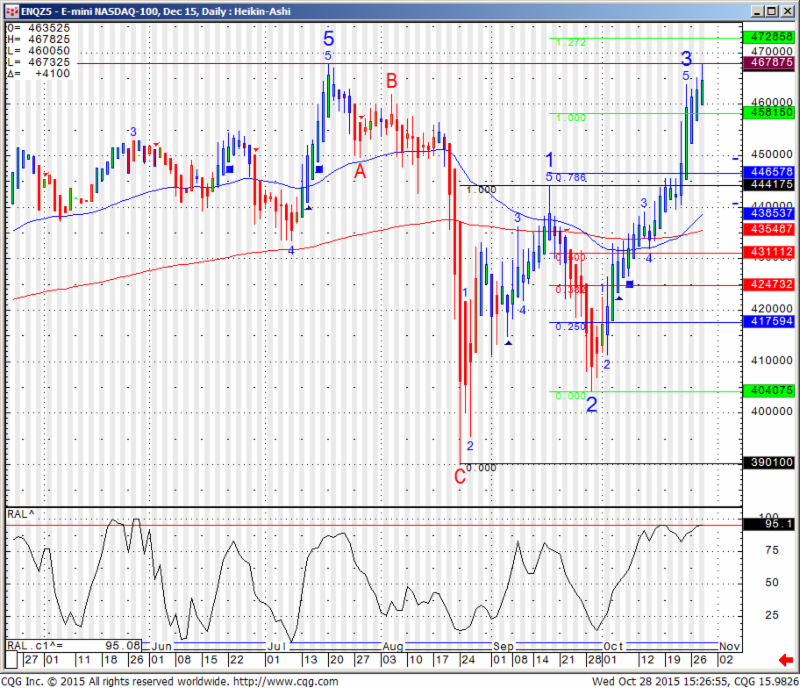

US stocks saw their fifth consecutive week of gains, with the S&P500 almost filling the gap from the August meltdown and coming to within 50 points of the all-time highs seen back in May. The Fed stood pat on rates, as expected, although UST yields rose to one-month highs later in the week as markets absorbed the message that rate liftoff could come in December. China waffled on setting a specific 2016 GDP target at the 13th plenum, deciding instead to adopt more flexible economic policy goals. In Washington, outgoing House Speaker Boehner concluded a two-year budget and debt ceiling deal before handing the baton to Paul Ryan, who opened his speakership by striking a more conciliatory tone, boding well for policy success in the future. For the week, the DJIA added 0.1%, the S&P500 rose 0.2% and the Nasdaq grew 0.4%, closing out their best month in four years with the major indices each up more than 8% in October.

The FOMC meeting on Wednesday served as a reminder that the US monetary policy will be shifting soon. The statement dropped a reference to global risks restraining growth that was used to justify no rate action in September. It also referred specifically to the next meeting in mid-December as a time for the Fed to weigh a decision on rate liftoff. Fed’s Lacker dissented for a second time, remaining in favor of an immediate 0.25% rate increase. While the job market looks healthy (the four-week moving average in continuing claims sank to its lowest level since 1973), inflation continues to be the main source of uncertainty. Both the September core PCE – the Fed’s main gauge of inflation – and third quarter GDP core PCE measures were anemic at 1.3% and undershot expectations. Fed funds futures readjusted after the decision, and now predict a roughly 50% chance of a rate hike at the December meeting, up sharply from below 36% going into the decision. EUR/US dropped precipitously after the decision, hitting 1.0900 from 1.1080. The pair was back above 1.1010 by week’s end.

The big US economic data out this week was the advance third-quarter GDP reading, which just missed consensus expectations at +1.5%, and dramatically slowed from the second quarter rate of +3.9%. Analysts widely interpreted the slowdown as a direct result of businesses cutting back on restocking to work off an inventory glut. Businesses accumulated $56.8 billion worth of inventory in the third quarter, the smallest since the first quarter of 2014 and down sharply from $113.5 billion in the April-June period. Meanwhile, third quarter consumer spending expanded at a +3.2% annualized rate in the quarter after expanding at a +3.6% annualized rate in the second quarter, suggesting the US consumer remains quite healthy. Sales of new homes fell in September, with the annualized rate dropping to 468K from August’s downwardly revised 529K rate. The data widely missed expectations and provided a strong contrast to the September existing home sales number, which came very close to the eight-year, post-crisis high seen in the August report.

The Chinese Communist Party held its 13th Plenum this week, announcing a goal for “medium-high” economic growth for 2016-2020, rather than setting any specific long term GDP targets. The official statement called for the Chinese economy to double GDP per capita by 2020 from 2010 levels, and independent economists suggest this should require annual economic growth in 6.5-7.0% range. Last Friday’s PBoC monetary policy moves – it cut the one-year rate and system-wide RRR rates by 25bps and 50bps, respectively, while also deciding to remove the ceiling on bank deposit rates – were timed just ahead of the plenum, and over the weekend Chinese leaders worked to manage market expectations of a potential downgrade from the 7% target. Premier Li said 7% is not a hard target that should be “defended to the death,” then later in the week commented that China needs an average GDP of 6.53% for the next five years to build a prosperous society by 2020. PBoC Deputy Governor Yi Gang commented that China can sustain growth of 6-7% for the next 3-5 years, while UBS also cut its 2016 GDP target for China to 6.2% from 6.5%. Also of interest: the party eliminated the one-child policy first introduced 35 years ago.

Congress and the Obama Administration reached a two-year budget deal to raise the debt ceiling and keep the government running through the end of Obama’s term. The deal includes $80 billion in additional spending and a $32 billion increase in an emergency war-contingency fund, signaling the end of an era of fiscal austerity in Washington. The deal would push back the likelihood of hitting the debt ceiling until March 2017. Speaker Boehner (R-OH) officially stepped down this week after brokering the landmark budget deal, and Rep Paul Ryan (R-WI) assumed the position.

Shares of Valeant got no relief as the Philidor pharmacy scandal deepened. Valeant issued a flurry of press releases in an attempt to put out the flames, appointed a special committee to review the matter and retained a former deputy US attorney general to lead an investigation. Valeant claimed it believed it complied with the law in its relationship with Philidor, and then on Friday severed its relationship with the pharmacy, but only after CVS and Express Scripts both terminated Philidor as a provider. Further press reporting on the issue claimed that Philidor may have modified prescriptions in efforts to boost sales for Valeant, including changing RX codes in favor of Valeant instead of generic drugs.

About two-thirds of the S&P500 components have now reported earnings, with most firms reporting flattish profits and declining revenue, with a distinct absence of major growth drivers. Tech names Apple and Twitter made headlines after earnings. Apple saw good gains after beating expectations, with iPhone numbers in line, Mac sales at a record 5.7M units and iPad sales at their lowest level since 2011. Shares of Twitter are in the red for the week after investors were disappointed with the firm’s weak growth in monthly active users (MAUs), up a mere 3 million q/q.

The third quarter marks one year since the beginning of the crude oil price meltdown, and reports from Big Oil reflected continued weak energy prices. Shell reported a $7.4 billion loss (versus a $4.5 billion y/y), or a $1.8 billion profit on an adjusted basis. Shell booked a $7.9 billion write-off for operations including its recently halted exploration venture off Alaska and a canceled heavy-oil project in Canada. Profits at BP fell 40% y/y. Earnings at Chevron and Exxon also declined, with Exxon’s earnings down 47% y/y. However both Chevron and Exxon widely beat expectations on unexpected strength in their downstream operations, thanks to lower crude costs. Chevron also slashed its FY16 capex forecast by 25%. Shares of the four majors lost ground on the week, with Shell’s ADRs down 4% on the week. Meanwhile, Valero’s earnings were up 40% y/y, helping it to beat pretty high expectations, and also raise its dividend. Shares of VLO were up 7% on the week.

On the merger front, Piedmont Natural Gas agreed to be acquired by Duke Energy for $60/share in cash, a 40% premium to the stock’s prior close, for total deal valued at $4.9B. Intercontinental Exchange reached a deal to acquire Interactive Data Corporation from Silver Lake and Warburg Pincus for $5.2 billion, including $3.65 billion in cash and $1.55 billion in ICE common stock. Pep Boys agreed to be acquired by Bridgestone for $15/share in cash in a deal valued at $835M. Walgreens Boots reached a deal to acquire Rite Aid for an enterprise value of $17.2B or $9.00/share in an all-cash deal. Shares of Starwood Hotels gained on press reports that Hyatt is in advanced talks to buy it, and that several Chinese firms are also interested.

![]()

![]()

![]()

![]()

![]()

![]()