What You Need to Know Before Trading July 7th + Futures Trading Levels 7.07.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

What You Need to Know Before Trading July 7th:

by Mark O’Brien

Softs:

Big news regarding

lumber futures! Pending approval, on Aug 8 the CME Group will introduce revamped

lumber futures and options. These are not newly offered alternative futures contracts and options, but a complete remodel of the existing ones. The contracts and options will keep the same symbols but the leverage will be 1/4 the existing specifications: 27,500 board feet, down from 110,000. A $1.00 move will be equal to $27.50, down from $110.00.

The contracts’ minimum tic size will be going up from $0.10 ($11) to $0.50 ($13.75).

Trading hours: Mon. – Fri.: 9:00 A.M. – 3:05 P.M., Central Time.

Contract settlement will remain physically delivered.

Energies:

Also due to the Independence Day holiday, the weekly Energy Information Agency (EIA) Petroleum Status Report (Energy Stocks) will be released tomorrow, as opposed to its regularly released time earlier this morning. The weekly

Natural Gas Storage Report typically released on Thursday will do so at its regular time: 9:30 A.M., Central Time. Then, at 10:00 the Energy Stocks report will be released.

After spiking above $120 a barrel only a month ago,

crude oil prices have been slipping over the last two weeks and the drop has accelerated in recent days, including trading down to an intraday low of $95.10 (Aug. WTI contract) this morning. That’s a ±$25K per contract move.

Take a look at a ±$40K per contract move. Aug.

natural gas pierced $9.50 on June 8th. It’s hovering near ±$5.50 today – and traded to $5.32 intraday yesterday.

Financials:

You didn’t miss it. Due to the Dept. of Labor Statistics’ release date rules, the first Friday of the month (last Friday) was not the date for the release of the June unemployment report. The Independence Day holiday pushed the report to this Friday, July 8. Same time: 7:30 A.M., Central Time.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

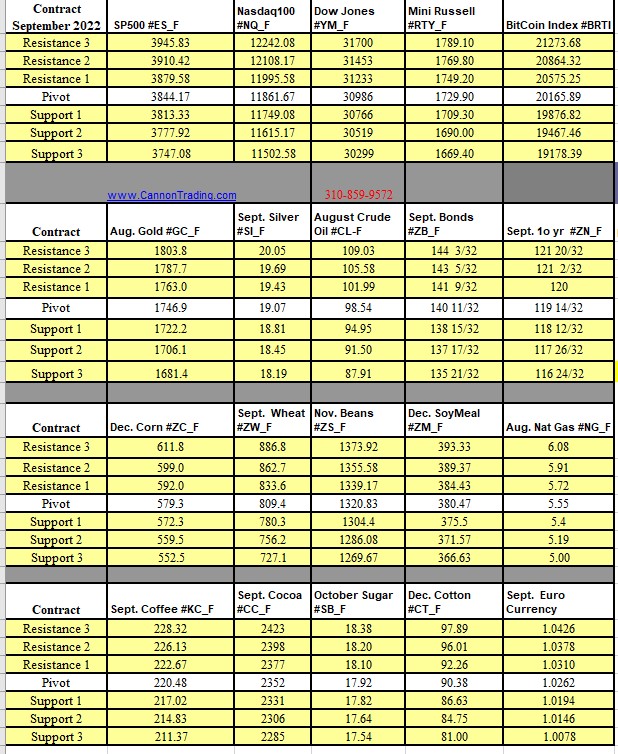

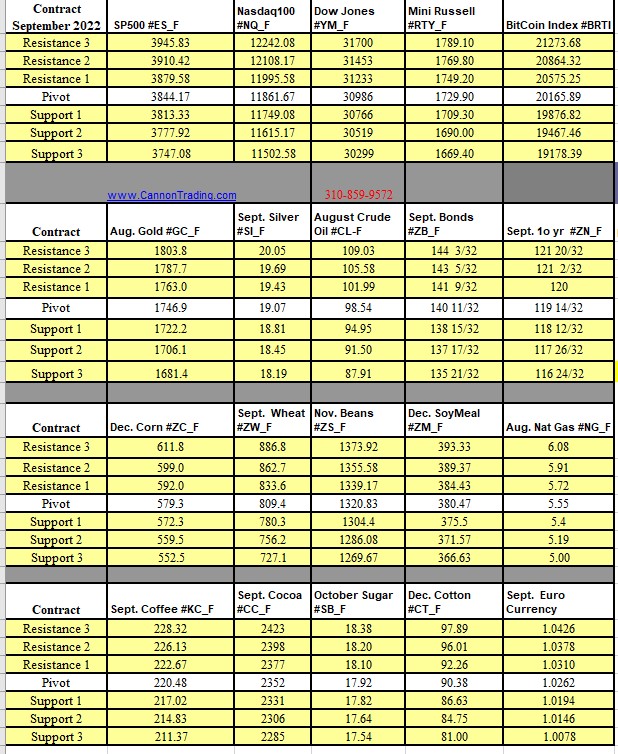

Futures Trading Levels

07-07-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education