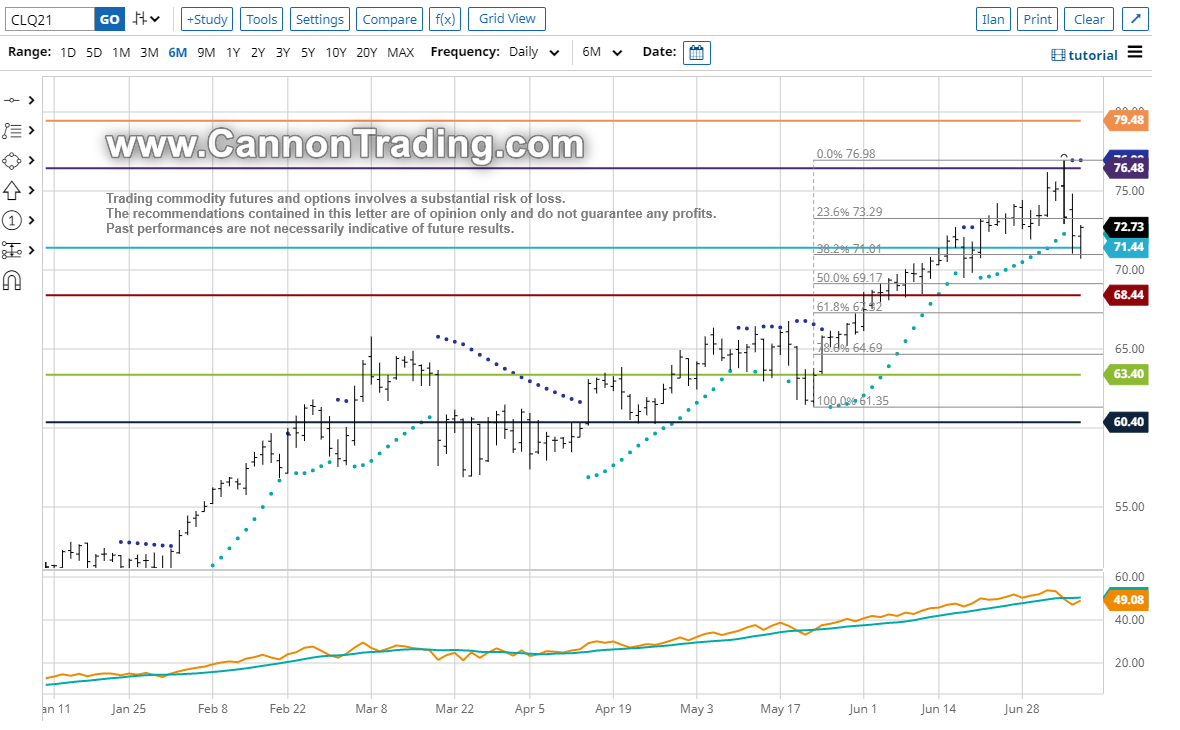

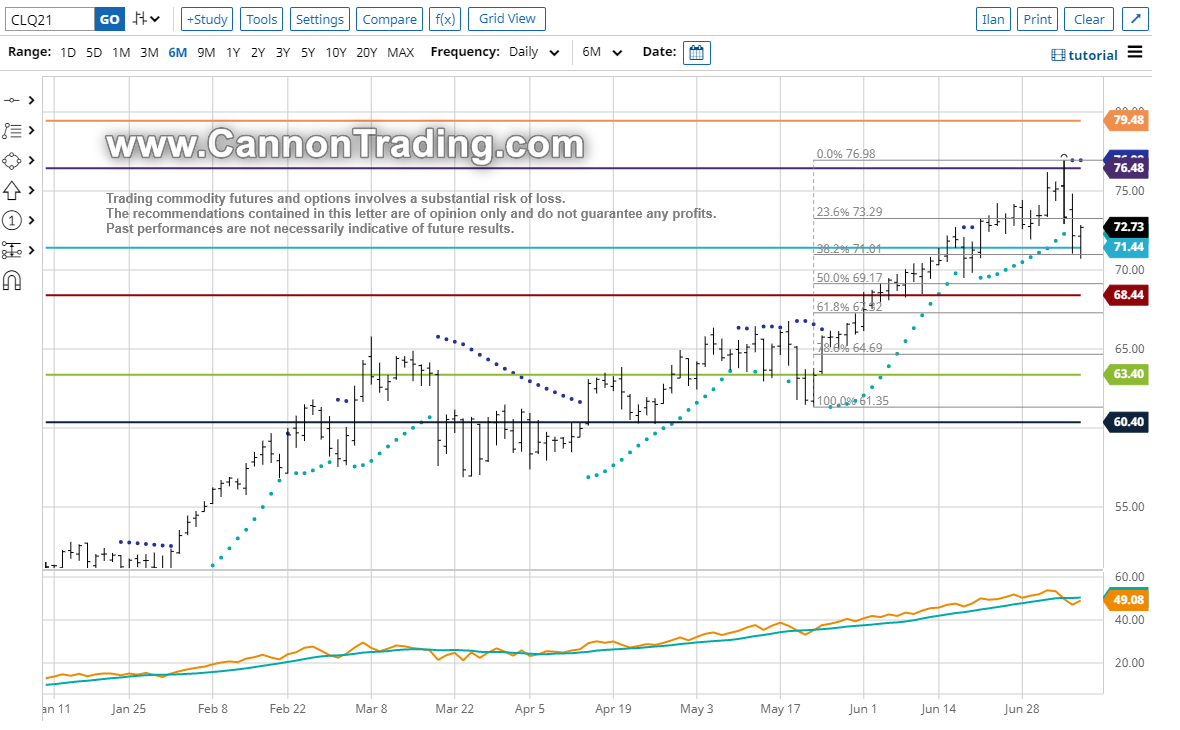

Crude Oil Chart Review & Support and Resistance Levels 7.09.2021

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Dear Traders,

Get Real Time updates and more on our private FB group!

A look at the daily crude oil chart below:

If you are a short term or swing trader, use a 4 hour chart and look for lower risk/ higher reward type of set ups.

I would look to go short at upper 74 levels ( 74.88) and I would look to go long at 71.20. Both entries can be used with a small stop.

If you are an option trader look to sell vertical call spreads above 77 and vertical put spreads below the 70 level with 30 days or less to expiration.

More on this strategy here.If you are a day trader, than good news! The CME is launching a MICRO WTI Crude Oil futures which are 1/10 the size and can be used for hedging, “pyramiding positions and more. The new contract will start trading July 12th.

More info here.For now, until I get a close a daily close below 70.97 I favor the long side, a close below 70.97 based on the daily chart will shift the strength to the bear camp.

**CME Group has removed the trading halt between 3:15 and 3:30 p.m. CT on CME Globex for Equity Index products.

Webinar Invite: Cannon Trading & CME Group invites you to attend an online event on Wednesday July 14, to learn more about

Micro WTI Crude Oil futures, a new tool for managing crude oil price exposure launching on July 12.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

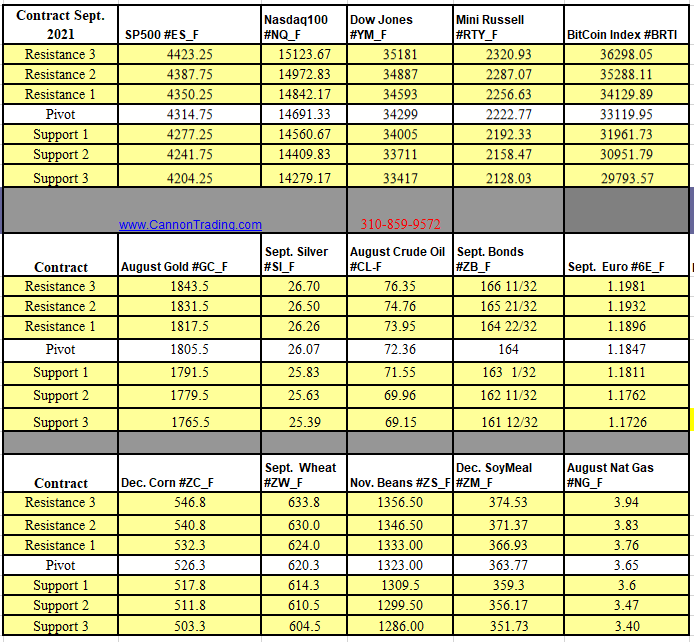

Futures Trading Levels

7-09-2021

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News