Do I hold on for the “big winner” or take small profits?

To start with, this is a good problem…this means you are taking some winning trades. The answer is not a simple yes or no.

One must have a combination of both smaller, consistent winners. Also a few “runners” large profit trades, regardless if you are day trading, position trading or swing trading.

Some traders solve the problem by breaking their trading size into more than just 1 unit.

Entering Multiple Contracts: Philosophy

I think that entering multiple contracts does 3 good things for you…

Reduces fear…

Reduces greed…

And gives you a chance to hang in there for the large winners or what I call a “runner”….

In order to enter multiple contracts while day trading, one has to have the appropriate risk capital and margin requirements ( MICROS are great for this purpose in my opinion). But the advantage of trading more than one “unit” or splitting your trading size into two or more parts is as such:

If you enter a trade with one contract (or if you are treating your trading size as one unit, meaning you enter a trade with 4 contracts and exit the trade with 4 contracts), you can face a very quick dilemma, especially when day-trading. Consider the two following scenarios:

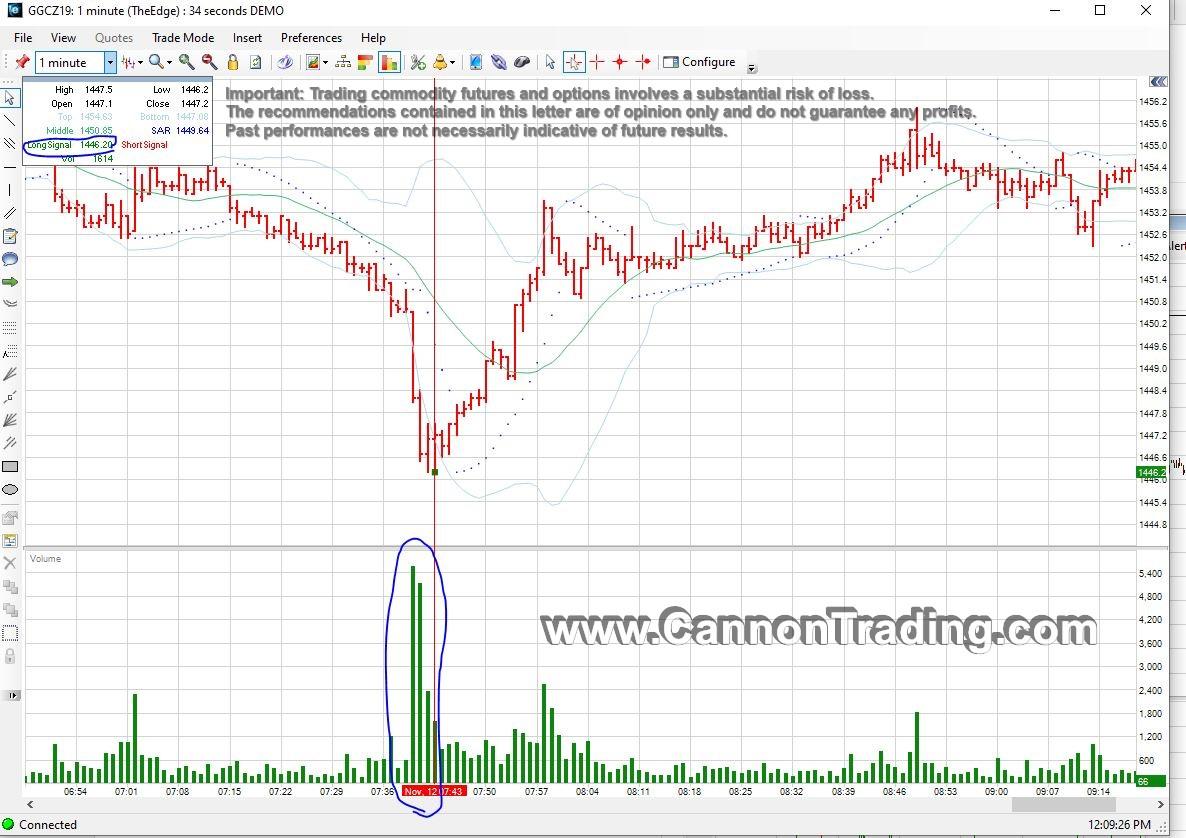

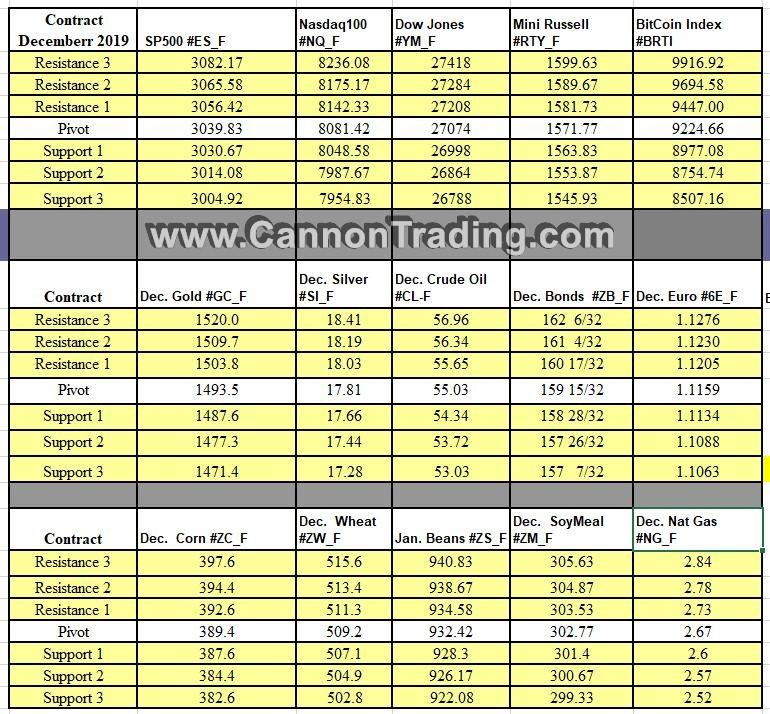

1. You get in and very quickly you are up 2 mini SP points…what do you do? Do you take profit? Bring your stop loss closer? How do you avoid getting out too early or too late?

2. You enter a trade and it goes against you rather quickly…if you get out then it is a loser…but the little voice in your head says “what if the market goes back up?”

In the first case scenario, when the market decided to be nice to us and moved in our direction, I like to exit half of my positions relatively quickly. In the case of the mini SP, this would be around 7 ticks profit.

What I’ve found is that this will allow me to manage the rest of the trade in a much more relaxed manner. Since I’ve already locked profits in, now I can look for a proper stop close to my break-even level. I can analyze my next target more realistically and, if the market provides room for additional gains, be there to participate.

I really think that traders need to give the “runners” (large winners, directional moves) a chance. Obviously, these don’t happen often but if you know the market you’re in (crude versus the mini SP for example) and you look at recent volatility, and behavior you may decide that you will give the chance of a large winner when you are in crude oil trade because the market has been trending and the volatility gives you a chance for a good “runner” (maybe 60 ticks if you are trading a range bar chart, maybe $1.40 or so if you are trading using the hourly chart).

In the second case scenario, I can choose to risk a smaller amount or use a tight stop on the first half of my position and a bit wider stop on the other half of the position. This can help prevent the scenario when one does not get out of a trade because mentally one does not want to accept the loss.

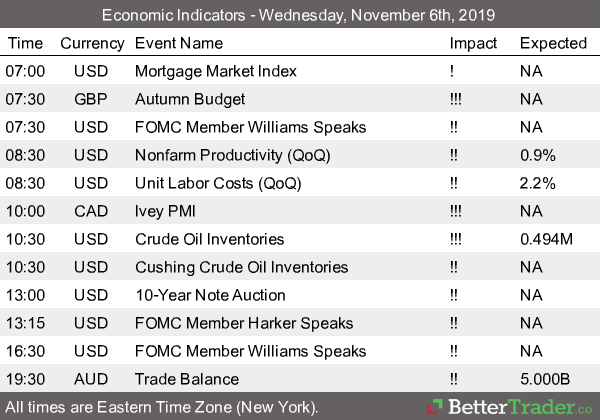

Of course, there is much more to trading and day trading. Entry signals, exit techniques, why and when to get in a trade, and so on — all of these are key.

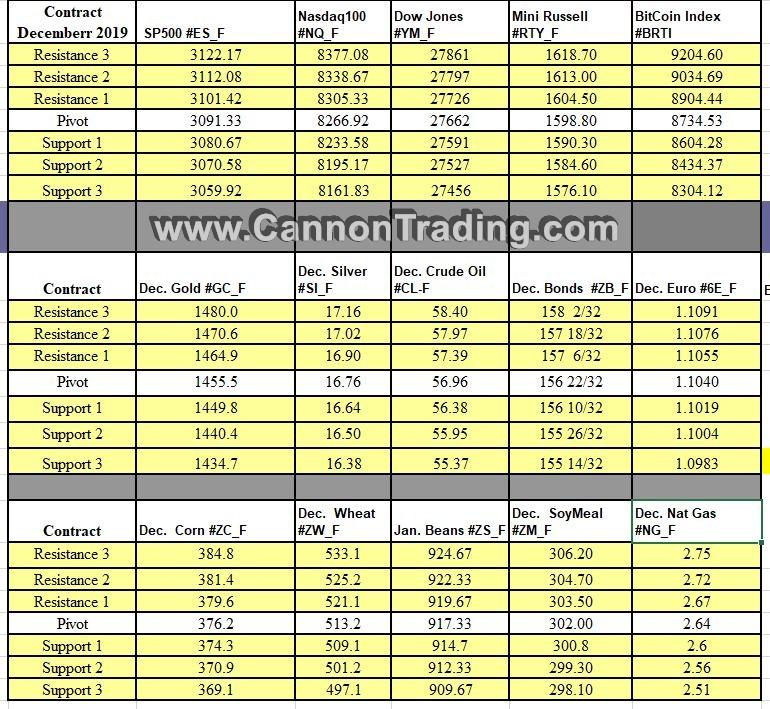

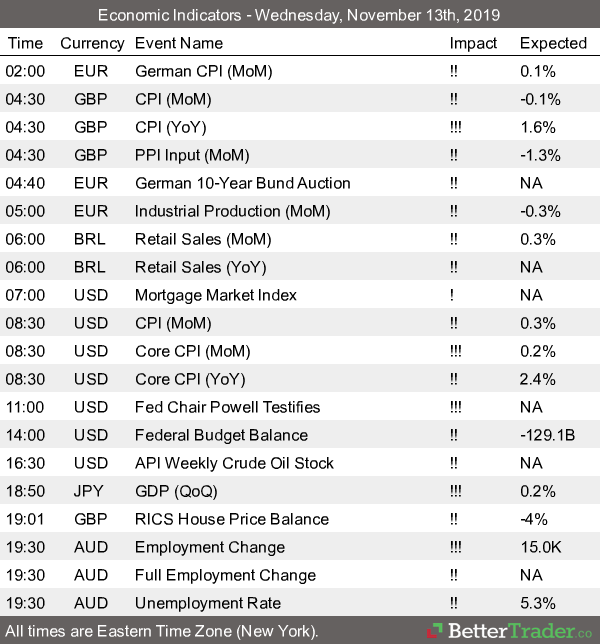

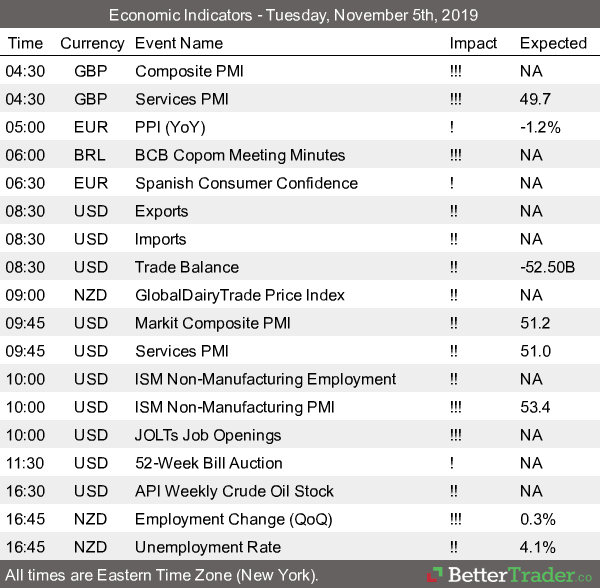

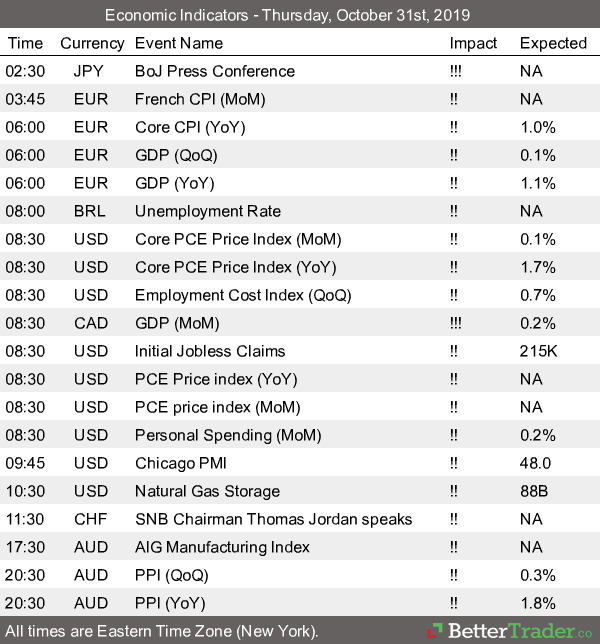

On the same token you may look at scheduled reports and recent price action (or lack of) in the SP and decide that you will be taking mostly small profits until the market environment changes.

I hope that this tip will assist you while trading and will prevent some of the instances where you get out of a trade too late or too early.