September 13th, 2019 - Issue #981

In This Issue

1. Futures Trading 101: Knowing What You Don't Know in Trading Markets

2. Hot Market Report: Gold Monthly Chart

3. Economic Calendar

Get Real Time Updates via Twitter!

1. Futures Trading 101: Knowing What You Don't Know in Trading Markets

From our friend Jim Wyckoff at JimWyckoff.com

The headline of this educational feature may be a bit confusing, but I will explain what I mean shortly. First, I want to reiterate that trading futures, stock and FOREX markets is not an easy undertaking. It disgusts me that there are a few unsavory people in our industry that portray trading as an easy, get-rich-quick scheme, or as some endeavor for which there are “secrets” to be learned from those who hold “trading secrets.”

Folks, the plain truth is that there are no trading secrets and no easy paths to quick success in trading markets. Beware of anyone who tries to tell (or sell) you such. One of the biggest obstacles to success in trading markets is a lack of knowledge and understanding of the process of trading. The “process of trading” includes understanding financial leverage, market behavior and trader psychology. Understanding the process of trading can be achieved with perseverance and a willingness to continue to learn.

It’s not coincidental that trading markets is similar to most other human endeavors: Hard work and experience are required to achieve notable success. A person who enjoys classic automobiles would not attempt to tear down and successfully rebuild an engine without having some previous experience, or without having learned about the workings of an automobile engine—including knowing about the tools involved in the operation.

Fill out the short form below to read the rest of the article

Finish Article

Cannon Trading respects your privacy and will never give this information to a 3rd party.

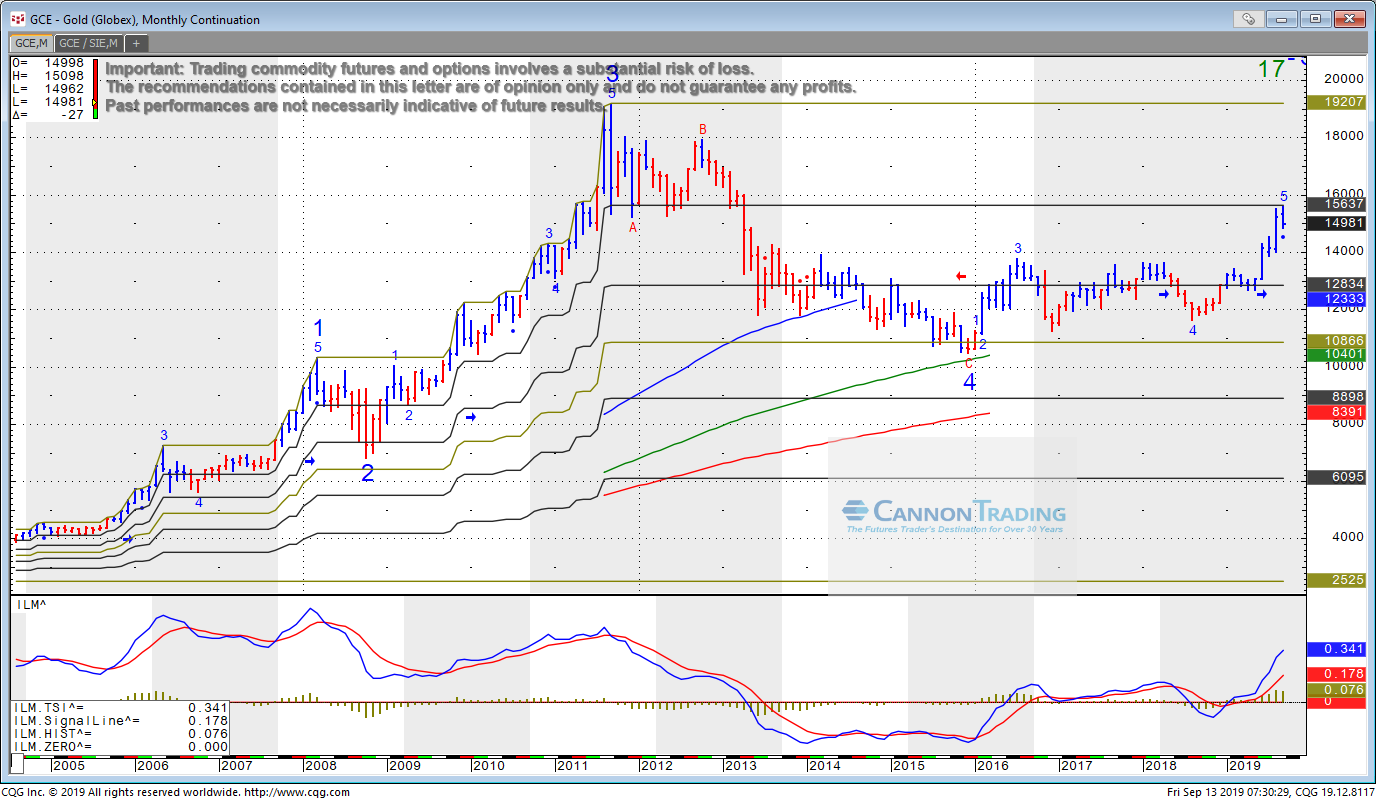

2. Hot Market Report: Hot Market Report: Gold Monthly Chart

By John Thorpe, Senior BrokerClick on image below to enlarge

This week’s highlighted Market is Gold. Gold is part of the Precious Metals sector along with its brothers Platinum, Palladium, Silver and Copper.. All traded on the COMEX and NYMEX exchanges.

This week’s highlighted Market is Gold. Gold is part of the Precious Metals sector along with its brothers Platinum, Palladium, Silver and Copper.. All traded on the COMEX and NYMEX exchanges.

According to the London Bullion Market Association, gold's recent rally is evidence of many placing hedges to protect the value of their pound sterling deposits in the event of a Brexit event on October 31st, "The pound staged a recovery and gold prices have tailed off, after members of parliament took steps to prevent Mr. Johnson from Taking the U.K. out of the EU without a deal", Outside of Brexit, the E.U. has begun a new bond buying program to further stimulate the E.U. economy. Central bank policy shifts toward monetary easing tend to buoy precious metals prices. In addition to recessionary fears here in the U.S. and other industrialized nations, instability in Sino-Hong Kong relations also are supportive factors for the yellow metal.

This chart was prepared using CQG Q Trader software, which you can demo for 14 days with real time data.Gold is a very liquid market with a relatively good volatility ( can work for you and against you....). Different behavior and personality than stock indices. I like using breakout methods as well as "counter trend" techniques as this market "fear and greed index" is high on my list. It goes without saying that gold is an excellent market for options, swing trading and long term trading as well with 23 hours trading, strong volume and excellent liquidity. In addition traders can use both mini Gold and MICRO gold. To access a free trial to the ALGOS shown in the chart visit and sign up for a free trial for 21 days with real-time data.

GOLD Futures Specs

Hours: 05:00 PM previous day to 4:00 PM Central Time

Margins: $4440 initial, $4000 Maint. ( as of the date of this newsletter)

Point Value: full point = $100 ( Example: 1285.0 to 1286.0 ). Min fluctuation is 0.1 = $10 ( Example: 1285.5 to 1285.6) Settlement: Physical Delivery

Months: February, April, June, August, October,December. G,J,M,Q,V,Z *** " Monthly contracts listed for 3 consecutive months and any February, April, August, and October in the nearest 23 months and any June and December in the nearest 72 months. We recommend, Speculators should stick with these liquid contracts" "G,J,M,Q,Z"

Weekly Options:YES

Some of the basic fundamentals to keep in mind when you are considering trading gold futures for this matter:

1. Research supply side in major producing countries.

2. Follow both the jewelry demand and investment demand for silver

3. Focus in macroeconomics not microeconomics

4. Correlation to silver and platinum

5. Correlation to US Dollar prices

6. Inflationary prospects

7. Geopolitical Stability

8. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the gold market, other metals, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 09/13 Fri |

7:30 AM CDT - Export (ex-ag) & Import (ex-oil) Prices(Aug)

7:30 AM CDT - Export & Import Prices(Aug) 7:30 AM CDT - Retail Sales(Aug) 7:30 AM CDT - Retail Sales Ex-Auto(Aug) 9:00 AM CDT - Business Inventories(Jul) 9:00 AM CDT - Univ of Mich Consumer Sentiment-Prelim(Sep) |

LT: Sep Wheat(CBT)

Sep Corn(CBT) Sep Oats(CBT) Sep Corn(CBT) Sep Rough Rice(CBT) Sep Soybeans,Soymeal,Soyoil(CBT) Sep Lumber(CME) Sep Cocoa(ICE) Oct Cotton Options(NYM) Oct Coffee Options(ICE) |

| 09/16 Mon |

7:30 AM CDT - Empire State Manufacturing(Sep)

11:00 AM CDT - NOPA Crush 3:00 PM CDT - Crop Progress |

FN: Sep Lumber(CME)

LT: Sep Currencies(CME) Sep Eurodollar(CME) Sep Mx Peso(CME) Sep US Dollar Index(ICE) Sep Eurodollar Options(CME) Oct Sugar-11 Options(ICE) |

| 09/17 Tue |

8:15 AM CDT - Capacity Util & Industrial Prod(Aug)

3:00 PM CDT - Net Long-Term TIC Flows(Jul) 3:30 PM CDT - API Energy Stocks |

LT: Sep Canadian Dollar(CME)

Oct Crude Lt Options(NYM) |

| 09/18 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Building Permits & Housing Starts(Aug) 9:30 AM CDT - EIA Petroleum Status Report 1:00 PM CDT - FOMC Rate Decision 2:00 PM CDT - Dairy Products Sales |

LT: Sep Coffee(ICE)

Oct Platinum Options(NYM) Oct Palladium Options(NYM) |

| 09/19 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Current Account Balance(Q2) 7:30 AM CDT - Philadelphia Fed Index(Sep) 9:00 AM CDT - Existing Home Sales(Aug) 9:00 AM CDT - Leading Indicators(Aug) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

LT: Sep 10 Year Notes(CBT)

Sep Bonds(CBT) Sep S&P 500(CME) Sep S&P 500 Options(CME) |

| 09/20 Fri |

2:00 PM CDT - Cattle On Feed

|

LT: Sep E-Mini Dow(CME)

Sep E-Mini S&P 500(CME) Sep NASDAQ(CME) Sep Russell(CME) Oct Crude Lt(NYM) Sep E-Mini Dow Options(CME) Sep E-Mini S&P 500 Options(CME) Sep NASDAQ Options(CME) Sep Russell Options(CME) Oct 2,5,10 Year Notes Options(CBT) Oct Bonds Options(CBT) Oct Canola Options(CBT) Oct Wheat Options(CBT) Oct Corn Options(CBT) Oct Oats Options(CBT) Oct Rough Rice Options(CBT) Oct Soybeans,Soymeal,Soyoil Options(CBT) |

| 09/23 Mon |

2:00 PM CDT - Cold Storage

3:00 PM CDT - Crop Progress |

|

| 09/24 Tue |

8:00 AM CDT - FHFA Housing Price Index(Jul)

8:00 AM CDT - S&P Case-Shiler Home Price Index(Jul) 9:00 AM CDT - Consumer Confidence(Sep) 3:30 PM CDT - API Energy Stocks |

FN: Oct Cotton(NYM)

Oct Crude Lt(NYM) |

| 09/25 Wed |

6:00 AM CDT - MBA Mortgage Index

9:00 AM CDT - New Home Sales(Aug) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales |

LT: Oct Copper Options(CMX)

Oct Gold Options(CMX) Oct Silver Options(CMX) Oct Natural Gas Options(NYM) Oct RBOB & ULSD Options(NYM) |

| 09/26 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Adv Intl Trade In Goods(Aug) 7:30 AM CDT - Adv Retail Inventories(Aug) 7:30 AM CDT - Adv Wholesale Inventories(Aug) 7:30 AM CDT - GDP-Third Estimate(Q2) 7:30 AM CDT - GDP Deflator-Third Estimate(Q2) 9:00 AM CDT - Pending Home Sales(Aug) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

LT: Sep Copper(CMX)

Sep Gold(CMX) Sep Silver(CMX) Sep Platinum(NYM) Sep Palladium(NYM) Sep Feeder Cattle(CME) Oct Natural Gas(NYM) Sep Feeder Cattle Options(CME) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!