Housing Data + Trading levels for 12.20.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Housing Data week

By John Thorpe, Senior Broker

A full week of trading!

Before I get into the market moving events for the week I would be remiss if I didn’t mention holiday light volume going into this weekends 3 day weekend. The best times to trade will be around the openings and closings while sprinkling in a few post report time frames.

The Housing market and GDP highlight this weeks market movers. Tuesday 7:30 am CST Housing Starts. Wednesday Existing home sales @9:00 am CST And Friday , same time New Home Sales.

Smattered in between we have Consumer Confidence On Wed @ 9 AM CDT , GDP on Thursday @ 7:30 CDT PREMARKET, this should be a big mover if it’s off the mark. Friday two more premarket numbers that could create the last volatility for the day and exhaust the energy for the week in the equity markets, they are Durable goods orders and personal income both at 7:30 CDT and will give the FED more information relative to efficacy of their current fed policy objectives.

Christmas 2022 Trading Schedule

Please contact your broker if you have any questions about your positions. And remember, the next front month for these contracts – March – is already well traded and available.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

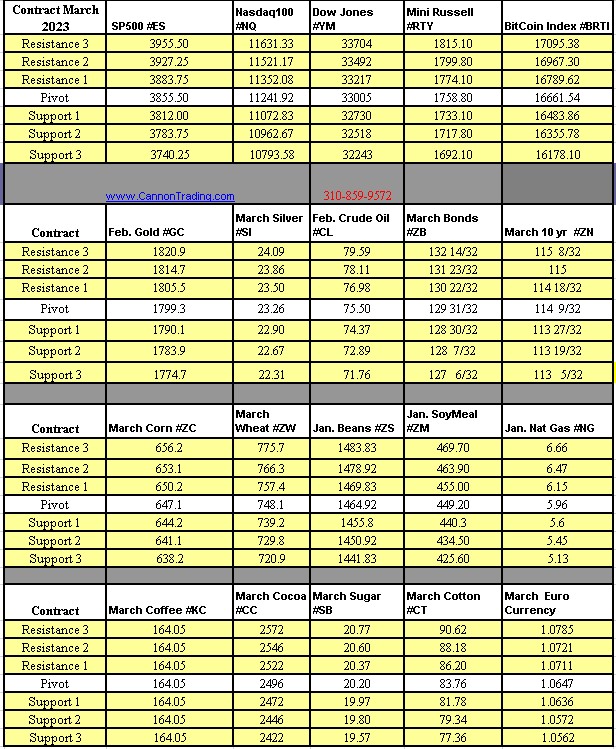

Futures Trading Levels

for 12-19-2022

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.