January 17th, 2020 - Issue #996

In This Issue

1. Trading Videos 101: Curious on an indicator that can help you with EXITS? How About using a certain indicator as a trailing stop?

2. Hot Market Report: Crude Oil Volatility Continues!

3. Economic Calendar

MLK Hoiliday this Monday. Markets will have modified trading hours and some are closed on Monday.

1. Trading Videos 101: Curious on an indicator that can help you with EXITS? How about using a certain indicator as a trailing stop?

Watch the latest trading videos we have posted and see if you can pick a tip or two on trading smarter!

In this week's newsletter we are sharing four videos, each a few minutes long. The videos discuss practical tips for trading and sharing our experience with you

1. Using bolinger Bands as a possible tool for exiting trades

2. One way you can use the Parabolics study ( also known as PSAR) to manage current positions, possibly as a trailing stop

3. Different ways traders can utilize support and resistance levels in their trading.

4. Entering trades on a stop, using "price confirmation".

5. Utilizing Range Bar charts for shorter term trading as a way to try and filter out some noise.

Watch the videos instantly by filling out the short form below

Trading Videos: bollinger, Parabolics, SR levels & More!

Cannon Trading respects your privacy and will never give this information to a 3rd party.

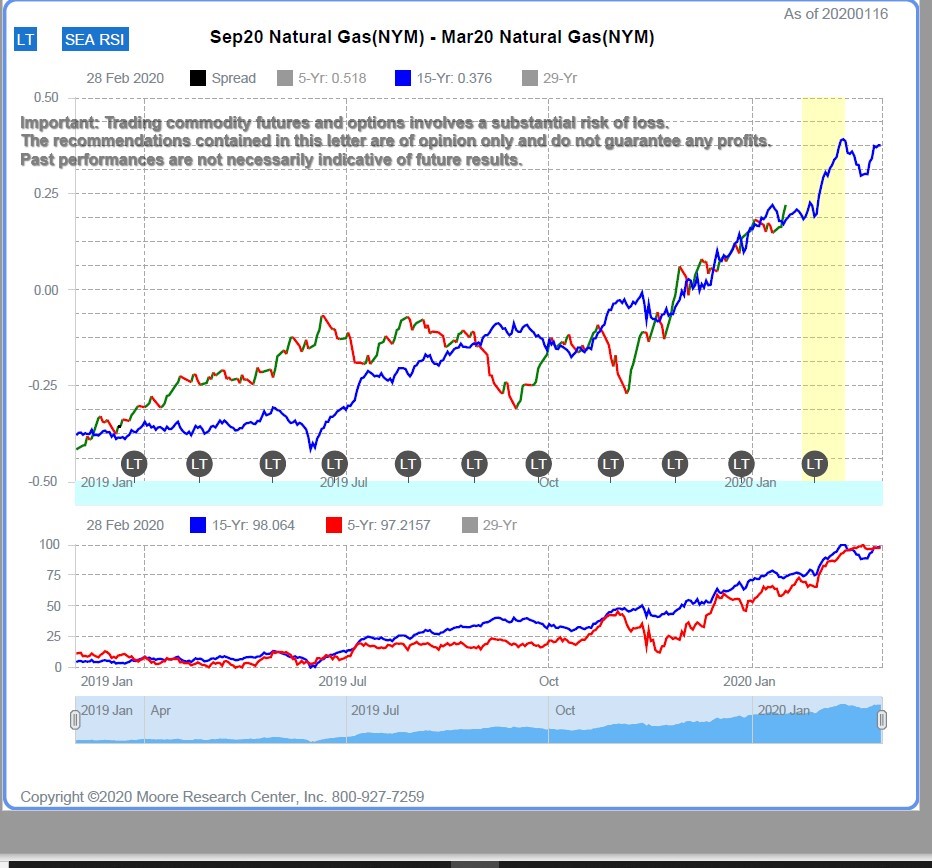

2. Hot Market Report: Natural Gas breaking new lows - perhaps a futures spread might be a smarter way to trade this market?

By Mark O'Brien, Senior BrokerClick on image below to enlarge

This week’s highlighted Market is Natural Gas futures. Natural Gas is part of the energy sector along with its cousins, Crude Oil, RBOB - Unleaded gas and heating oil. All traded on the NYMEX/GLOBEX exchange.

Today's commentary is a bit different than usual as we look at a futures spread, which is the simultaneous purchase of one futures contract and sale of a related futures contract as a unit. In this case, were looking at a spread that’s long the Sept. ‘20 Natural Gas and short March ‘20 Natural Gas. This is considered a “bear spread,” as indicated by the spread’s front month – the short March contract.

When we look at the general supply/demand forces involved in this commodity, it’s worth noting that natural gas consumption is highest during the heating season, running November-March. But there is a secondary season of high consumption – the cooling season during the heat of summer when large regions of the country depend on natural gas to generate electricity to run air conditioners. In between are the so-called shoulder months, when temperatures are neither too hot nor too cold and consumption is low. Before winter sets in, distributors in cold weather regions accumulate inventories. When the heating season begins, they begin to sell their stocks into the retail market. Throughout winter, they become progressively more aggressive in order to liquidate those inventories down to minimal levels by spring. As they do, more nearby contracts are pressured more. Furthermore, contracts for delivery in low-use months tend to suffer more than do those in high-use months. This spread – long Sept. ‘20 Natural Gas / short March ‘20 Natural Gas – has traded more favorably around Feb. 11 than on Jan. 24 for the last 16 years in a row. This spread has generally followed its seasonal pattern, which now suggests lower prices are ready to push this bear spread into an uptrend that could accelerate as winter progresses. Historical odds favor this spread. The breakout to new lows in natural gas prices would result in new highs on the spread.

Thank you to Jerry Toepke at Moore Research Center, Inc. for his contribution to this commentary.

Spread chart for your review

.Natural Gas Futures Specs. (this market also offers a mini Nat Gas futures contract which is half the size)

Hours: 5:00 PM to 4:00 PM the following day, Central Time

Margins: $2500 initial, $2200 maintenance ( as of the date of this newsletter)

Point Value: full point = $100 ( Example: 404.0 to 405.0 ). Min. price fluctuation is 0.1 = $10 ( Example: 404.1 to 404.2)

Settlement: Physical, deliverable commodity

Months: Monthly cycle, All Months

Weekly Options:YES

Some of the basic fundamentals to keep in mind when you are considering trading the Nat Gas market:

1. Longer term view of current market prices

2. Supply and Demand

3. Seasonality, i.e. heating and cooling cycles

4. Be aware of Thursday morning’s EIA gas storage report at 9:30 AM CDT

Our brokers here at Cannon will be happy to chat about the Natural Gas market, other energies, other futures, options, futures spreads and much more! Feel free to contact us at any time.

Seasonal tendencies are a composite of some of the more consistent commodities futures seasonals that have occurred over the past 15 years. There are usually underlying fundamental circumstances that occur annually that tend to cause the futures markets to react in a similar directional manner during a certain calendar period of the year. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account h as in the past or will in the future achieve profits utilizing these strategies. No representation is being made that that price patterns will recur in the future. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Results not adjusted for commission and slippage.

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 01/17 Fri |

7:30 AM CST - Housing Start & Building Permits(Dec)

8:15 AM CST - Industrial Prod & Capacity Util(Dec) 9:00 AM CST - Univ of Michigan Consumer Sentiment-Prelim(Jan) |

LT: Jan Nikkei Options(CME)

Feb Orange Juice Options(ICE) |

| 01/20 Mon |

MARTIN LUTHER KING, JR DAY

|

|

| 01/21 Tue |

|

|

| 01/22 Wed |

6:00 AM CST - MBA Mortgage Index

8:00 AM CST - FHFA Housing Price Index(Jan) 9:00 AM CST - Existing Home Sales(Dec) 2:00 PM CST - Cold Storage 3:30 PM CST - API Energy Stocks |

|

| 01/23 Thu |

7:30 AM CST - Initial Claims-Weekly

9:30 AM CST - EIA Gas Storage 10:00 AM CST - EIA Petroleum Status Report 2:00 PM CST - Dairy Products Sales 2:00 PM CST - Milk Production 3:30 PM CST - Money Supply |

FN: Feb Crude Lt(NYM)

|

| 01/24 Fri |

7:30 AM CST - USDA Weekly Export Sales

2:00 PM CST - Cattle On Feed |

LT: Feb 2,5,10 Year Notes Options(CBT)

Feb Bonds Options(CBT) Feb Canola Options(CBT) Feb Wheat Options(CBT) Feb Corn Options(CBT) Feb Oats Options(CBT) Feb Rough Rice Options(CBT) Feb Soybeans,Soymeal,Soyoil Options(CBT) |

| 01/27 Mon |

9:00 AM CST - New Home Sales(Dec)

|

|

| 01/28 Tue |

7:30 AM CST - Durable Goods-Ex Transportation(Dec)

7:30 AM CST - Durable Orders(Dec) 8:00 AM CST - S&P Case-Shiller Home Price Index(Nov) 9:00 AM CST - Consumer Confidence(Jan) 3:30 PM CST - API Energy Stocks |

LT: Feb Copper Options(CMX)

Feb Gold & Silver Options(CMX) Feb Natural Gas Options(NYM) Feb RBOB & ULSD Options(NYM) |

| 01/29 Wed |

6:00 AM CST - MBA Mortgage Index

9:00 AM CST - Pending Home Sales(Dec) 9:30 AM CST - EIA Petroleum Status Report 1:00 PM CST - FOMC Rate Decision(Jan) 2:00 PM CST - Dairy Products Sales |

LT: Jan Copper(CMX)

Jan Gold & Silver(CMX) Jan Platinum & Palladium(NYM) Feb Natural Gas(NYM) |

| 01/30 Thu |

7:30 AM CST - USDA Weekly Export Sales

7:30 AM CST - Initial Claims-Weekly 7:30 AM CST - GDP-Adv(Q4) 7:30 AM CST - GDP Deflator & Adv(Q4) 9:30 AM CST - EIA Natural Gas Report 3:30 PM CST - Money Supply |

FN: Feb Natural Gas(NYM)

LT: Jan Feeder Cattle(CME) Jan Feeder Cattle Options(CME) |

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!