Price Limits & Circuit Breakers + Futures Trading Levels for July 21st 2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Price Limits and Circuit Breakers

By Mark O’Brien, Senior Broker

The CME Group – where stock index futures like the

E-mini S&P 500,

E-mini Nasdaq, E-mini $5 Dow Jones and other markets trade – has several measures in place to ensure that their markets work in an efficient and orderly manner during volatile market conditions.

Given the volatility in several markets over these last many months – and of course the volatility that almost inevitably lies ahead – it’s important to know these measures. Among the more commonly-known put in place by the CME Group are their

price limits and circuit breakers.Price limits are the maximum price range permitted for a futures contract in a trading session. Price limits vary from product to product, as does what happens when a price limit is hit. In some markets, trading is temporarily halted from moving beyond the price limit until it can be expanded. In others trading is stopped from moving beyond a price limit for the day.

Circuit breakers are price limits that, when reached, pause a market for a particular period of time. Most circuit breakers are “traditional,” where a series of price limits are set above and below a reference price, usually based on the market’s previous settlement price. Once a circuit breaker is triggered, the next level of circuit breaker comes into effect. Some circuit breakers are “dynamic,” meaning they move with the market and allow them to move a certain distance within a certain period of time, usually an hour. Each CME Group product has its own assigned values used to calculate the circuit breakers levels. Typically, they’re calculated as percentages of their previous settlement price.

By establishing these types of price fluctuation limits specific to each product, the exchange can help restrict a market from moving too far or too fast in a specific period of time.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

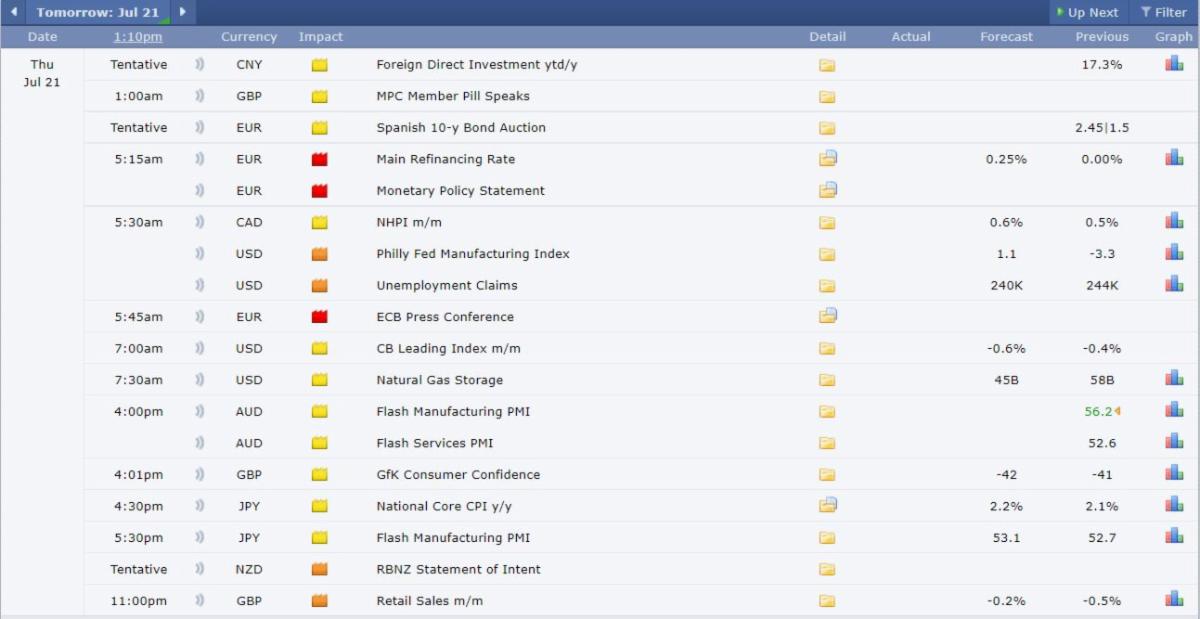

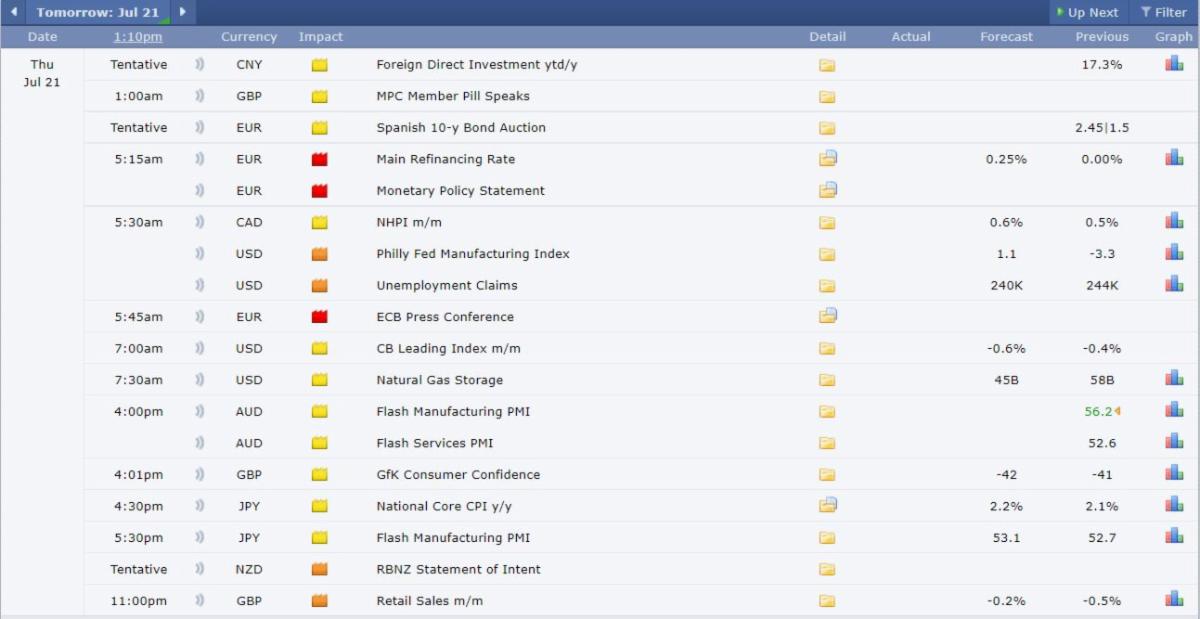

Futures Trading Levels

07-21-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education