The Week Ahead + 04.11.2023 Trading Levels

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

The Week Ahead

by John Thorpe, Senior Broker

I hope everyone is rested from the holiday week behind us, this week’s economic number releases should keep all the traders on their toes.

CPI Wednesday! The standouts will be the March CPI data on Wednesday at 7:30 CT and retail and food services sales at 7:30 CT on Friday. The CPI will be critical to the inflation outlook for Fed policymakers.

Previous CPI reports have created velocity logic events in the stock indices at the CME. The above reports will Bookend the FOMC minutes release @1pm CT on Wednesday.

If you recall the FED Meeting Black out period was before the Bank issues so don’t expect too much verbage about the banking situation in this report. Also Remember, expectations will be baked into the market at release time, after release, the market has sustained moves when the reality is much different from the expectations.

Plan your trade and trade your plan.

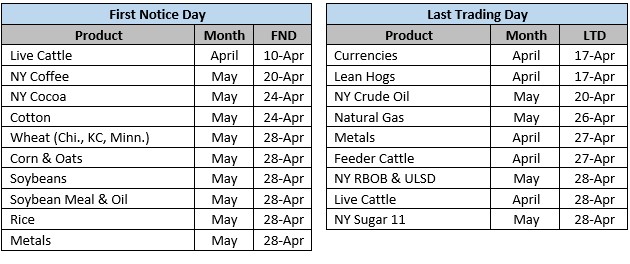

First Notice and Last trading Days for the month of May below

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

for 04-11-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.