August 7th, 2020 - Issue #1017

In This Issue

1. Day-Trading Alerts via Text Directly to Your Phone FREE TRIAL ($249 value)

2. Hot Market Report: Next Round of Stimulus: Where are the 10 year Notes Headed?

3. Economic Calendar

1. Day- Trading Alerts via Text Directly to Your Phone FREE TRIAL ($249 value)

3 Weeks FREE TRIAL

The real time trade alerts FREE 3-week trial uses a combination of proprietary information technical studies, trading ALGOS and a few popular indicators for confirmation.

You will receive a text and email each time there is an entry or exit in a simple language along with the current price for that specific market.

Text alerts available to US and Canada residents. Int'l clients will receive the alerts via email.

* Gold, silver, copper, platinum

* mini SP, mini Nasdaq, mini Dow, mini Russell

* Major currenciey pairs

* Wheat, Beans, Soymeal, Bean oil

* Crude oil, RBOB, Heating oil, Natural gas

* 30 year Bonds and 10 year Notes

* Hogs, Cattle

Sign up below and make sure to provide valid mobile number and email

Real Time Text Alerts

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Hot Market Report: Next Round of Stimulus: Where are the 10 year Notes Headed?

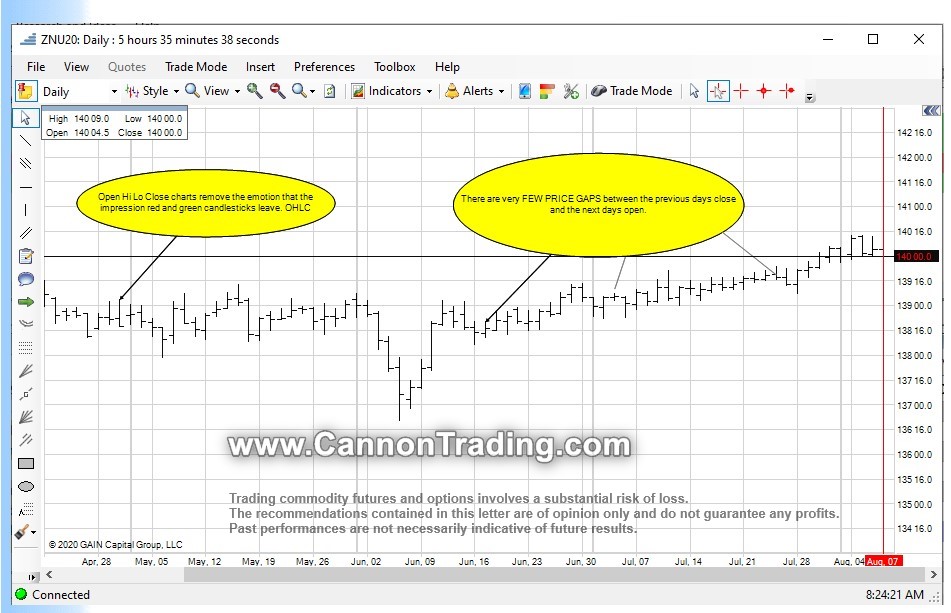

By John Thorpe, Senior BrokersClick on image below to enlarge

This week’s highlighted Market is 10 yr Treasury Note Futures The US 10 year treasury note market belongs to the "interest rate family" 30 year, 5 year, 2 year notes, the "Ultra bond" and others. All traded on the CBOT exchange.

The open interest in the 10yr note market is dwarfed by few contracts, With a current OI in the front month ZNU20 at 3,452,000 today , this market dominates U.S. Treasury Futures contracts across the yield curve. When the stimulus cash dispersal again increases, we know the Fed will be buying most of the Treasury paper offered through the Thursday weekly auctions. Our U.S. Governments fiscal year end is less than 8 weeks away. Funding through the end of September for a variety of obligations is done through the issuance of new debt. This time of year with greater demand for Govt debt, the price of Ten Yr Notes ZNU20 should continue to increase. It appears this bull is waiting for congress to determine the next round of stimulus, The overnight margin is low relative to the contract size.

Here is a link to the Treasury auction Calendar

Here is a link to the Treasury Auction Results link

Continue watching the size of the weekly Treasury auctions (see this week's sizes). They'll be getting bigger. And watch the bid-to-covers on the longer dated issues. The question I ask is will the demand hold up for the longer-dated paper? This from Bloomberg yesterday “ The US Treasury expanded its plans for the issuance of longer-term debt in coming months, after depending mainly on shorter-dated bills to fund the federal government’s record spending surge to address the Covid-19 crisis. The department yesterday said it will issue a record $112bn of securities at next week’s so-called quarterly refunding of maturing Treasuries. Over the three months through October, it will ramp up issuance of nominal coupon-bearing debt by a total of $132bn compared with the previous quarter. The department plans to boost auction sizes across all nominal coupon tenors, with larger increases for the longer-dated securities maturing in seven to 30 years.”

Daily chart for your review from this morning ( August 7th, 2020).

This chart was prepared using our FREE E-Futures Int'l software, which you can demo for 28 days with real time data.

10 yr Treasury Note Futures

Hours: 05:00 PM previous day to 4:00 PM Central Time

Margins: $1705 initial, $1550 Maint. ( as of the date of this newsletter)

Point Value: full point = $1000 ( Example: 140 31.5 to 139 31.5 ). Min fluctuation is 0.5 = $15.625 ( Example: 139 31.0-139 31.5) Settlement: Physical Delivery

Months: March, June, September,December. H,M,U,Z

Weekly Options:YES

Some of the basic fundamentals to keep in mind when you are considering trading the U.S.10 yr Treasury Note for this matter:

1. Interest Rates.

2. FOMC Rate decisions and Language

3. Focus in macroeconomics

4. Bond Prices have an inverse relationship to Interest rates

5. Correlation to US Dollar prices

6. Inflationary prospects

7. Geopolitical Stability

8. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the 10 yr notes market, other financials, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 08/07 Fri |

7:30 AM CDT - Ave Workweek & Hourly Earnings(Jul)

7:30 AM CDT - Nonfarm Payrolls(Jul) 7:30 AM CDT - Unemployment Rate(Jul) 9:00 AM CDT - Wholesale Inventories(Jun) 2:00 PM CDT - Consumer Credit(Jun) |

LT: Aug Canadian Dollar Options(CME)

Aug Currencies Options(CME) Aug Live Cattle Options(CME) Aug Mx Peso Options(CME) Aug US Dollar Options(ICE) Sep Cocoa Options(ICE) |

| 08/10 Mon |

3:00 PM CDT - Crop Progress

|

FN: Aug Live Cattle(CME)

LT: Sep Sugar-16(ICE) |

| 08/11 Tue |

7:30 AM CDT - Core PPI & PPI(Jul)

3:30 PM CDT - API Energy Stocks |

FN: Sep Sugar-16(ICE)

|

| 08/12 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Core CPI & CPI(Jul) 9:30 AM CDT - EIA Petroleum Status Report 11:00 AM CDT - WADSE Report & Crop Production 2:00 PM CDT - Dairy Products Sales |

|

| 08/13 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Export(ex-ag) & Import(ex-oil) Prices(Jul) 7:30 AM CDT - Initial Claims-Weekly 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

|

| 08/14 Fri |

7:30 AM CDT - Productivity-Prel(Q2)

7:30 AM CDT - Retail Sales(Jul) 7:30 AM CDT - Retail Sales Ex-Auto(Jul) 8:15 AM CDT - Capacity Util & Industrial Prod(Jul) 9:00 AM CDT - Business Inventories(Jun) 9:00 AM CDT - Univ of Mich Consumer Sent-Prelim(Aug) |

LT: Aug Lean Hogs(CME)

Aug Soybeans,Soymeal,Soyoil(CBT) Aug Lean Hogs Options(CME) Aug Eurodollar Options(CME) Sep Coffee Options(ICE) |

| 08/17 Mon |

7:30 AM CDT - Empire State Manufacturing(Aug)

9:00 AM CDT - NAHB Housing Market Index(Aug) 11:00 AM CDT - NOPA Crush 2:00 PM CDT - Net Long-Term TIC Flows(Jun) 3:00 PM CDT - Crop Progress |

LT: Aug Eurodollar(CME)

Aug Mx Peso(CME) Sep Crude Lt Options(NYM) Sep Sugar-11 Options(ICE) |

| 08/18 Tue |

7:30 AM CDT - Building Permits & Housing Starts(Jul)

3:30 PM CDT - API Energy Stocks |

FN: Sep Cocoa(ICE)

|

| 08/19 Wed |

6:00 AM CDT - MBA Mortgage Index

9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales 2:00 PM CDT - Milk Production |

LT: Sep Platinum Options(NYM)

Sep Palladium Options(NYM) |

| 08/20 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Philadelphia Fed Index(Aug) 9:30 AM CDT - EIA Natural Gas Report |

LT: Sep Crude Lt(NYM)

|

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!