Weekly Newsletter #1090 Insights from a Day Trader & Support and Resistance Levels for the Week Ahead

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Cannon Futures Weekly Newsletter Issue # 1090

Dear Traders,

Trading 102: Insights from a Day Trader on preparing for the trading day, mental notes and much more – Written by a current, active day-trader

The following was shared with me by a client of ours, an international trader, who has been trading with us for a few years now. I was VERY IMPRESSSED with the content and the thoughts behind this so I asked his permission to share this with our readers and he agreed. The content was originally written in another language and the translation below is intended to try and preserve some of the authenticity of the writing….

Focusing for the Trading Day

1. I believe that you can earn and make a living from intraday trading on futures contracts. It is very difficult but achievable.

2. Responsibility – I am absolutely responsible for being an intraday trader in general and for my trading activities in particular. This responsibility is comprehensive, expansive (also subjects that are not directly responsible for me – they are my responsibility !!!) and can not be divided.

3. My trading plan is orderly and has a positive financial profit expectancy. I believe in her.

4. Success in intraday trading is a statistical matter and therefore I am required to adopt a statistical thinking that focuses on long-term profitability rather than focusing on the outcome of a single transaction / short sequence of transactions. I have no control over the order in which the results of the transactions appear and therefore I am required to be able to withstand a series of losses.

5. My ego has a decisive influence on my trading way by guiding me to the desire to win every deal and since it is not possible to win every transaction I have to produce control over the ego and thereby reduce its influence on my trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

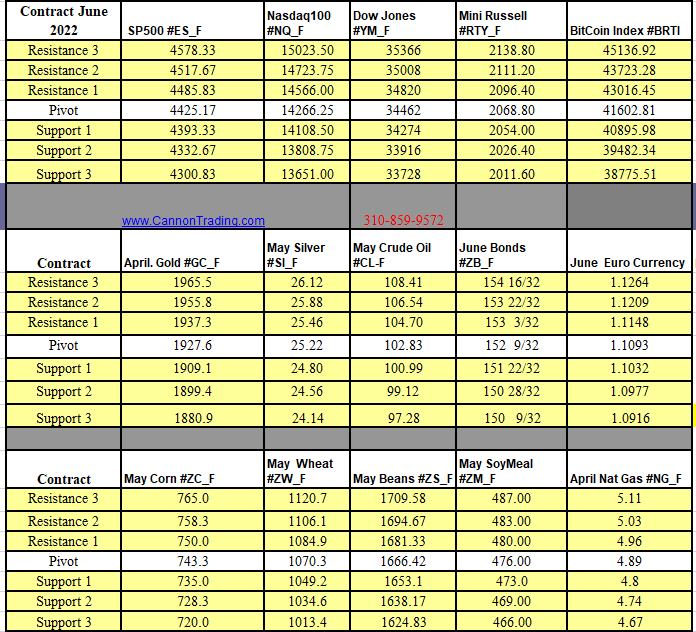

Futures Trading Levels

03-21-2022

Weekly Levels

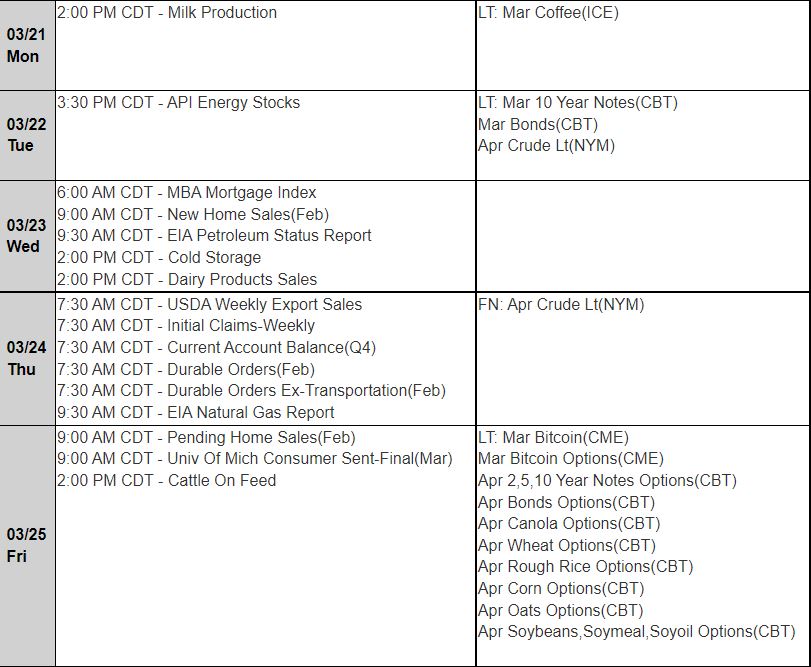

Reports, First Notice (FN), Last trading (LT) Days for the Week:

https://mrci.com

Date Reports/Expiration Notice Dates

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Posted in: Weekly Newsletter