The Week Ahead:

By John Thorpe, Senior Broker

There will be few government reports released this week that will have much of an impact on equity prices.

This past Saturday we have entered the FOMC Blackout period which will last through the next FOMC Rate decision on Wednesday, June 14th and conclude at midnight on June 15th.

Since there is no significant data, we are certain Fed Policy makers will have been able to breathe a bit easier after the debt limit breach was averted.

Next week is going to be considerably different. Why? the Consumer Price Index will be released a day prior to the FED rate decision and may have an 11th hour impact on the policy makers decision to raise or stay firm at current short term fed fund rate. According to the CME’s FedWatch tool, the prospect for rate changes has been anything but sanguine. May 5th there was only an 8.5% chance of another .25 increase and as recently as a week ago there was an over 60% chance and as of todays date the tool is projecting less that a 22% increase by .25 to the .0525-.0550 area. . .

As I said about CPI at the moment the market is pricing in no change but a CPI figure reversing the slow downtrend in current price levels could immediately change the expectations for no change this go round.

Understanding expectations will allow you to trade with more confidence when there is a sudden change in policy directives!

Plan your trade and trade your plan.

Webinar: Order Flow Trading Platform

Wed, June 7th, 2023 12:01 PM – 1:00 PM PDT

In this webinar, we’ll tour the platform and take a look at how to utilize Order Flow, Delta Filer bars and other innovative features while observing a variety of futures markets with a focus on some of the smaller Micro futures contracts.

Our host, Antonio Sartorello of Volumetrica will guide attendees as the markets trade in real time. Learn more about VolSys’s core features

• Order Flow and it’s pullback bar

• How to use Advances T&S

• How to use Advanced DOM

• Delta Filter Bars to identify Strength/weakness

• Where are the big traders/ orders?

Attendees will receive a FULLY functionable demo with live data!!

SPACE is LIMITED, so reserve your space now!

https://attendee.gotowebinar.com/register/3653796317657144918

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 06-06-2023

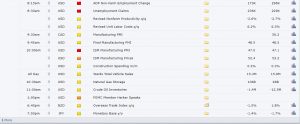

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.