Fed Pause Rates, ECB Tomorrow + Levels for June 15th

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Don’t take anything for granted:

By Mark O’Brien, Senior Broker

It’s a big week for financial markets and their related futures contracts with interest rate decisions from three major central banks coming one after another: the U.S. Federal Reserve (which just decided not to raise rates for the first time in eleven months), the European Central Bank and the Central Bank of Japan.

The Bank of Canada hiked rates last Wednesday to a 22-year high of 4.75%, having held rates steady since January. The day prior, Australia’s central bank raised rates by a quarter point to an 11-year high and warned of further tightening ahead.

One of the take-aways from last week’s surprise rate increases in Canada and Australia and today’s first-time respite by the Fed.: don’t take anything for granted.

Economies around the world are experiencing disparate inflation trajectories compared to others – including the U.S. – and their central bank’s efforts to getting inflation down have started to deviate somewhat. Financial and other futures markets, ever reacting to uncertainty – often overreacting – may become even more challenging arenas within which to trade.

This is pretty clear set-up to submit again the usefulness of trading options – either in combination with your futures trading or exclusive of it. Trading options offers a near limitless range of risk/reward scenarios to take on, from that on par with straight futures trading to substantially less to absolutely limited. And because options are valued in part by their ever-decaying lifespans, they offer another component to a trade’s outcome: time value.

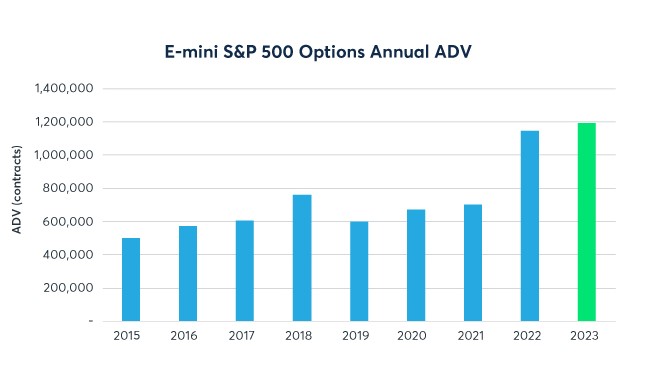

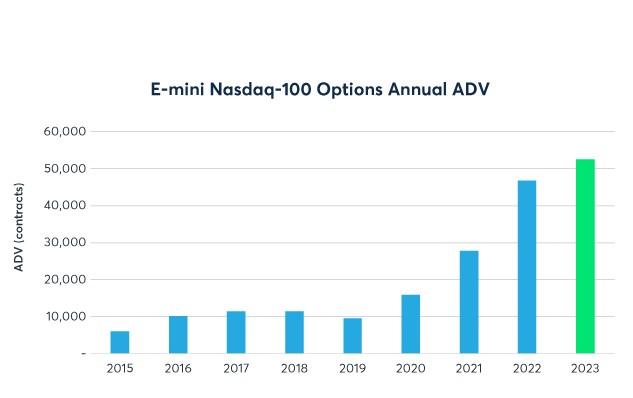

If you think options aren’t for you, consider one sector’s growth in this area in the last recent years: equity index options. Options in the E-mini S&P 500 and E-mini Nasdaq continue to see strong growth in participation and volume as market participants are increasingly turning to the them as part of their trading – and talk to your broker at Cannon Trading Co. for more information.

See below the ADV ( avg. daily volume) for NQ and ES

Rollover is here for stock indices. i.e., the E-mini and Micro S&P, Nasdaq, Dow Jones and Russell 2000.

Volume in the June contracts will begin to drop off until their expiration next Friday, June 16th (8:30 A.M., Central Time). At that point, trading in these contracts halts. Stock index futures are CASH SETTLED contracts. If you hold any June futures contracts through 8:30 A.M., Central Time on Friday, June 16th, they will be offset with the cash settlement price, as set by the exchange.

The month code for September is ‘U.’ Please consider carefully how you place orders when changing over.

Watch the video below on how to rollover your market depth and charts!

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 06-15-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.