural Gas Options(NYM) Nov RBOB & ULSD(NYM) |

| 10/29 Tue |

8:00 AM CDT - S&P Case-Shiller Home Price Index(Aug)

9:00 AM CDT - Consumer Confidence(Oct) 9:00 AM CDT - Pending Home Sales(Sep) 3:30 PM CDT - API Energy Stocks |

LT: Oct Butter(CME)

Oct Milk(CME) Oct Copper(CMX) Oct Gold & Silver(CMX) Oct Platinum & Palladium(NYM) Nov Natural Gas(NYM) Oct Butter Options(CME) Oct Milk Options(CME) |

| 10/30 Wed |

6:00 AM CDT - MBA Mortgage Index

7:15 AM CDT - ADP Employment Change(Oct) 9:30 AM CDT - EIA Petroleum Status Report 1:00 PM CDT - FOMC Rate Decision(Oct) 2:00 PM CDT - Dairy Products Sales |

FN: Nov Natural Gas(NYM)

|

| 10/31 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Employment Cost Index(Q3) 7:30 AM CDT - Personal Income & Spending(Sep) 7:30 AM CDT - PCE & Core PCE Price Index(Sep) 8:45 AM CDT - Chicago PMI(Oct) 9:30 AM CDT - Natural Gas Report 3:30 PM CDT - Money Supply |

FN: Nov Copper(CMX)

Nov Gold & Silver(CMX) Nov Platinum & Palladium(NYM) Nov Canola(CBT) Nov Rough Rice(CBT) Nov Soybeans(CBT) LT: Oct Feeder Cattle(CME) Oct Fed Funds(CME) Oct Live Cattle(CME) Nov RBOB & ULSD(NYM) Oct Feeder Cattle Options(CME) Oct Fed Funds Options(CME) Nov Lumber Options(CME) |

| 11/01 Fri |

7:30 AM CDT - Ave Workweek & Hourly Earnings(Oct)

7:30 AM CDT - Nonfarm Payrolls(Oct) 7:30 AM CDT - Unemployment Rate(Oct) 9:00 AM CDT - ISM Manufacturing Index(Oct) 9:00 AM CDT - Construction Spending(Sep) 2:00 PM CDT - Cotton System 2:00 PM CDT - Grain Crushings 2:00 PM CDT - Fats & Oils |

FN: Nov Orange Juice(ICE)

LT: Nov Live Cattle Options(CME) Dec Cocoa Options(ICE) |

| 11/04 Mon |

9:00 AM CST - Factory Orders(Sep)

3:00 PM CST - Crop Progress |

FN: Nov RBOB & ULSD(NYM)

|

| 11/05 Tue |

7:30 AM CST - Trade Balance(Sep)

9:00 AM CST - ISM Non-Manufacturing Index(Oct) 3:30 PM CST - API Energy Stocks |

|

| 11/06 Wed |

6:00 AM CST - MBA Mortgage Index

7:30 AM CST - Productivity-Prel(Q3) 9:30 AM CST - EIA Petroleum Status Report 2:00 PM CST - Dairy Products Sales |

|

| 11/07 Thu |

7:30 AM CST - USDA Weekly Export Sales

7:30 AM CST - Initial Claims-Weekly 9:30 AM CST - EIA Natural Gas Report 2:00 PM CST - Consumer Credit(Sep) 3:30 PM CST - Money Supply |

|

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!