In this post:

1. Market Commentary

2. Support and Resistance Levels

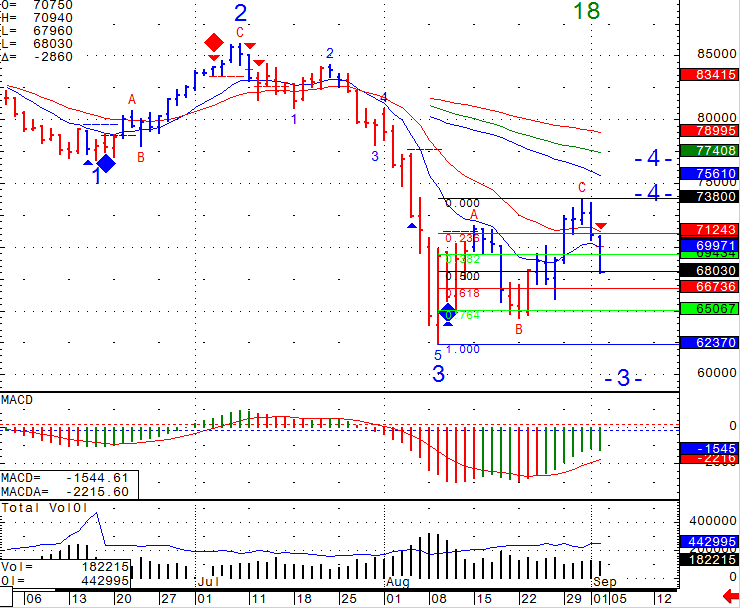

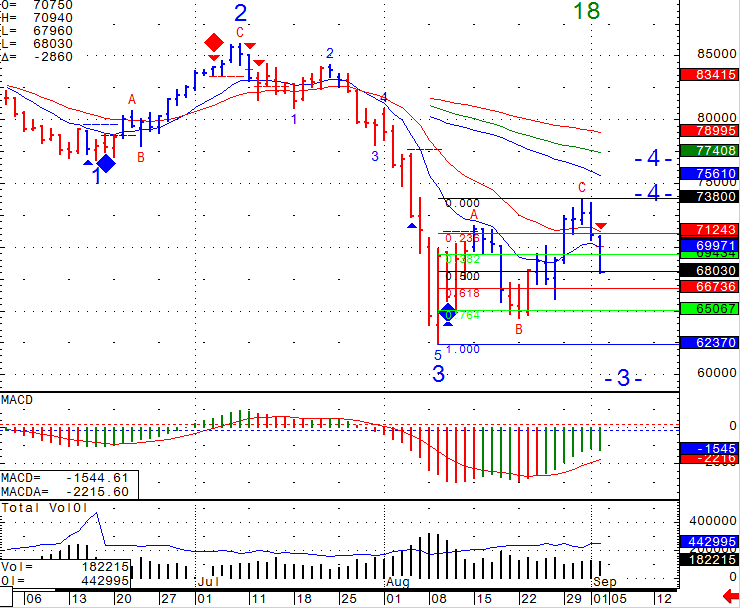

3. Daily Futures Chart for Mini Russell 2000

4a. Economic Reports Monday September 5th

4b. Economic Reports Tuesday September 6th

1. Market Commentary

I wrote the following yesterday:

I am getting mixed signals from the chart perspective and there is a case both for the bulls and the bears.

The bulls need to hold above 1183.00 and break above 1215.75

The bears need to break below 1183.00 to have a shot at the 1142.50 level.

Well we broke below 1183 and closed right around 1172, which to me is a bearish close. However to keep things in perspective, this is pretty much the same price we traded at last Friday…..The next level the bulls must defend is 1132.75.

It will be interesting to see which direction this market takes after the long weekend.

Wishing all of you a great, long Labor Day weekend. recharge, relax, enjoy and see you next week! You can view the Labor Day 2011 futures trading hours below.

View Labor Day 2011 Holiday Futures Trading Hours

Daily chart of Mini Russell 2000 including a sell signal I got yesterday after the close for your review below.

2. Support and Resistance Levels!

| Contract (Sept. 2011) |

SP500 (big & Mini) |

Nasdaq100 (big & Mini) |

Dow Jones (big & Mini) |

Mini Russell |

| Resistance 3 |

1198.23 |

2274.25 |

11745 |

730.13 |

| Resistance 2 |

1191.62 |

2248.00 |

11631 |

719.77 |

| Resistance 1 |

1181.93 |

2208.25 |

11426 |

700.33 |

| Pivot |

1175.32 |

2182.00 |

11312 |

689.97 |

| Support 1 |

1165.63 |

2142.25 |

11107 |

670.53 |

| Support 2 |

1159.02 |

2116.00 |

10993 |

660.17 |

| Support 3 |

1149.33 |

2076.25 |

10788 |

640.73 |

| Contract |

Dec. Gold |

Sept. Euro |

Oct. Crude Oil |

Dec. Bonds |

| Resistance 3 |

1916.9 |

1.4365 |

92.26 |

145 2/32 |

| Resistance 2 |

1900.7 |

1.4326 |

90.62 |

142 23/32 |

| Resistance 1 |

1892.7 |

1.4258 |

88.69 |

141 16/32 |

| Pivot |

1876.5 |

1.4219 |

87.05 |

139 5/32 |

| Support 1 |

1868.5 |

1.4151 |

85.12 |

137 30/32 |

| Support 2 |

1852.3 |

1.4112 |

83.48 |

135 19/32 |

| Support 3 |

1844.3 |

1.4044 |

81.55 |

134 12/32 |

3. Daily Futures chart for Mini Russell 2000 from September 2nd, 2011

4a. Economic Reports Monday September 5th, 2011

Bank Holiday

8:30am USD

4b. Economic Reports Tuesday September 6th, 2011

ISM Non-Manufacturing PMI

10:00am USD

Economics Report Source: http://www.forexfactory.com/calendar.php

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!