All Roads Lead to Jackson Hole + Futures Trading Levels 8.23.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

All Roads Lead to Jackson Hole…

By John Thorpe, Senior Broker

Most of the August 22 week economic data will probably take a backseat to anticipation of Jerome Powell’s speech about “The Economic Outlook” on Friday at 10:00 ET at the Jackson Hole Symposium.

In the past, the Fed Chair has used this opportunity to signal the direction of monetary policy or policy framework updates or offering insight into the Fed’s balance sheet impending adjustments. What is expected are comments related to Policymakers continuing to move to a restrictive stance on interest rates (additional tightening) until they are sure that inflation is on a trajectory of the 2 % inflation target rate.

Chairman Powell will probably also note that Fed’s balance sheet reductions will pick up the pace in September providing less stimulus. Chairman Powell will probably be able to speak to some improvements in Demand as well as some relief in the supply chain issues.

Even though we have a number of economic numbers the Fed’s Open market committee will be digesting this week for policy change announcements for the next meeting in September, I will expect Chairman Powell will include the caveat that the FOMC is data dependent and there’s plenty of data between now and then. As we look forward to this open Microphone meeting on the 26th, we have plenty of Data for the market to digest as well between now and then, Tuesday PMI Composite and New Home Sales, Wednesday Durable Goods and pending home sales, Thursday GDP (second estimate of Q2 GDP) and Jobless claims Plan your trade and trade your plan!!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

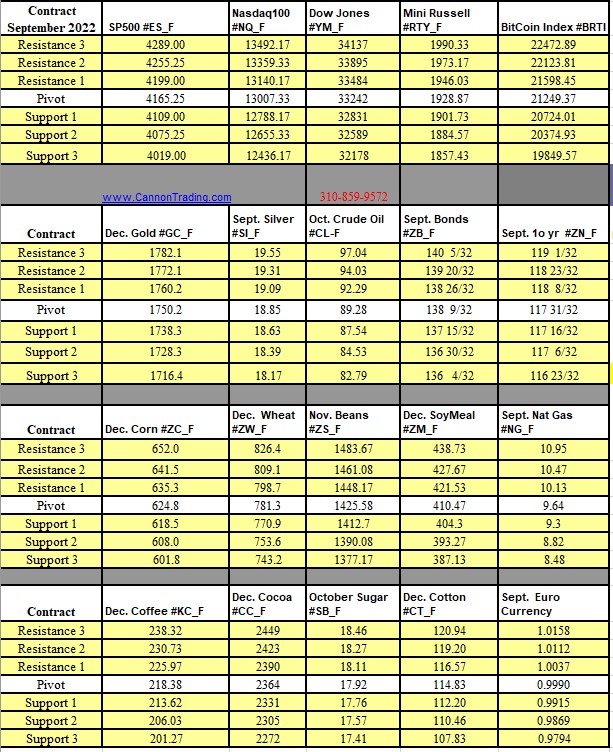

Futures Trading Levels

08-23-2022

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.