Adjusting for Volatility & Futures Trading Levels 2.24.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Adjusting for volatility

By Josh Meyers, Cannon Trading Series 3 Broker

Expansion, contraction, and regime switches. How does volatility impact you? It’s relative to each of us, our trade style, risk tolerance, even our headspace. Babysitting tight-stops in a noisy order book can make trading miserable, but a market order triggered late is counter-productive. The results of volatility and leverage can be shocking. A few losses on a volatile day can impact a trader more than they realize. Sometimes the risk in trading comes from peeking over the edge or bending your rules because “today has more opportunity.” Trading the structure of the markets may help with consistency during volatile times. Stop sizes and take profits become relative to what you’re experiencing and the environment may seem more familiar. Although trading result may be amplified, this can be mitigated by sizing your position down.

Psychologically preparing to engage a volatile environment can help as well. Volatility mixed with leverage is an advanced-level test of your mettle or resolve, and traders that get comfortable in the environment tend to enjoy it. Something notable is the idea of the E-Micro contract sizing. The reduced exposure of these contracts can make fast markets seem more manageable, and the scale of the moves created from volatility may reduce the impact of commissions on your bottom line. Larger contract sizes are proportionately more commission friendly, but only if they don’t impact your performance. Trading smaller on volatile days may give you performance edge over other traders who are dealing with challenges of trading larger than usual. Trading the correct size should yield the best result and help you navigate the mental and emotional challenges of a volatile market.

Are you using Sierra charts and looking to implement their Teton order routing?

If so, look no further, Cannon can assist you in getting set up!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

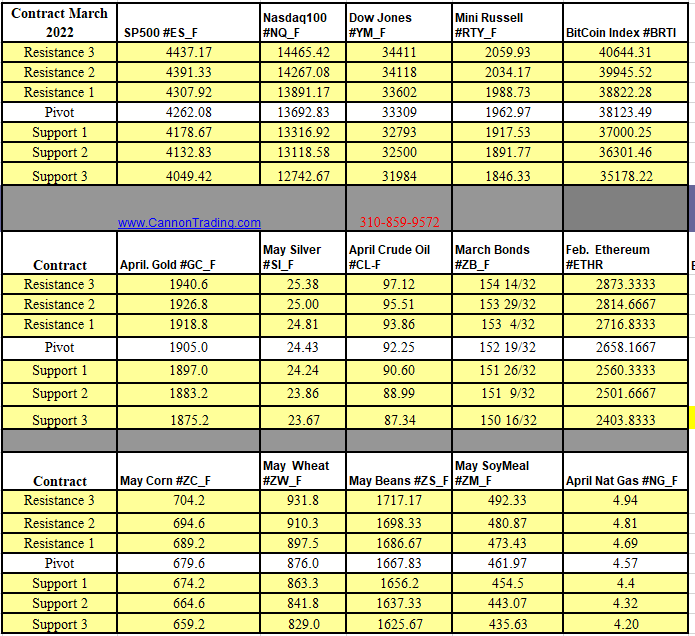

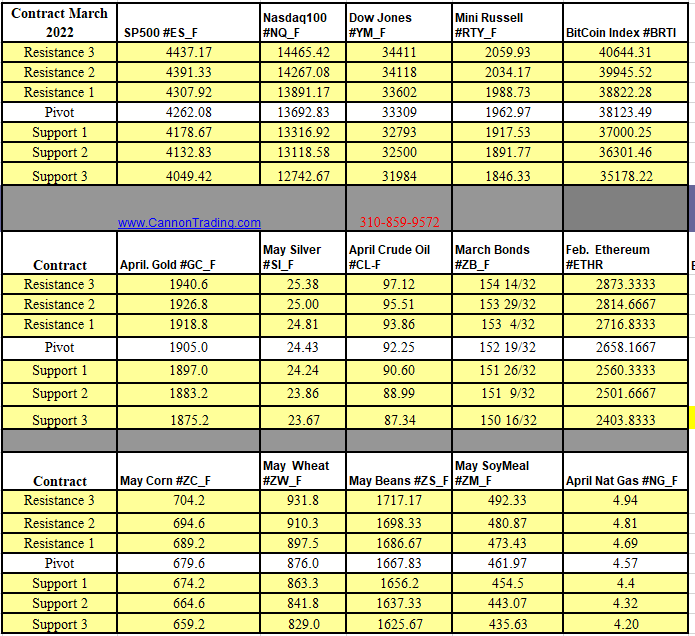

Futures Trading Levels

02-24-2022

Improve Your Trading Skills

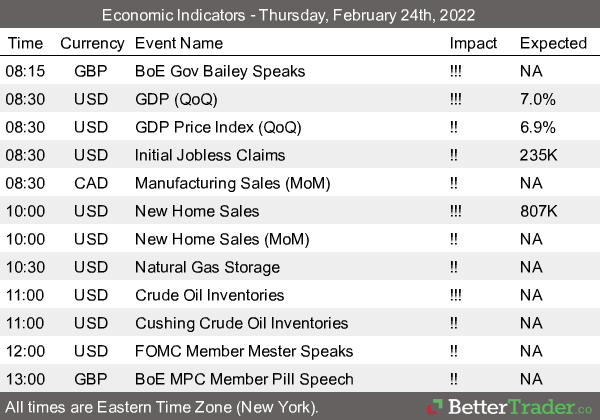

Economic Reports, Source:

ForexFactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education