Futures Markets: The Week Ahead

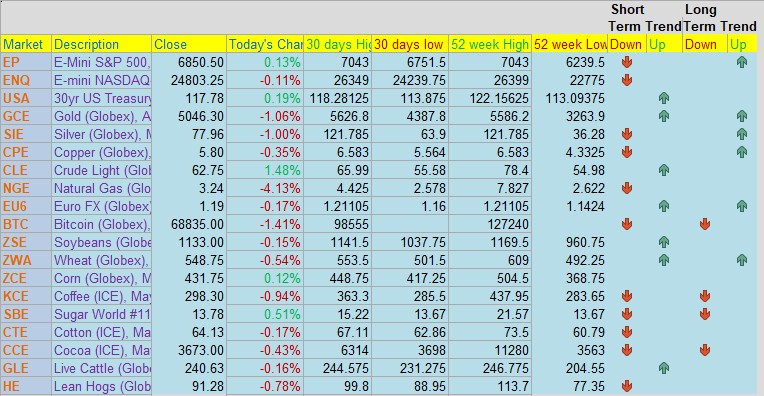

Dow, S&P 500 Equal Weight Hit Fresh All-Time Highs, supported by money rotation away from non-tech areas of the market. Selling pressure accelerated, particularly in areas of the market associated with the software industry and cryptocurrency which translates to “risk off”. Money rotated into other areas of the market viewed as relative value/safety play.

Several sectors hit fresh all-time highs this week, such as industrials, materials, energy, and consumer staples, and the S&P Equal Weight index hit a fresh all-time high.

Earnings reports continued to pour in this week, and the eye-popping hikes in capital expenditure *(CapEx) budgets from hyperscalers Google & Amazon generated a lot of buzz this week.

The spending hikes signal confidence in AI, healthy demand, and suggest that the AI infrastructure buildout still has more room to run out of the 291 S&P 500 companies that have reported results, 65% have beat on the top line while 79% have beat on the bottom line.

Revenue growth has been +9.25% year-over-year while EPS growth is tracking at 13.64%. FactSet is currently forecasting blended Q4 EPS growth for the SPX to be approximately 11.9-12.1%, while 2026 EPS growth is expected to be ~14.3-15.0%.

It’s encouraging to see fresh all-time highs in the Dow and S&P Equal Weight indices. On the other hand, ask yourself whether Fridays sharp bounce-back in higher risk areas of the market, like software and crypto, is a legitimate signal of capitulation/seller exhaustion, or whether it’s a short-term oversold bounce that will give in to more selling pressure next week. It’s impossible to know now only time will tell.

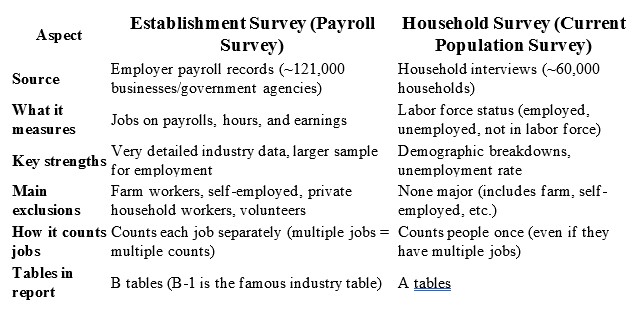

We also saw deterioration in labor market data, though markets didn’t seem to react negatively to that news. We’ll get monthly jobs report Wednesday, if payrolls come in well below estimates, or unemployment makes a notable jump, will markets be able to shrug that off?

DOW above 50K; Every sell the news on MAG 7 stocks was absorbed with buying in heavy industrials, financials and value, we saw leadership in staples. If you look at the broad economy stocks such as FedX the stock is up 25% for the year. The market is pointing that it believes that will get a spring higher in broad earnings growth and were gonna run a hot economy. The question is whether the market priced that in yet or not.

RSI, was at 20 for Gold, Silver, MSFT, ORCL, PLTR. We saw the bottom for now the question is what happens with this rally and how to play it?

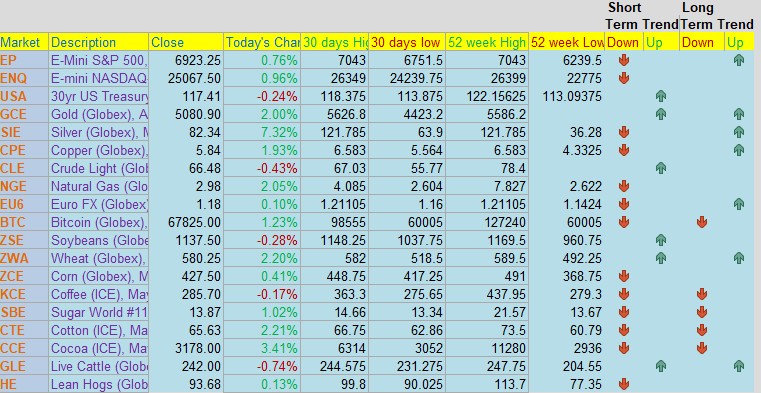

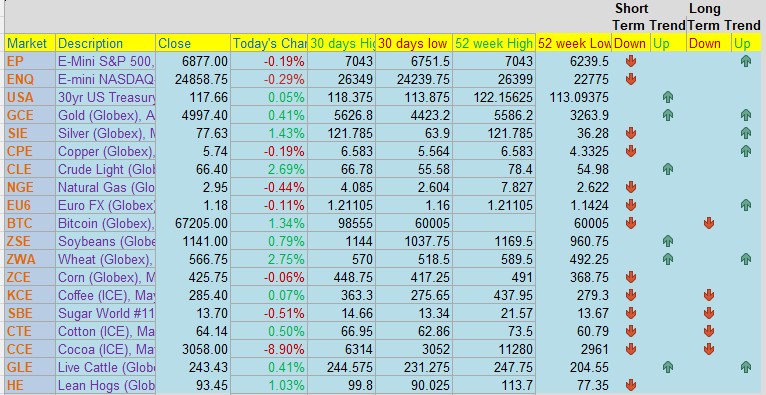

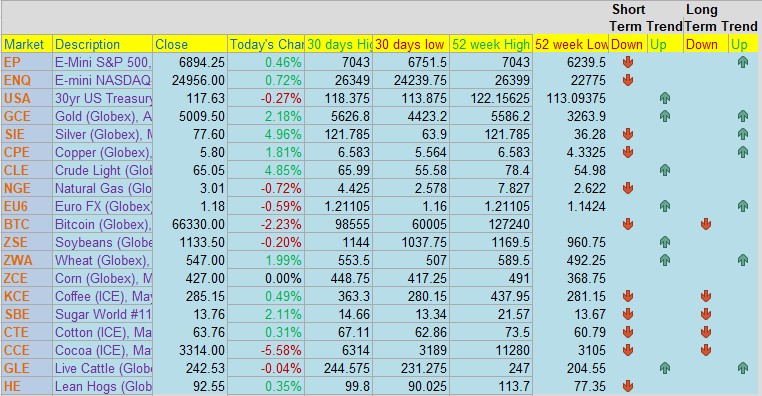

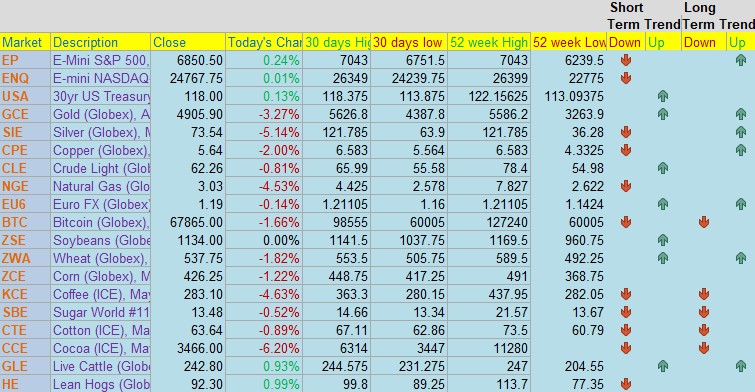

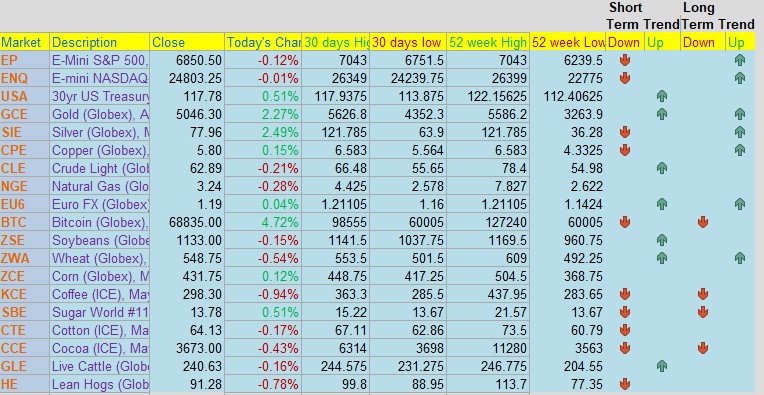

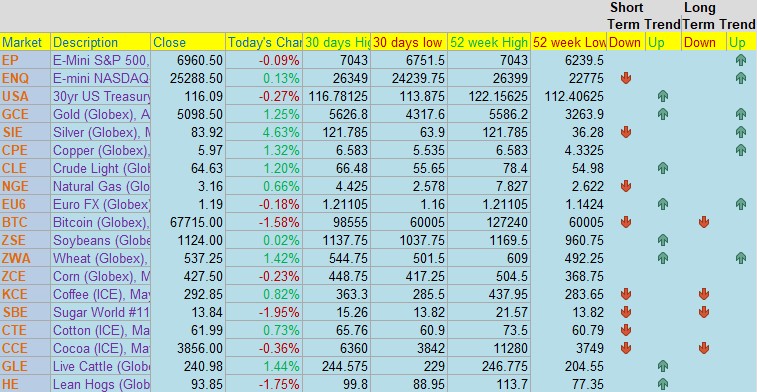

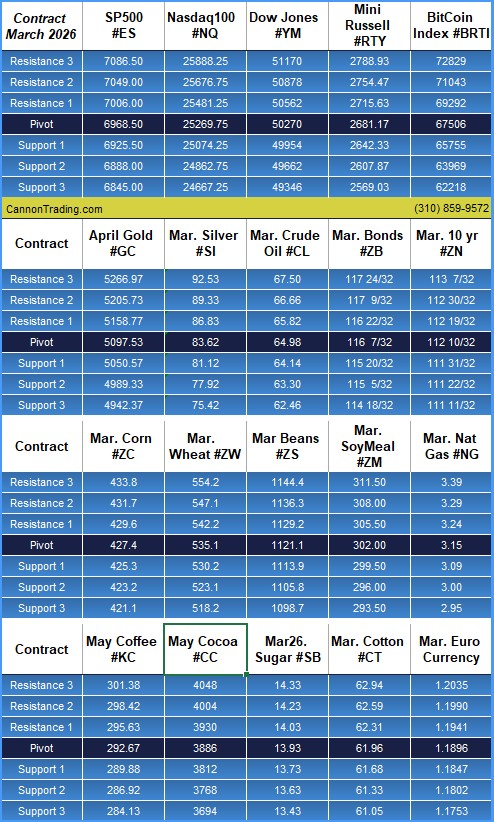

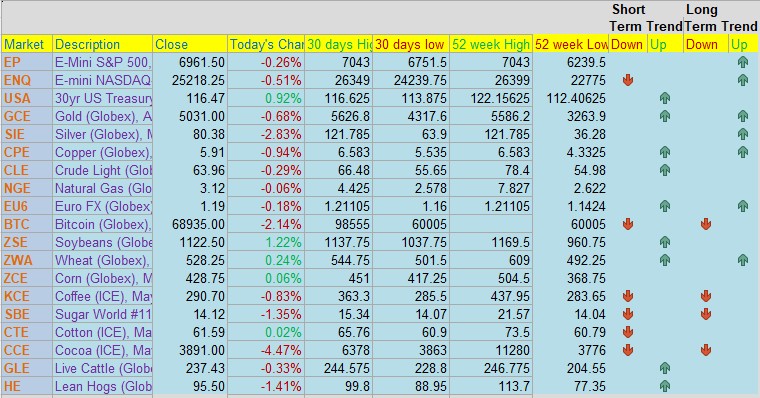

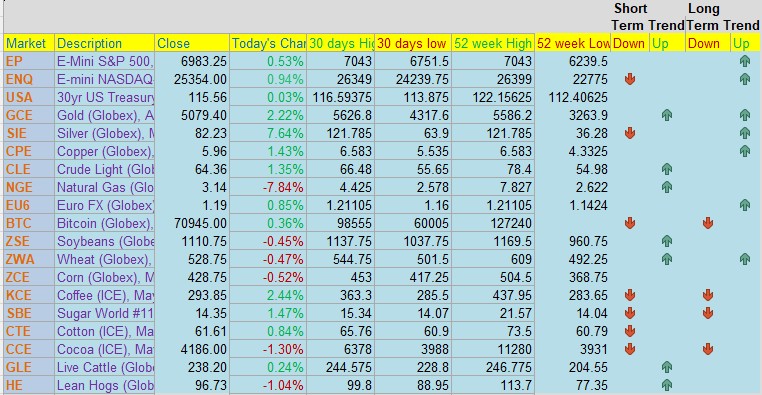

What happened in the futures commodity markets this week

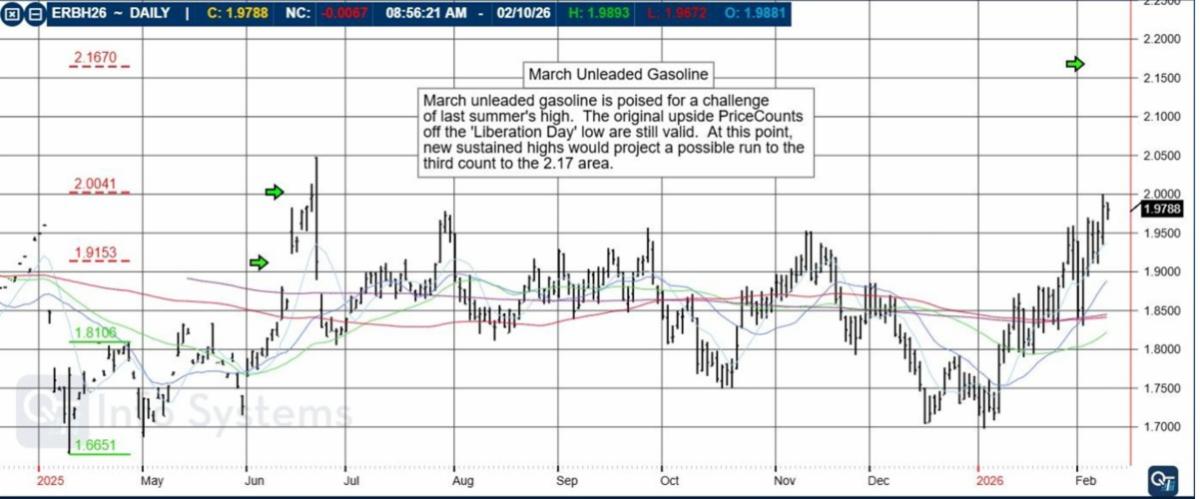

- Oil prices were volatile: Earlier in the week Brent and WTI crude climbed sharply (~3%) on heightened Middle East geopolitical risk as U.S.–Iran tensions flared, with markets pricing potential supply disruptions near the Strait of Hormuz. This supported energy futures mid-week.

- Then prices slid: As geopolitical tensions temporarily eased, crude futures pulled back from those gains later in the week.

- Natural gas futures softened: The broader commodity dashboard shows natural gas trading lower on the week, reflecting a pullback from recent volatility.

Precious Metals

- Silver weakness: Silver futures saw a sharp downturn (~15% on a single session) as investors exited hard assets amid reduced geopolitical risk and a firmer dollar.

- Gold also pulled back: Gold retraced from recent rally highs, though it remains elevated compared with earlier in the year.

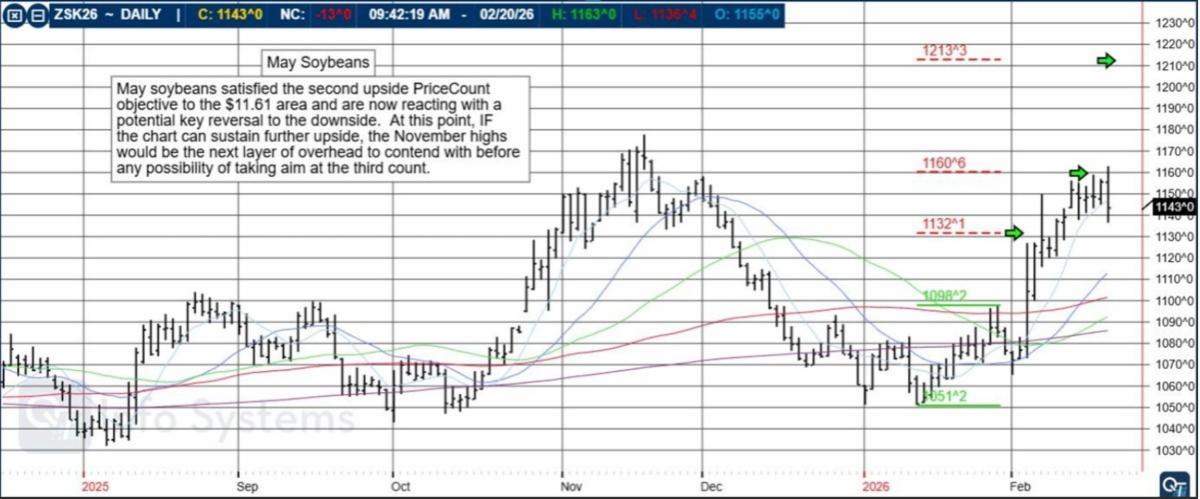

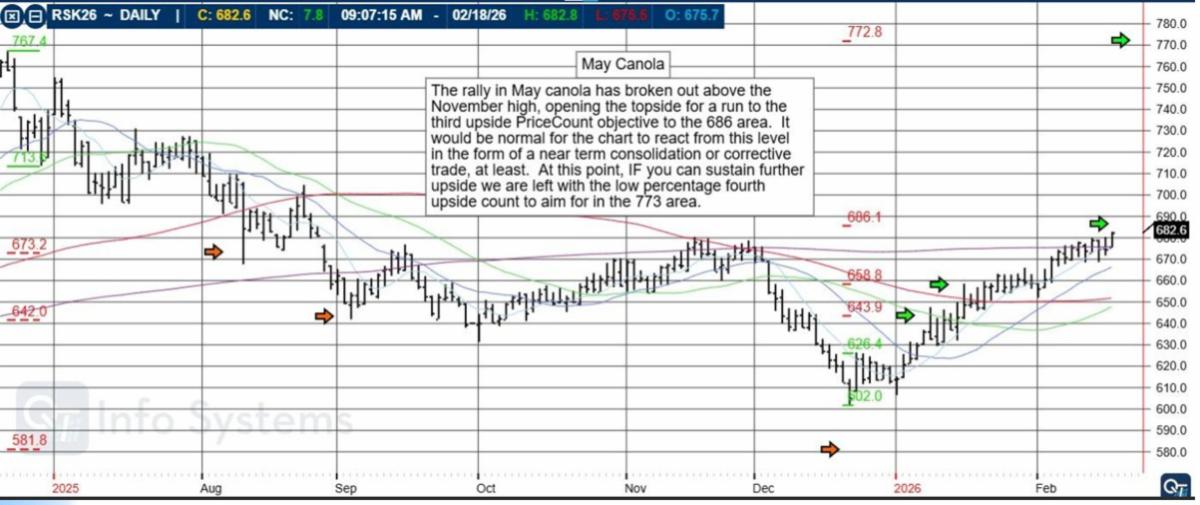

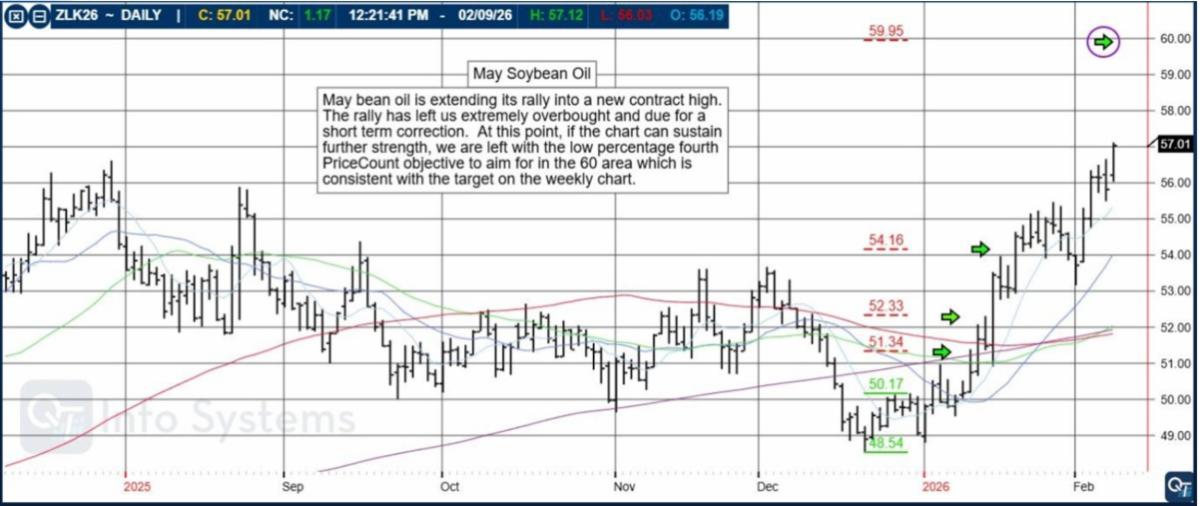

Agriculture Futures

- Soybeans held strong: U.S. soybean futures extended gains to multi-month highs on Chinese demand optimism, helping grains show relative strength.

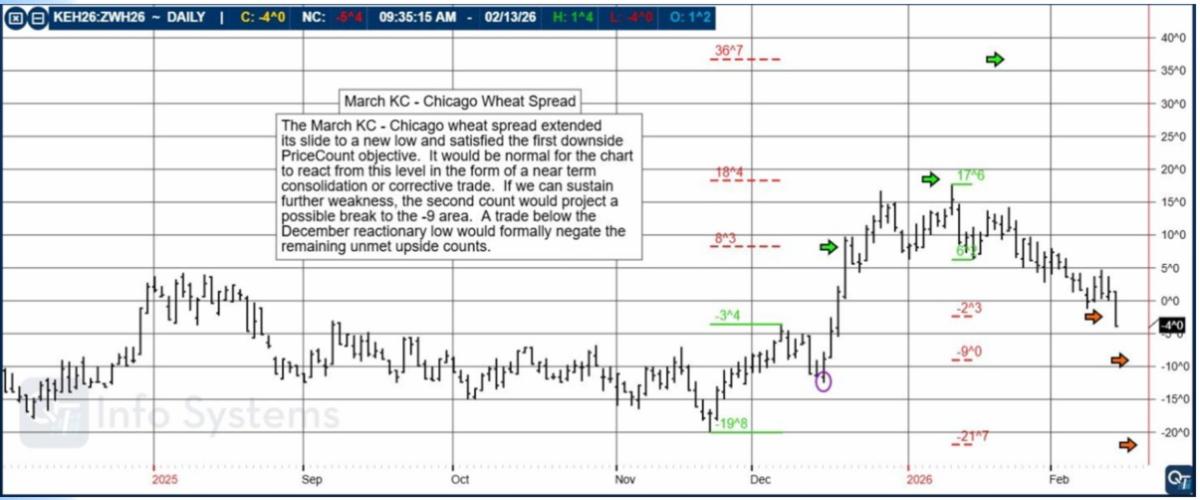

- Corn & wheat mixed: Corn and winter wheat prices faded or traded softer after earlier strength.

Risk Management Is Paramount

- Elevated volatility and margin requirement hikes in metals underscore the importance of robust risk management.

- Strong price moves can trigger forced liquidations — especially in leveraged futures accounts.

- Client action: Encourage stop-loss discipline, volatility-adjusted position sizing.

Fundamentals Remain Mixed Across Sectors

- Agriculture trades are influenced by seasonal demand, weather, and global supply dynamics — not just macro data. Seasonal patterns are still key catalysts.

- Natural gas and energy transition metals continue to offer divergent fundamentals vs. crude — they don’t always move together.

- Client action: Avoid one-size-fits-all commodity themes; analyze sector–specific fundamentals (weather, export demand, policy drivers).

Stay ahead of the curve by following our YouTube channel https://www.youtube.com/@Cannontrading and Facebook page, (20+) Cannon Trading Company Group | Facebook where we are posting frequent video updates to help you navigate the commodity markets.

Software stocks were down big with Anthropic’s recent software news triggered a massive sell-off because their new tools, specifically Claude Cowork, shifted AI from a “writing assistant” to an autonomous agent capable of replacing specialized software. The IGV software ETF is down 24%, I hear analysts saying when companies will report that they are increasing their buy backs that may mark a bottom. the Relative Strength Index hit 14.

My takeaway from this report and the effects it had on software stocks is that ”we need to be ready that at any moment there scan suddenly be breakthrough that will break something and devalue a particular sector”.

On the AI front for 2026, Google and Amazon have announced record-breaking increases in capital expenditures (Capex) to fuel the AI race, largely for data centers and infrastructure. Amazon: Projected to spend $200 billion in 2026, representing a 50.6% increase over its $131.8 billion spend in 2025.

Google (Alphabet): Projected to spend between $175 billion and $185 billion in 2026, effectively doubling (97%–100%+ increase) its 2025 spend of approximately $91.4 billion. Various industries that should benefit from this spend, power companies, data centers grid & the consumer.

The total amount of capx from last year and the next 2 years anticipated from the hyperscalers is around 2 trillion $, which is almost exactly as much market cap that the market lost in software sector since the high in October.

Key Drivers of the Yield Drop. The yield decline was concentrated on Thursday, February 5, after several economic data points suggested the labor market might be cooling faster than expected. Today Monday Feb 8, we saw Bloomberg News report; China urges banks to curb US Treasuries exposure.

The US dollar: scott Bessent said on TV “are we doing the things to create a strong backdrop for the dollar; our tax policy, our trade policy, our deregulatory policy, our energy policy, reasserting our sovereignty in critical minerals are we making the US the best place for capital in the world.

Bitcoin, which was around $83,000 last Friday, hit $60,000 earlier this morning but is snapping back towards $70,000 today. Does fridays “risk on” bounce signal that we hit a capitulation extreme in software/crypto and the near-term low is in place? Of course that’s a possibility, but it’s too early to be sure. Bitcoin: there was a report on CNBC that around 40% of spot bitcoin ETF holders are underwater. There was roughly $1.3 billion in net outflows last week.

AMZN went down 50% 8 times in its first 15 years of existence. Volatility is the name of the game.

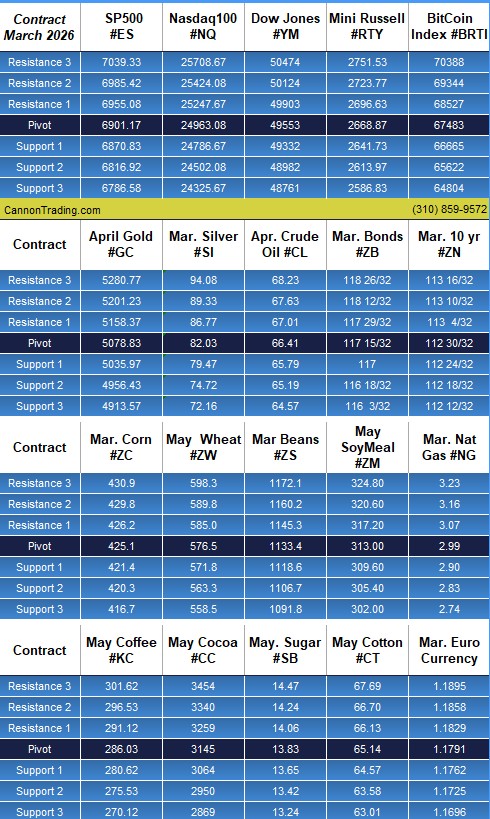

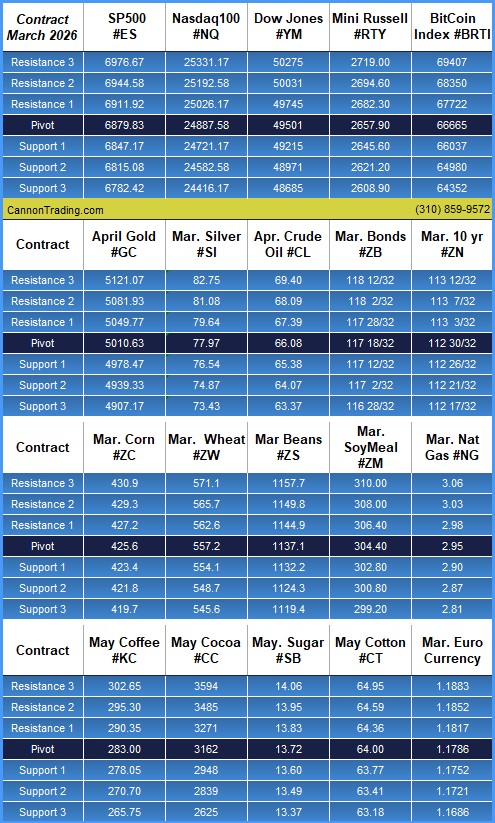

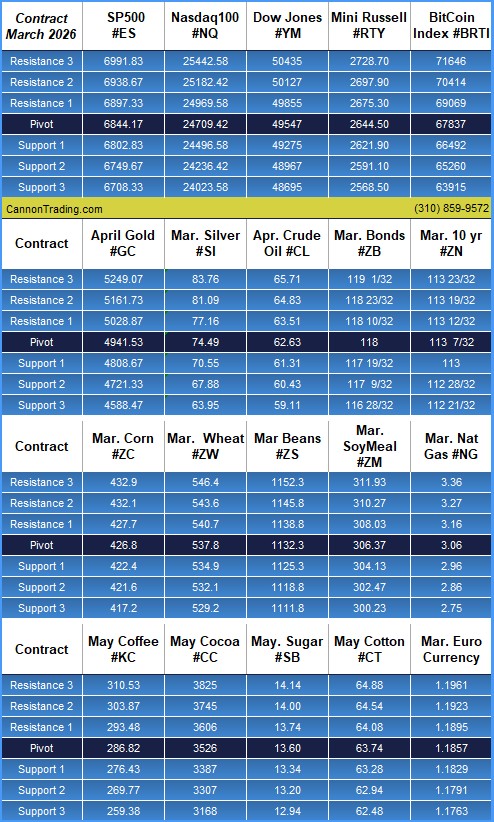

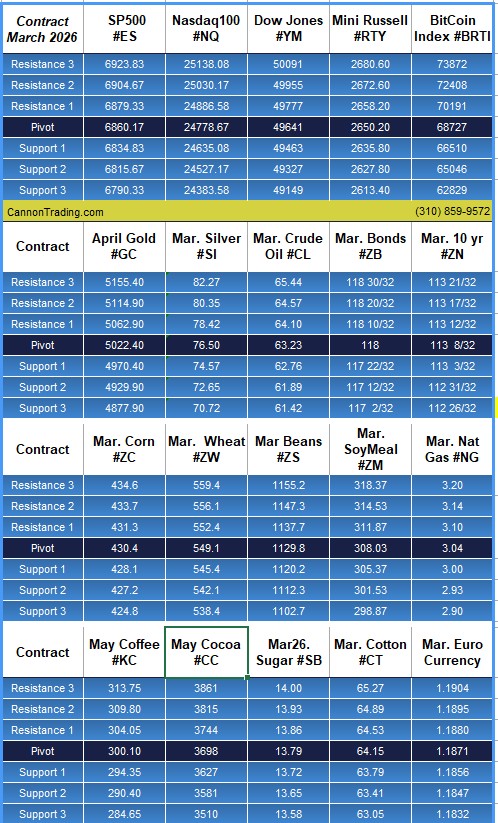

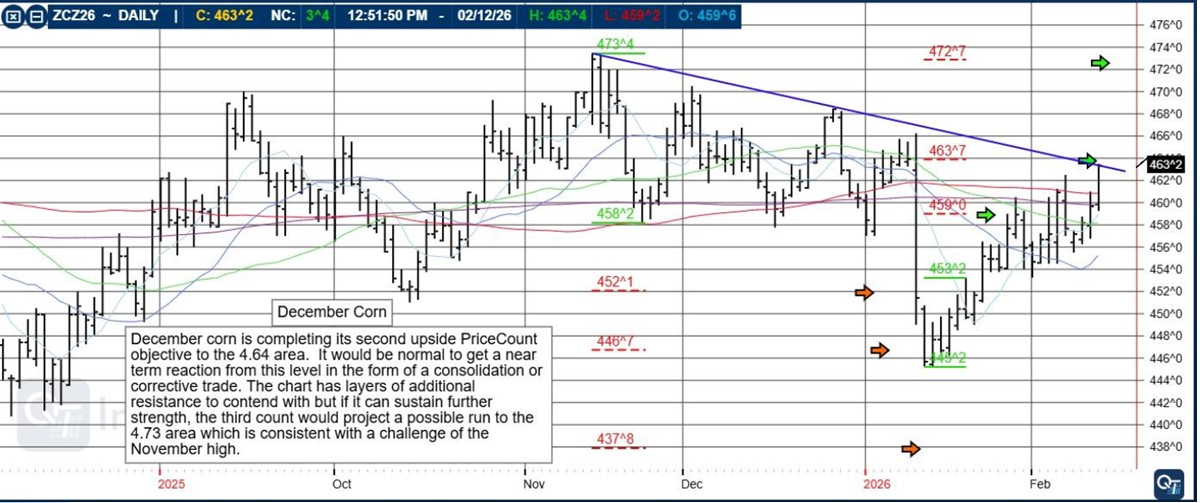

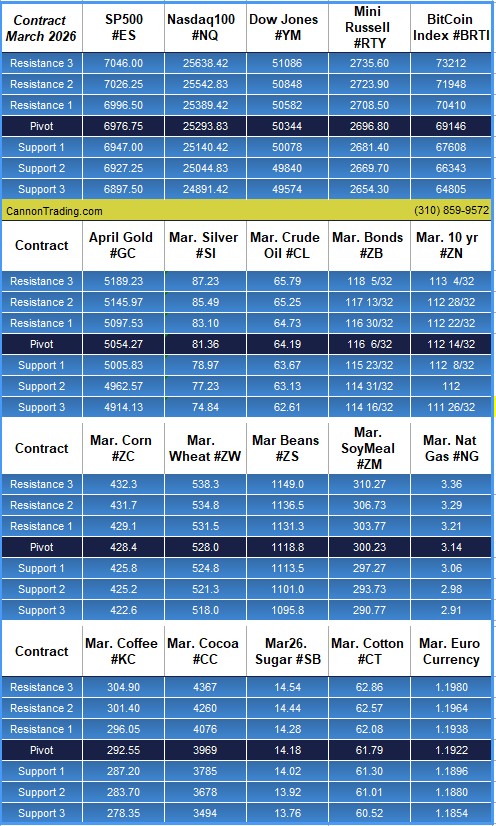

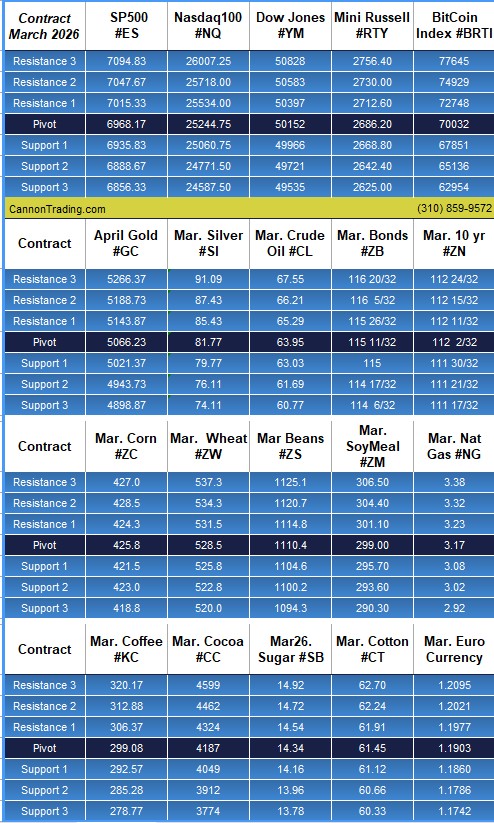

Technical Analysis:

$COMP & NDX fell through support this week and the near-term outlook is questionable. Concerned of a bearish confirmation in the $COMP and NDX, meaning that the indices continue to move higher early next week but encounter resistance at the underside of the 100-day SMA or some other resistance level and turn lower; this is technically called a bearish “pullback”. Should that occur, this could broadly dampen investor sentiment, and the selling could spill over into the overall market.

You can view the charts am fallowing this week at – https://www.youtube.com/@Cannontrading

The standout this week is the rollover in market breadth on the CCMP, which has been occurring due to the carnage in software-related companies. Compared to last Friday’s, the SPX breadth declined to 63.44% from 67.27% and the CCMP sank to 43.05% from 48.51%, while the RUT eased to 63.4% from 64.77%.

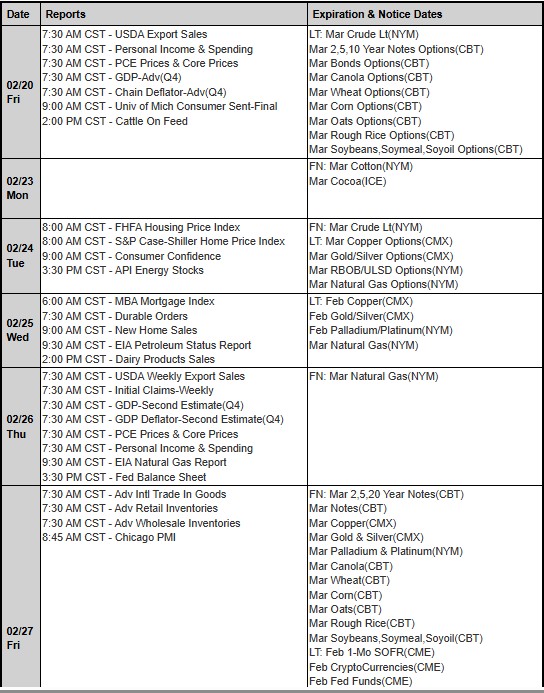

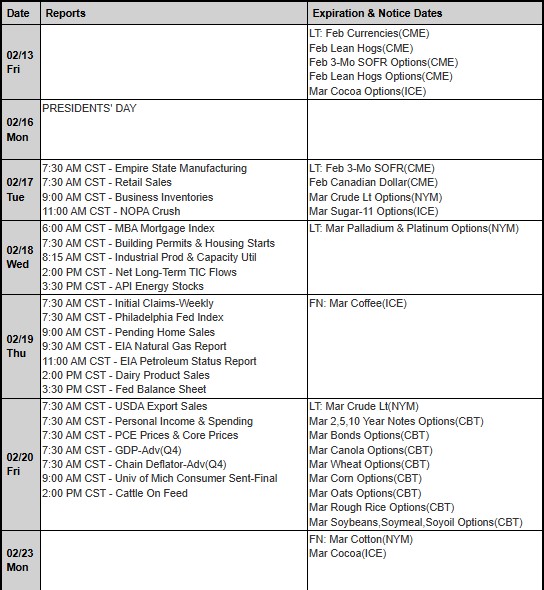

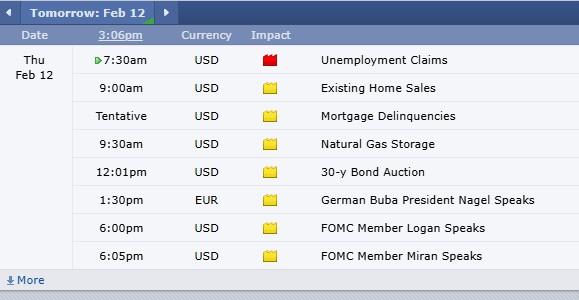

Economic reports:

- Monday (Feb. 9): no reports

- Tuesday (Feb. 10): Business Inventories, Employment Cost Index, Export Prices ex-ag, Factory Orders, Import Prices, Retail Sales

- Wednesday (Feb. 11): Nonfarm Payrolls, Average Hourly Earnings, Average Workweek, Unemployment Rate, EIA Crude Oil Inventories, MBA Mortgage Applications Index, Treasury Budget

- Thursday (Feb. 12): Producer Price Index (PPI), Continuing Claims, EIA Natural Gas Inventories, Existing Home Sales, Initial Claims

- Friday (Feb. 13): Consumer Price Index (CPI)

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions and other financial instruments involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources.

You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. I am registered solely as a commodities broker. Any references, recommendations & information contained in this article are of opinion only, should not be considered investment advice. And do not guarantee any profits. |