Cannon Futures Weekly Letter Issue # 1196

In this issue:

- Important Notices – Non Farm Payrolls is the main event

- Futures 101 – Vertical Option Spreads

- Hot Market of the Week –

- Broker’s Trading System of the Week – Crude Oil Day Trading System

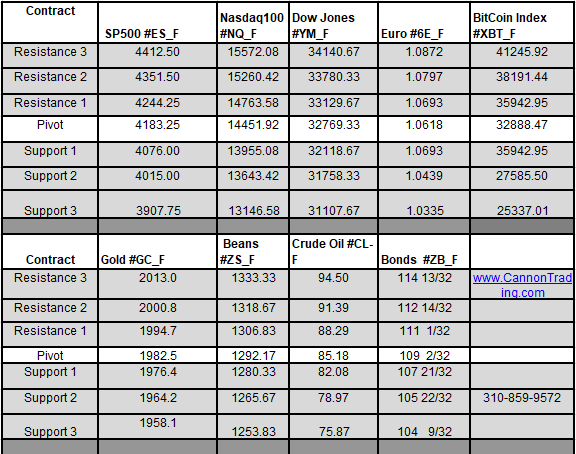

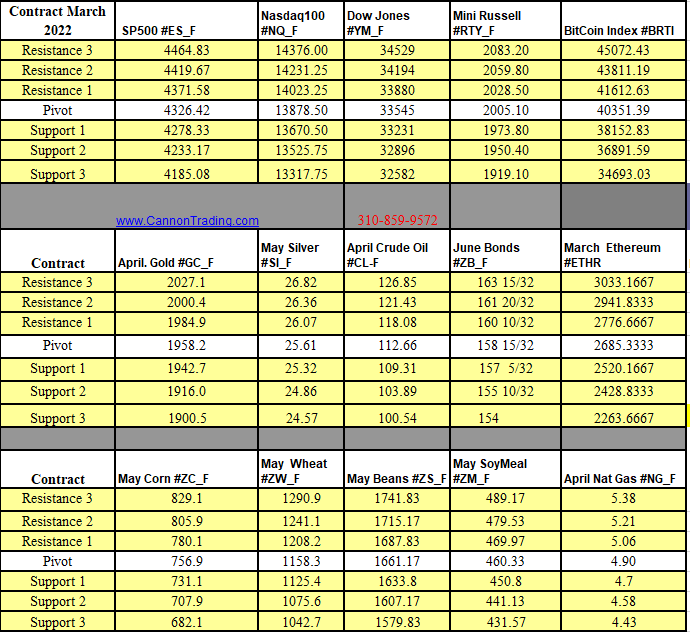

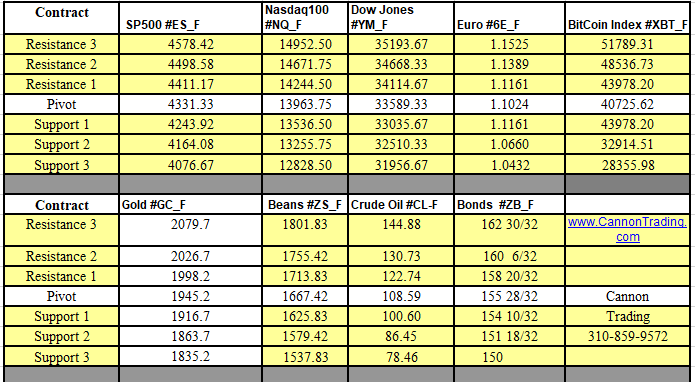

- Trading Levels for Next Week

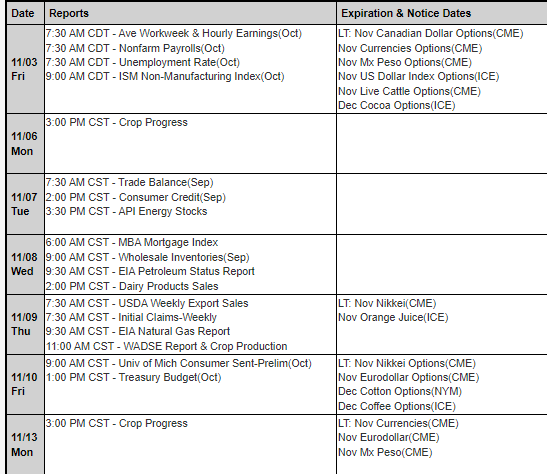

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

- Light Earnings week: Crowdstrike, LULULemon, Dollar Tree and HP are the 4 headliners

- FOMC Blackout Period Begins in advance of the June 11-12 FOMC Mtg.

- Econ Data: ISM MFG PMI Mon., JOLTS Tues., ISM SVCS PMI Wed, Jobless Claims Thur, NON Farm Payrolls B4 the open Fri.

- August gold is front month

- September is front month for bonds, 10 years, 5/2 notes.

Futures 101 :

Vertical Spreads

By Craig Bewick CMEGroup.com

“Vertical Spreads” involve buying (selling) a higher strike price option and selling (buying) a lower strike price option and can be executed with either Calls or Puts.

- If a trader sells the lower strike CALL option and buys the higher strike CALL option, they would receive a CREDIT (the lower strike Call will trade at a higher price than the higher strike Call) for that trade. Selling the higher strike and buying the lower strike CALL would result in a DEBIT. The opposite is true if the trader executed a PUT spread.

These spreads are known as “risk defined” strategies because the max potential profit and loss is known to the trader at the time of execution.

If we hold all other variables constant, Call and Put Vertical spreads represent a bullish or bearish view on the price of the underlying instrument:

- Long (debit) Call spreads and Short (credit) Put spreads represent a bullish view

- Short (credit) Call spreads and Long (debit) Put spreads represent a bearish view

Of course, as with most options strategies, several factors, including volatility, can also impact the value of vertical spreads, as we’ll demonstrate below.

EXAMPLE:

Let’s look at a real-life example using E-mini S&P 500 options:

Using markets from 4/25 @ 10:35 AM CST, we selected the following options:

Futures: 5,038

Sell 1 5,090 Call | Premium 58.25 | IV: 14.3% | Delta: -.41 | Gamma: -.0019 | Vega: -550.8 | Theta: 1.35

Buy 1 5,130 Call | Premium 42.0 | IV: 13.9% | Delta: .33 | Gamma: .0018 | Vega: 513.8 | Theta: -1.23

Position: Delta: -.08 | Gamma: -.0001 | Vega: -37 | Theta: .12

Max profit and loss (excluding all fees and commissions):

- The max profit that this position could realize is the credit taken in at execution

- 58.25-42.0 = 16.25 pts (16.25*$50 = $812.50)

- The max loss that this position could realize is the credit taken in minus the difference between the strike prices

- 16.25-40.00 = 23.75 pts (23.75*$50 = $1,187.50)

- The P&L graph of each option and the overall P&L is shown in the TOP image below

Short 5090 Call (Blue Line)

- 58.25 points were collected at execution on the 5090 Call. At any price below 5090 at expiry, this option is worthless and the trader will keep the premium collected (58.25).

- As the price rises above 5090, the option gains value incrementally which, because this position is short, has a negative impact on the P&L.

Long 5130 Call (Orange Line)

- 42 points were paid at the execution of the 5130 Call. This option, at expiry, is worthless at any futures price at, or under, 5130.

- Similar to the 5090, as the price rises above 5130, the option gains value incrementally, which, in this case, has a positive impact on the P&L.

Position P&L

- They gray line represents the overall P&L of the position at expiration, based on the futures price on the X-axis. This is simply the addition of the value of the blue and orange lines.

P&L Scenarios Prior to Expiration

However, though the max profit and loss is defined at the entry point of the trade, as we mentioned earlier, because option pricing is multi-dimensional, factors like volatility and time can impact the value of the position between execution and expiration. Although it is impossible to illustrate all the different values at which this option could theoretically trade because of the dynamic nature of options pricing, we wanted to illustrate some “what-if” scenarios to demonstrate how things like implied volatility and time decay might impact the position. These are illustrated in the bottom image below.

-

Hot Market of the Week – December Corn

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

Dec Corn

The rally in

December corn ran out of momentum after completing a second upside PriceCount objective. Now, on the correction lower the chart has activated downside counts too. The first downside objective project a run to the $4.61 area. It takes a trade below $4.56 1/2 to formally negate the remaining unmet upside counts

PriceCounts – Not about where we’ve been , but where we might be going next!

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at

www.qtchartoftheday.comTrading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

Agora Crude

PRODUCT

SYSTEM TYPE

Swing

Recommended Cannon Trading Starting Capital

$20,000

COST

USD 70 / monthly

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data.

Please read full disclaimer HERE.

|

Would you like to receive daily support & resistance levels?

|

If you are a day trader, below you will see markets that our proprietary ALGO has identified as being more suitable for attacking either from the long side or the short side.

Daily Levels for June 3rd 2024

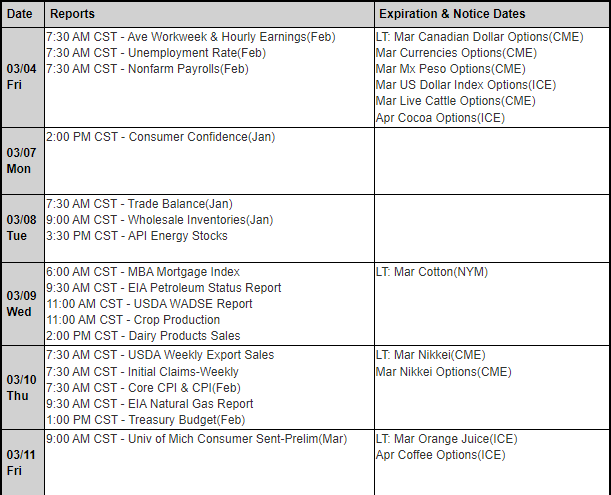

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.