|

|

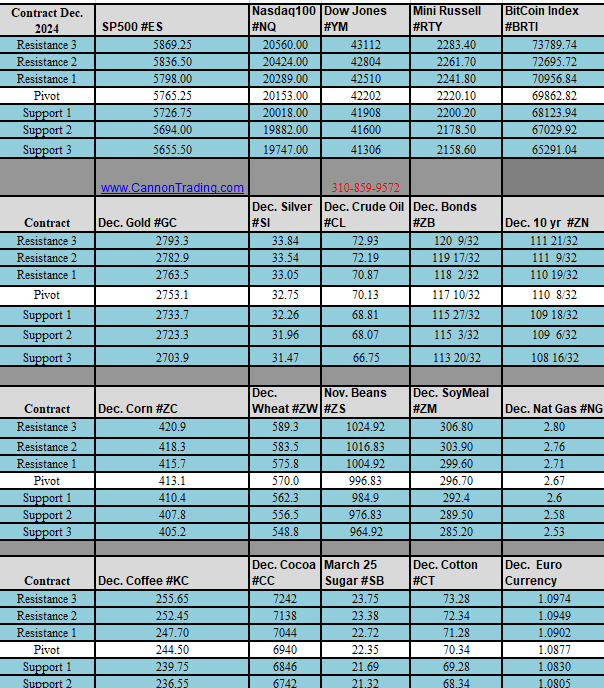

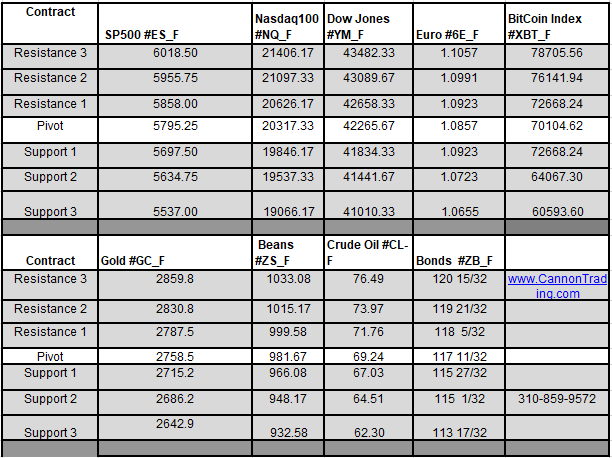

This Blog provides futures market outlook for different commodities and futures trading markets, mostly stock index futures, as well as support and resistance levels for Crude Oil futures, Gold futures, Euro currency and others. At times the daily trading blog will include educational information about different aspects of commodity and futures trading.

|

|

The oil market is one of the most significant and dynamic global markets, with crude oil futures representing one of the most actively traded commodities worldwide. For both new and experienced traders, understanding how to trade oil futures is key to gaining exposure to the oil market, which is impacted by a multitude of factors, from geopolitics to technological advancements. In this guide, we’ll explore the history of crude oil futures trading, why they are so popular, and the advantages and disadvantages for various types of traders, including retail traders, institutional traders, and hedgers. We’ll conclude with an analysis of oil price forecasts for the end of the year, addressing relevant factors that may impact these predictions.

Oil, often referred to as “black gold,” has been a critical resource in the global economy since its discovery as a fuel source. The journey of oil from its early use to becoming a dominant global commodity on the futures trading market is complex. Originally, oil was traded in physical markets, where buyers and sellers would negotiate contracts for delivery. However, as global energy demand grew, especially in the 20th century, oil became an essential commodity, fueling industries, economies, and transport systems worldwide.

To facilitate oil trading and address the volatility in oil prices, crude oil futures were introduced in the 1980s, allowing for price stabilization and hedging. The New York Mercantile Exchange (NYMEX) launched the first crude oil futures contract in 1983, followed by similar offerings from the Intercontinental Exchange (ICE) and other exchanges. These contracts allowed market participants to buy or sell oil at a predetermined price on a future date, bringing a significant degree of predictability and security to the volatile oil market.

Crude oil futures are among the most popular futures contracts, and there are several reasons why traders are drawn to crude oil futures trading:

To successfully engage in crude oil futures trading, traders should familiarize themselves with the trading process, understand market terminology, and stay informed on global events. Below are key steps for how trade oil futures:

Advantages:

Disadvantages:

Advantages:

Disadvantages:

Advantages:

Disadvantages:

The price of crude oil futures heading into the end of the year is likely to be influenced by several critical factors, including global demand recovery, OPEC+ production decisions, and geopolitical issues.

Based on current market conditions, analysts predict that oil prices could remain relatively high through the end of the year, with potential spikes if any supply disruptions occur. Crude oil futures may see increased buying pressure, but price sensitivity to unforeseen disruptions could cause fluctuations. Retail and institutional traders, as well as hedgers, should remain vigilant, monitoring relevant indicators and adjusting their strategies accordingly. Given these factors, how to trade oil futures effectively will require a close watch on economic reports, OPEC announcements, and geopolitical developments.

Understanding how to trade oil futures requires a grasp of market mechanics, key influences, and the reasons behind the popularity of crude oil futures trading. With high liquidity, volatility, and a strong influence from global factors, oil futures present unique opportunities and risks for traders of all kinds. For retail traders, the potential for high returns is met with significant risk. Institutional traders benefit from data and scale, but face regulatory challenges, while hedgers achieve price stability at the cost of flexibility.

The outlook for crude oil futures remains complex, with oil prices predicted to face various pressures that may drive prices higher or, conversely, cause corrections. As oil remains essential to the global economy, futures trading in this sector will continue to be a focal point for market participants. For anyone engaging in crude oil futures trading, maintaining a strategic approach and staying informed of global events are essential for navigating the unpredictable and profitable world of oil futures.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

The E-Mini S&P 500, a futures contract for the S&P 500 index, has grown to become one of the most popular financial products in the world for futures trading. From retail traders to institutional investors and hedgers, the E-Mini S&P offers a flexible, accessible way to participate in the stock market, speculate on price movements, and hedge against risks. Brokers play a crucial role in facilitating these trades, providing guidance, resources, and a robust platform for responsible futures trading. This article explores why indices like the S&P 500 are so popular, the importance of experienced brokers, and common mistakes that new traders should avoid when entering the complex world of futures trading.

The S&P 500, also known as the Standard and Poor’s 500 Index, represents 500 of the largest publicly traded companies in the United States. This index has become a barometer of the U.S. economy, and its futures contracts, like the E-Mini S&P 500, have become a popular choice for traders. But what makes these futures so attractive?

Brokers are essential in the stock index trading ecosystem. They provide traders with the necessary infrastructure, resources, and guidance to navigate the markets. Their services are tailored to cater to various types of traders, from retail investors to institutional clients and hedgers. Here’s how they assist each group:

For retail traders, brokers offer a user-friendly platform, educational resources, and customer support to make trading more accessible. Brokers help retail traders in the following ways:

Institutional traders, such as hedge funds, asset managers, and pension funds, have larger capital bases and are typically more sophisticated in their trading strategies. Brokers offer these traders advanced tools and services to meet their complex needs:

Hedgers, such as companies with large stock portfolios or those affected by economic cycles, use the E-Mini S&P 500 and other index futures to offset risks. Brokers assist hedgers with specific services:

New traders often face a steep learning curve when entering the futures markets, and the S&P 500 futures are no exception. Here are some rookie mistakes that traders should avoid:

Experienced brokers help traders avoid these pitfalls by providing educational resources, effective trading tools, and disciplined practices. Here’s how they can make a difference:

Choosing a broker with a solid reputation and strong regulatory standing is vital for futures traders. Here’s why a broker with 5-star ratings on TrustPilot and Google, along with a robust regulatory history, matters:

Legacy futures brokers—those who have been around for decades—offer a wealth of knowledge, experience, and insight that newer brokers may lack. Here are some characteristics that set them apart:

The E-Mini S&P 500 futures contract has cemented its place as one of the most widely traded financial instruments, appealing to a diverse range of market participants. Stock indices like the S&P 500 offer traders access to broad market exposure, high liquidity, and efficient hedging opportunities. Brokers play an instrumental role in facilitating these trades, providing support, education, and the necessary tools to help traders succeed.

For retail traders, institutional investors, and hedgers alike, choosing a broker with a solid reputation and a strong regulatory background is essential. Avoiding rookie mistakes and understanding risk management are crucial for anyone looking to trade S&P 500 futures. Ultimately, a broker with experience, high ratings, and regulatory trust offers an invaluable foundation for responsible, successful futures trading. With the right broker by their side, traders can confidently navigate the opportunities and challenges of the S&P 500 index futures market.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|

Futures quotes are fundamental to the world of futures trading, serving as the essential indicators of market sentiment, pricing, and future expectations across a broad array of asset classes. These quotes play a vital role for various market participants, from commodities brokers and future brokers to retail and institutional traders, as well as hedgers. By offering detailed insights into contract prices, trade volumes, and open interest, futures quotes help in making informed trading and hedging decisions, enhancing the efficiency of the entire marketplace.

Futures quotes represent the current prices and associated data for futures contracts in the market. They typically include key information such as the bid (the highest price a buyer is willing to pay), ask (the lowest price a seller is willing to accept), last traded price (the most recent transaction price), open interest (total number of open contracts), and volume (the number of contracts traded over a given period). The price of a futures quote fluctuates in real time based on supply and demand and reflects the market’s expectations of where an asset’s price is headed in the future.

These quotes are crucial for market participants because they provide insights into the current sentiment and expected direction of prices for various commodities, currencies, stock indices, and other underlying assets. By interpreting futures quotes, traders and brokers can gauge market conditions, strategize on entry and exit points, and anticipate potential price movements to maximize profitability or mitigate risks.

Traders, brokers, and investors alike use futures quotes as a real-time source of information for decision-making. These quotes allow them to monitor market trends and price fluctuations and analyze supply and demand dynamics in the futures market. For example, commodities brokers closely follow futures quotes to assess the prices of agricultural products, metals, or energy resources. Future brokers, on the other hand, may focus on quotes across different asset classes, offering insights and trading options to their clients.

Futures quotes also help market participants recognize patterns and trends. If a quote shows a consistent upward trend, traders might interpret this as a signal of increasing demand or decreasing supply. In contrast, if a futures quote exhibits frequent fluctuations or erratic movements, this could suggest market uncertainty or volatility, potentially influencing brokers’ and traders’ strategies. By understanding these patterns, traders and brokers can make more informed decisions, placing themselves in a stronger position to capitalize on price movements.

Access to real-time futures quotes is essential for traders who want to act on the most current information. Futures quotes can be found through several sources, including online trading platforms, financial news websites, brokerage platforms, and dedicated market data providers. Many commodities brokers and future brokers provide real-time or delayed futures quotes on their trading platforms, making it convenient for clients to monitor market changes and adjust their strategies accordingly.

Popular sources of futures quotes include:

Retail traders, or individual investors, can leverage futures quotes to develop strategies for short-term trading, day trading, or long-term positions. By analyzing futures quotes, they can spot opportunities for profit in trending markets or capitalize on price swings. Here are a few strategies through which retail traders use futures quotes to their advantage:

By using futures quotes as the foundation of their trading strategies, retail traders can enhance their potential for success and build more resilient portfolios.

Institutional traders, such as hedge funds, mutual funds, and large investment firms, often rely on futures quotes as part of their sophisticated trading strategies. Institutional traders tend to have access to high-quality, real-time data and advanced trading platforms, enabling them to process vast amounts of information and respond quickly to market changes. Futures quotes offer institutional traders various advantages:

Institutional traders’ use of futures quotes highlights the flexibility and potential for profit that these quotes offer, particularly for those with the resources and expertise to interpret and act on complex market information.

Hedgers, including agricultural producers, manufacturers, and corporations, use futures quotes to reduce price uncertainty and protect against adverse price movements in the underlying assets they rely on. Here are a few ways hedgers utilize futures quotes:

Hedgers’ primary objective is not profit but risk mitigation, and futures quotes serve as a vital tool to achieve this goal. By using futures quotes, hedgers can achieve greater financial stability, protecting themselves against market fluctuations that might otherwise impact their business operations.

Certain companies stand out in the industry for producing reliable and comprehensive futures quotes. These organizations provide real-time data feeds, analysis tools, and market insights that serve brokers, traders, and investors alike.

Each of these companies offers a range of tools to facilitate trading, hedging, and market analysis, making them indispensable for accessing reliable futures quotes.

Futures quotes are an indispensable tool for understanding market sentiment, predicting price movements, and making informed trading and hedging decisions. For commodities brokers and future brokers, these quotes are essential for providing clients with actionable information and market access. Retail traders rely on futures quotes to time trades, analyze trends, and execute hedging strategies, while institutional traders use them for advanced analysis, arbitrage, and risk management. Hedgers, on the other hand, utilize futures quotes to stabilize costs and secure prices for future transactions.

By interpreting and leveraging futures quotes, all market participants can gain an edge, allowing them to navigate complex and often volatile markets more effectively. Companies like CME Group, ICE, Bloomberg, Thomson Reuters, and Nasdaq play a critical role in providing access to high-quality futures quotes, enhancing the accessibility and transparency of the futures market for everyone involved.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

In this issue:

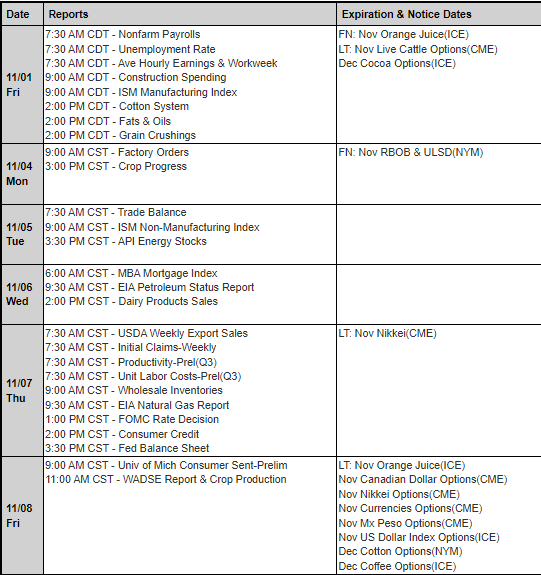

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

Time change, Clocks “Fall Back” 1 hour in U.S. Nov. 2nd, US Presidential Election Nov 5th, Fed Rate announcement (expectations are .25 cut), 3756 corporate earnings reports and a few Economic data releases. To wit, Market volatility could be very high next week.

Many clearing firms will be raising margins to protect from and for the undercapitalized in what could be extreme moves related to the US Election outcomes which may not be known for hours or days following poll closings Tuesday evening.

Tuesday is the 60th U.S. Quadrennial Presidential Election, Polls close @ 7:00 P.M. in each of the 4 time zones. (a recent Nevada Supreme Court Ruling allows un-postmarked mail-in ballots received within 3 days past the official poll closing may be counted)

Prominent Earnings this Week:

FED SPEECHES:

Big Economic Data week:

|

Please click here to instantly view a PDF with Crude Oil outlook for the short, medium and long term.

With tensions in Middle East yoyoing…you may want o read and view the outlook provided by Artac Advisory!

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

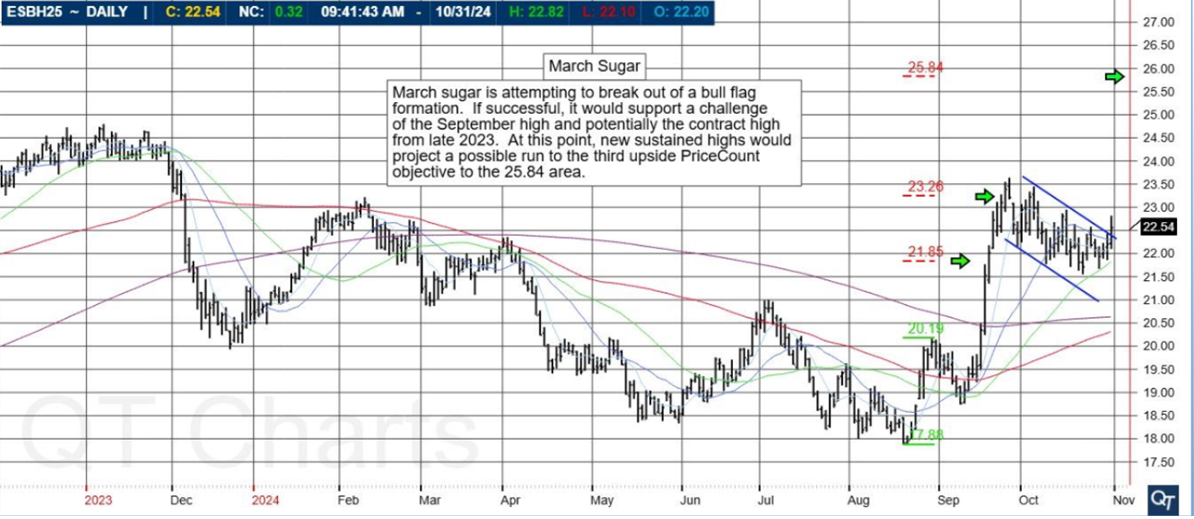

March Sugar

March sugar is attempting to break out of a bull flag formation. If successful, it would support a challenge of the September high and potentially the contract high from late 2023. At this point, new sustained highs would project a possible run to the third upside PriceCount objective to the 25.84 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

NK – Nikkei 225

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$50,000

COST

USD 165 / monthly

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

|

|

|

|