Cannon Trading / E-Futures.com

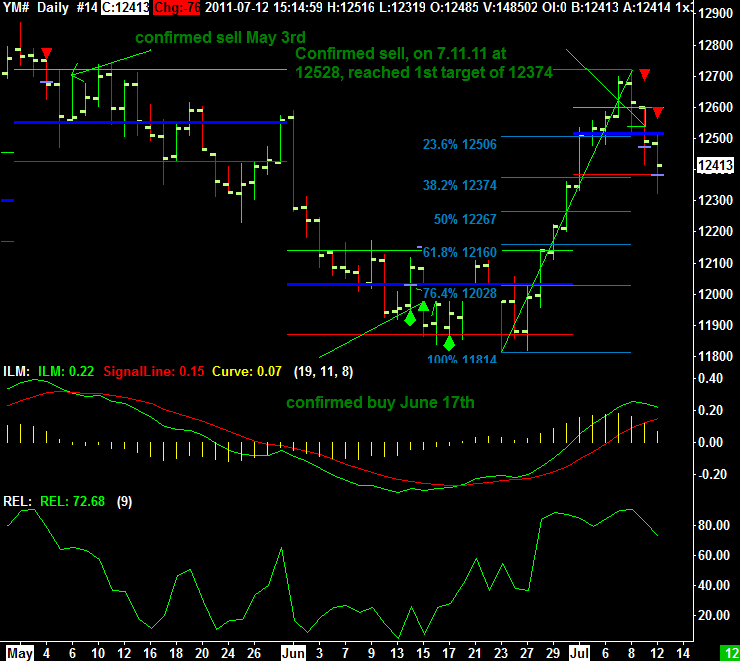

On Friday and yesterday I wrote the following below:

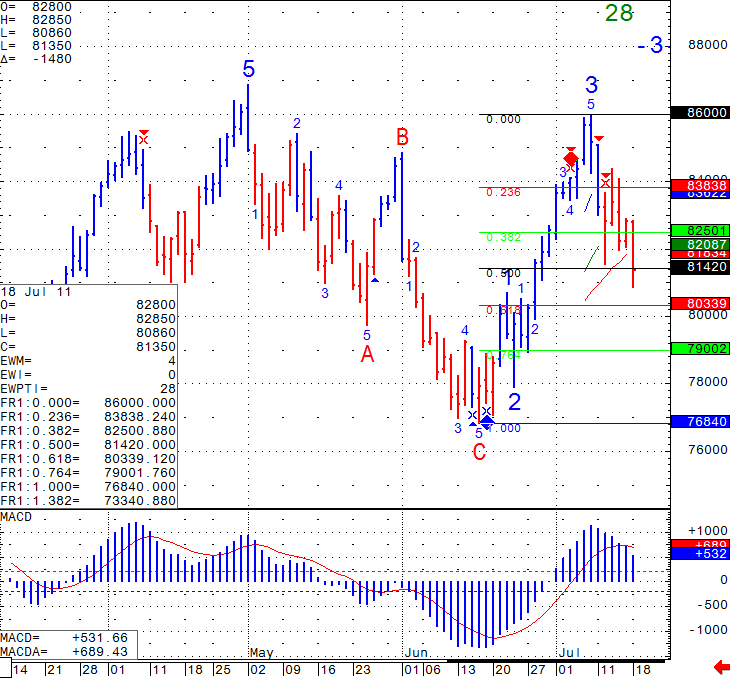

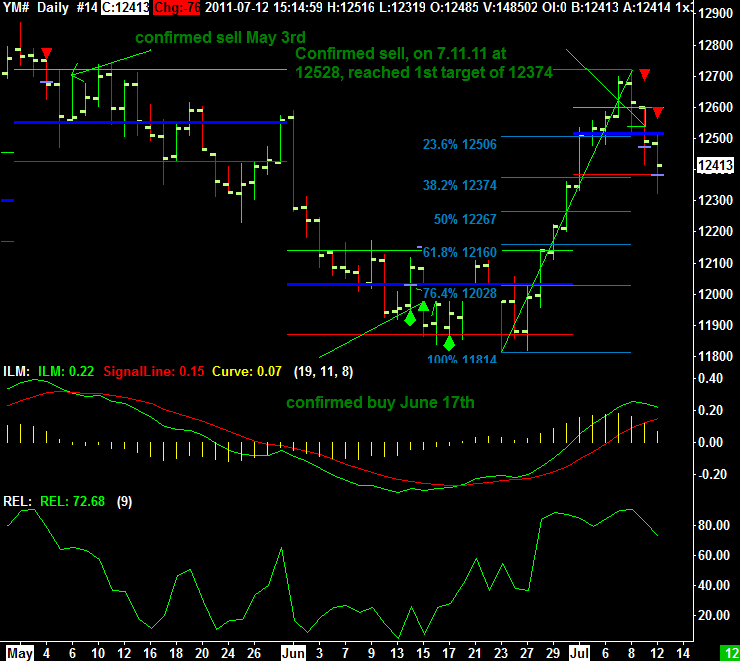

Friday: Looking at the Mini Dow Jones daily chart below, i will need to see a break below 12528 in order to get more confidence that the trend is starting to reverse and that odds prefer the down side.

Monday: Now that we broke this level, the next question is possible targets on the down side as well as protection on the top….Updated chart for your review below. I am looking at 126.05 as resistance above and 12374 as initial target below:

Today ( Tuesday, July 12th 2011)

With recent price action and looking at updated chart below, I would look for failed rallies against today’s high at 12516 and possible test of next target at 12267

Daily Chart of the Mini Dow Jones from July 12th 2011

Would you like to have access to my DIAMOND ALGO as shown above and be able to apply for any market and any time frame? The screen shot above is of the Mini Dow from today.

If so, please send me an email with the following information:

- Are you currently trading futures?

- Charting software you use?

- If you use sierra or ATcharts, please let me know the user name so I can enable you.

- Markets you currently trading? Read the rest of this entry »

![]()

![]()

![]()

![]()

![]()

![]()