Cannon Futures Weekly Newsletter Issue # 1170

Join our private Facebook group for additional insight into trading and the futures markets!

In this issue:

- Important Notices – Daylight saving officially ends

- Trading Resource of the Week – 25 Options Strategies

- Hot Market of the Week – December Mini SP

- Broker’s Trading System of the Week – NQ Day Trading System

- Trading Levels for Next Week

- Trading Reports for Next Week

-

Important Notices – Daylight saving officially ends

Heads up traders in the United States. Get ready to set your clocks back one hour this Sunday, November 5th. Daylight saving officially ends on the first Sunday in November for the United States, which is this coming Sunday.

This follows the UK and European Union adjustment, which takes place the last Sunday in October, so our European traders have already “fallen back.”

Over 1900 stocks report earnings next week . Main feature for Equities markets with an over quiet week of Govt Rpts, Consumer Credit Tuesday and Jobless claims on Thursday would be the two majors the Fed will be looking at hence may impact short term market direction.

On the Ag front the Monthly WASDE numbers will be released on Thursday and will be an important one for the size of our harvested crops.

There will be 7 speeches / presentations next week by Fed Governors, 2 by Fed Chair Powell. The first, Wednesday @ 8:15 am CST @ the Research and Statistics Centennial Conference in D.C. . The second Thursday@ 1:00 p.m. CST At the 24th Jacques Polak Annual Research Conference, Washington, D.C.

Lastly , in a salute to all US Vets, Friday is Veterans Day is a federal holiday, most government agencies and schools are closed. Many banks are also closed on Veterans Day, as it’s a designated federal holiday. All markets will remain open for your trading pleasure.

- click above for a LIVE demo, streaming prices

-

Trading Resource of the Week

Strategies For Trading Options

Learn about the 25 Proven Strategies for trading options on CME Group Futures for FREE!

If you are currently trading options on futures or are interested in exploring them further, check out our newly updated trading guide, featuring 25 commonly used options strategies, including butterflies, straddles, strangles, backspread and conversions. Each strategy includes an illustration demonstrating the effect of time decay on the total option premium involved in the position.

Options on futures rank among our most versatile risk management tools, and are offered on most of our products. Whether you trade options for purposes of hedging or speculating, you can limit your risk to the amount you paid up-front for the option while maintaining your exposure to beneficial price movements. To learn more about CME Group options, you can also visit our Options page.

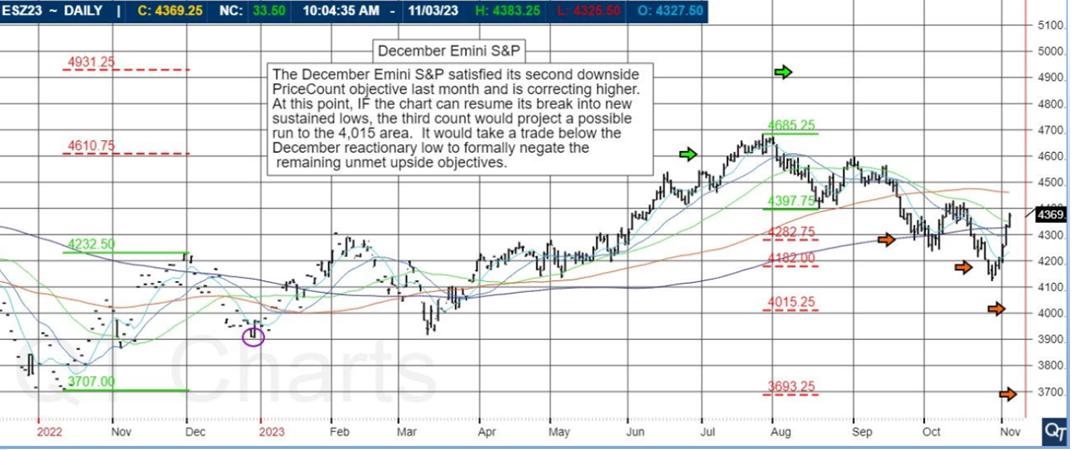

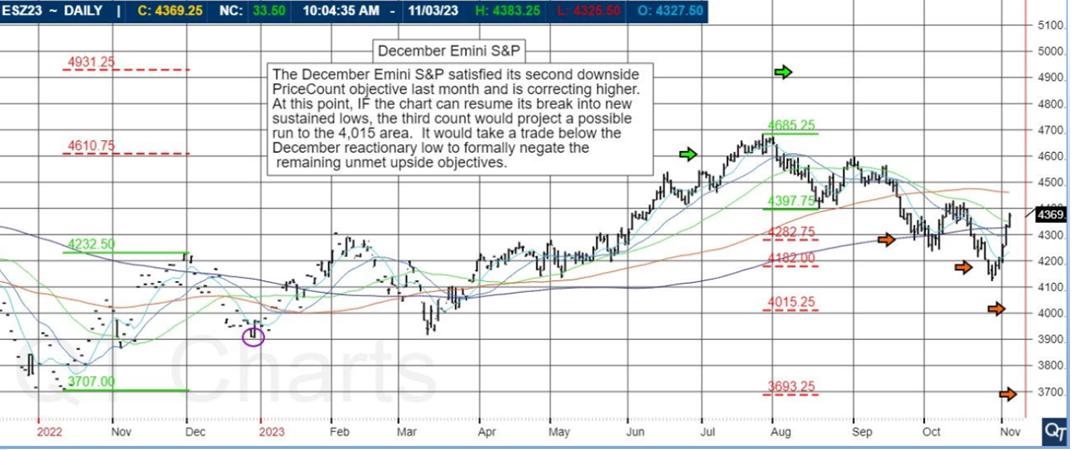

Hot market of the week is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

December Mini SP500 satisfied it’s second downside PriceCount objective last month and is correcting higher. At this point, IF the chart can resume its break into new sustained lows, the third count would project a possible run to the 4,015 area. It would take a trade below the December reactionary low to formally negate the remaining unmet upside objectives.

PriceCounts – Not about where we’ve been , but where we might be going next!

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at

www.qtchartoftheday.comTrading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

-

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

SYSTEM TYPE

Swing

Recommended Cannon Trading Starting Capital

$30,000.00

COST

USD 155 / monthly

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data.

Please read full disclaimer HERE.

Questions about the markets? trading? platforms? technology? trading systems? Get answers with a complimentary,

confidential consultation with a Cannon Trading Company series 3 broker.

|

Would you like to receive daily support & resistance levels?

|

-

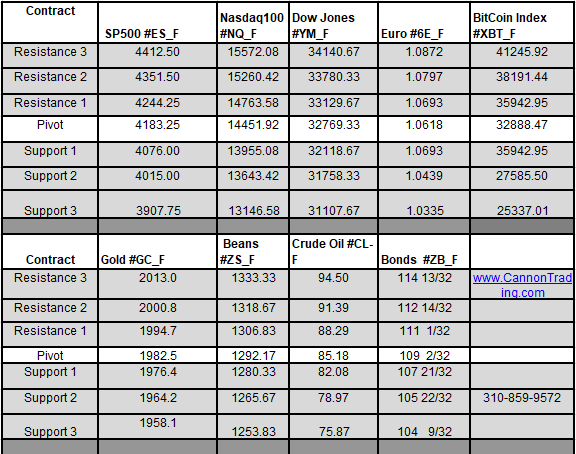

Trading Levels for Next Week

Daily Levels for November 6th, 2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

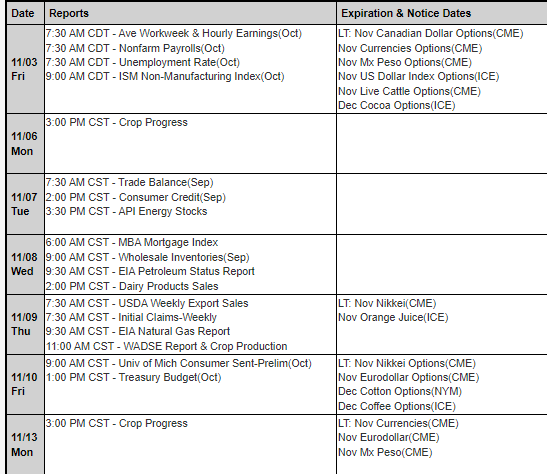

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week: www.mrci.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading.

Good Trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Tags: #cbot > #comex > #commoditiesmarket > #commoditiestrader > #commoditytrading > #crudeoil > #daytrader > #futuresmarket > #futurestrader > #kcbt > #mgex > #nymex > #smfe > #stockindices > #swingtrader > CME > commodities > daytrading > futures > Globex > gold

Posted in: Commodity Brokers | Commodity Trading | Day Trading | Future Trading News | Future Trading Platform | Futures Broker | Futures Trading | futures trading education | Index Futures | Indices | Options Trading | Trading Guide | Weekly Newsletter