Futures Trading Levels & Economic Reports for July 7th 2010

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

The futures markets in general had some “futures trading to make up” after the long weekend and we some strong moves and bit more volatility in variety of commodity and futures markets.

I mentioned on Friday blog:

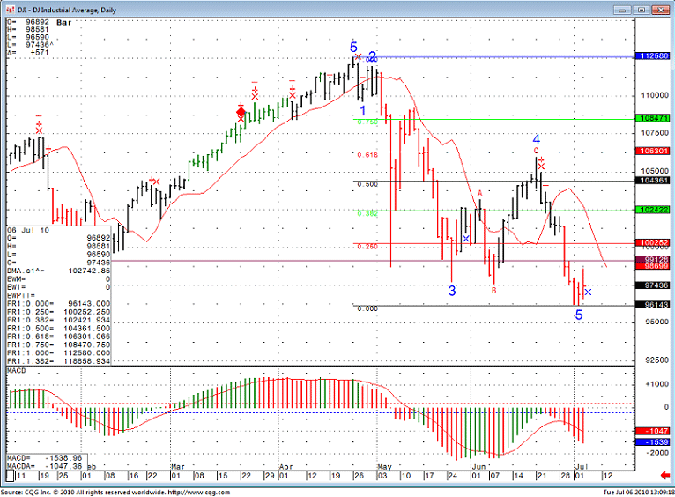

“Stock indices are getting a bit oversold and I suspect that sometime next week we should see a good, short covering rally. However, i don’t try to predict when it will happen but rather use price action with support/resistance lines to get a confirmation. Daily chart of the e mini Russell 2000 for your review below. A break above 613 would give me more confidence in taking a trade from the long side, until then the trend is still pointing lower.”

Well.. today we did see a nice rally that peaked at 612.20 on Sept. mini Russell and headed south afterwards.

In today’s chart I decided to share the popular and followed Dow Jones index. Same analysis from Friday still holds. While indices may be oversold, I would like to see more follow through on the buy side instead of price failure like we saw in today’s session. 9913 is my level to watch on the Dow Jones cash index.

SP 500 Day Trading for July 6th 2010

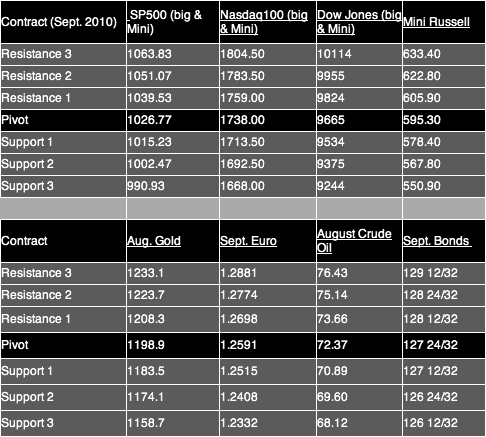

Trading Levels:

Futures Trading Levels for July 6th 2010

- Jul 07 10:30 Crude Inventories 07/03 NA NA -2.01M

- Jul 08 08:30 Continuing Claims 06/26 4600K 4600K 4616K

- Jul 08 08:30 Initial Claims 07/03 465K 460K 472K

- Jul 08 15:00 Consumer Credit May -$2.5B NA -$3.0B $1.0B

- Jul 09 10:00 Wholesale Inventories May 0.3% 0.4% 0.4%

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!