May 15th, 2020 - Issue #1006

In This Issue

1. Trading 201: Using Tick/Volume charts and Oscillators for Scalping

2. Hot Market Report: Crude Oil Futures...What's Next?

3. Economic Calendar

Get Real Time Updates via Twitter!

1. Trading 201: Using Tick/Volume charts and Oscillators for Scalping

Using tick charts and oscillators for day-trading (by Ilan Levy-Mayer VP of Cannon Trading and CTA at Levex.net )

I really don't think anyone has found a "perfect way" to day-trade.

Different techniques work well in different market environment.

In this week short educational feature, I will touch on one technique you can add to your trading arsenal. This technique works better on choppy, two sidedway and/or volatile markets. It does NOT work well when the market has a strong trend.

The chart below illustrates a few principals I like:

- It uses a tick chart rather than a time chart. I like tick charts ( range bar, volume charts, renko) better when day-trading shorter time frames for the simple reason it already includes a big factor in the market, VOLUME. If you are using a 5 minute chart for example, you may get signals simply because time "has passed" and certain indicators you are using adopt certain values. When using tick charts during periods where there are lots of movement, you won't have to wait until your time frame bar closes to get your signal, volume becomes a bigger more important part of your trading decision.

- The other part for this trading approach is to use overbought/ oversold indicators in an attempt to catch exhastion in selling or buying and catch the counter trend move. Sometimes that move will be minor, sometimes it will be a trend reversal and at other times just a little pause in a strong trend....no crystal balls here, just another tool to observe and consider in your trading. In the PDF you will see the same indicators, same market, same time frame BUT using different type of charts.....

To read article and view video:

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Hot Market Report: Crude Oil Futures...More Volatility Ahead?

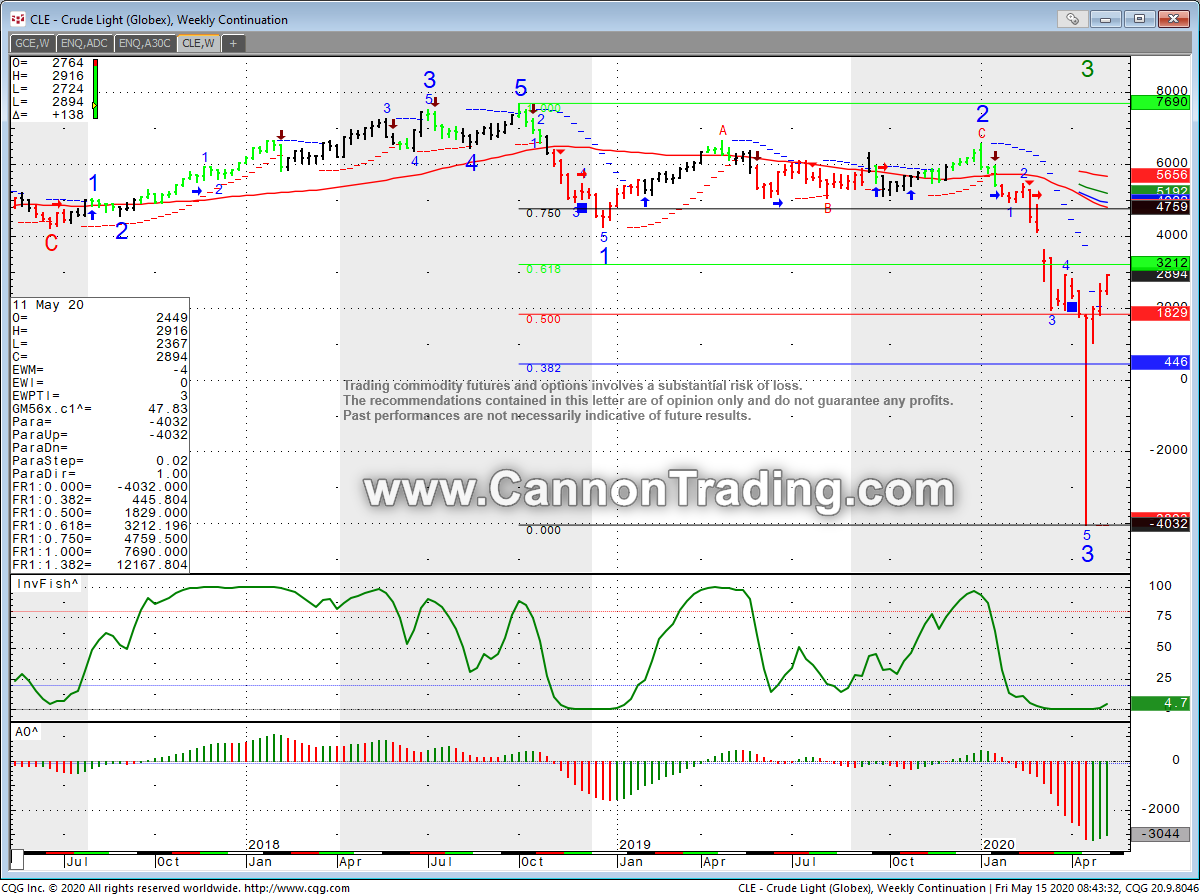

By Ilan Levy-Mayer, VPClick on image below to enlarge

This week’s highlighted Market is Crude Oil. Crude Oil is part of the energy sector along with "it's" brothers "RBOB - Unleaded gas" and heating oil and cousin, natural gas. All traded on the NYMEX/GLOBEX exchange.

Weekly Chart with levels of support and resistance

Last trading day for June Crude Oil is Tuesday, May 19th. The CFTC has issued a staff advisory indicating that the June WTI contract expires on 5/19/20 and could go to negative pricing along with various other contracts. The markets are expected to be volatile with low liquidity and the closer to expiration the harder it may be to get out of positions. So much has been written about crude oil trading to a negative value, so I won’t waste more space on that, however here are some pointers I like to make:

1. The margins have more than doubled these past few weeks and many clearing houses will even ask for 200% margins if you trade the front month.

2. Volatility is EXTREME, make sure you know what you are doing, know the rules and understand the environment. There is a big difference in the way the front active month trades compared to the back months.

3. If you’ve never taken physical delivery of crude oil and all of a sudden this idea has sprouted in your brain, take heed. Don't think you can get set up for that scenario in short order – in case June repeats the same behavior. Taking delivery of crude oil requires a rather lengthy set-up process. The minimum account balance required to be in place: $1,000,000 ( with us anyway ). You also will be required to be set up with a licensed storage facility, provide verifiable shipping logistics and be approved by certain FCM’s and the exchange

4. This is the type of trading environment where an experienced broker can assist you by a suggested strategy and ideas such as placing hedges, incorporating options, implementing spreads and much more.

To access a free trial to the ALGOS shown in the chart visit and sign up for a free trial for 21 days with real-time data.

On a different note, Crude Oil futures are fastly becoming one of the more popular contracts for day-trading as volatility, speed, price fluctuations are all there for the double edge sword, day-traders love.

Crude Oil Futures Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $9500 initial, $8600 Maint. FRONT MONTH margins are: $13,200 and $12,000 Maint.( as of the date of this newsletter)

Point Value: full point = $1000 ( Example: 71.80 to 72.80 ). Min fluctuation is 0.1 = $10 ( Example: 71.80 to 71.81)

Settlement: Physical, deliverable commodity

Months: Monthly cycle, All Months

Weekly Options:YES

Crude Oil is one of my favorite markets for Day Trading because of the intraday voilatility and movements. Be careful, these factors can work against you or in your favor.

Some of the basic fundamentals to keep in mind when you are considering a trade in the crude oil as well as other energies:

1. Longer term view of current market prices

2. Dates and times of important reports. Namely, Tuesday afternoon report (API) and the DOE report on Wednesday mornings at 10:30 Am EST

3. Weather and Seasonality

4. Correlation to US Dollar prices

5. Inflationary prospects

6. Geopolitical Stability

7. U.S. Fiscal and Monetary Stability

Keep in mind that the GLOBEX/NYMEX also offers the mini Crude oil contract which is half the size and may be a good alternative for smaller/ begginer traders.

MINI Crude Oil Futures Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $4750 initial, $4350 Maint. ( as of the date of this newsletter)

Point Value: full point = $500 ( Example: 62.80 to 63.80 ). Min fluctuation is 0.25 = $12.5 ( Example: 61.80 to 61.825)

Settlement: Cash Settled commodity one day prior to the Big Contract

Months: Monthly cycle, All Months

Our brokers here at Cannon will be happy to chat about the crude olil market, other energies, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 05/15 Fri |

7:30 AM CDT - Empire State Manufacturing(May)

7:30 AM CDT - Retail Sales(Apr) 7:30 AM CDT - Retail Sales-Ex Auto(Apr) 8:15 AM CDT - Capacity Util & Industrial Prod(Apr) 9:00 AM CDT - Business Inventories(Mar) 9:00 AM CDT - Univ of Mich Consumer Sent-Prelim(May) 11:00 AM CDT - NOPA Crush 3:00 PM CDT - Net Long-Term TIC Flows(Mar) |

LT: May Lumber(CME)

May Nikkei Options(CME) May Eurodollar Options(CME) Jun Orange Juice Options(ICE) Jun Sugar-11 Options(ICE) |

| 05/18 Mon |

9:00 AM CDT - NAHB Housing Market Index(May)

3:00 PM CDT - Crop Progress |

FN: May Lumber(CME)

LT: May Eurodollar(CME) May Coffee(ICE) May Mx Peso(CME) |

| 05/19 Tue |

7:30 AM CDT - Building Permits & Housing Starts(Apr)

3:30 PM CDT - API Energy Stocks |

LT: Jun Crude Lt(NYM)

|

| 05/20 Wed |

6:00 AM CDT - MBA Mortgage Index

9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Milk Production 2:00 PM CDT - Dairy Products Sales |

LT: Jun Platinum Options(NYM)

Jun Palladium Options(NYM) |

| 05/21 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Philadelphia Fed Index(May) 9:00 AM CDT - Existing Home Sales(Apr) 9:30 AM CDT - EIA Natural Gas Report 2:00 PM CDT - Cold Storage 3:30 PM CDT - Money Supply |

FN: Jun Crude Lt(NYM)

LT: May Feeder Cattle(CME) May Feeder Cattle Options(CME) |

| 05/22 Fri |

2:00 PM CDT - Cattle On Feed

|

LT: Jun 2,5,10 Year Notes Options(CBT)

Jun Bonds Options(CBT) Jun Canola Options(CBT) Jun Wheat Options(CBT) Jun Corn Options(CBT) Jun Oats Options(CBT) Jun Rough Rice Options(CBT) Jun Soybeans,Soymeal,Soyoil Options(CBT) |

| 05/25 Mon |

MEMORIAL DAY

|

|

| 05/26 Tue |

8:00 AM CDT - FHFA Housing Price Index(May)

8:00 AM CDT - S&P Case-Shiller Home Price Index(Mar) 9:00 AM CDT - Consumer Confidence(May) 9:00 AM CDT - New Home Sales(Apr) 3:00 PM CDT - Crop Progress |

LT: Jun Copper Options(CMX)

Jun Gold & Silver Options(CMX) Jun Natural Gas Options(NYM) Jun RBOB & ULSD Options(NYM) |

| 05/27 Wed |

6:00 AM CDT - MBA Mortgage Index

3:30 PM CDT - API Energy Stocks |

LT: May Copper(CMX)

May Gold & Sliver(CMX) May Platinum & Palladium(NYM) Jun Natural Gas(NYM) |

| 05/28 Thu |

7:30 AM CDT - Initial Claims-Weekly

7:30 AM CDT - Durable Goods-Ex Transportation(Apr) 7:30 AM CDT - Durable Orders(Apr) 7:30 AM CDT - GDP-Second Estimate(Q1) 7:30 AM CDT - GDP Deflator-Second Estimate(Q1) 9:00 AM CDT - Pending Home Sales(Apr) 9:30 AM CDT - EIA Natural Gas Report 10:00 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales 3:30 PM CDT - Money Supply |

FN: Jun Natural Gas(NYM)

|

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!