Dear Traders,

Get Real Time updates and more on our private FB group!

“The Market Keeps Hitting My Stop Orders!” by Mark O’Brien, Senior Broker:

This is a shared annoyance among

futures traders, particularly for those trades where their initial

stop orders are hit. Certainly, this condition can be approached by discussing any trade’s risk – in terms of actual dollars, or number of points or cents. But for purposes of this blog post, let’s approach the condition by discussing strategy. One strategy in particular that can be implemented in lieu of simply placing a stop order is regularly termed a

back spread. It involves taking a position – long or short – in a futures contract, then entering a long, opposing option position. A simple example would be to take a long position in the

E-mini S&P 500 futures contract and purchasing a

put option. The selection of which option to purchase will determine the risk/reward parameters of the overall trade. Generally, the closer to the money, or the deeper in the money the purchased option’s strike price is, the less tolerant the back spread will be to adverse price movement, because as the futures contract incurs losses, so too will the purchased option incur gains. The delta of the option at the time of purchase will provide the initial amount of protection against an adverse price move, expressed as a percentage of a single futures contract (equal to 100%) and which will increase with adverse price movement. Conversely, the protection will decrease with a favorable price move. An important component to this position, of course, is the expiration date of the option. It will not only determine how long the insurance will be in place, but it will also determine in part the overall strategy’s ability to tolerate. An at-the-money option whose expiration date is within days will more effectively provide protection against an adverse price move than one whose expiration date is weeks away, but for a more limited amount of time. Everything considered, if you’re looking for an alternate strategy substitute to simply placing a stop order, a back spread could be considered.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

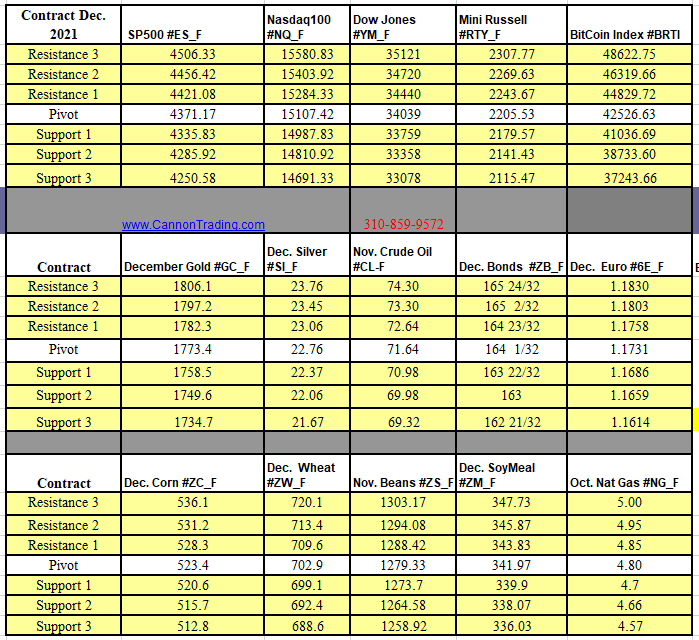

Futures Trading Levels

9-23-2021

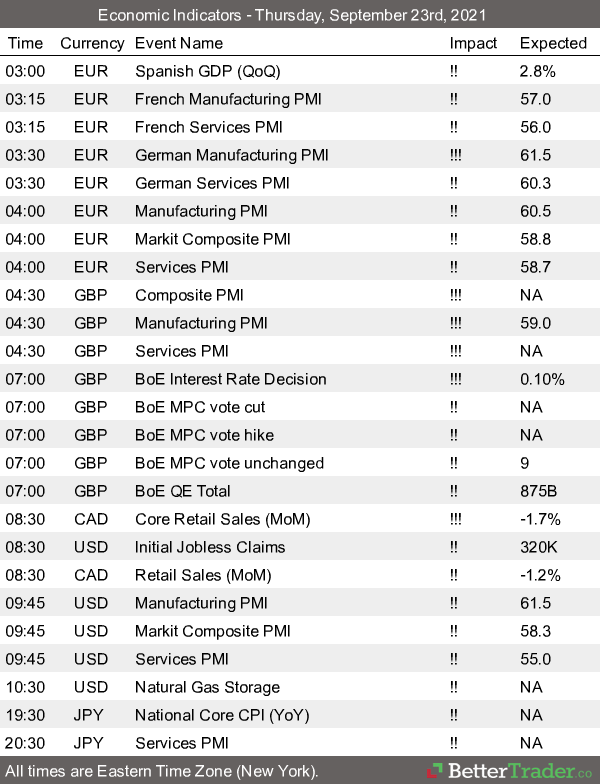

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.

Posted in: Future Trading News | futures trading education | Options Trading