October 11th, 2019 - Issue #985

In This Issue

1. Live Trading: Enhance Your Trading with Trade Alerts & Real Time ALGOS

2. Hot Market Report: Bonds, Yields, Recession and Trading....

3. Economic Calendar

Get Real Time Updates via Twitter!

1. Live Trading: Enhance Your Trading with Trade Alerts & Real Time ALGOS

Thu, Oct 17, 2019 9:00 AM - 10:00 AM PDT

In this webinar, we will take a look at some innovative new trader development tools from Cannon Trading and ExitPoints.com

Join Cannon's VP, Ilan Levy-Mayer as he shares his trading screen, opinions and how he likes to use the ALGORITHMIC tools in real-time market conditions using a live feed simulated trading account:

* How to utilize a daily email in deciding which markets to trade and what direction to take

* mini SP, mini Nasdaq, mini Dow, mini Russell, crude oil, grains, metals and more!

* How to trade using the realtime alerts

* Review on how to set up your charts and have access to the real-time trading ALGOS

* Managing existing trades using Bollinger bands, Parabolics, CCI and more!

In the end, we hope to have opened your eyes to new processes that can help you get the most from your methods. Special 3 weeks FREE trial to both real-time trade alerts, daily email and other tools SPACE is LIMITED, so reserve your space now!

2. Hot Market Report: Bonds, Yields, Recession and Trading....

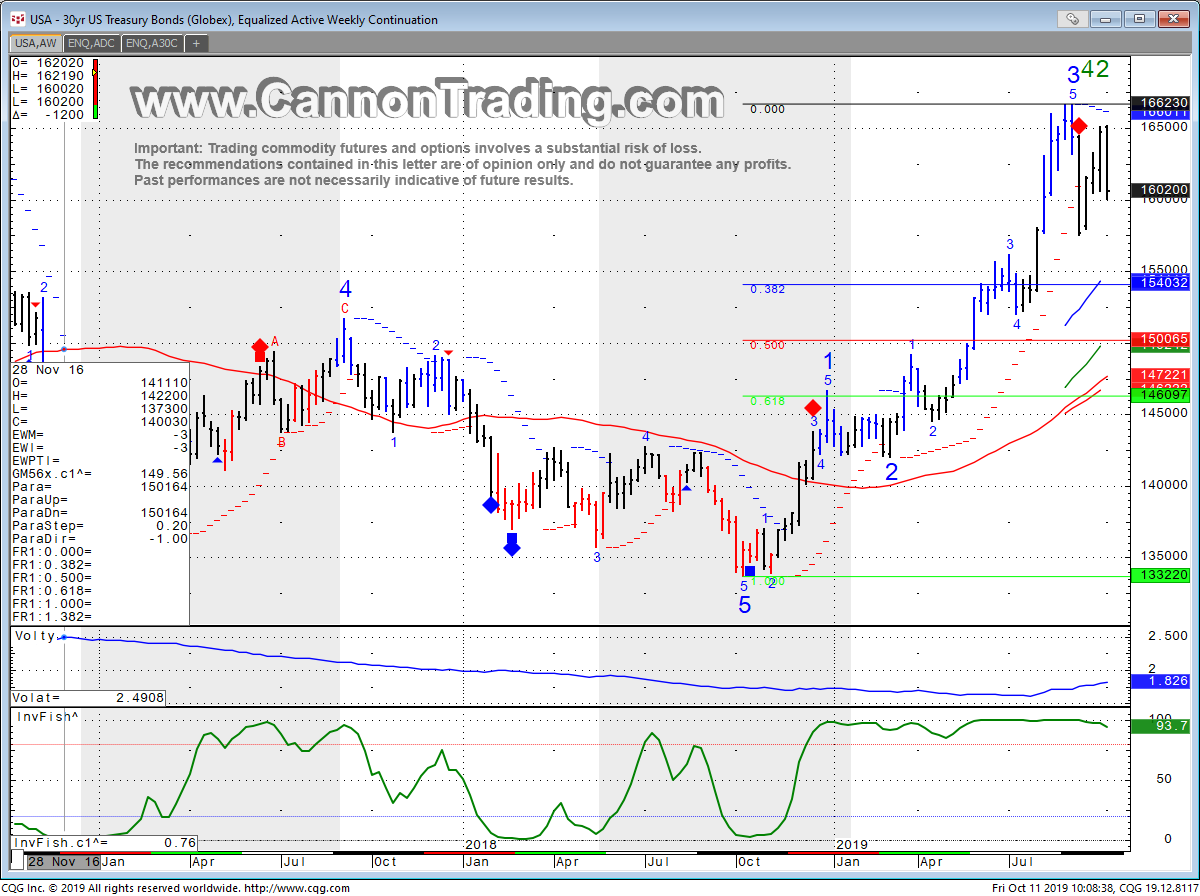

By John Thorpe, Senior BrokerClick on image below to enlarge

This week’s highlighted Market is The US 30 year treasury bond market and belongs to the "interest rate family" 10 year, 5 year, 2 year notes, the "Ultra bond" and others. All traded on the CBOT exchange.

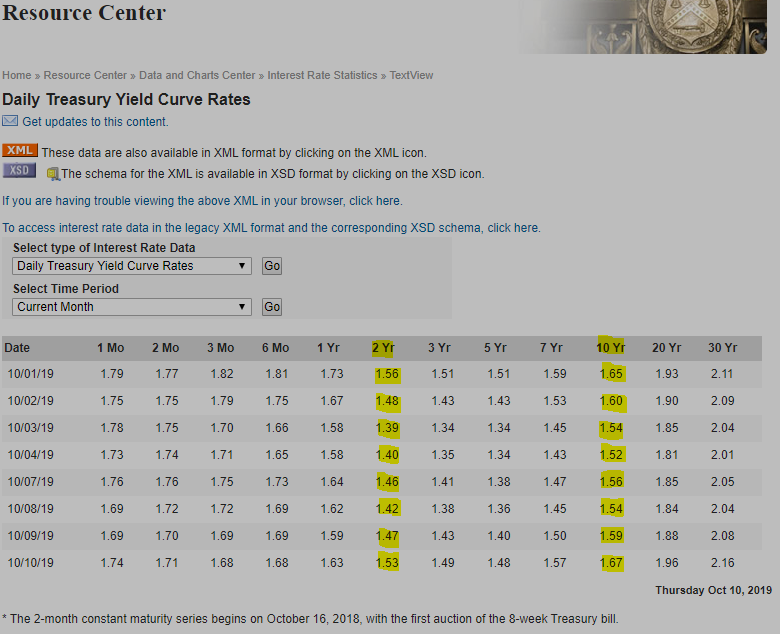

According to the way the markets have been behaving, recession fears should be put to rest by recent market behavior. You have probably been exposed to the benchmark Econo chatter about the relationship between yields in the 2 yr. vs 10 yr. U.S. Treasury note spread also known as the yield differential. We hear that conclusions can be drawn from the changing relationship between the yields of both of these U.S. Treasury securities about where the U.S. Economy is heading and is determined by activity in the bond market. The reasoning for the case to be made for recession is that If the 10 yr. note yield dips, trades or holds below the 2 year, then the market is pricing in the likelihood of a recession. Here is a table I use from the U.S. Treasury department, I receive daily, to look at this relationship from a yield perspective rather than price.

Contrast this to the 30yr U.S. Bond market and you will see that on prior to the Oct 4th release the spread was widening and discounting the possibility of no recession “Buy the rumor sell the fact!” Right? widening when the most closely watched economic number was released, the monthly release from the U.S. Labor department. And the spread bottomed recently when TradeWar murmours were about “no Deal” this week on Sunday night. Yields are currently increasing on the long bond, the 30yr , prices for the 30yr ZBZ19 are moving fast to the downside and will probably overshoot into the 158.00 area before the market reaches an equilibrium and rests around the 160.00 -161.00 for a short time period while it consolidates.

30 yr Treasury Bond Futures Specs

Hours: 05:00 PM previous day to 4:00 PM Central Time

Margins: $2530 initial, $2300 Maint. ( as of the date of this newsletter)

Point Value: full point = $1000 ( Example: 144.16 to 145.16 ). Min fluctuation is 0.01 = $31.25 ( Example: 144.16-144.17)

Settlement: Physical Delivery

Months: Quarterly (March,June,Sep,Dec)

Weekly Options:YES

Some of the basic fundamentals to keep in mind when you are considering trading the U.S. 30yr Treasury Bonds for this matter:

1. Interest Rates.

2. FOMC Rate decisions and Language

3. Focus in macroeconomics

4. Bond Prices have an inverse relationship to Interest rates

5. Correlation to US Dollar prices

6. Inflationary prospects

7. Geopolitical Stability

8. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the Bond market, other interest rate products, other futures, options, futures spreads and much more!

Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 10/11 Fri |

7:30 AM CDT - Export & Import Prices(Sep)

7:30 AM CDT - Export(ex-ag) & Import(ex-oil) Prices(Sep) 9:00 AM CDT - Univ of Mich Consumer Sent-Prelim(Oct) |

LT: Oct Mx Peso(CME)

Oct Eurodollar Options(CME) Nov Coffee Options(ICE) |

| 10/14 Mon |

COLUMBUS DAY

|

LT: Oct Eurodollar(CME)

Oct Lean Hogs(CME) Oct Soymeal(CBT) Oct Soyoil(CBT) Oct Lean Hogs Options(CME) |

| 10/15 Tue |

7:30 AM CDT - Empire State Manufacturing(Oct)

11:00 AM CDT - NOPA Crush 3:00 PM CDT - Crop Progress |

LT: Nov Sugar-11 Options(ICE)

|

| 10/16 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Retail Sales(Sep) 7:30 AM CDT - Retail Sales Ex- Auto(Sep) 9:00 AM CDT - Business Inventories(Aug) 1:00 PM CDT - Fed's Beige Book(Sep) 3:00 PM CDT - Net Long-Term TIC Flows(Aug) 3:30 PM CDT - API Energy Stocks |

LT: Nov Platinum Options(NYM)

Nov Palladium Options(NYM) |

| 10/17 Thu |

7:30 AM CDT - Building Permits & Housing Starts(Sep)

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Philadelphia Fed Index(Oct) 8:15 AM CDT - Capacity Util & Industrial Prod(Sep) 9:30 AM CDT - EIA Natural Gas Report 10:00 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales 3:30 PM CDT - Money Supply |

LT: Nov Crude Lt Options(NYM)

|

| 10/18 Fri |

7:30 AM CDT - USDA Weekly Export Sales

9:00 AM CDT - Leading Indicators(Sep) |

LT: Oct Nikkei Options(CME)

Nov Cotton Options(NYM) Nov Orange Juice Options(ICE) |

| 10/21 Mon |

3:00 PM CDT - Crop Progress

|

|

| 10/22 Tue |

9:00 AM CDT - Existing Home Sales(Sep)

2:00 PM CDT - Cold Storage 3:30 PM CDT - API Energy Stocks |

LT: Nov Crude Lt(NYM)

|

| 10/23 Wed |

6:00 AM CDT - MBA Mortgage Index

8:00 AM CDT - FHFA Housing Price Index(Aug) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales |

|

| 10/24 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Durable Goods-Ex Transportation(Sep) 7:30 AM CDT - Durable Orders(Sep) 9:00 AM CDT - New Home Sales(Sep) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

FN: Nov Crude Lt(NYM)

|

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!