August 30th, 2019 - Issue #979

In This Issue

1. Trading 101: 5 Big Mistakes Beginners Should Avoid Making

2. Hot Market Report: Gold Futures Regaining Safe Haven Status

3. Economic Calendar

This Monday is Labor Day. Markets will have modified trading hours Monday, most are closed. Have a safe and nice holiday!

1. Trading 101: 5 Big Mistakes Beginners Should Avoid Making

Trading futures is a tough business, but if you are one of the very few that can succeed, this could be a lucrative business as well

Ilan Levy-Mayer I have seen quite a bit since I became a broker in 1998. Some war stories to share about the markets, some crazy moves and much more in between. I was trading futures with clients on the sad Sept. 11th 2001 day when the planes hit and the markets were plunging before they were closed for almost a week. I witnessed the meat contracts making limit up and limit down moves over the years and much more…..

As a commodity broker I have observed MANY traders, many of them were new traders, and this allows me to share with you some valuable observations I hope will help you start your futures trading journey on a much smoother road than most.

Here are the FIVE CRUICIAL MISTAKES you need to avoid!

- Starting with low amount of capital. I don’t care what some people try to sell you out there….If you don’t have risk capital, don’t trade futures. Some trading styles may allow you to start with $5,000, but most will require a higher amount of risk capital in order for you to attempt trading properly and minimize the “greed/ fear” factor. It is my opinion that if you are looking to day trade, $5,000 is the bare minimum. If you are looking to swing trade, $25,000 is the minimum. If you are looking to buy options, you may be able to give it a good shot with $10,000. If you are looking to sell options, make sure you have enough room for the margin calls. Of course, the markets you trade and how aggressively you trade will determine if you need more than the bare minimums I mentioned above. Don’t try to trade 5 lots of crude oil with $5,000. Save yourself the pain – it will not work.

- Not spending enough time on education and research before starting to trade. I have seen too many traders jump into the futures markets because: A. A friend told them they can make money. B. They heard on the news there is a shortage of wheat/coffee/insert name….C. They saw an advertisement of “trading technique” that made it sound like you can make money trading futures in a way that is too good to be true….(if it sounds too good to be true….it is too good to be true!). All of the above are fine in the fact that they exposed you to futures trading and got you curious. Now don’t take the easy way out….Research… talk to experienced traders or brokers. Find out what exactly is the story, what are commodities and futures? Learn about the different trading styles available and then decide how you want to get started.

- Jumping in with real money right away OR spending WAY too much time in simulation mode.

Finish Article

Finish Article

Cannon Trading respects your privacy and will never give this information to a 3rd party.

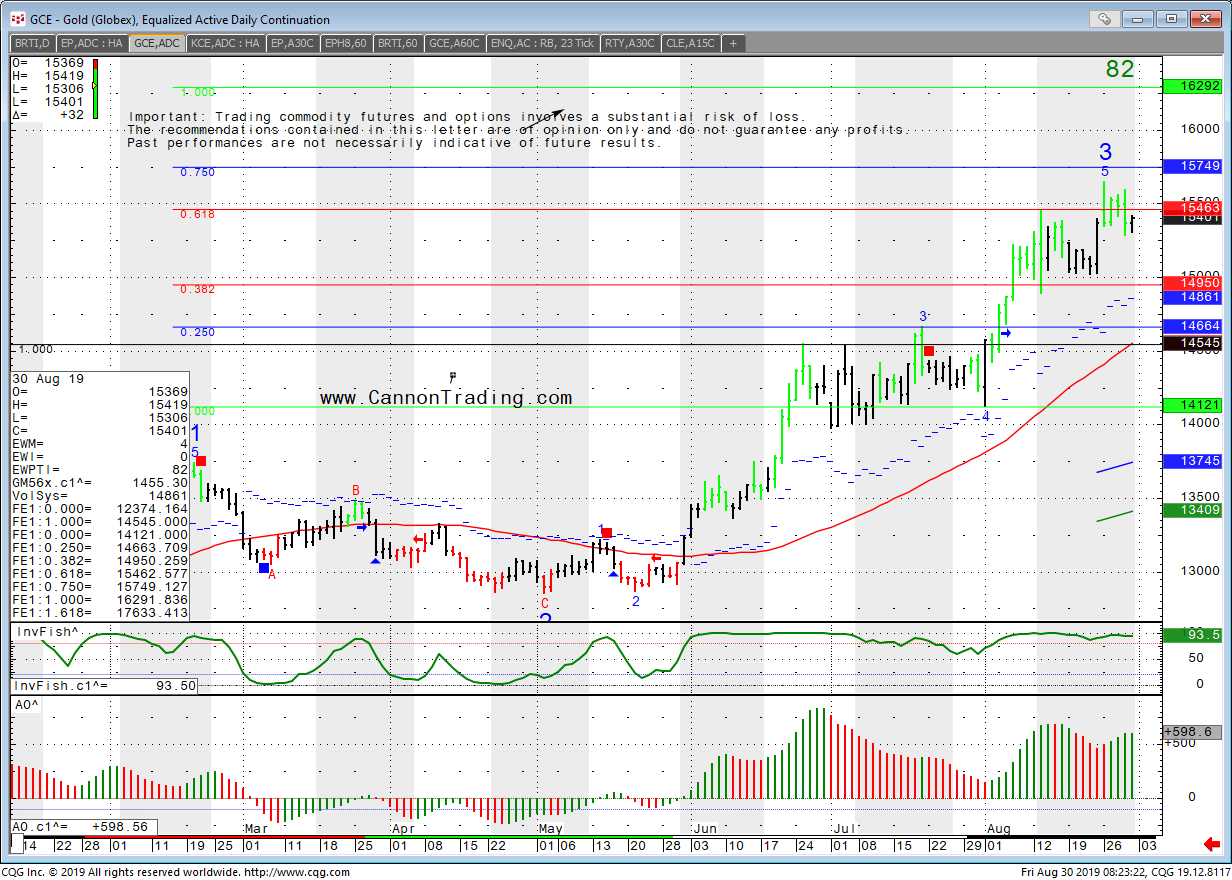

2. Hot Market Report: Hot Market Report: Gold Futures Regaining Safe Haven Status

By Matt KangClick on image below to enlarge

This week’s highlighted Market is Gold. Gold is part of the Precious Metals sector along with its brothers Platinum, Palladium, Silver and Copper.. All traded on the COMEX and NYMEX exchanges.

This week’s highlighted Market is Gold. Gold is part of the Precious Metals sector along with its brothers Platinum, Palladium, Silver and Copper.. All traded on the COMEX and NYMEX exchanges.

This week (Wednesday) gold traded up to its highest levels in more than six years – $1565 per ounce (December futures contract on the COMEX exchange). Not since April 2013 has it breached that price. That also pushed its 2019 gains above 20%, surpassing the S&P 500’s ±14% year-to-date gains. Reasons abound for gold’s ascent – traditionally considered a safe haven asset in times of uncertainty: The U.S.-China trade hostilities have intensified: the Chinese yuan tumbled past the psychologically important level of 7 to the dollar for the first time since the financial crisis. When the People's Bank of China took steps to stabilize the yuan – a move seen as likely part of the PBOC's defense of Pres. Trump's threat to extend tariffs to essentially all Chinese imports – the U.S. Treasury Department labeled China a currency manipulator for the first time since 1994.

The gold market is still holding their gains since May 21st Gold prices have seen some expected selling pressure after prices hit a fresh six-year high earlier in the week. A bull market is expected from the technical perspective but the key fundamental is the president - Pres. Trump. If Trump try to make a deal with China to preserve the equity market then it would be a short term negative for the gold market.

This chart was prepared using CQG Q Trader software, which you can demo for 14 days with real time data.

Gold is a very liquid market with a relatively good volatility ( can work for you and against you....). Different behavior and personality than stock indices. I like using breakout methods as well as "counter trend" techniques as this market "fear and greed index" is high on my list. It goes without saying that gold is an excellent market for options, swing trading and long term trading as well with 23 hours trading, strong volume and excellent liquidity. In addition traders can use both mini Gold and MICRO gold. To access a free trial to the ALGOS shown in the chart visit and sign up for a free trial for 21 days with real-time data.

GOLD Futures Specs

Hours: 05:00 PM previous day to 4:00 PM Central Time

Margins: $4440 initial, $4000 Maint. ( as of the date of this newsletter)

Point Value: full point = $100 ( Example: 1285.0 to 1286.0 ). Min fluctuation is 0.1 = $10 ( Example: 1285.5 to 1285.6) Settlement: Physical Delivery

Months: February, April, June, August, October,December. G,J,M,Q,V,Z

Weekly Options:YES

Some of the basic fundamentals to keep in mind when you are considering trading gold futures for this matter:

1. Research supply side in major producing countries.

2. Follow both the jewelry demand and investment demand for silver

3. Focus in macroeconomics not microeconomics

4. Correlation to silver and platinum

5. Correlation to US Dollar prices

6. Inflationary prospects

7. Geopolitical Stability

8. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the gold market, other metals, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

Date Reports Expiration & Notice Dates 08/30

Fri7:30 AM CDT - Personal Income & Spending(Jul)

7:30 AM CDT - PCE Price Index(Jul)

7:30 AM CDT - Core PCE Price Index(Jul)

8:45 AM CDT - Chicago PMI(Aug)

9:00 AM CDT - Univ of Mich Consumer Sent-Final(Aug)FN: Sep 2,5,10 Year Notes(CBT)

Sep Bonds(CBT)

Sep Copper(CMX)

Sep Gold & Silver(CMX)

Sep Platinum & Palladium(NYM)

Sep Wheat(CBT)

Sep Corn(CBT)

Sep Oats(CBT)

Sep Rough Rice(CBT)

Sep Soybeans,Soymeal,Soyoil(CBT)

LT: Aug Bitcoin(CME)

Aug Fed Funds(CME)

Aug Live Cattle(CME)

Sep RBOB & ULSD(NYM)

Aug Fed Funds Options(CME)

Sep Lumber Options(CME)

09/02

MonLABOR DAY

09/03

Tue7:30 AM CDT - Chicago PMI(Aug)

9:00 AM CDT - Construction Spending(Jul)

9:00 AM CDT - ISM Manufacturing Index(Aug)

2:00 PM CDT - Cotton System

2:00 PM CDT - Fats & Oils

2:00 PM CDT - Grain Crushings

3:00 PM CDT - Crop Progress

FN: Sep Orange Juice(ICE)

09/04

Wed6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Trade Balance(Jul)

1:00 PM CDT - Fed's Beige Book(Sep)

3:30 PM CDT - API Energy StocksFN: Sep RBOB & ULSD(NYM)

LT: Aug Butter(CME)

Aug Milk(CME)

Aug Butter Options(CME)

Aug Milk Options(CME)

09/05

Thu7:15 AM CDT - ADP Employment Change(Aug)

7:30 AM CDT - Initial Claims-Weekly

7:30 AM CDT - Productivity-Rev(Q2)

7:30 AM CDT - Unit Labor Costs-Rev(Q2)

9:00 AM CDT - Factory Orders(Jul)

9:00 AM CDT - ISM Non-Manufacturing Index(Aug)

9:30 AM CDT - EIA Natural Gas Report

10:00 AM CDT - EIA Petroleum Status Report

2:00 PM CDT - Dairy Products Sales

3:30 PM CDT - Money Supply

09/06

Fri7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Ave Workweek & Hourly Earnings(Aug)

7:30 AM CDT - Nonfarm Payrolls(Aug)

7:30 AM CDT - Unemployment Rate(Aug)LT: Sep Canadian Dollar Options(CME)

Sep Currencies Options(CME)

Sep Mx Peso Options(CME)

Sep US Dollar Index Options(ICE)

Sep Live Cattle Options(CME)

Oct Cocoa Options(ICE)

09/09

Mon2:00 PM CDT - Consumer Credit(Jul)

3:00 PM CDT - Crop Progress

09/10

Tue3:30 PM CDT - API Energy Stocks

LT: Sep Orange Juice(ICE)

09/11

Wed6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Core PPI & PPI(Aug)

9:00 AM CDT - Wholesale Inventories(Jul)

9:30 AM CDT - EIA Petroleum Status Report

2:00 PM CDT - Dairy Products Sales

09/12

Thu7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly

7:30 AM CDT - Core CPI & CPI(Aug)

9:30 AM CDT - EIA Natural Gas Report

11:00 AM CDT - WADSE Report & Crop Production

1:00 PM CDT - Treasury Budget(Aug)

3:30 PM CDT - Money SupplyLT: Sep Nikkei(CME)

Sep Nikkei Options(CME)

FN=First Notice, OE=Option Expiration, LT=Last Trade Disclaimer: This calendar is compiled from sources believed to be reliable. Moore Research Center, Inc. assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The release dates for certain economic reports may have been rescheduled.

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!