Micro Crude Oil + Trading August 9th Futures Levels

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Crude Oil Trading Updates, Opportunities and Risks:

By John Thorpe, Senior Broker

Have you had an opportunity to trade the financially settled Micro WTI Crude oil contract? I have and this contract is just what the doctor ordered. When you are faced with the high price and volatility we have seen over the past few years you won’t have to make a decision to either be out or be in the

WTI Crude oil contract where we have seen $10,000.00 daily price swings.

With the Micro, which is one tenth the size of the 1000 barrel WTI Crude contract or 100 barrels only, each dollar move per contract in the price of Crude oil is $100.00 rather than $1000.00. What this allows you to do is adjust the amount of leverage you want and not expose yourself to the volatility of the larger

CL contract.

The symbol is MCL U22 for the current September contract.

According to the CMEGroup, 33,000 unique traders have come to the CME to trade this contract since it was listed a year ago. The CME Group declares traders from over 145 countries trade the Micro crude oil contract and traders from over 33 countries have traded the new Options contracts on the Micro Crude contract.

Transaction Costs are inexpensive for this contract as exchange fees are .50 per contract.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

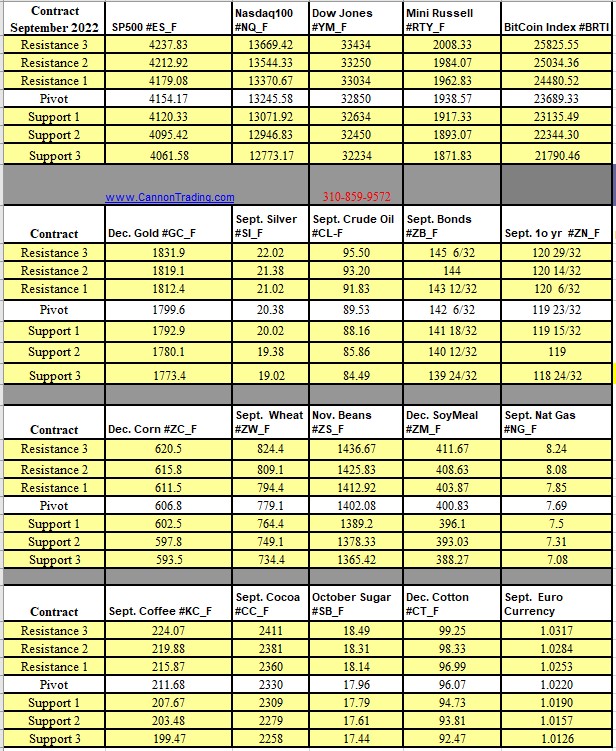

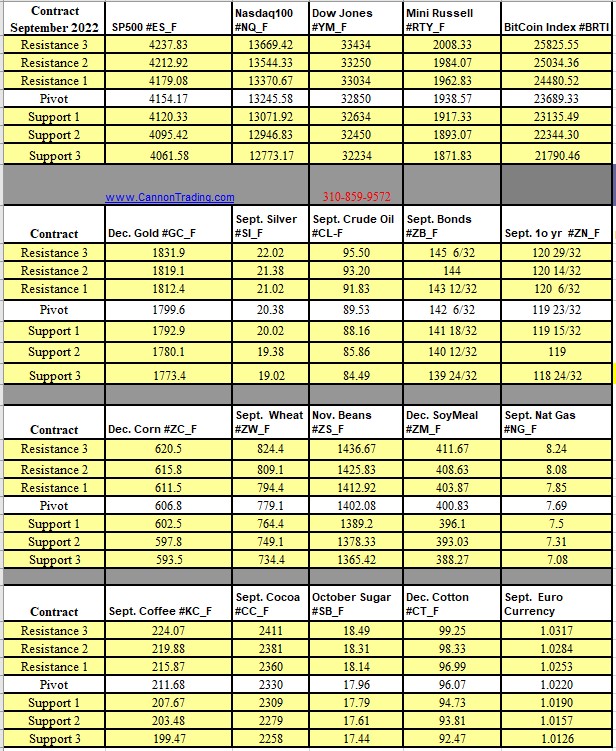

Futures Trading Levels

08-08-2022

Improve Your Trading Skills

Economic Reports, Source:

Forexfactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Crude Oil | Energy Futures | Future Trading News