Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

This Blog provides futures market outlook for different commodities and futures trading markets, mostly stock index futures, as well as support and resistance levels for Crude Oil futures, Gold futures, Euro currency and others. At times the daily trading blog will include educational information about different aspects of commodity and futures trading.

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Hello Traders,

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Time sure does tick a bit different in the commodities and futures world….

Some traders know time has passed quickly when it is time to change to the Dec. contract versus the Sept. contract, others may notice it when they think “wow, monthly unemployment is this Friday, time sure flies…” and still other traders, perhaps professionals and money managers notice it when one month ends and another starts and it is time to share monthly results with their clients…..

Either way you look at it, hope October will be a great trading month!

Today I noticed a couple of market behaviors I have noticed in the past and wanted to share with you.

The first is us Bonds trading behavior on the last trading day of the month on the last 15 minutes of the old pit session, i.e. 13:45 to 14:00 central time.

While I did not spend any time trying to predict the direction of the move, I seen it many times, the bonds will make a 10-15 ticks ( 15 tick in bonds = $500 per contract) move during the last 15 minutes as large traders position themselves ahead of months close.

Below is a 15 minute chart of Bonds from today….notice the very tight range all day long until the last 15 minutes….if you go back to the last trading day of the month, you will notice this pattern more often than not. Of course, I leave the important work to you…and that is which way and how can one try to take advantage of it….PS: My trade system below missed entering the short by 1 tick )-:

The second pattern for you to investigate if interested is the behavior of crude oil futures around “round numbers”. Today was obviously a HUGE move in crude ( down over $3 or $3000 per contract or 3.5%) but notice the 10 seconds chart I am sharing with ( yes, seconds, not minutes…) of what happened when crude broke below 93.00 and 92.00 today…..Once again, the million dollar question, how and can you take advantage of it? Obviously in this case it seems like there were MANY sell stops placed right below the round numbers which resulted in another accelerated move to the down side.

Crude breaking below $93.00

Crude breaking below $92.00

Continue reading “Bonds Futures and Crude Oil Futures Unique Patterns”

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Volatile action in the markets as events around the globe are injecting some fear factor into the markets.

It may take a while before the bears get over their fear factor of going short due to QE but at least at this point we are noticing the bulls finally having a little more fear as well……

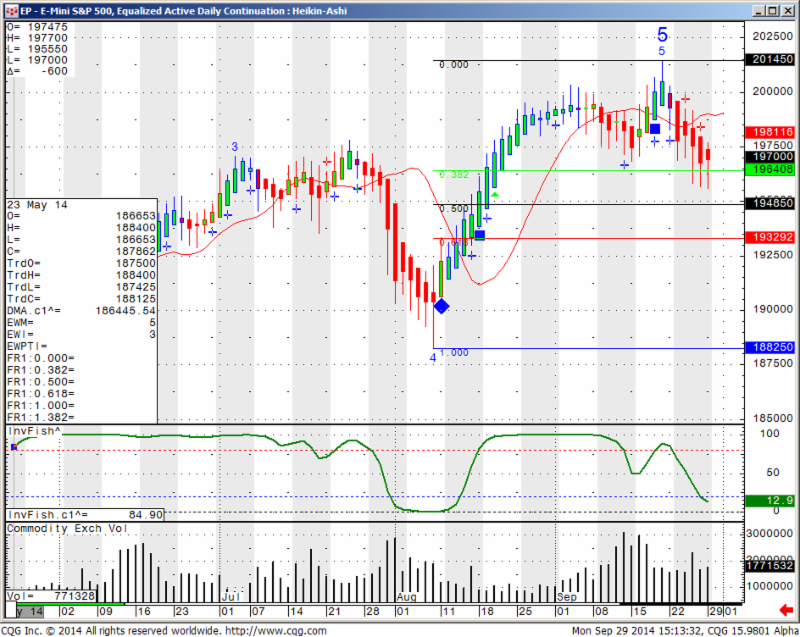

My thought for the SP500 is that we need to see a break below 1955, preferably below 1948.50 to accumulate more momentum and speed to the downside.

At this point I am leaning towards selling rallies but one needs to be flexible and adapt to this market which is picking up volatility and seems to go through a changing personality right now.

Daily Heikin-Ashi chart of Dec. Mini SP 500 futures for your review below:

Continue reading “Heiken-Ashi Mini S&P Chart; Economic Reports & Levels 9.30.2014”

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

There will be no commentary today. Thank you and good trading!

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

Continue reading “Futures Trading Levels & Economic Reports 9.26.2014”

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Powerful bounce this morning, which started as Obama was speaking in front of the UN. Don’t think it was related but such was the timing…..

Daily chart of the mini Russell 2000 for your review below. I am sure many of you have noticed the divergence between the different stock indices. The SP500 is still flirting with all time highs, while the Russell 2000 is off quite a bit from the highs made on July 1st 2014.

My best guess for the Russell is a bounce towards the 1141.50 level, followed by a retest of the 1098 level but I must admit this is a pure guess on my side as am trying to predict a few moves ahead….

Continue reading “Mini Russell 2000 Insight, Economic Reports & Levels 9.25.2014”

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

After a frustrating trading day, I read this one again and thought it is worth sharing:

Educational Feature: Dealing With Losing Trades

A main tenet of success in futures trading is the ability to accept losing trades as part of the overall trading process. This is not an easy undertaking–especially since many futures traders tend to be of a more competitive nature in the first place. Traders certainly don’t have to enjoy losing trades, but they must accept the fact and move on. Those who can’t accept the fact that losing trades are a part of futures trading usually don’t stay in the business very long.

My wife is a school teacher, and one of her favorite acronyms–ADM–can be applied to losing futures trades. “Accept” it. “Deal” with it. “Move” on. (This is a part of the important psychological aspect of trading, and deserves much more discussion than I can provide in this feature.)

I had lunch with one of my trading mentors a while back. We discussed losing trades. I asked my mentor how many losing trades in a row he has had to endure during his long and successful trading career. His reply was 13 in a row. I asked him how he coped with that. He said that while it was certainly not easy, he knew that losing trades are a part of the business and that he was in the business “for the long haul,” and that his trading methodology was sound. He added, “Ninety-percent of futures trading profits are made on 10% of the trades, which means most of the other trades are either small losers or break-even-type trades.” This is an important fact for all traders to keep in mind.

My lunch meeting with my mentor was good for me because, even though we made no “break-through” discoveries on the path to increased futures trading success, we did reaffirm our own philosophies on trading and markets. My passion for trading and market analysis is fed immensely every time I talk with people in my profession, or attend the quality trading seminars.

Continue reading “Futures Trading Levels & Economic Reports 9.24.2014”

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

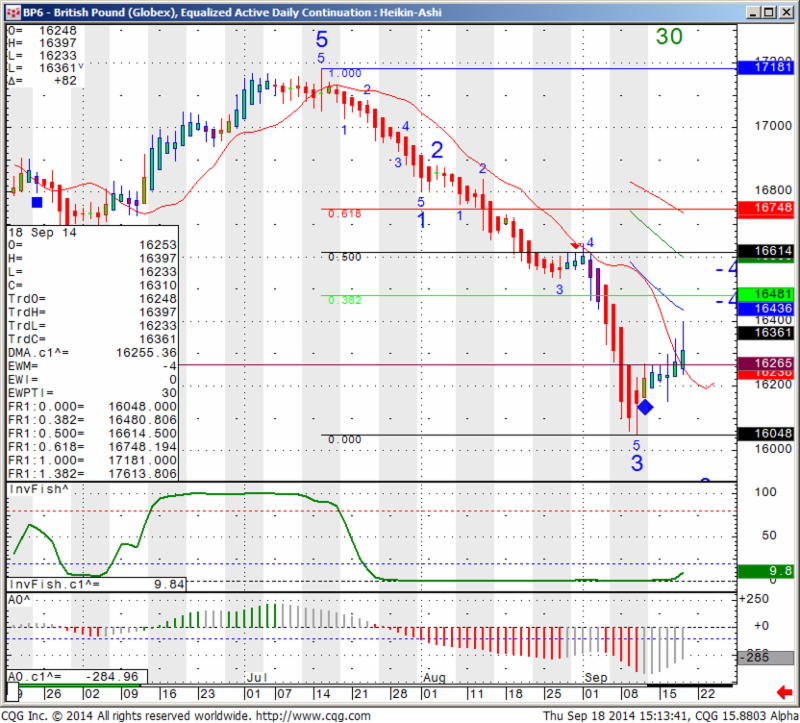

British Pound waiting for the Scottish Vote for clues on next move

On Thursday, after a 307-year-old union with England and Wales, Scottish voters age sixteen and over will decide in a referendum that will ask the question: Should Scotland be an independent country?

Most opinion polls show more Scots want to remain in the U.K. than leave it, but enough voters are undecided to swing it either way.

The “Better Together” campaign says Scotland should remain part of a larger country that has a greater say in the world and can better withstand financial shocks. Voting “no” to secession would also ensure it keeps the British pound after the U.K. government ruled out sharing the currency with an independent Scotland.

From the technical perspective I did get a possible buy signal ( see the blue diamond in the chart below). My diamond indicators are an output of an extreme overbought/ oversold along with price action that suggests a good counter trend move. In this case we saw an extreme sell off starting July 15th , falling over 11 points, I think if the market can take the 162.65 level , the door is open for a move up to 164.81 and 166.14!

One thing for sure, volatility may be QUITE HIGH and it’s really hard to tell the immediate affect. Make sure you have a solid money management/ risk plan in tact!!

Read the rest of the analysis at:

http://experts.forexmagnates.com/british-pound-waiting-scottish-vote-clues-next-move/

Continue reading “British Pound Waiting for The Scottish Vote, Economic Reports & Levels 9.19.2014”

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

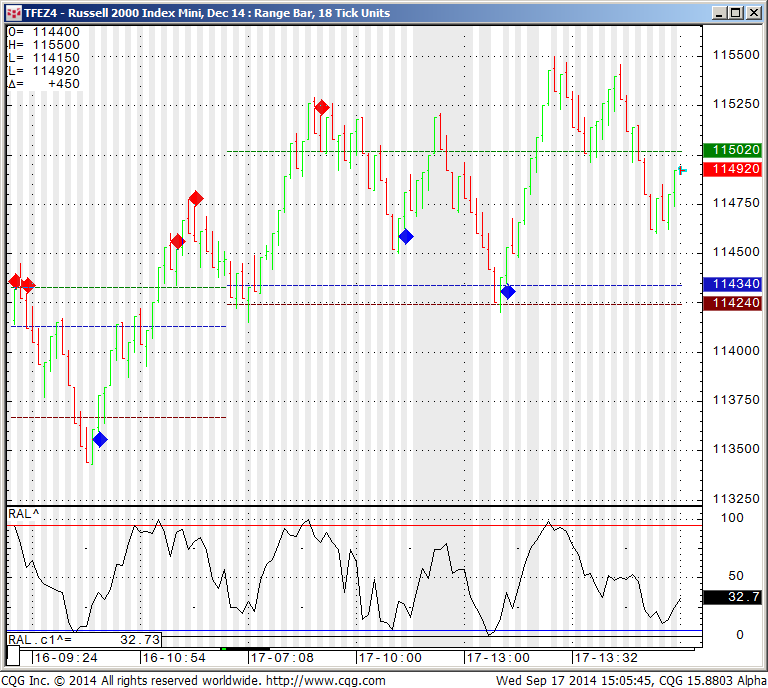

FOMC day provided the volatility expected. I speculate that we will see more volatility tomorrow as well.

In addition we got the vote in Scotland that can affect the British Pound as well as some other currencies. My outlook for the pound is available here.

On a different note, I am sharing with you a screen shot of my mini Russell chart. 18 ticks range bar chart along with my DIAMOND ALGO, which works better when there is two sided action like we seen the last couple of days versus when we have a strong trending day.

The DIAMOND ALGO tries to predict turning points in the market.

Would you like to have access to my DIAMOND and TOPAZ ALGOs as shown above and be able to apply for any market and any time frame on your own PC ? You can now have a three weeks free trial where I enable the ALGO along with few studies for your own sierra/ ATcharts OR CQG Q Trader.

To start your trial, please visit: http://levex.net/trading-algo/

Continue reading “FOMC Provided Volatility, Economic Reports & Levels 9.18.2014”

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

The FOMC interest rate decision is due at 14:00 ET in the US tomorrow ( Wednesday, Sept. 17th ).

FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow.

if you are a newcomer, take a more conservative approach and make sure you understand that the news can really move the market.

The following are suggestions on trading during FOMC days:

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

As of tomorrow make sure you are trading DECEMBER stock indices and CURRENCIES…..

I know many of you have read this one before but many others have not….

While it is not a “magic formula” I think the steps outlined should provide you the trader with some what of a base/ foundation of what you need to have in order to succeed in day-trading:

8 Steps to succeed in futures trading:

Hopefully if you are already trading you have completed your initial education: contract specs, trading hours, futures brokers, platforms, the opportunities as well as the risk and need to use risk capital in futures, and so on. Understanding this information is essential to futures trading. The second type of education is ongoing: learning about trading techniques, the evolution of futures markets, different trading tools, and more.

I am definitely not advising you to go on the web and subscribe to a “black box” system (using buy/sell triggers if don’t know why they are being generated). What I am advising is developing a trading technique: a general set of rules and a trading concept. As you progress, you may want to put the different rules and indicators into a computerized system, but the most important factor is to have a focus and a plan. Don’t just wake up in the morning and trade “blank.”

This is the key! Do what you need to do in order to survive this brutal business and give yourself the chance of being here down the road with more experience and a better chance of success. Survival is probably the biggest key for beginning traders. There is a saying in this business: “live to trade another day.” It is so true!

Continue reading “Rollover Notice Futures Currencies; Economic Reports & Levels 9.12.2014”