SPR Explained & Cattle Outlook & Support and Resistance Levels for 4.05.2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Get Real Time updates and more on our private FB group!

Let’s Talk SPR

by John Thorpe, Senior Broker

Where is the SPR and how much

Sweet Crude do we have? Energy futures contracts have taken our breath away and our bank accounts over the past month. Volatility is directly correlated to levels of uncertainty. A more certain supply and demand futures tend to reduce Volatility greatly. Higher price volatility has historically been linked to greater supply and demand instability. The

Crude oil futures market has seen extraordinary volatility over the last month and for a variety of reasons. One recent reason for the downdraft in

Crude oil futures prices has been the proclamation from the Biden administration that oil will be released from the SPR (Strategic Petroleum Reserve). I have read a number of articles from a number of well respected national news outlets and they all provide a little different information about the size of the reserves and the amount of the limits to daily withdrawals.. You too may have come across some of the confusion. The U.S. Office of Fossil Energy and Carbon Management is our entity in charge of the SPR, a branch of the U.S. Department of Energy and they are responsible for the 4 underground storage locations and recordkeeping. Crude oil traders keeping score some of the rules of the game of the SPR should know, there are limits to daily withdrawals and the holdings are actually quite a mix of sweet crude and sour, all with different industrial uses.

Drawdown Capability

- Maximum nominal drawdown capability – 4.4 million barrels per day

- Time for oil to enter U.S. market – 13 days from Presidential decision

Moving Markets

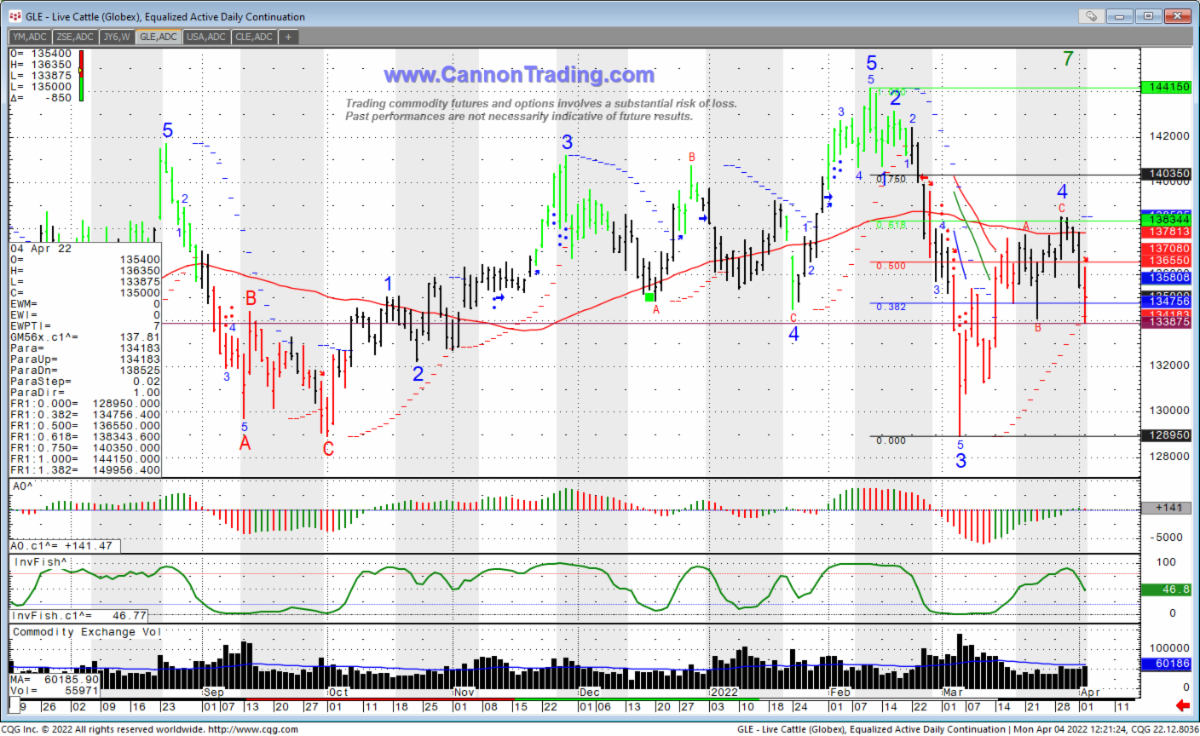

Bearish technical signal on the daily chart.

Can the market break support?

If you are looking for other reference material please

contact your Cannon Broker for lists of solid, informative and helpful trading tomes

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

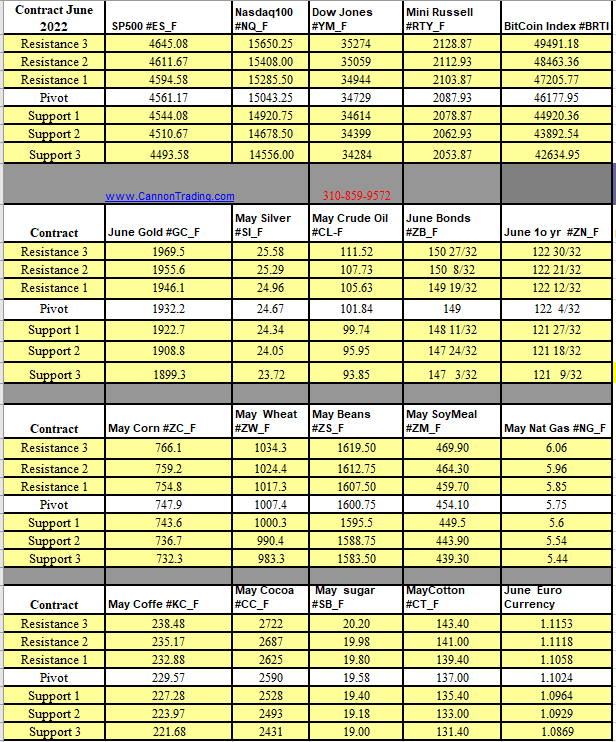

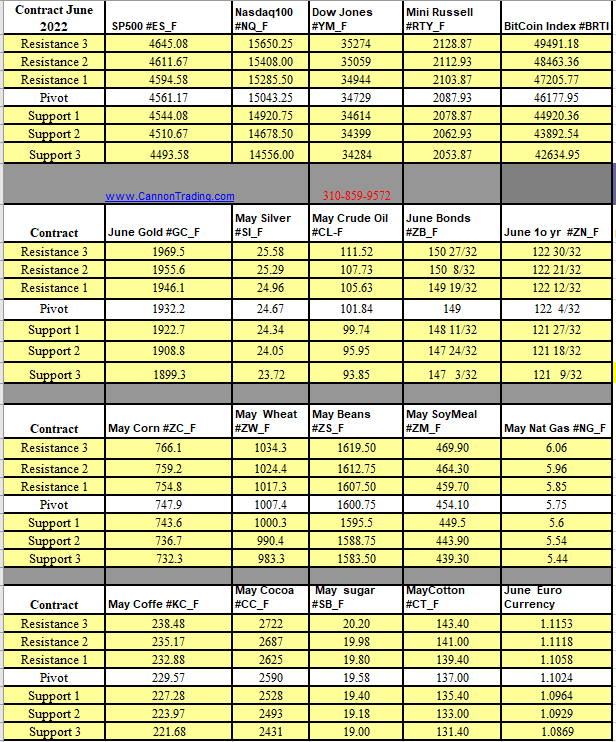

Futures Trading Levels

04-05-2022

Improve Your Trading Skills

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Posted in: Crude Oil | Future Trading News