August 14th, 2020 - Issue #1018

In This Issue

1. Trading 102: Video on Few Ways to Trail a Stop

2. Hot Market Report: Small Exchange Metals Index

3. Economic Calendar

1. Trading 102: Video on Few Ways to Trail a Stop

In this 3 minutes video, Ilan Levy-Mayer of Cannon Trading shares a recent trading example with silver futures and a few different ways to use a trailing stop.

Hopefully if you are already trading you have completed your initial education: contract specs, trading hours, brokers, platforms, the opportunities as well as the risk and need to use risk capital in futures, and so on. Understanding this information is essential to trading. The second type of education is ongoing: learning about trading techniques, the evolution of markets, different trading tools, and more. The following 2 videos are part of this ongoing education. Enjoy!

View Trading Educational Video

Cannon Trading respects your privacy and will never give this information to a 3rd party.

2. Hot Market Report: Small Exchange Precious Metals Index

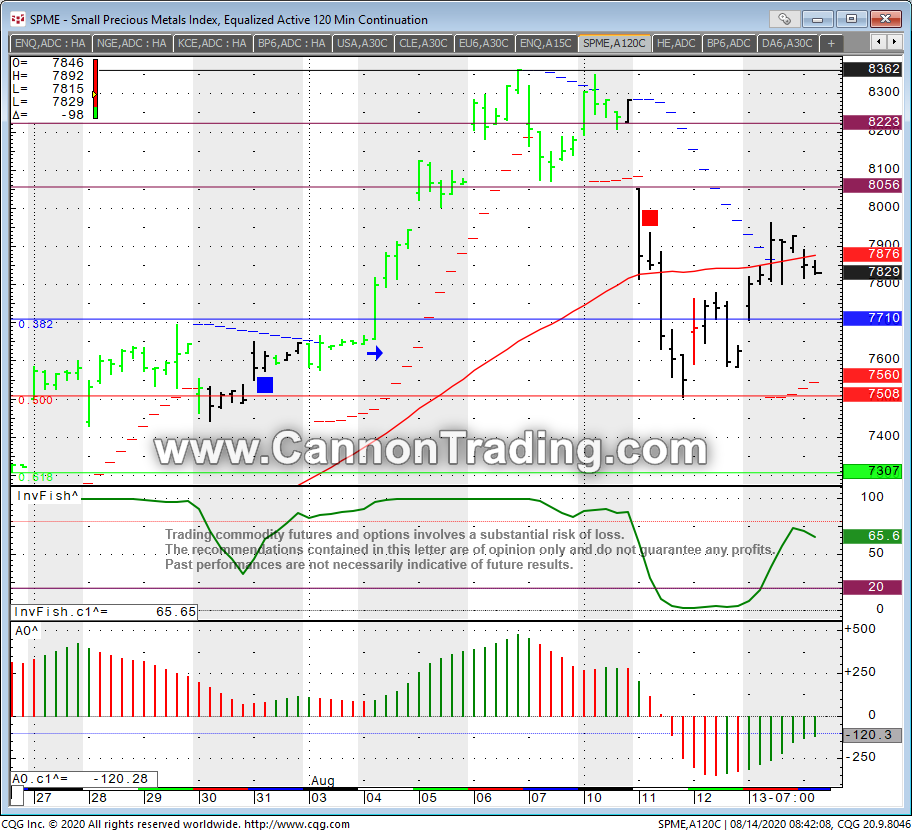

By Ilan Levy-Mayer, VPClick on image below to enlarge

This week’s highlighted Market is Small Precious Metals Index. Small Precious Metals combines gold, silver, and platinum relative to their consumption, production, and volume, so you trade the developments that matter most in a changing metals market.

The Small Exchange is a relatively new exchange with a unique approach and concept: Gain exposure to popular markets with standardized tick values and expiration dates on the Small Exchange. This brand new exchange joins the benefits of trading futures like capital efficiency, with the accessibility of the stock market. Learn why Smalls are a simple yet exciting addition to your trading plan

The Smalls Metals Index MIGHT be a good way for certain clients who are looking to trade the metals complex with out the need for the larger margins involved with trading gold, silver and platinum. Some advantages: • Small size compared to existing futures (with smaller margins) • Simple contract specs ($1 whether you're trading precious metals or foreign exchange, same expiration date too) • Standard and relevant construction so on days when silver is quiet you have exposure to gold and platinum and vice versa

120 minute ( 2 hours chart) Chart of the Smalls Metals index Futures for your review from this morning ( Aug 14th, 2020).

The next resistance is $80.56 and $82.23. Immediate support at: $77.10 and $75.08

To access a free trial to the ALGOS shown in the chart visit and sign up for a free trial for 21 days with real-time data.

SPME ( some platforms called SPRE) Futures Specs

Hours: 07:00 AM to 4:00 PM Central Time

Margins: $440 initial, $400 Maint. ( as of the date of this newsletter)

Point Value: full point = $100( Example: 26.80 to 27.80 ). Min fluctuation is 0.01 = $1 ( Example: 26.81 to 26.82)

Settlement: Cash Settelment third Friday of every month

Months: Monthly cycle, All Months

Weekly Options:NO

Some of the basic fundamentals to keep in mind when you are considering trading the metals Index for this matter:

1. Research supply side in major silver producing countries like Mexico, China, and Peru.

2. Follow both the industrial demand and investment demand for silver

3. Focus in macroeconomics not microeconomics

4. Correlation to gold

5. Correlation to US Dollar prices

6. Inflationary prospects

7. Inter market relationship between gold, silver and platinum

8. U.S. Fiscal and Monetary Stability

Our brokers here at Cannon will be happy to chat about the Small Exchange Metals Index, other metals, other futures, options, futures spreads and much more! Feel free to contact us at any time.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 08/14 Fri |

7:30 AM CDT - Productivity-Prel(Q2)

7:30 AM CDT - Retail Sales(Jul) 7:30 AM CDT - Retail Sales Ex-Auto(Jul) 7:30 AM CDT - Unit Labor Costs-Prelim(Q2) 8:15 AM CDT - Capacity Util & Industrial Prod(Jul) 9:00 AM CDT - Business Inventories(Jun) 9:00 AM CDT - Univ of Mich Consumer Sent-Prelim(Aug) |

LT: Aug Lean Hogs(CME)

Aug Soybeans,Soymeal,Soyoil(CBT) Aug Lean Hogs Options(CME) Aug Eurodollar Options(CME) Sep Coffee Options(ICE) |

| 08/17 Mon |

7:30 AM CDT - Empire State Manufacturing(Aug)

9:00 AM CDT - NAHB Housing Market Index(Aug) 11:00 AM CDT - NOPA Crush 2:00 PM CDT - Net Long-Term TIC Flows(Jun) 3:00 PM CDT - Crop Progress |

LT: Aug Eurodollar(CME)

Aug Mx Peso(CME) Sep Crude Lt Options(NYM) Sep Sugar-11 Options(ICE) |

| 08/18 Tue |

7:30 AM CDT - Building Permits & Housing Starts(Jul)

3:30 PM CDT - API Energy Stocks |

FN: Sep Cocoa(ICE)

|

| 08/19 Wed |

6:00 AM CDT - MBA Mortgage Index

9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales 2:00 PM CDT - Milk Production |

LT: Sep Platinum Options(NYM)

Sep Palladium Options(NYM) |

| 08/20 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - Philadelphia Fed Index(Aug) 9:00 AM CDT - Leading Indicators(Jul) 9:30 AM CDT - EIA Natural Gas Report |

LT: Sep Crude Lt(NYM)

|

| 08/21 Fri |

9:00 AM CDT - Existing Home Sales(Jul)

2:00 PM CDT - Cattle On Feed |

FN: Sep Coffee(ICE)

LT: Aug Nikkei Options(CME) Sep 2,5,10 Year Notes Options(CBT) Sep Bonds Options(CBT) Sep Canola Options(CBT) Sep Wheat Options(CBT) Sep Corn Options(CBT) Sep Oats Options(CBT) Sep Rough Rice Options(CBT) Sep Soybean,Soymeal,Soyoil Options(CBT) Sep Cotton Options(NYM) Sep Orange Juice Options(ICE) |

| 08/24 Mon |

2:00 PM CDT - Cold Storage

3:00 PM CDT - Crop Progress |

FN: Sep Crude Lt(NYM)

|

| 08/25 Tue |

8:00 AM CDT - FHFA Housing Price Index(Aug)

8:00 AM CDT - S&P Case-Shiller Home Price Index(Jun) 9:00 AM CDT - Consumer Confidence(Aug) 9:00 AM CDT - New Home Sales(Jul) 3:30 PM CDT - API Energy Stocks |

|

| 08/26 Wed |

6:00 AM CDT - MBA Mortgage Index

7:30 AM CDT - Durable Goods-Ex Transportation(Jul) 9:30 AM CDT - EIA Petroleum Status Report 2:00 PM CDT - Dairy Products Sales |

LT: Sep Copper Options(CMX)

Sep Gold & Silver Options(CMX) Sep Natural Gas Options(NYM) Sep RBOB & ULSD Options(NYM) |

| 08/27 Thu |

7:30 AM CDT - USDA Weekly Export Sales

7:30 AM CDT - Initial Claims-Weekly 7:30 AM CDT - GDP & Deflator-Second Estimate(Q2) 9:00 AM CDT - Pending Home Sales(Jul) 9:30 AM CDT - EIA Natural Gas Report 3:30 PM CDT - Money Supply |

LT: Aug Copper(CMX)

Aug Gold & Silver(CMX) Aug Platinum & Palladium(NYM) Aug Feeder Cattle(CME) Sep Natural Gas(NYM) Aug Feeder Cattle Options(CME) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!