Cannon Trading / E-Futures.com

The following is taken from a guide I have written that helps subscribers to my daily chart service. You can have a 2 week free trial to the daily live charts service along with buy/sell triggers and get the full guide along with chart examples, rules and much more by signing up at:

Cannon Trading Inc. Day Trading Webinar

General Notes:

At any given day, one must understand the trading environment that specific day has to offer and adjust their trading style accordingly. In our case it relates more to the size of stops and target based on volatility. Some days the market gives us many opportunities; some not as much; and some days it provides us with mostly risks…….take what the market gives you and not what you want it to give…..

I think if a trader understands early enough what type of trading day it is, he or she can choose which tools from the webinar are most suited for that days trading. If one can do that successfully (which is not easy), I think that is half the battle.

Not taking a trade is better than a bad trade.

My opinion is that there are 3 main types of trading days.

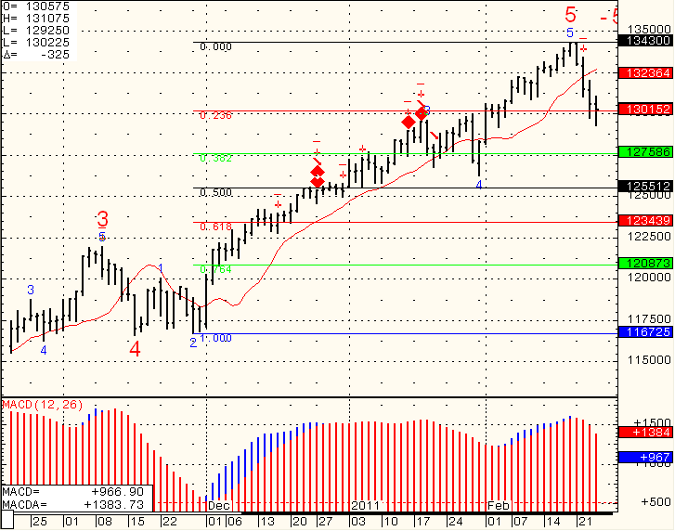

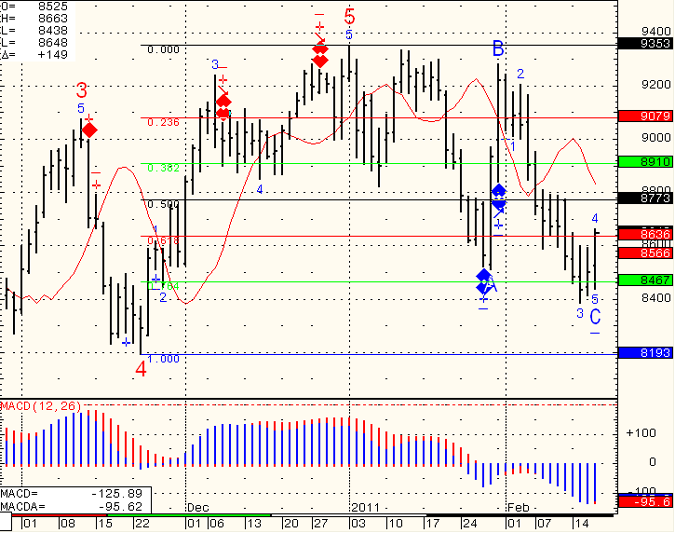

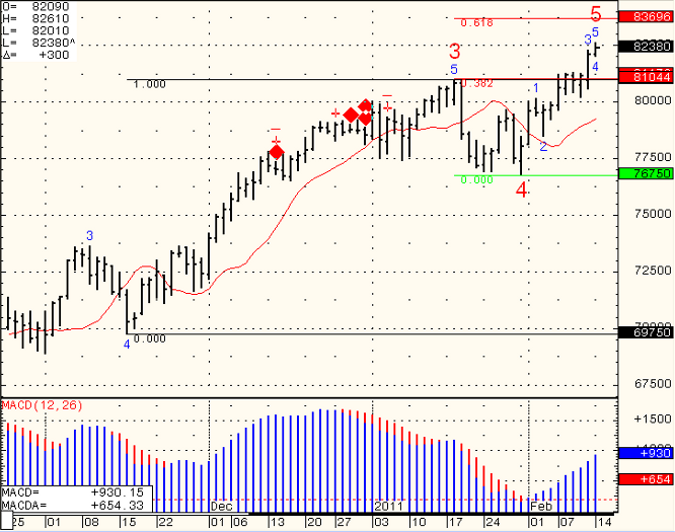

- Most common is two sided trading action with swings up and down – this type of trading day is most suitable for the main aspect of this model, which is taking trades based on the arrows.

- Strong trending day, mostly one directional – this type of trading day is the least common, many times this will happen on Mondays and maybe 3-5 times a month at most – this type of trading day is most suitable for using the color scheme I have on the charts. Green bars mean strong up trend, red bars mean strong down trend. If you determined that this is a trend day, then use pull backs to enter with the direction of trend and use the parabolic (little dashes) as you trailing stop.

- Slow and/ or choppy trading day – this type of trading day is best suited for taking small profits from the market by either using the main model or taking the diamonds as entry signal, and going for quick profits and tight stops.