Are you Watching? Futures Support & Resistance Trading Levels 2.10.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Keep an Eye on . . . . Everything

By Mark O’Brien, Cannon Trading Senior Broker

Last Friday’s monthly unemployment report caught nearly every economist off guard, showing a gain of 467,000 new jobs in Jan. compared to the median estimate of 150,000 and a massive upward revision in the November and December totals: November was revised up to 647,000 from 249,000 and December was revised up to 510,000 from a previously reported 199,000. Those changes brought the 2021 total to 6.665 million, easily the biggest single-year gain in U.S. history.

Inflation-sensitive commodities markets including

metals,

equity indexes and

currencies have been anticipating an increasingly hawkish inflation-fighting Fed to hike interest rates at least five times in 2022. The current resiliency in the jobs market against the pandemic generally and the Omicron variant surge in recent months is likely to keep the Fed on this schedule. In the commodity sectors referenced above, look for expanded volatility ahead.

Already apparent and not to be ignored,

Chicago Board of Trade soybean and

corn futures set eight-month highs today on concerns that more unfavorable crop conditions due to drought are in store in growing areas of South America.

Cattle, Hogs and

cotton all hit life-of-contract highs in their respective front month futures contracts within the last week (not to be confused with all-time highs). Notable mention: March

cotton traded through $1.28 intraday and made its highest weekly close since July 2011.

Lastly,

crude oil traded in the neighborhood of $90/barrel – an 8-year high – as global consumption remains strong and oil stockpiles have plummeted in the past year with many major producers – OPEC + and the U.S. among them – struggling to pump more.

We’re just one month into this calendar year with more developments ahead – geopolitically, weather-related and monetary policy related – all set to cause commodity prices across a range of asset classes to exhibit potentially rugged price action. Keep an eye out.

.

Are you using Sierra charts and looking to implement their Teton order routing?

If so, look no further, Cannon can assist you in getting set up!

The Teton Futures Order Routing service is a high-quality order routing service with advanced risk management from Sierra Chart to provide order routing, for outright futures and spreads, direct to the major exchanges. There is no other intermediary provider.

Orders are routed direct to the exchange with high reliability and very low latency, in under 500 microseconds.

Supported exchanges are CME, CBOT, NYMEX, COMEX, FairX.

This service is offered at no cost to both clearing firms and to users. It has no transaction fee per contract traded. To our knowledge this is an industry first. This Teton Order Routing service still provides very high quality order routing.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

02-10-2022

Improve Your Trading Skills

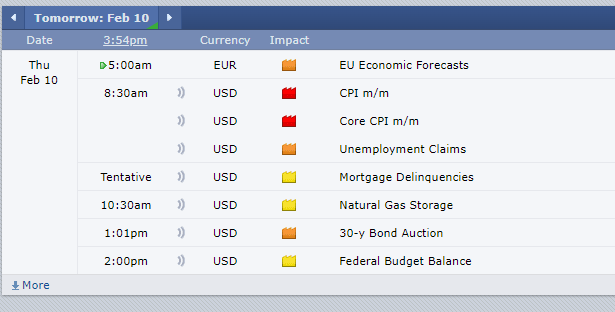

Economic Reports, Source:

ForexFactory.com

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Future Trading News | futures trading education