_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Precious Metals Trading

Dear Traders,

Day Trading Mind Traps

“One way our brain helps keep us safe is to protect us from an awareness of our weaknesses. The brain believes that it is better to be falsely confident than recognize the real risks. This protective mechanism tends to work against us in trading.” Kenneth Reid, Ph.D

MINDING THE MIND

The mind can play tricks on us. Intuitive Trading is an attempt to mind read the market, which makes us susceptible to whipsaws. Hindsight Bias causes traders to underestimate the difficulty of trading, while Competency Bias causes us to over-estimate our abilities. These are mental banana peels that set us up for a fall.

INTUITIVE TRADING

Intuitive trading is a natural response to excessive randomness and non-linearity in the market. But making informed guesses is not the same as formulating a rule-based pattern-recognition system that gives a trader a true edge. Without a rule-based plan, intuitive traders expend a great deal of energy mindreading the market, which will not improve your odds of success. In fact, professional traders make a good living exploiting the emotionally-driven behavior of intuitive amateurs.

Precious Metals Trading: ETFs vs Futures

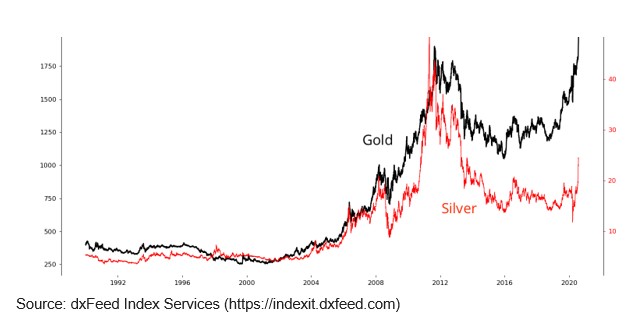

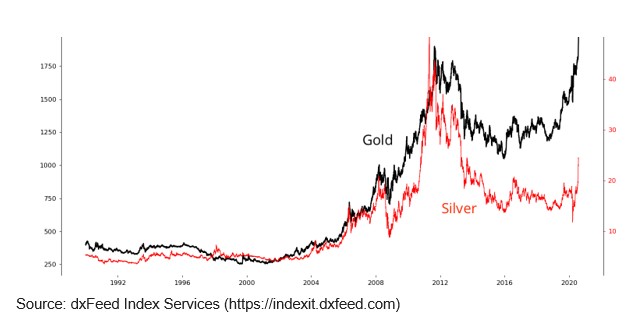

Gold is hanging around its most expensive prices since futures on the commodity started trading almost half a century ago in 1974. While the price levels have increased, the action around gold has not. Volatility has only risen slightly in gold products, and it is in fact still below its historical average. As gold feels out new highs in a more calculated manner, its metallic companion silver has almost doubled in volatility.

Whether it’s by price extremes or large moves, the curiosity of many stock traders is piqued. But those familiar with precious metals trading may have a hard time finding the right precious metal product to speculate on since the choices vary widely in exposure, size, and look.

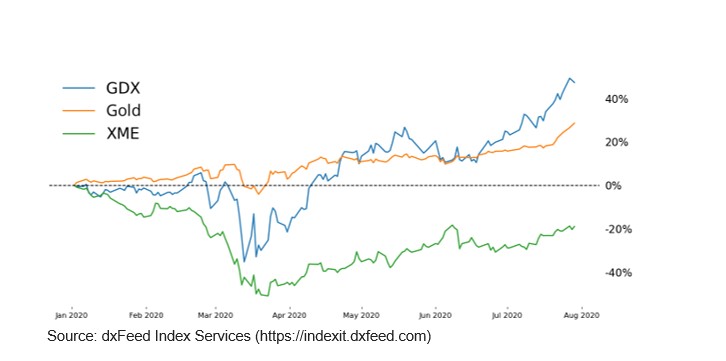

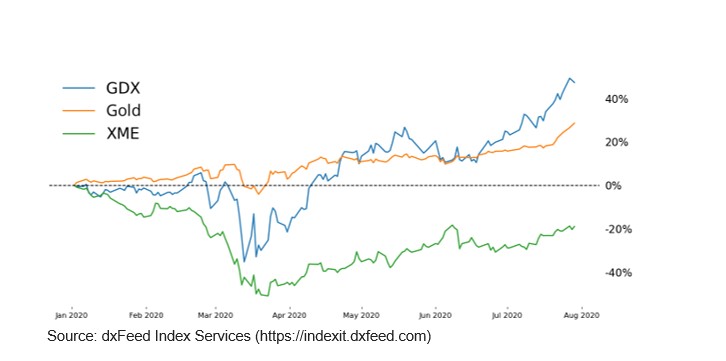

Metals or Mining Stocks?

Exchange-traded funds (ETFs) that package stocks in the mining business might be the easiest first venture into metals, but ETFs such as XME and GDX can diverge greatly from the commodity itself. Their correlation to the equity market can push them one way as metals pull them the other creating significant long-term deviations.

Some ETFs that track commodities more closely, like GLD and SLV, can be heavy on capital usage. For example, the shares needed to see daily movement in an SLV position greater than $50 would cost between $1,000 and $2,000. These expensive ETFs make large returns on capital difficult to attain.

Capital Efficiency at What Cost?

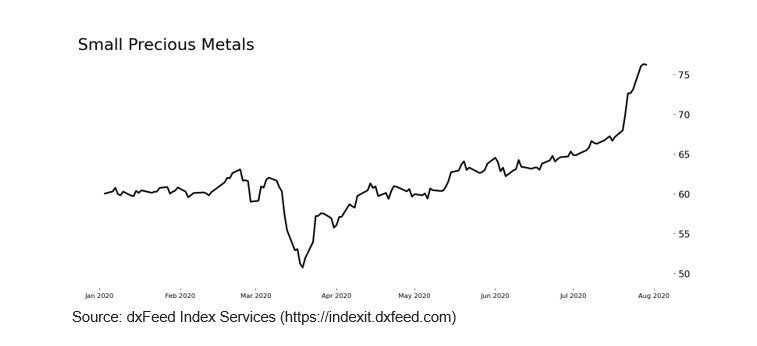

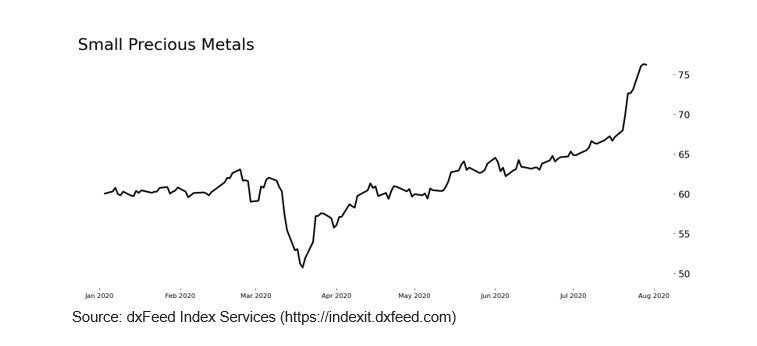

Futures contracts on gold and silver can offer large fluctuations for smaller capital requirements than stocks and ETFs, but traditional metal futures such as /GC and /SI can be too large for the everyday investor. Both markets have seen daily moves exceeding $2,000 just in the last week, and silver futures have made multi-thousand dollar moves a regular event.

New futures products like Small Precious Metals (/SPRE) present smaller investors the capital efficiency of futures at a more manageable rate than traditional products. The product moves close to $100 on the average day, and its initial margin is usually around a few hundred dollars. Also, it combines gold and silver into the same product, so you don’t have to decide on which precious metal to trade.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures and Precious Metals Trading.

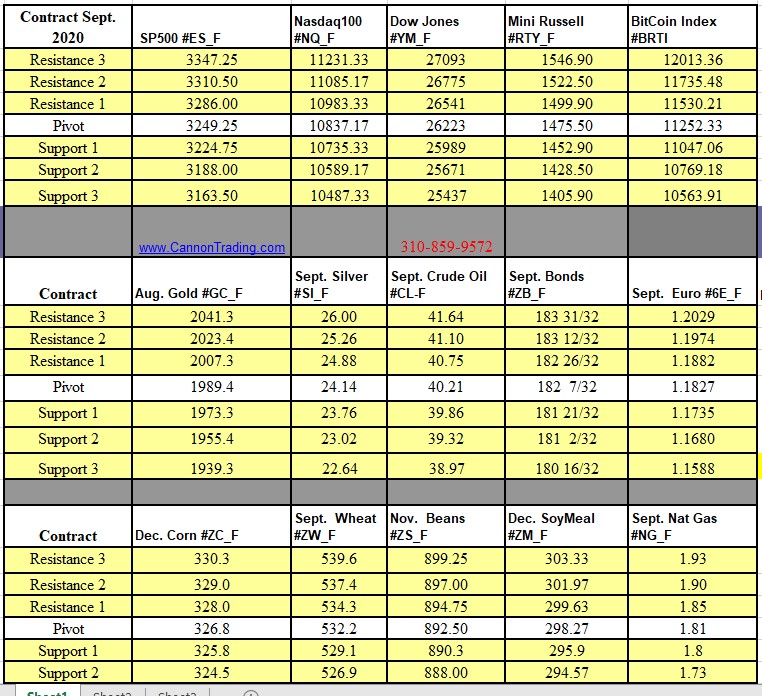

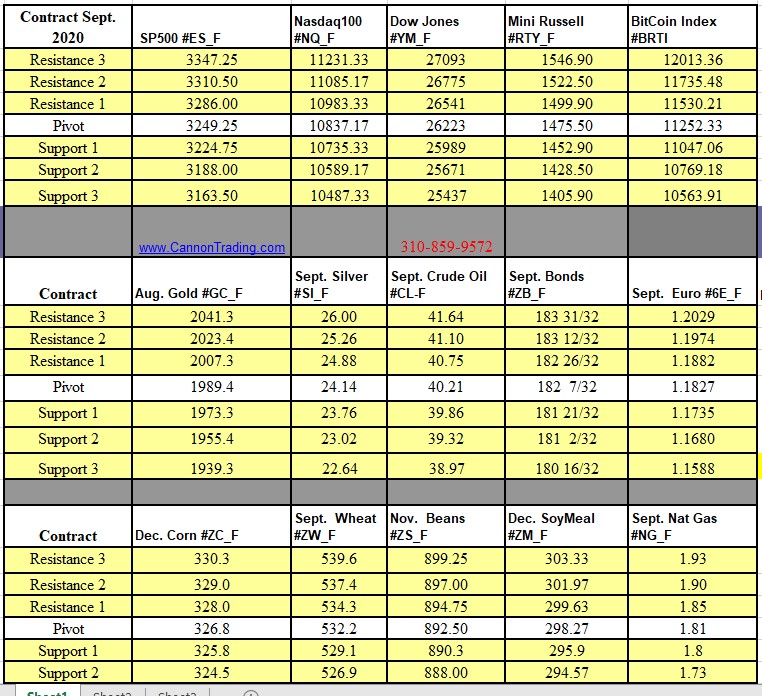

Futures Trading Levels

8-03-2020

Weekly Levels for August 3rd-7th

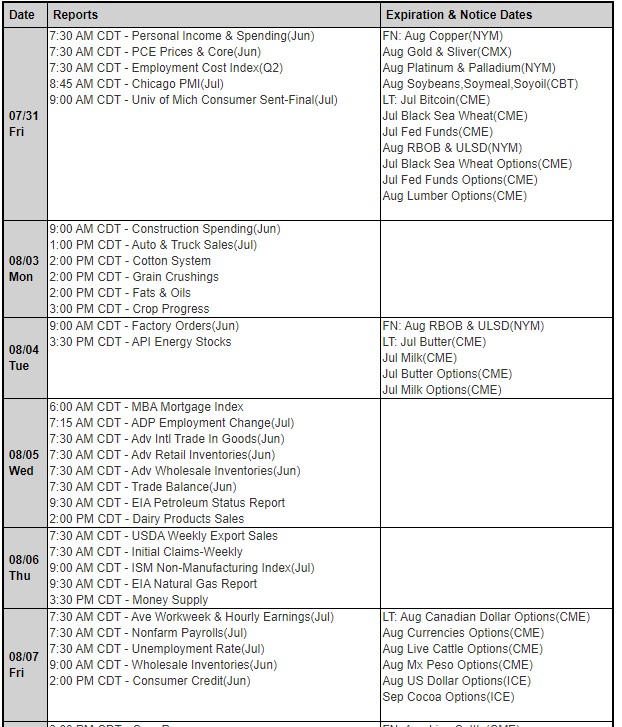

Economic Reports, source:

Economic Reports, source:

https://mrci.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News

Economic Reports, source:

Economic Reports, source: