September 18th, 2020 - Issue #1022

In This Issue

1. To Become a Winning Trader, you Must Learn How to Lose...

2. Hot Market Report: ES Futures Sitting on Major Pivot Line

3. Economic Calendar

1. Trading 102: To Become a Winning Trader, you Must Learn How to Lose...

Important NOTE: With the recent volatility across markets, we have seen margins increase in some markets as well as wild swings and extreme volatility in many markets. For some, it can cost the full account value but doesn’t need to. These volatile times require MAJOR adjustments in how you approach trading and risk management. I hope this article helps and I encourage you to utilize our brokers and the knowledge they have to assist you.. contact us

Many different factors go into trading. Too many to discuss efficiently in one blog post. Some relate to trading techniques, other to money management, mental aspect, risk capital and much more.

I am not sure how a trader can embed this into their trading mind, BUT in my opinion if you train your brain to expect losses, understand losses and that losing days will happen, you will increase your chances of surviving in this business, which in return will actually give you a chance to succeed....

Losses are part of trading and as long as your losses are part of the plan and are quantified in advance and you can adhere to your rules, then you have a chance. I think it's easy when traders are winning...making money etc. Much harder when you lose or down. your brain starts playing tricks on you...it tells you to double down, maybe reverse even though your analysis does not say so....all of a sudden you start pulling trades out of instinct, fear rather than a calculated plan that has solid risk/ reward. If a trader learns how to lose, to accept losses, to have realistic expectations, then he/ she can avoid having one of those terrible days when traders can lose almost of all their account.

I went into this subject and detailed day-trading money mgmt in an article I wrote a few years back for SFO magazine. You can read the full article by filling out the form below

Learn to Lose

Read Survivor Day Trader

Cannon Trading respects your privacy and will never give this information to a 3rd party.

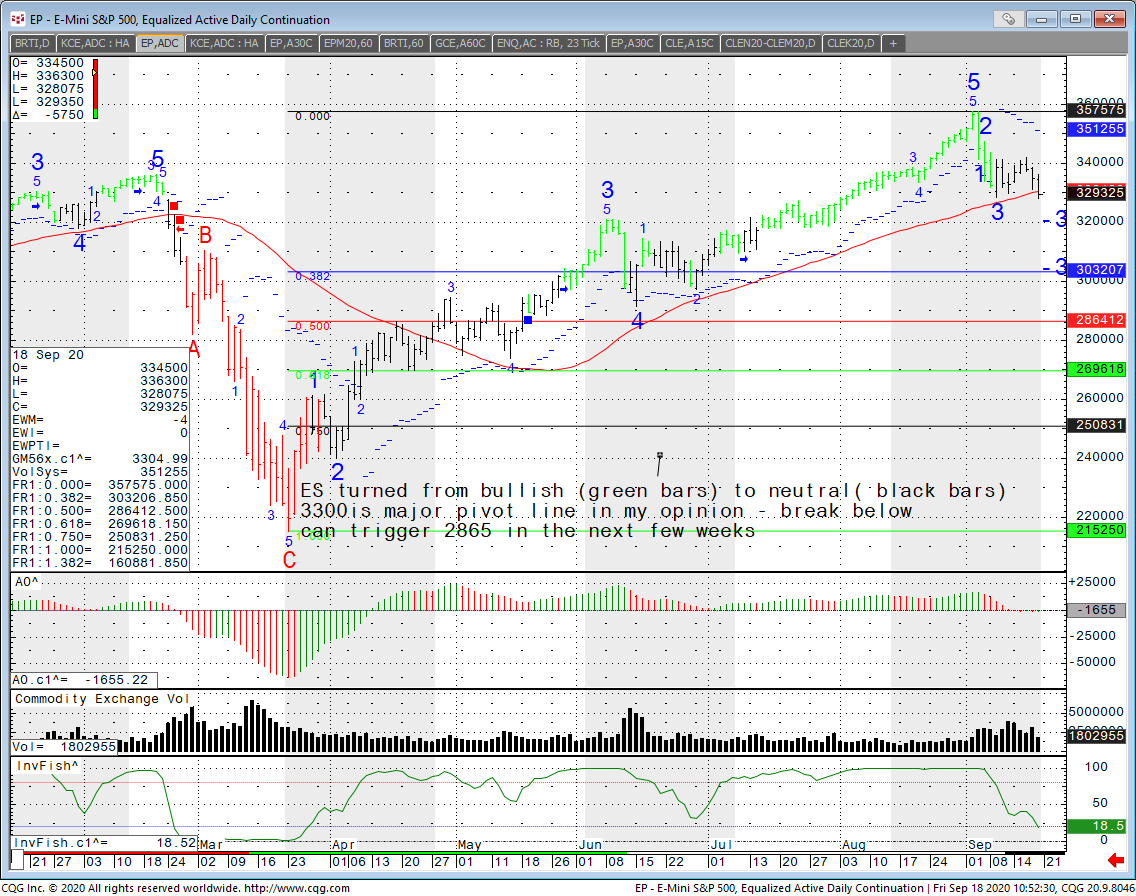

2. Hot Market Report: ES Futures Sitting on Major Pivot Line

By Ilan Levy-Mayer, VPClick on image below to enlarge

Mini SP 500 futures are part of the stock index family that includes mini NASDAQ, mini Russell, mini Dow, Mid cap, Nikkei and a few more. Most traded on the CME/CBOT/GLOBEX exchanges..

After making all-time highs a few weeks ago, the SP 500 along with the rest of the stock market are taking a "break"....The big question is will this break be a short one and uptrend resumes or will this be a more meaningful correction.

for a much larger correction in the weeks to come. I am using both Elliott Wave as well as some proprietary indicators and ALGOS I created and use. At the time of writing the ESZ20 is sitting right at that level...Very interesting to follow here in the next few weeks.

Keep in mind we have elections coming up and still LOTS of uncertainty with COVID...stay tuned, be ready for the unexpected and have a trading plan.

This chart was prepared using our CQG Q Trader software, which you can demo for 14 days with real time data.

With the historical volatility we are seeing, I would highly recommend looking at the MICRO contracts including the MICRO ES which is 1/10th the size of the mini SP. The symbol is MES and you can read more about the MICROS here.

Mini S&P 500 Futures Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $13200 initial, $12000 Maint. ( as of the date of this newsletter)

Point Value: full point = $50( Example: 3480.00 to 3481.00 ). Min fluctuation is 0.25 = $12.50( Example: 3480.00 to 3480.25) Settlement: Cash on the open of the third Friday of each month

Months: Quarterly cycle, June, Sep, Dec, March. M,U,Z,H

Weekly Options:YES

Micro S&P 500 Futures Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $1320 initial, $1200 Maint. ( as of the date of this newsletter)

Point Value: full point = $5( Example: 3480.00 to 3481.00 ). Min fluctuation is 0.25 = $1.25 ( Example: 3480.00 to 3480.25) Settlement: Cash on the open of the third Friday of each month

Months: Quarterly cycle, June, Sep, Dec, March. M,U,Z,H

Mini S&P 500 is one of my favorite markets for Day Trading because of the intraday range and movements. Be careful, these factors can work against you or in your favor.

Some of the basic fundamentals to keep in mind when you are considering trading the ES or other indices for this matter:

1. Longer term view of current market prices

2. Dates and times of important reports. CPI, Housing, employment, FOMC are just some of the reports you need to watch for

3. Earning reports

4. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the mini SP 500 market, other indices, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 09/17 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Housing Starts & Building Permits(Aug) 7:30 AM CDT - Philadelphia Fed Index(Sep) 9:30 AM CDT - EIA Natural Gas Report 2:00 PM CDT - Milk Production 3:30 PM CDT - Money Supply |

LT: Sep S&P 500(CME)

Sep S&P 500 Options(CME) Oct Crude Lt Options(NYM) |

| 09/18 Fri |

7:30 AM CDT - Current Account Balance(Q2)

9:00 AM CDT - Leading Indicators(Aug) 9:00 AM CDT - Univ of Mich Consumer Sent-Prelim(Sep) |

LT: Sep E-Mini Dow(CME)

Sep E-Mini S&P 500(CME) Sep E-Mini NASDAQ(CME) Sep Russell(CME) Sep Coffee(ICE) Sep E-Mini Dow Options(CME) Sep E-Mini S&P 500 Options(CME) Sep E-Mini NASDAQ Options(CME) Sep Russell Options(CME) Oct Orange Juice Options(ICE) |

| 09/21 Mon |

3:00 PM CDT - Crop Progress

|

LT: Sep 10 Year Notes(CBT)

Sep Bonds(CBT) |

| 09/22 Tue |

9:00 AM CDT - Existing Home Sales(Aug)

2:00 PM CDT - Cold Storage 3:30 PM CDT - API Energy Stocks |

LT: Oct Crude Lt(NYM)

|

| 09/23 Wed |

6:00 AM CDT - MBA Mortgage Index

8:00 AM CDT - FHFA Housing Price Index(Sep) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Product Sales |

|

| 09/24 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 9:00 AM CDT - New Home Sales(Aug) 9:30 AM CDT - EIA Natural Gas Report 2:00 PM CDT - Hogs & Pigs 3:30 PM CDT - Money Supply |

FN: Oct Cotton(NYM)

Oct Crude Lt(NYM) LT: Sep Feeder Cattle(CME) Sep Feeder Cattle Options(CME) Oct Copper Options(CMX) Oct Gold Options(CMX) Oct Silver Options(CMX) |

| 09/25 Fri |

7:30 AM CDT - Durable Goods-Ex Transportation(Aug)

7:30 AM CDT - Durable Orders(Aug) 2:00 PM CDT - Cattle On Feed |

LT: Sep Bitcoin(CME)

Oct 2,5,10 Year Notes Options(CBT) Oct Bonds Options(CBT) Oct Canola Options(CBT) Oct Wheat Options(CBT) Oct Corn Options(CBT) Oct Oats Options(CBT) Oct Rough Rice Options(CBT) Oct Soybeans,Soymeal,Soyoil Options(CBT) Oct Natural Gas Options(NYM) Oct RBOB & ULSD Options(NYM) |

| 09/28 Mon |

3:00 PM CDT - Crop Progress

|

LT: Sep Copper(CMX)

Sep Gold & Silver(CMX) Sep Platinum & Palladium(NYM) Oct Natural Gas(NYM) |

| 09/29 Tue |

8:00 AM CDT - S&P Case-Shiller Home Price Index(Jul)

9:00 AM CDT - Consumer Confidence(Sep) 3:30 PM CDT - API Energy Stocks |

|

| 09/30 Wed |

6:00 AM CDT - MBA Mortgage Index

7:15 AM CDT - ADP Employment Change(Sep) 7:30 AM CDT - GDP & GDP Deflator-Third Estimate(Q2) 8:45 AM CDT - Chicago PMI(Sep) 9:00 AM CDT - Pending Home Sales(Aug) 9:30 AM CDT - EIA Petroleum Status Report 11:00 AM CDT - Grain Stocks 11:00 AM CDT - Small Grains Summary 2:00 PM CDT - Dairy Products Sales |

FN: Oct Copper(NYM)

Oct Gold & Sliver(CMX) Oct Platinum & Palladium(NYM) Oct Soymeal & Soyoil(CBT) LT: Sep 2,5 Year Notes(CBT) Sep Black Sea Wheat(CME) Sep Fed Funds(CME) Oct RBOB & ULSD(NYM) Oct Sugar-11(ICE) Sep Black Sea Wheat Options(CME) Sep Fed Funds Options(CME) Oct Lumber Options(CME) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!