Weekly Newsletter #1088 Options Trading & Volatility & Trading Levels for the Week Ahead 3.07.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Cannon Futures Weekly Newsletter Issue # 1088

Dear Traders,

Trading 201: My Cheap Lesson on Volatility Premium

By Josh Meyers, Series 3 Broker

I couldn’t tell you the day or the date, but the market was bearish that morning. I found the

long call I liked and filled it with a

limit order. A good entry, no chasing. The market jumps toward the money and I feel confident in my decision. The market climbs, but my call price doesn’t. The bid-ask of my long call hopelessly lower than I had hoped. The market moved up, but my premium did not? A greenhorn options trader, I was still learning the rules. Focused on my delta, but naïve to everything else. I’m sure I bought a market maker a steak dinner that day. My cheap lesson on how volatility impacts options premiums.

The bearish movement of the morning expanded option premiums across the board. Regardless of price direction, the ensuing contraction of volume and volatility reduced call premiums. I bought near the low of the day, but just after the peak of the volatility event. The market no longer perceived the same movement it did before and I was left with deflated extrinsic(time) value. My party was over before it started.

To rookie options traders, long calls sound premiere. Unlimited profit potential and limited risk. The problem is, they fail to recognize the multiple inputs related to the price of an option and how challenging the management can be. It’s hard enough for a trader to manage price direction, let alone price direction, speed, perception, etc. all at the same time. Mitigating variables such as time decay(theta) or volatility(vega) can be as simple as using an option spread. Had I opened a

vertical spread instead of a long call, my result would’ve been better. How many mistakes have I made that I still don’t know about, or how many more are in store? A testament to the significance of perpetual trading education….

DOWNLOAD FREE OPTION REPORT

Are you using Sierra charts and looking to implement their Teton order routing?

If so, look no further, Cannon can assist you in getting set up!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

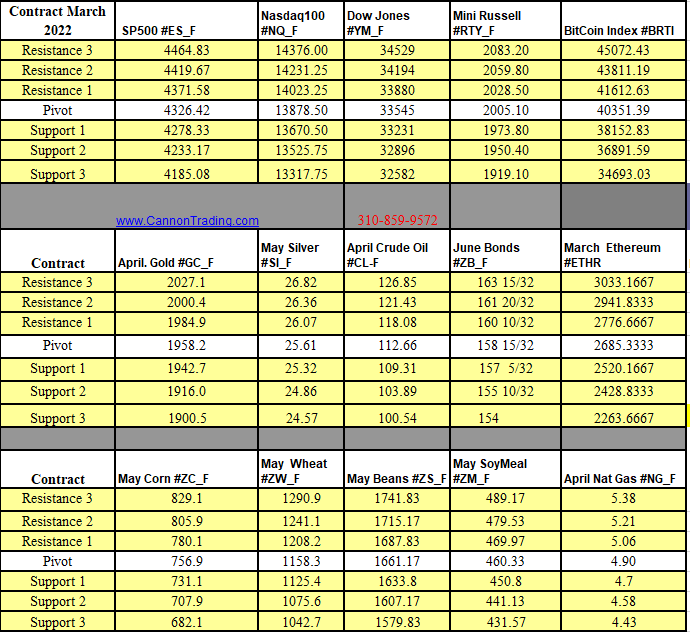

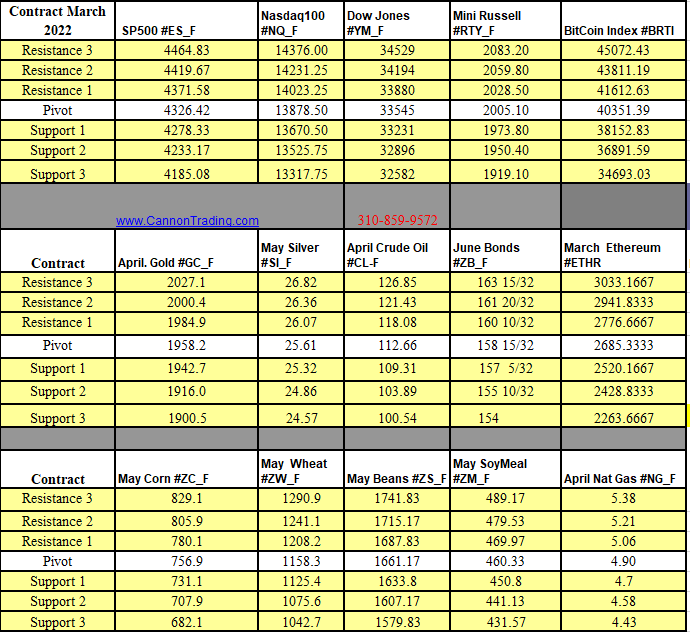

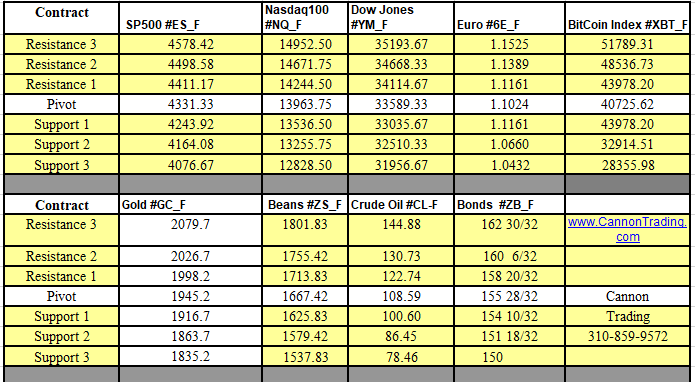

Futures Trading Levels

03-07-2022

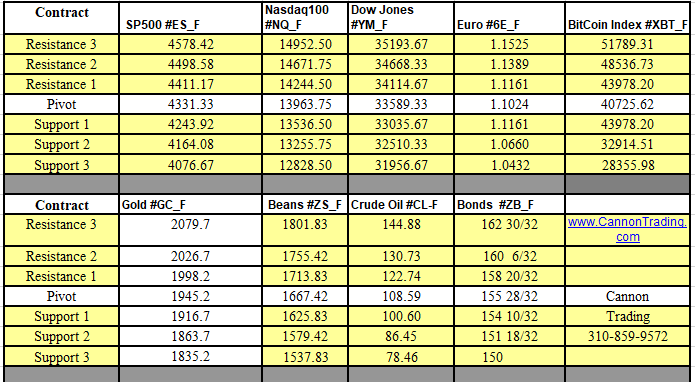

Weekly Levels

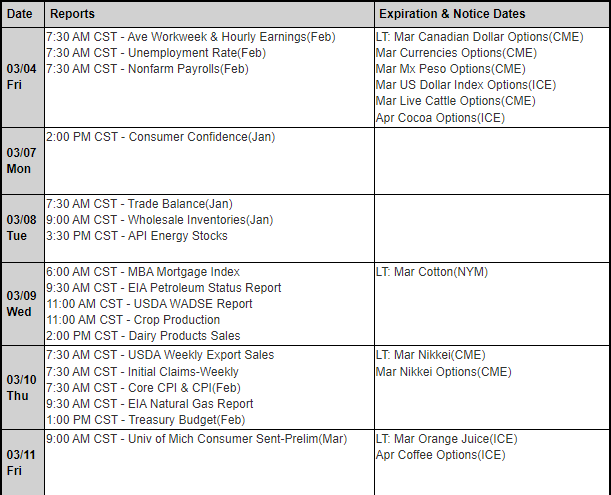

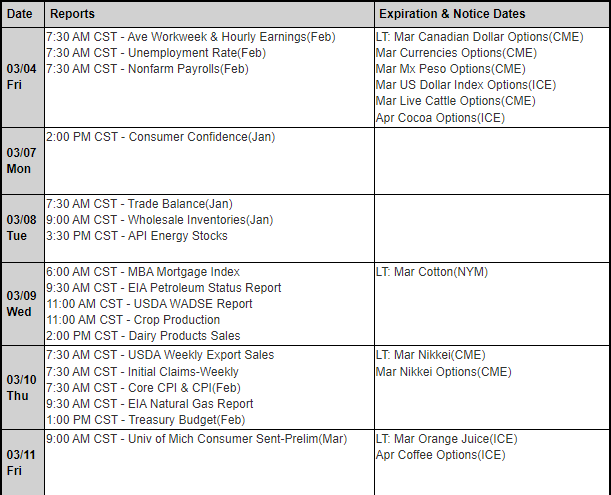

Reports, First Notice (FN), Last trading (LT) Days for the Week:

https://mrci.com

Date Reports/Expiration Notice Dates

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading

Posted in: Options Trading | Weekly Newsletter