Get Real Time updates and more on our private FB group!

FOMC Statement tomorrow:

The following was written by my colleague, John Thorpe, an ex floor broker and a Senior Broker with Cannon Trading:

Since the depths of the pandemic, the Fed has been buying U.S. Treasuries and agency mortgage-backed securities in the open to signal its commitment to easy money policies. The Feds balance sheet has more than doubled during the Pandemic, from just under 4 trillion to nearly 9 trillion U.S. dollars. At the November Fed meeting , the governors had for the first time admitted that inflation may not be “transitory” and charted a path to “gradually” taper purchases with a target of mid 2022 to wind down the necessary taper .“If the market perceives that the Fed is behind the curve in controlling inflation, it would lead to higher inflation expectations and long-term interest rate hikes, potentially weakening the dollar and pressuring asset values,” said Madhavi Bokil, senior vice president at Moody’s Investors Service. In lieu of a gaudy CPI number recently at 6.8 and PPI increased by the largest amount in recorded economic history.

The market is looking for the Fed to acknowledge the existence of inflation in clearer terms than the November statement and the need to decelerate asset purchases and accelerating the “Taper” in an attempt to prevent a flat yield curve between the 2 yr and 10 yr notes. If this portion of the yield curve flattens or turns negative, this typically signals a recession. It has narrowed in recent weeks to a spread of only .75. This meeting is a very important one and so far this week, the equity markets are reacting to a potential need to accelerate the taper, an admission by the FED that they may be nervous about their inability to control inflation and an impending recession.

The following are my PERSONAL suggestions on trading during FOMC days:

· Reduce trading size

· Be extra picky = no trade is better than a bad trade

· Choose entry points wisely. Look at longer time frame support and resistance for entry. Take the approach of entering at points where you normally would have placed protective stops. Example, trader x looking to go long the mini SP at 4325.00 with a stop at 4319.00, instead “stretch the price bands” due to volatility and place an entry order to buy at 4319.75 and place a stop a few points below in this hypothetical example ( consider current volatility along with support and resistance levels).

· Expect the higher volatility during and right after the announcement

· Expect to see some “vacuum” ( low volume, big zigzags) right before the number.

· Consider using automated stops and limits attached to your entry order as the market can move very fast at times.

· Keep in mind statement comes out at 1 Pm Central time, the news conference which dissects the language comes out 30 minutes later so the volatility window stretches out.

· Know what the market was expecting, learn what came out and observe market reaction for clues

· Be patient and be disciplined

· If in doubt, stay out!!

If you are looking for other reference material please

contact your Cannon Broker for lists of solid, informative and helpful trading tomes

Introducing Micro Ether Futures

At 1/10 the size of one ether, Micro Ether futures (MET) provides a precision, efficient, cost-effective way to manage your exposure to one of the largest cryptocurrencies in the world by market capitalization.

- Features & Benefits

- Fine-tune your Ether exposure

- Enjoy price discovery on a regulated exchange

- Lower margin

- Diversify your portfolio

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

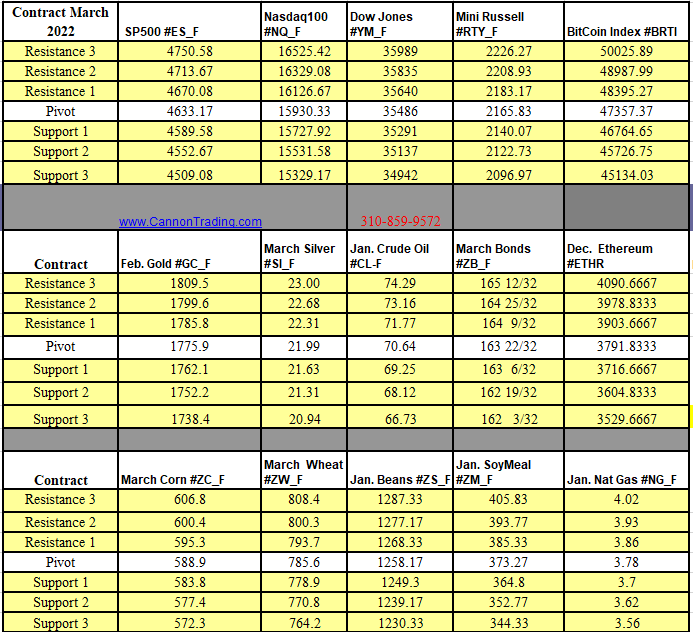

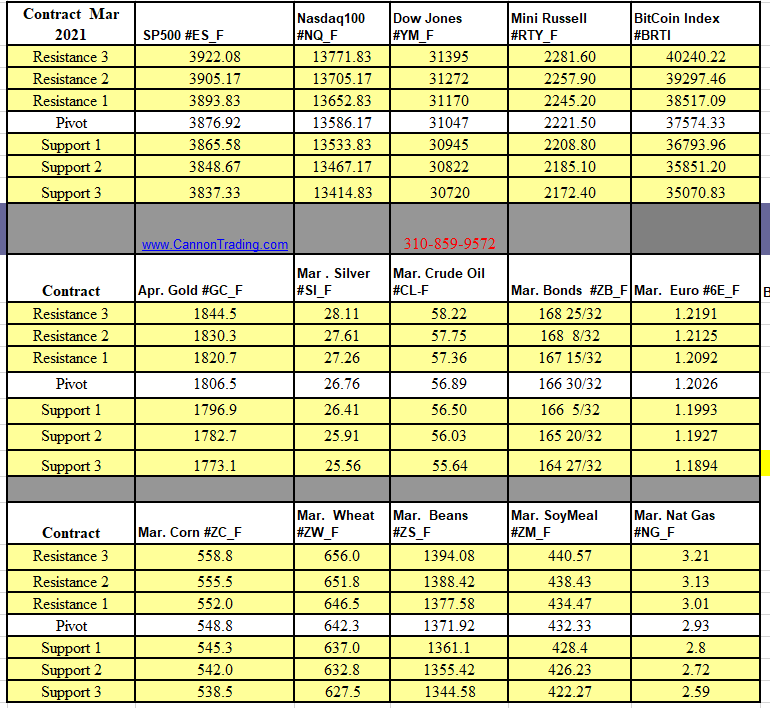

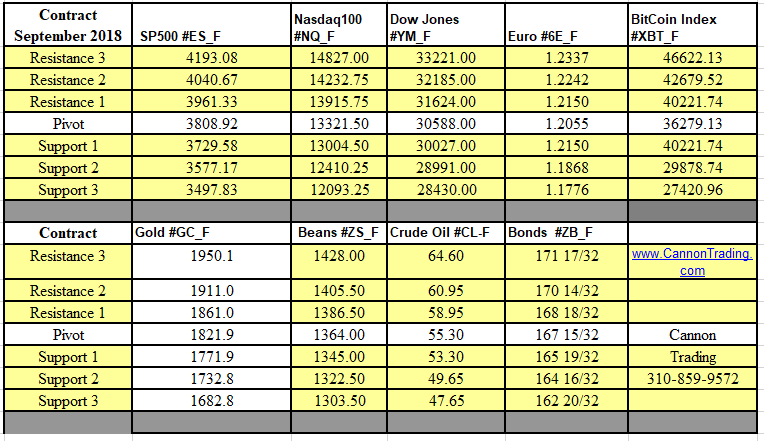

Futures Trading Levels

12-15-2021

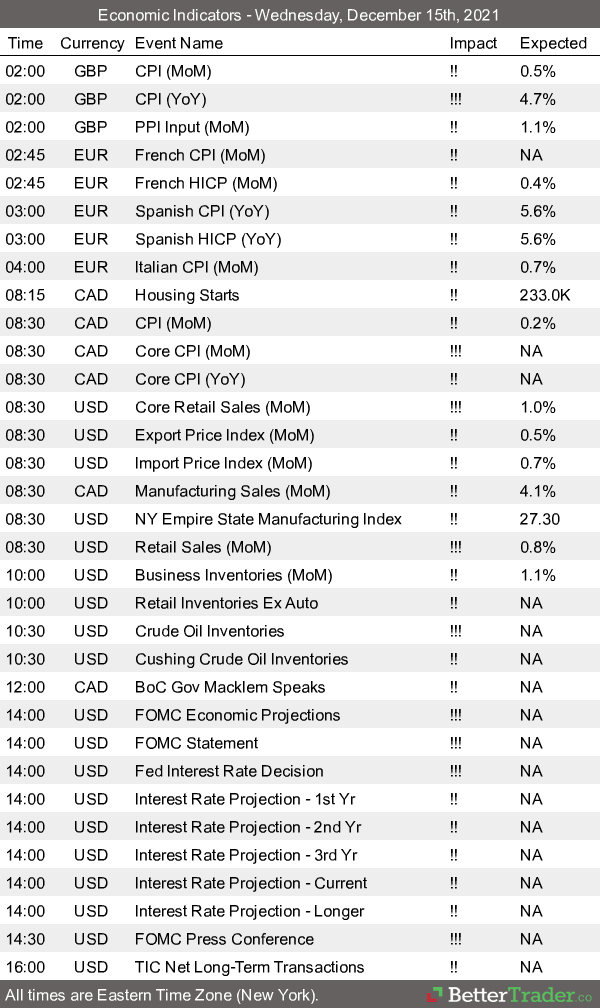

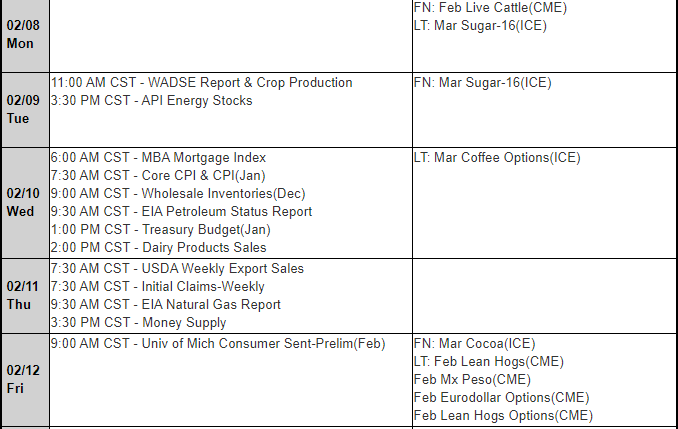

Economic Reports, Source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.