|

|

|

|||||||||||||||||||||||||||||||

|

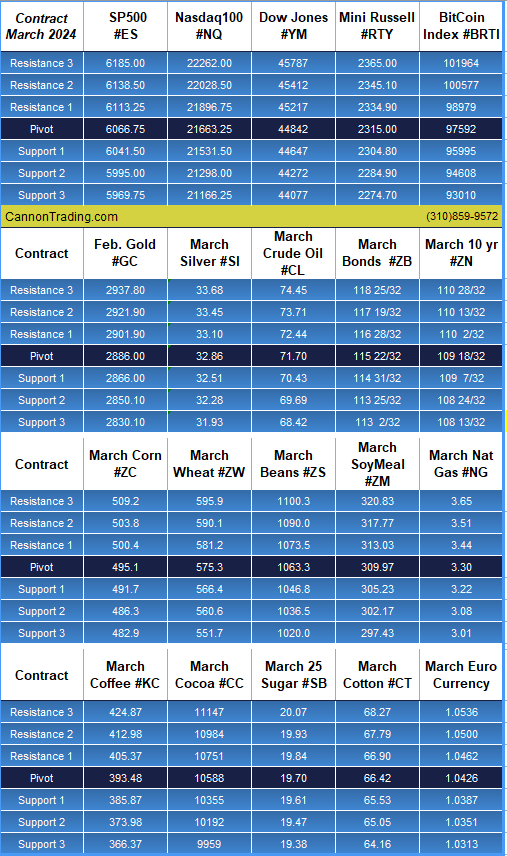

This Blog provides futures market outlook for different commodities and futures trading markets, mostly stock index futures, as well as support and resistance levels for Crude Oil futures, Gold futures, Euro currency and others. At times the daily trading blog will include educational information about different aspects of commodity and futures trading.

|

|

|

|||||||||||||||||||||||||||||||

|

The SPX index futures contract, which is based on the S&P 500 Index, was conceived as a mechanism to provide traders, institutional investors, and portfolio managers with a liquid and efficient way to hedge their exposure to the U.S. stock market or speculate on its direction. Before its introduction, market participants faced limited tools for effectively managing broad market risk. The SPX index futures contract bridged this gap by tying the performance of futures to the S&P 500 Index, a benchmark that represents the stock performance of 500 of the largest publicly traded companies in the United States.

The origins of the SPX index futures contract trace back to the late 20th century, a period marked by increasing financial innovation. The Chicago Mercantile Exchange (CME), now part of CME Group, played a central role in this endeavor. As early as the 1970s, the concept of index-based derivatives was gaining traction, but it wasn’t until April 21, 1982, that SPX index futures officially launched. The groundwork for these contracts was laid through the collaborative efforts of financial pioneers, economists, and institutional market participants.

One notable figure behind the success of SPX index futures was Leo Melamed, a visionary who served as chairman of the Chicago Mercantile Exchange. Melamed is often referred to as the “father of financial futures” for his role in introducing new derivatives markets, including SPX index futures. His efforts were complemented by economists like Richard Sandor, who contributed to the theoretical framework underpinning financial futures markets.

SPX index futures are contracts that allow traders to speculate on or hedge against the future value of the S&P 500 Index. Each contract represents a specified notional value, typically calculated by multiplying the index’s level by a fixed multiplier (e.g., $50). These contracts are cash-settled, meaning that no physical delivery of assets occurs; instead, the difference between the contract’s purchase price and its settlement price is exchanged in cash.

One of the key advantages of trading SPX index futures is their efficiency. Traders can gain exposure to the entire S&P 500 Index through a single contract, rather than trading individual stocks. This efficiency makes SPX index futures an attractive instrument for a wide range of participants, from retail investors to institutional asset managers.

SPX index futures tend to follow trends tied closely to macroeconomic conditions, corporate earnings reports, and market sentiment. Historically, several patterns have emerged:

During the COVID-19 pandemic, SPX index futures became a focal point for market participants seeking to hedge their portfolios or capitalize on volatility. In March 2020, SPX index futures dropped dramatically as fears of a global recession gripped markets. Futures traders who anticipated the downturn and took short positions saw substantial gains. For instance, a futures trading broker reported that a trader who shorted SPX index futures at 3,200 and covered their position at 2,200 earned a profit of $50,000 per contract.

Risk Level: High. Such trades require precise timing and a strong understanding of market dynamics. The volatility of SPX index futures during crises can result in rapid losses if the market moves against a position. Futures traders should use stop-loss orders and maintain adequate margin to mitigate risks.

Looking ahead to the first quarter of 2025, SPX index futures are likely to be influenced by several key factors:

In Q1 2023, a futures trader identified a rotation from high-growth technology stocks to value-oriented sectors like energy and financials. By analyzing sector weightings in the S&P 500 Index, the trader predicted that SPX index futures would experience moderate gains due to the resilience of value stocks. The trader entered a long position at 3,800 and exited at 4,200, earning a profit of $20,000 per contract.

Risk Level: Moderate. While sector rotation provides opportunities, predicting its timing and impact on SPX index futures requires extensive research. Futures contract trading during sector rotation should involve diversification and risk management strategies.

Risk Level: Very High. Leverage amplifies both gains and losses. Futures traders must exercise caution and ensure they have sufficient margin to withstand adverse price movements.

Risk Level: Low to Moderate. Hedging with SPX index futures can effectively reduce risk, but improper execution or misalignment with portfolio holdings can lead to suboptimal results.

SPX index futures have transformed the way investors and traders interact with the broader stock market. From their inception in 1982 to their current role as a cornerstone of futures trading, these contracts offer unparalleled opportunities for hedging, speculation, and portfolio management. However, the potential for substantial rewards comes with significant risks, making it crucial for futures traders to approach SPX index futures with caution, discipline, and a thorough understanding of market dynamics.

As we move into the first quarter of 2025, SPX index futures are poised to reflect the economic and geopolitical landscape of the time. Whether you’re a seasoned futures trading broker or a novice exploring trading futures, staying informed and vigilant will be the key to success.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

|

|

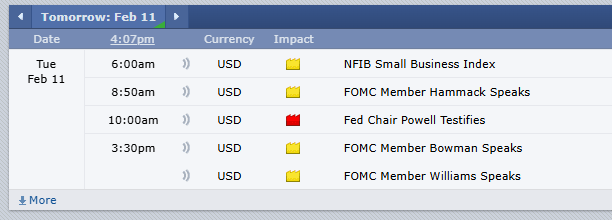

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

The Dow Jones Industrial Index Futures (commonly referred to as DJ Index Futures) play a pivotal role in the global financial markets, offering investors and traders a tool to hedge risks, speculate on future price movements, and diversify portfolios. This financial instrument has a rich history that intertwines innovation, strategic foresight, and the evolving needs of futures traders. This article explores the origins of the Dow Jones Industrial Index Futures contract, highlights the key figures behind its inception, examines trends in currency futures, and anticipates possible movements in DJ Index Futures during the first quarter of 2025. Additionally, real-life anecdotes and case studies underscore the practical applications and risks of trading futures.

The Dow Jones Industrial Index Futures were first introduced on October 6, 1997, by the Chicago Board of Trade (CBOT). At the time, the growing popularity of stock index futures—first pioneered with the S&P 500 Index Futures in 1982—revealed a demand for a futures contract tied specifically to the Dow Jones Industrial Average (DJIA), a blue-chip index widely regarded as a bellwether for the U.S. economy. The goal was to offer a product that would enable investors to manage exposure to the Dow’s 30 component companies, which represent leading industries in the U.S.

Key figures instrumental in bringing the Dow Jones Industrial Index Futures to market included the leadership of the CBOT, such as Thomas Donovan, then-president and CEO of the exchange. Donovan’s vision for expanding the CBOT’s product offerings underscored the necessity of keeping pace with the evolving preferences of futures traders. Another notable contributor was Leo Melamed, often called the “father of financial futures,” whose groundbreaking work in the 1970s and 1980s set the stage for the development of stock index futures. The combined efforts of exchange leaders, regulators, and financial engineers ensured the successful launch of DJ Index Futures, despite initial skepticism.

The appeal of trading futures contracts tied to the Dow Jones Industrial Average lay in their simplicity and widespread recognition. Institutional investors, retail traders, and portfolio managers quickly adopted these futures as tools for hedging and speculation. Futures trading brokers facilitated access to these contracts, bridging the gap between individual traders and global markets.

Currency futures—contracts that lock in the exchange rate of one currency for another at a future date—exhibit trends influenced by macroeconomic factors, geopolitical events, and central bank policies. A comparison of currency futures and DJ Index Futures reveals overlapping dynamics, as both instruments are deeply affected by investor sentiment and market volatility.

Risk Level and Caution: Trading futures based on macroeconomic trends involves considerable risk. Unexpected data releases or geopolitical developments can result in significant losses. Futures trading brokers often recommend employing stop-loss orders and limiting exposure to avoid catastrophic outcomes.

The first quarter of 2025 presents a challenging yet potentially rewarding environment for futures traders. Anticipating trends in DJ Index Futures requires an understanding of current economic conditions, earnings reports, and market sentiment.

Risk Level and Caution: The use of leverage in futures trading magnifies both potential profits and losses. Traders should carefully calculate position sizes and utilize risk management tools such as margin requirements and protective stops.

The history of DJ Index Futures is replete with examples of dramatic successes and failures, underscoring the importance of strategy and discipline.

Risk Level and Caution: Historical case studies reveal the importance of patience and resilience. Futures traders must avoid emotional decision-making and adhere to pre-defined trading plans.

To navigate the complexities of DJ Index Futures, traders should keep the following in mind:

The Dow Jones Industrial Index Futures represent a cornerstone of modern financial markets, offering unparalleled opportunities for hedging, speculation, and portfolio diversification. From their inception in 1997 to the present day, these futures contracts have evolved alongside market dynamics, driven by the vision of pioneers and the needs of traders.

Understanding the trends in currency futures and DJ Index Futures underscores the interconnectedness of global markets. The first quarter of 2025 is poised to bring both challenges and opportunities, with economic data, sector-specific developments, and geopolitical factors shaping outcomes.

Ultimately, trading futures requires discipline, education, and prudent risk management. While the potential rewards are significant, the risks are equally substantial. By leveraging the expertise of futures trading brokers and adhering to sound strategies, traders can navigate the complexities of this dynamic market.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

|

|

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

|

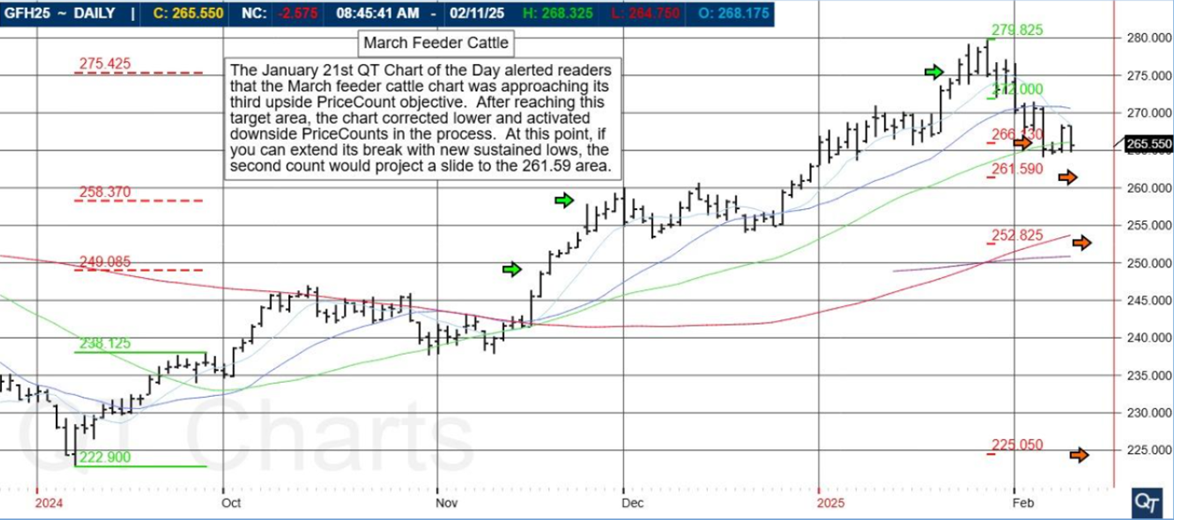

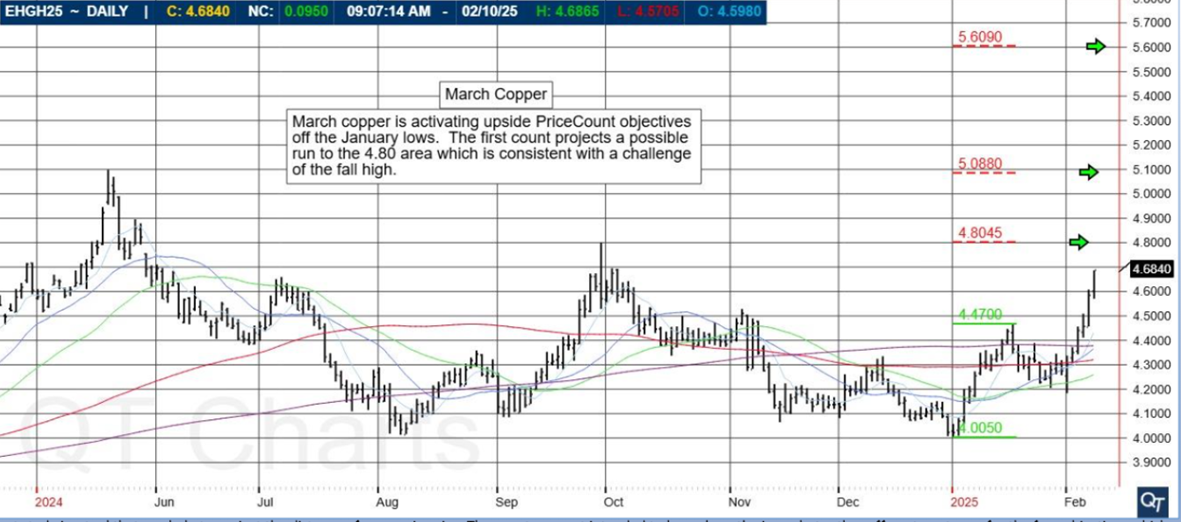

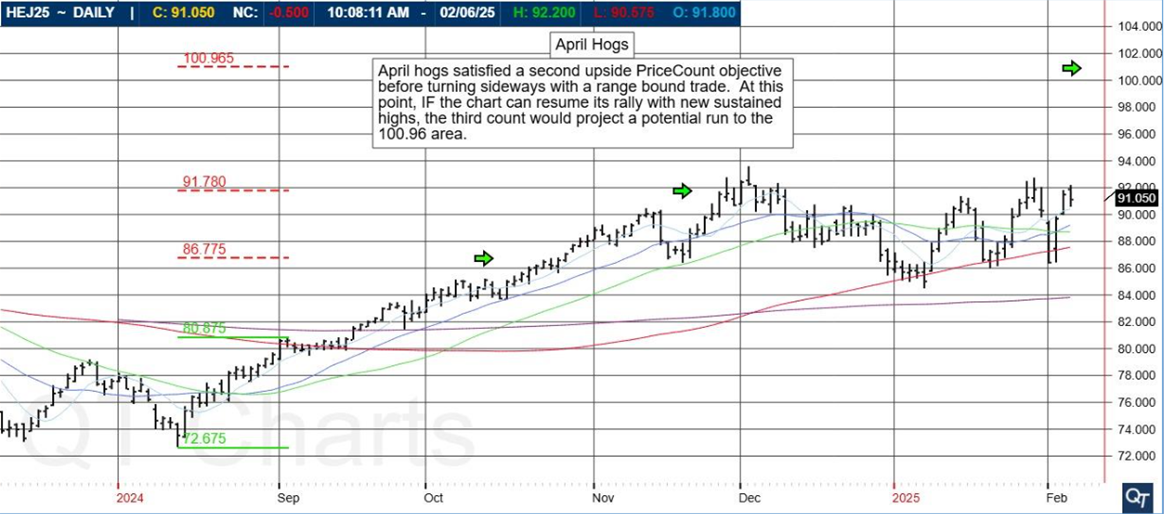

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading and options on futures needs.

December 25 Corn

April Hogs satisfied a second upside PriceCount objective before turning sideways with a range bound trade. At this point, IF the chart can resume its rally with new sustained highs, the third count would project a potential run to the 100.96 area.

PriceCounts – Not about where we’ve been, but where we might be going next!

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

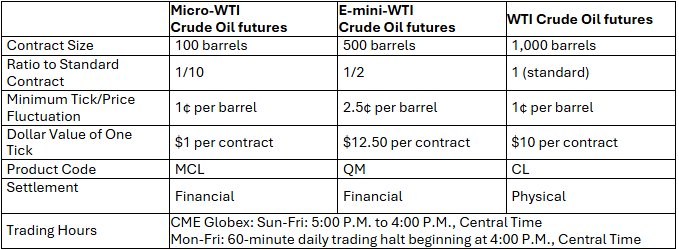

Crude oil future contracts represent one of the most actively traded commodities in the financial world. For seasoned futures traders, navigating the complexities of crude oil futures trading requires a deep understanding of market dynamics, risk management, and strategic execution. This article will explore the history of crude oil future contracts, provide 10 tips for advanced traders, and highlight the risks involved in trading futures contracts. Real-life anecdotes and case studies are included to enhance the insights presented.

Crude oil has long been a cornerstone of the global economy. Futures contract trading for crude oil began in 1983 when the New York Mercantile Exchange (NYMEX) introduced the first crude oil futures contract. This innovation provided a mechanism for producers, refiners, and other market participants to hedge price risks while also offering speculative opportunities for futures traders.

The development of crude oil futures contracts coincided with significant global events, including the oil crises of the 1970s, which underscored the need for more efficient price discovery mechanisms. Over the years, these contracts have evolved to include variants such as e-mini futures, enabling smaller-scale traders to participate in the market. Today, crude oil future contracts are traded on multiple platforms, including ICE (Intercontinental Exchange) and CME (Chicago Mercantile Exchange), solidifying their role as a crucial financial instrument.

Crude oil prices are influenced by a range of factors, including geopolitical events, OPEC production decisions, and economic data. Advanced futures traders must stay informed about these drivers and their potential impacts.

Real-Life Example: In 2020, crude oil prices plunged into negative territory due to a combination of oversupply and reduced demand from the COVID-19 pandemic. Traders who anticipated this downturn and shorted futures contracts reaped significant profits.

Risk Level: High. The market’s sensitivity to global events can lead to extreme volatility. Traders must prepare for rapid price swings and maintain a robust risk management plan.

Additionally, the shale revolution in the United States, starting in the mid-2000s, drastically increased oil supply, affecting crude oil prices. Advanced futures traders who understood the impact of this trend often incorporated long-term bearish strategies, profiting from lower price floors.

Technical analysis remains an essential tool for futures traders. Understanding chart patterns, support and resistance levels, and moving averages can help identify entry and exit points.

Case Study: An experienced futures trader used a Fibonacci retracement tool to predict a bounce in WTI crude oil prices in 2022, capitalizing on a short-term rally. Similarly, a detailed analysis of Bollinger Bands allowed traders to identify overbought or oversold conditions, improving their timing.

Risk Level: Moderate. While technical analysis is valuable, it should not be used in isolation. Combining it with fundamental analysis can mitigate risks.

Stop-loss and limit orders are crucial for minimizing losses and locking in profits. Advanced traders should also consider trailing stops to protect gains as the market moves in their favor.

Real-Life Anecdote: A futures trader once avoided significant losses during a sharp price drop by setting a trailing stop order, which automatically exited their position at a predetermined level. Another trader used OCO (One Cancels the Other) orders to simultaneously manage profit targets and stop-loss levels, ensuring balanced risk-reward ratios.

Risk Level: Low to Moderate. Proper use of advanced order types can significantly reduce trading risk.

Liquidity and volatility vary throughout the trading day. The overlap between London and New York trading sessions often provides the best opportunities for crude oil futures trading.

Pro Tip: Monitor the market around key economic announcements, such as U.S. crude inventory reports, which can cause significant price movements. Another overlooked opportunity lies in trading futures during Asian hours, particularly when geopolitical events arise in the Middle East.

Risk Level: Moderate. Trading during high-volatility periods increases both profit potential and risk exposure.

Proper position sizing is critical in futures trading. Allocating too much capital to a single trade can amplify losses.

Case Study: A seasoned trader maintained consistent position sizes across multiple trades, enabling them to weather losses during a prolonged downtrend. Using tools provided by futures trading brokers, the trader also calculated risk as a percentage of total portfolio capital, limiting losses to 1-2% per trade.

Risk Level: Low to Moderate. Adequate position sizing minimizes the impact of individual losses on overall portfolio performance.

Open interest and trading volume provide insights into market sentiment and liquidity. High volume often indicates strong trends, while declining open interest can signal trend exhaustion.

Pro Tip: Use these metrics to confirm the validity of breakouts and reversals. Pairing volume indicators with price action improves overall trading accuracy, especially during false breakouts.

Risk Level: Low. These indicators enhance decision-making but do not eliminate market risks.

Relying on a single strategy can be detrimental. Advanced traders often employ a mix of trend-following, mean-reversion, and options strategies to adapt to changing market conditions.

Real-Life Example: A trader alternated between a breakout strategy during trending markets and a mean-reversion approach in range-bound conditions, achieving consistent profitability. Options spreads, such as bull call spreads, were also employed to hedge against unexpected price movements.

Risk Level: Moderate. Diversification reduces dependence on a single strategy but requires mastery of multiple techniques.

Regulations governing futures contract trading can change, affecting margin requirements and market access. Working with a reputable futures trading broker ensures compliance and access to updated information.

Real-Life Example: In 2010, regulatory changes post-financial crisis increased margin requirements for crude oil futures, significantly impacting traders who were over-leveraged. Staying informed helped disciplined traders adjust their positions accordingly.

Risk Level: Low. Staying informed reduces the risk of non-compliance and operational disruptions.

Emotional trading can lead to impulsive decisions and significant losses. Advanced traders prioritize discipline and adhere to their trading plans.

Case Study: A futures trader maintained composure during a major market downturn, sticking to their strategy and recovering losses in subsequent trades. Leveraging meditation and regular breaks helped mitigate decision fatigue.

Risk Level: High. Emotional trading is a common pitfall, especially during periods of extreme volatility.

A reliable futures trading broker provides advanced platforms, analytical tools, and educational resources. These features can give traders a competitive edge.

Pro Tip: Compare platforms to ensure they meet your trading needs, focusing on latency, charting tools, and real-time data. Advanced traders often use APIs for automated trading, enhancing execution speed and efficiency.

Risk Level: Low. Working with a reputable broker reduces operational risks and enhances trading efficiency.

Crude oil futures trading involves varying levels of risk, depending on the strategies employed and market conditions. Volatility, leverage, and geopolitical factors contribute to the inherent risks. Traders must adopt robust risk management practices, such as using stop-loss orders, maintaining proper position sizes, and diversifying portfolios.

Additionally, the emergence of algorithmic trading has increased market speed, introducing risks related to slippage and system malfunctions. Advanced traders must backtest algorithms rigorously and maintain redundancy protocols.

Crude oil future contracts offer significant profit potential for experienced traders but come with substantial risks. By leveraging advanced strategies, staying informed about market dynamics, and working with reliable futures trading brokers, traders can enhance their performance while mitigating risks.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572> (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

|

April Hogs satisfied a second upside PriceCount objective before turning sideways with a range bound trade. At this point, IF the chart can resume its rally with new sustained highs, the third count would project a potential run to the 100.96 area. |

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|