Geo Political Events Pose Risks? & Futures Support and Resistance Levels 2.14.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Are GeoPolitical Risks Factored into FOMC Decisions?

By John Thorpe, Cannon Trading Senior Broker

Data Dependent? Will

Crude Oil and

Grain Prices weigh on Fed Minutes? and is this data relevant in the Fed’s decision making process? This Wednesday @ 2PM eastern the Federal Reserve Board releases to the public the Minutes from the January 25-26th meeting. we will find out the answers on Wednesday and the market will react. 1. Yes they had an announcement on the 26th about rates and 2. Yes a statement was released on the 26th that included this language ” The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.” and Yes the Federals Open Market Committee on the 26th disclosed it’s “principles for Reducing the Size of the Federal Reserve’s Balance sheet”

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm These however are not the Minutes of the Meeting, which , when released on Wednesday are market movers. Traders and Analysts copiously review the language used, looking for clues to Policy. The Minutes do include the complete economic analysis compiled by officials and whether or not Members had voiced opposition to the majority of the group If the FOMC minutes reveal inflation related pressure from a breach of the nationalized borders of Ukraine by Russia, the concerns will not only effect and Impact the world Crude Oil market, but will inevitably impact global prices of Grain, namely Wheat. Ukraine is the second largest country in Europe, after Russia and is a major producer and exporter of Wheat, Maize, Barley and Oats and account for 16% of world grain exports according to SGS; a global grain inspection company and commodity consultancy firm.

Are you using Sierra charts and looking to implement their Teton order routing?

If so, look no further, Cannon can assist you in getting set up!

The Teton Futures Order Routing service is a high-quality order routing service with advanced risk management from Sierra Chart to provide order routing, for outright futures and spreads, direct to the major exchanges. There is no other intermediary provider.

Orders are routed direct to the exchange with high reliability and very low latency, in under 500 microseconds.

Supported exchanges are CME, CBOT, NYMEX, COMEX, FairX.

This service is offered at no cost to both clearing firms and to users. It has no transaction fee per contract traded. To our knowledge this is an industry first. This Teton Order Routing service still provides very high quality order routing.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

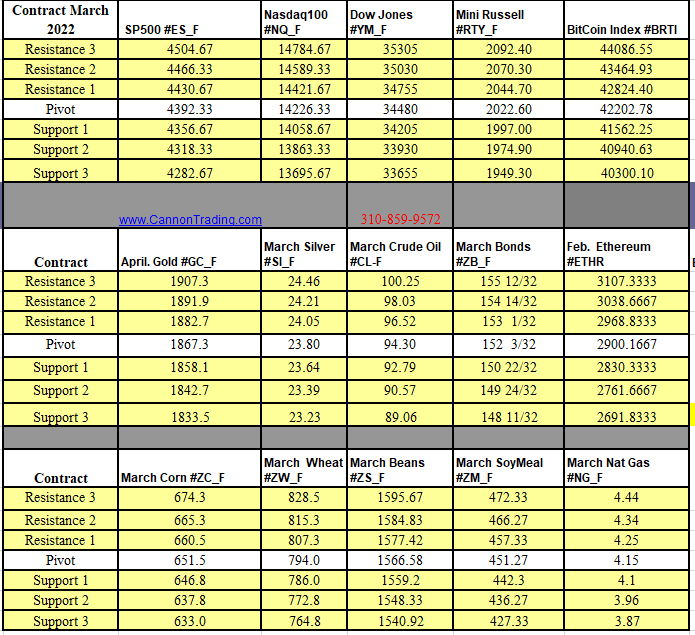

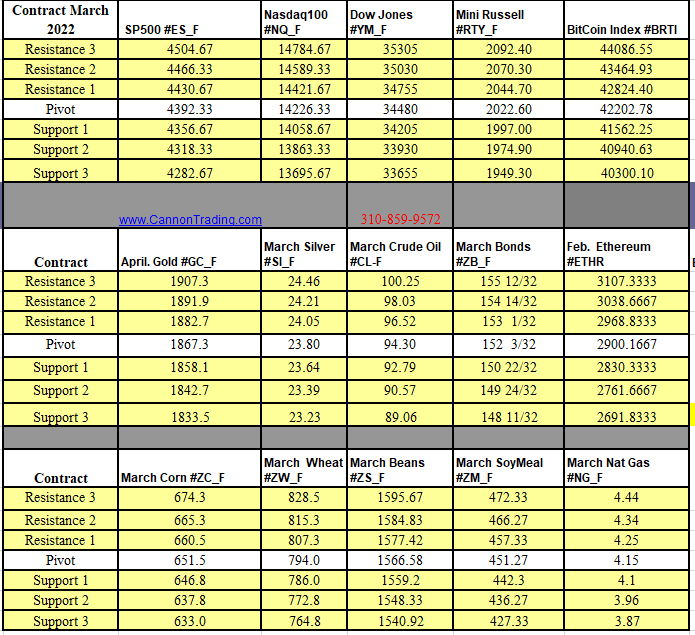

Futures Trading Levels

02-15-2022

Improve Your Trading Skills

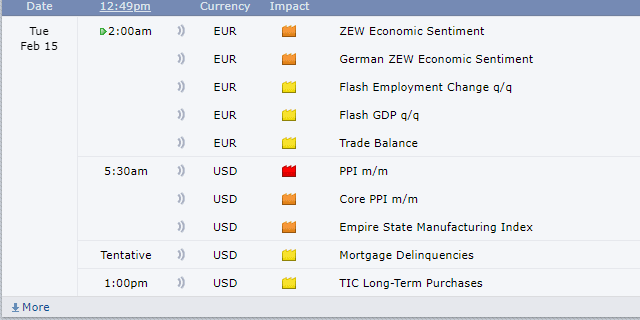

Economic Reports, Source:

ForexFactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education