WYNTK for the Week of September 26th…

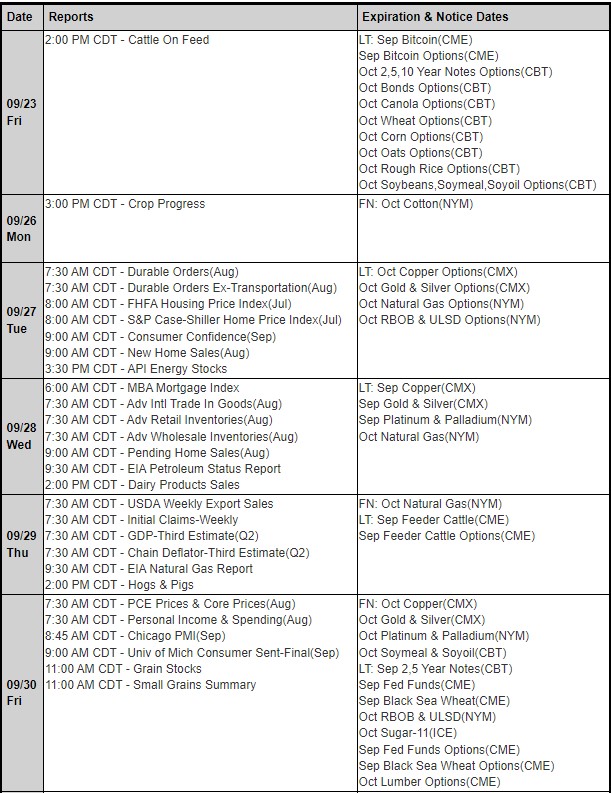

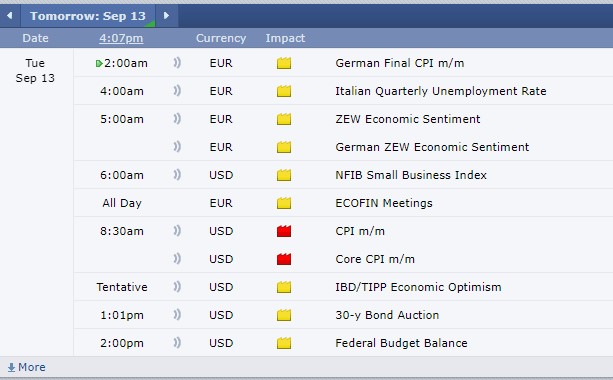

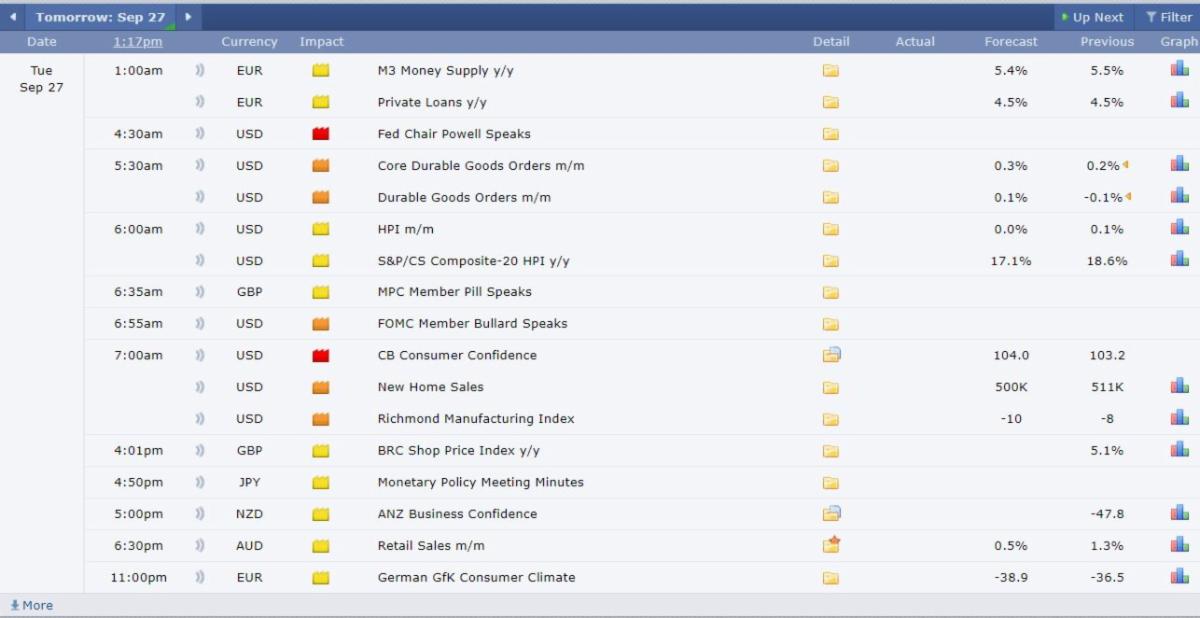

Tuesday is going to be an extremely busy day for FED Speak! and early too! The EARLY Kickoff begins at 3:30 am ET and again at 6:15 am ET for Chicago Fed Chair Charles Evans. To be followed by Jerome Powell Fed Chair at 7;30 am ET BEFORE MARKET OPEN. James Bullard will also be presenting @ 9:55 am ET. We can throw into the mix a few economic data releases as well. Durable goods orders will be released at 8;30 am ET some housing data at 9am and consumer confidence , new home sales at 10amET., Money supply released at 1PM ET this should all make for a volatile Tuesday session, please adjust your trading size accordingly.. On Wednesday the 28th we have more speeches from Fed members Bostic, Bullard, Powell and Bowman 8:35 am ET, 10:10 am ET, 10:15am ET and 11am ET respectively. Advance international trade in goods will be released @ 8:30am ET, these should all keep the energy in the markets moving. Thursday the 29th we get the all important GDP, the third iteration of the 2nd quarter number with a consensus range of -7%- -5% quarter over quarter annual rate, a deviation from this consensus may be enough to shock market direction in a very short period of time.. then jobless claims should also effect the market direction, Both will be issued at 8:30 am ET . and Finally, for Friday, the equity markets will need to unwind a bit before the weekend, but first it will need to digest Personal Income and Outlays; this report is released at 8:30 am ET with 2 more fed speakers ,Barkin and Brainard at 8:30 am and 9:30 am Respectively. Make it a solid week and remember to plan your trade and trade your plan!

As always, plan your trade and trade your plan. Please contact your broker or Cannon Trading with any questions.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

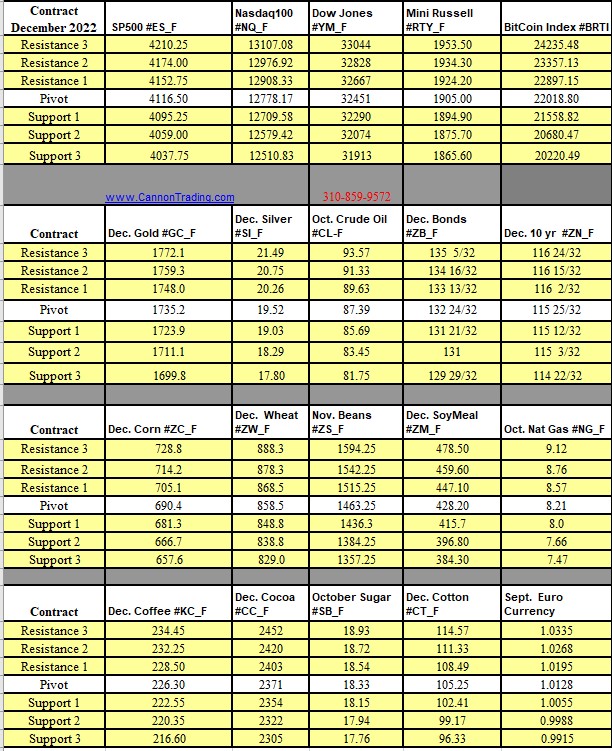

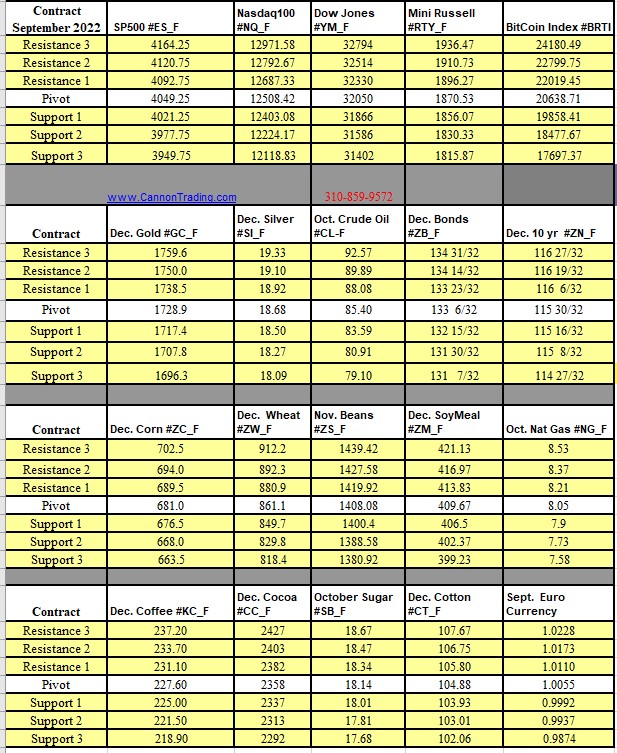

Futures Trading Levels

09-27-2022

Improve Your Trading Skills

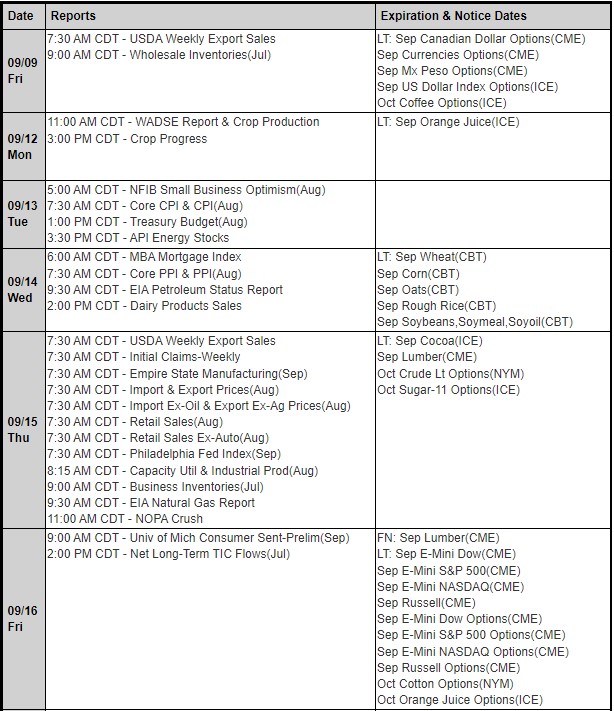

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.