March 29th, 2019 - Issue #959

In This Issue

1. Trading 202: Live Trading - Orion Trader and Short term trading insights

2. Hot Market Report: Palladium Volatility Reaches new heights

3. Economic Calendar

Get Real Time Updates via Twitter!

1. Trading 202: Live Trading - Orion Trader and Short term trading insights

Join us April 10th at 11 AM PDT/ 1 PM CDT for 40 minutes of Live trading where David Story will give you an inside peek of Orion Multi-Trader and methodology he uses for short-term trading. David Story has been trading the markets since 2006 and he is the creator of the SISO trading system. SISO is a systems trading module within the Orion Multi-Trader platform (David's preferred platform). David is also a professional pilot and an entrepreneur and has a unique approach on how to interpret the financial markets. David will explain how his experience as a pilot has shaped his success as a trader.

During this live trading session, David will share the following:

• Basic overview of Orion MTs• Describe the Orion MT modules he usess

• Preparing for the trading days

• Deciding on trade entries/exits and trade managements

• Explain his proprietary SISO trading systemss

• Describe how he manages risk & emotionss

David will be able to answer questions while analyzing the markets LIVE.s

SPACE is LIMITED, so reserve your space now!

Risk: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time

2. Hot Market Report: Palladium Volatility Reaches new heights

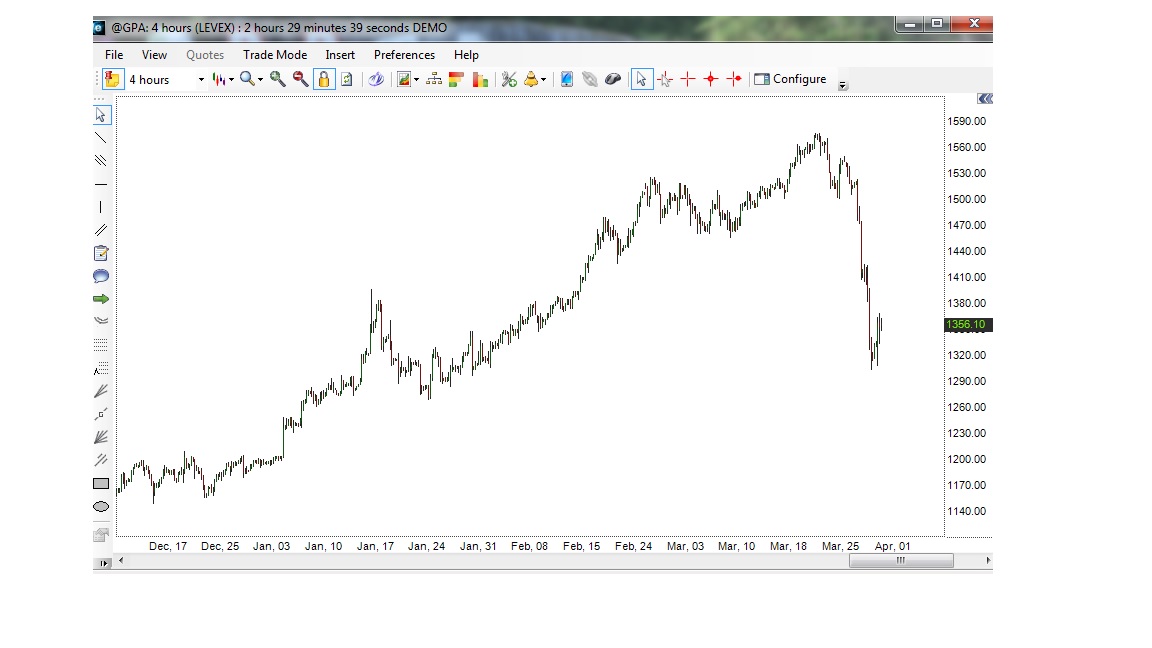

By Joe Easton, Senior BrokerClick on image below to enlarge

Palladium is part of the Precious Metals sector along with "it's" brothers Platinum, Gold, Silver and Copper.

Palladium is part of the Precious Metals sector along with "it's" brothers Platinum, Gold, Silver and Copper.

Palladium futures is not the most popular market, but this week it was one of the more volatile Futures Markets. Good traders know volatile markets create better opportunity for profit and higher risk of loss.

4 hour chart from this morning, (Mar. 29th 2019). From the chart… we have been on a serious uptrend, followed by a significant retracement this week. In January PA Futures were just about $1200. By late March PA traded over $1575 per contract. This week from Monday around price $1540 we dropped to Thursday low of $1303. Roughly a $237 move per 1 contract is = $23,700 over 4 days. I suggest being careful with this market when trying to capitalize on the volatility, make sure you can afford the risk, use stops to try and limit the risk and make sure you are paying attention and watching price action!!. Markets with less volume like PA cause for more chance of larger moves in shorter times. $1385 and $1460 are levels to watch for reaction off previous Support and resistance and below the current price of $1356 is $1270. Good Trading!

This chart was prepared using E-Futures Int'l software, which you can demo for 28 days with realtime data.

To access a free trial to the ALGOS shown in the chart ( DIAMONDS included) along with other tools, visit and sign up for a free trial for 21 days with real-time data.

Palladium Futures Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: Front two months: $10,300 initial, $9,300 Maint. ( as of the date of this newsletter)

Point Value: Each $1 move = $100. Min fluctuation is 0.1 = $10

Settlement: Physical, deliverable commodity 100 troy ounces

Months: Quarterly cycle of March H, June M, September U, and December Z

Weekly Options:NO, only quarterly options

Some of the basic fundamentals to keep in mind when you are considering trading the Palladium or other metals for this matter:

1. Longer term view of current market prices

2. Dates and times of important reports.

3. Commitment of Traders report (COT)

4. Correlation to US Dollar prices

5. Inflationary prospects

6. Geopolitical Stability

7. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the Palladium market, other metals, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 03/29 Fri |

7:30 AM CDT - Personal Income & Spending(Feb)

7:30 AM CDT - PCE Price Index(Feb) 7:30 AM CDT - Core PCE Price Index(Feb) 9:00 AM CDT - New Home Sales(Feb) 9:00 AM CDT - Univ Of Mich Consumer Sent-Final(Mar) 11:00 AM CDT - Grain Stocks 11:00 AM CDT - Prospective Plantings |

FN: Apr Copper(CMX)

Apr Gold & Silver(CMX) Apr Platinum & Palladium(NYM) LT: Mar 2,5 Year Notes(CBT) Mar Bitcoin(CME) Mar Fed Funds(CME) Apr RBOB & ULSD(NYM) Mar Fed Funds Options(CME) Apr Lumber Options(CME) |

| 04/01 Mon |

7:30 AM CDT - Retail Sales(Feb)

7:30 AM CDT - Retail Sales Ex-Auto(Feb) 9:00 AM CDT - Construction Spending(Feb) 9:00 AM CDT - ISM Manufacturing Index(Mar) 1:00 PM CDT - Auto & Truck Sales(Mar) 2:00 PM CDT - Cotton System 2:00 PM CDT - Fats & Oils 2:00 PM CDT - Grain Crushings |

|

| 04/02 Tue |

3:30 PM CDT - API Energy Stocks

|

FN: Apr RBOB & ULSD(NYM)

LT: Mar Butter(CME) Mar Milk(CME) Mar Butter Options(CME) Mar Milk Options(CME) |

| 04/03 Wed |

6:00 AM CDT - MBA Mortgage Index

7:15 AM CDT - ADP Employment Change(Mar) 7:30 AM CDT - Trade Balance(Feb) 9:00 AM CDT - Factory Orders(Feb) 9:00 AM CDT - ISM Non-Manufacturing Index(Mar) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales |

|

| 04/04 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

|

| 04/05 Fri |

7:30 AM CDT - Ave Workweek & Hourly Earnings(Mar)

7:30 AM CDT - Nonfarm Payrolls(Mar) 7:30 AM CDT - Unemployment Rate(Mar) 2:00 PM CDT - Consumer Credit(Feb) |

LT: Apr Canadian Dollar Options(CME)

Apr Currencies Options(CME) Apr Live Cattle Options(CME) Apr Mx Peso Options(CME) Apr US Dollar Index Options(ICE) May Cocoa Options(ICE) |

| 04/08 Mon |

|

FN: Apr Live Cattle(CME)

LT: May Sugar-16(ICE) |

| 04/09 Tue |

11:00 AM CDT - WADSE Report & Crop Production

3:30 PM CDT - API Energy Stocks |

FN: May Sugar-16(ICE)

|

| 04/10 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Core CPI & CPI(Mar) 9:00 AM CDT - Wholesale Inventories(Feb) 9:30 AM CDT - EIA Petroleum Status Report 1:00 PM CDT - Treasury Budget(Mar) 2:00 PM CDT - Dairy Products Sales |

|

| 04/11 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Core PPI & PPI(Mar) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

|

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!