July 17th, 2020 - Issue #1014

In This Issue

1. (Day)Trading Got You Frustrated? Take a Look at a Simpler Approach to Trading Futures

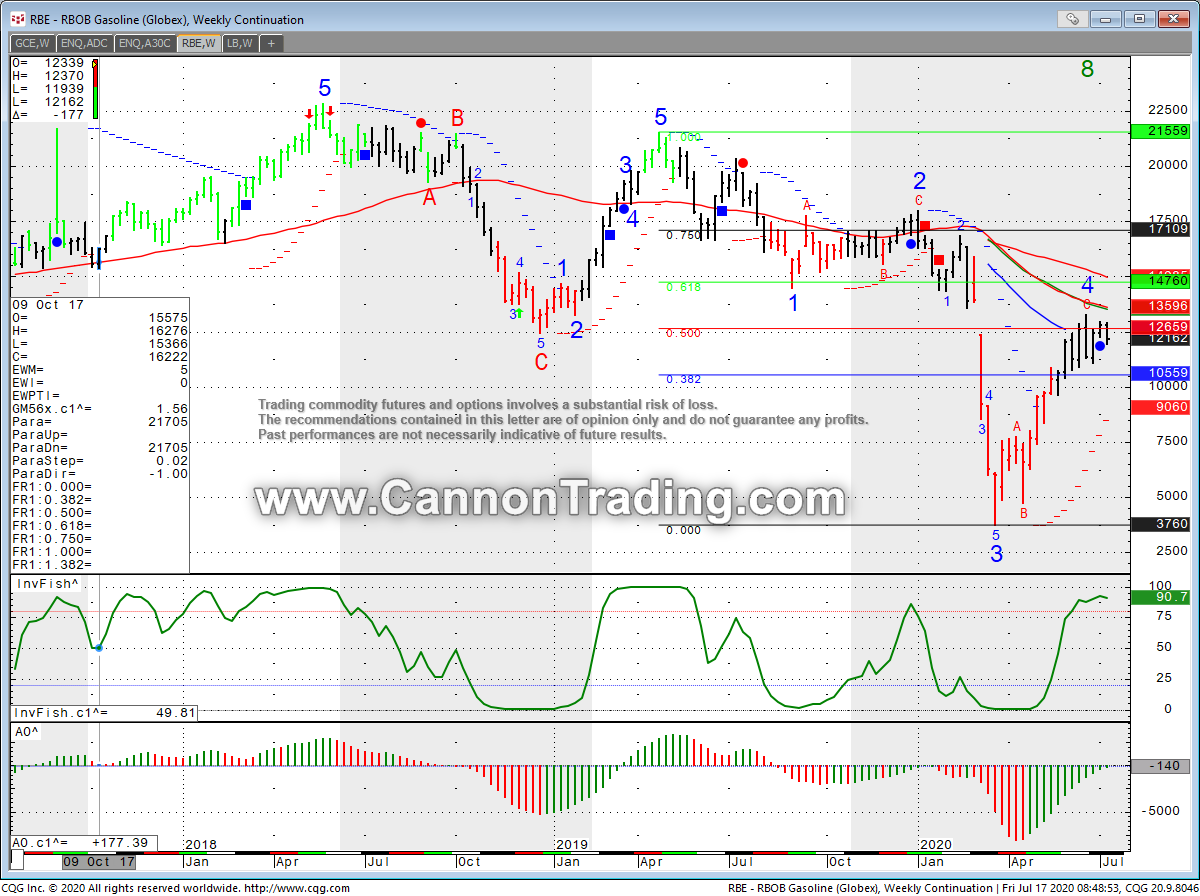

2. Hot Market Report: Unleaded Gasoline Completes 50% Weekly Retracement

3. Economic Calendar

1. Trading Video: How I like to day-trade futures using either counter trend or trend following concepts ( or what I call a simpler approach to day trading)

In this 25 minutes video you will learn the following:

1. Possible advantages of using range bar charts over time charts for day trading2. Trade set ups using counter trend indicators

3. Trade set ups using trend following indicators

4. The concept of price confirmation

5. Tips and insights from Ilan's observations of different markets

6. You will be able to install the indicators/concepts mentioned and practice right away with your own demo!

View Video Instantly "simple approach to Day Trading"

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Hot Market Report: Unleaded Gasoline Completes 50% Weekly Retracement

By John Thorpe, Senior BrokerClick on image below to enlarge

This week’s highlighted Market is Unleaded Gasoline. RBOB - Unleaded gas is part of the energy sector along with "it's brothers" Crude Oil and heating oil and cousin, natural gas. All traded on the NYMEX/GLOBEX exchange.

U.S. gasoline demand is faltering with the coronavirus continuing to spread. keeping a lid on higher prices for the short term, This takes us to a Market that, since the steep selloff that began February 20th had recovered from the Mar 23rd low and has , for the past nearly 6 weeks been trading between two very important Fibonacci retracement levels, 50% @ 1.14 per gal and the 67% 1.29 1/2 per gal , I would look for the market to remain range bound through and until the expiration of the August contract at the end of this month.

To access a free trial to the ALGOS shown in the chart visit and sign up for a free trial for 21 days with real-time data.

Unleaded Gasoline Specs

Hours: 5:00 PM to 4:00 PM next day PM Central Time

Margins: $7480 initial, $6800 Maint. ( as of the date of this newsletter)

Point Value: full point = $420( Example: 1.2014 to 1.2114 ). Min fluctuation is 0.0001 = $4.2( Example: 1.2017 to 1.2018)

Settlement: Physical, deliverable commodity

Months: Monthly cycle, All Months

Weekly Options:NO

Unleaded Gasoline is one of my favorite markets for Swing Trading because of the longer-term market volatility and movements. Be careful, these factors can work against you or in your favor.

Some of the basic fundamentals to keep in mind when you are considering a trade in the Unleaded Gasoline as well as other energies:

1. Longer term view of current market prices

2. Dates and times of important reports. Namely, Tuesday afternoon report (API) and the DOE report on Wednesday mornings at 10:30 Am EST

3. Weather and Seasonality

4. Correlation to US Dollar prices

5. Inflationary prospects

6. Geopolitical Stability

7. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the Unleaded Gasoline market, other energies, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 07/17 Fri |

7:30 AM CDT - Building Permits & Housing Starts(Jun)

9:00 AM CDT - Univ of Mich Consumer Sentiment-Prelim |

LT: Jul Nikkei Options(CME)

Aug Orange Juice Options(ICE) |

| 07/20 Mon |

3:00 PM CDT - Crop Progress

|

|

| 07/21 Tue |

2:00 PM CDT - Catfish Production

2:00 PM CDT - Milk Production 3:30 PM CDT - API Energy Stocks |

LT: Jul Coffee(ICE)

Aug Crude Lt(NYM) Aug Canola Options(CBT) |

| 07/22 Wed |

6:00 AM CDT - MBA Mortgage Index

8:00 AM CDT - FHFA Housing Price Index(Jul) 9:00 AM CDT - Existing Home Sales(Jun) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Cold Storage 2:00 PM CDT - Dairy Products Sales |

|

| 07/23 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

FN: Aug Crude Lt(NYM)

|

| 07/24 Fri |

9:00 AM CDT - New Home Sales(Jun)

2:00 PM CDT - Cattle 2:00 PM CDT - Cattle On Feed |

LT: Aug 2,5,10 Year Notes Options(CBT)

Aug Bonds Options(CBT) Aug Wheat Options(CBT) Aug Corn Options(CBT) Aug Oats Options(CBT) Aug Rough Rice Options(CBT) Aug Soybeans,Soymeal,Soyoil Options(CBT) |

| 07/27 Mon |

7:30 AM CDT - Durable Orders(Jun)

7:30 AM CDT - Durable Goods-Ex Transportation(Jun) 3:00 PM CDT - Crop Progress |

|

| 07/28 Tue |

8:00 AM CDT - S&P Case-Shiller Home Price Index(May)

9:00 AM CDT - Consumer Confidence(Jul) 3:30 PM CDT - API Energy Stocks |

LT: Aug Copper Options(CMX)

Aug Gold & Silver Options(CMX) Aug RBOB & ULSD Options(NYM) |

| 07/29 Wed |

6:00 AM CDT - MBA Mortgage Index

9:00 AM CDT - Pending Home Sales(Jun) 9:30 AM CDT - API Petroleum Status Report 1:00 PM CDT - FOMC Rate Decision(Jul) 2:00 PM CDT - Dairy Products Sales |

LT: Jul Copper(CMX)

Jul Gold & Silver(CMX) Jul Platinum & Palladium(NYM) Aug Natural Gas(NYM) |

| 07/30 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - GDP-Adv(Q2) 7:30 AM CDT - Chain Deflator-Adv(Q2) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

FN: Aug Natural Gas(NYM)

|

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!