Weekly Newsletter – Trading Resources and more! 4.19.2021

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

_________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

_________________________________________________

Dear Traders,

Get Real Time updates and more on our private FB group!

|

|

Trading 202: Futures Options Writing

Have you ever wondered who sells the futures options that most people buy?

These people are known as the option writers/sellers. Their sole objective is to collect the premium paid by the option buyer. Option writing can also be used for hedging purposes and reducing risk. An option writer has the exact opposite to gain as the option buyer. The writer has unlimited risk and a limited profit potential, which is the premium of the option minus commissions. When writing naked futures options your risk is unlimited, without the use of stops. This is why we recommend exiting positions once a market trades through an area you perceived as strong support or resistance. So why would anyone want to write an option?

Here are a few reasons:

- Most futures options expire worthless and out of the money. Therefore, the option writer is collecting the premium the option buyer paid.

- There are three ways to win as an option writer. A market can go in the direction you thought, it can trade sideways and in a channel, or it can even go slowly against you but not through your strike price. The advantage is time decay.

- The writer believes the futures contract will not reach a certain strike price by the expiration date of the option. This is known as naked option selling.

- To hedge against a futures position. For example: someone who goes long cocoa at 850 can write a 900 strike price call option with about one month of time until option expiration. This allows you to collect the premium of the call option if cocoa settles below 900, based on option expiration. It also allows you to make a profit on the actual futures contract between 851 and 900. This strategy also lowers your margin on the trade and should cocoa continue lower to 800, you at least collect some premium on the option you wrote. Risk lies if cocoa continues to decline because you only collect a certain amount of premium and the futures contract has unlimited risk the lower it goes.

To read the rest of the article as well as power point presentation along with a summary table instantly

|

|

- Longer term, perhaps seasonal

- Day trading/ swing trading, looking for the strength or weakness of one sector versus the other. Gold vs. Silver, Hogs vs. cattle, mini Russel versus mini Dow, heating oil vs unleaded gas, SP vs NQ and more. Certain spreads have specific ratios for them to work and the field of spreads can not be learned overnight and requires effort, time and studying.

|

|

To access a free trial to the ALGOS shown in the chart along with other tools? (Slanted arrows possible buy, pink squares = possible exit/ tighten stops) visit and

sign up for a free trial for 21 days with real-time data.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

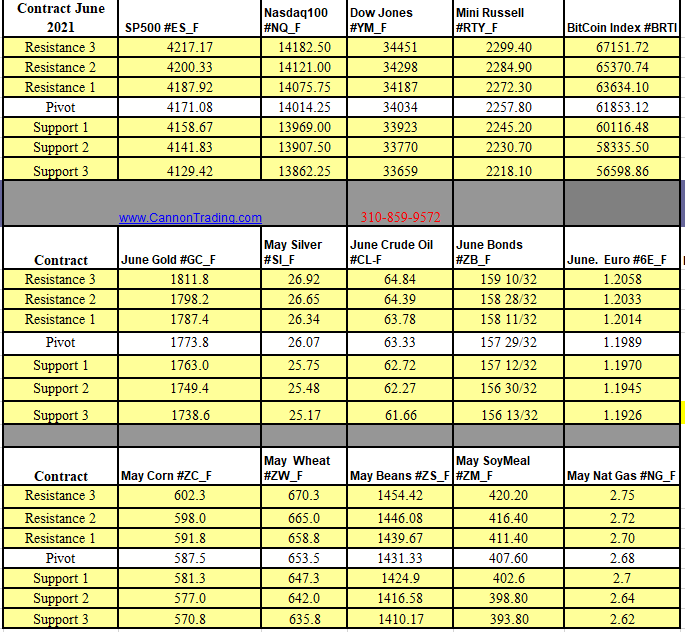

Futures Trading Levels

4-19-2021

Weekly Levels

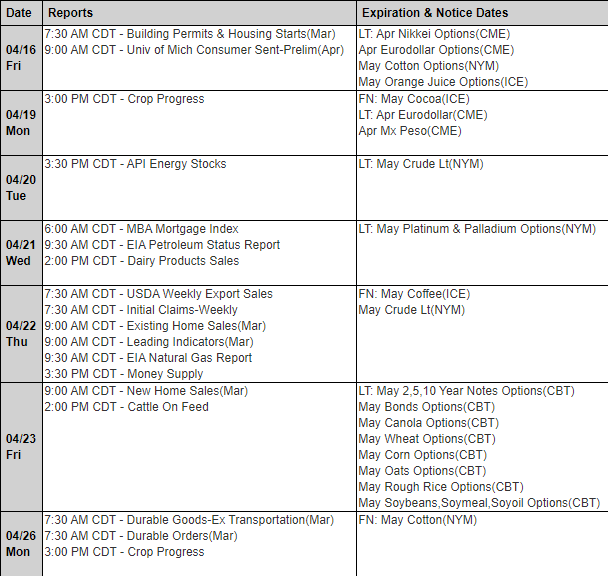

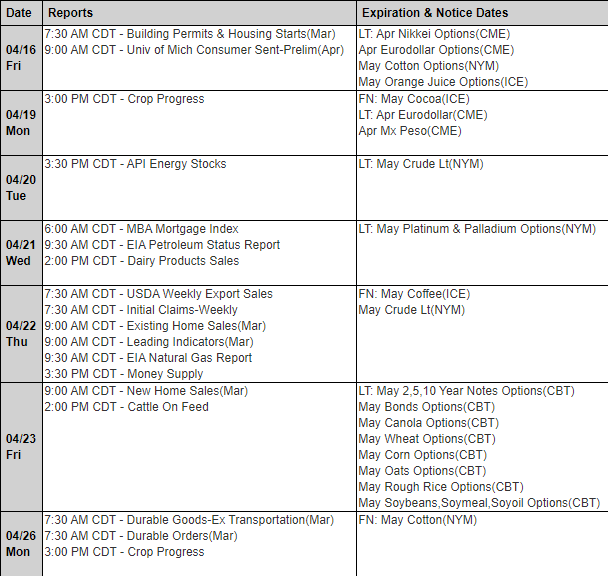

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Weekly Newsletter