Good Bye BIG S&P500 & Support and Resistance Levels 9.14.2021

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Dear Traders,

Get Real Time updates and more on our private FB group!

Good Bye BIG S&P500 by John Thorpe, senior broker:

A Swan song for the venerable FULL Size or BIG S&P 500 Futures contract.

The initial $500.00 per point then subsequently $250.00 per point

S&P contract is done, over. Because the contract became unwittingly large as the index value increased, the CME will be delisting the “Big” S&P following this week’s expiration leaving the

E-Mini and Micro E-mini contracts as its legacy to thrive.

The price of the index itself became too expensive for smaller investors and lead to the creation of the

ES in 1997 and the MES in 2019 as index values soared from 959.90 on September 17

th 1997 to 4450.00 as of Friday’s close.

This from the CME:

As announced on May 4, 2021, and subject to regulatory review, CME Group will delist its standard-size futures and options on futures contracts on the Standard and Poor’s 500 Stock Price Index (“standard-size contracts”) following the expiration of the September 2021 contracts on Friday, September 17, 2021. After the delisting of the standard-size contracts, the E-mini suite of futures and options on the S&P 500 Index will continue to meet the trading and risk management needs of customer

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

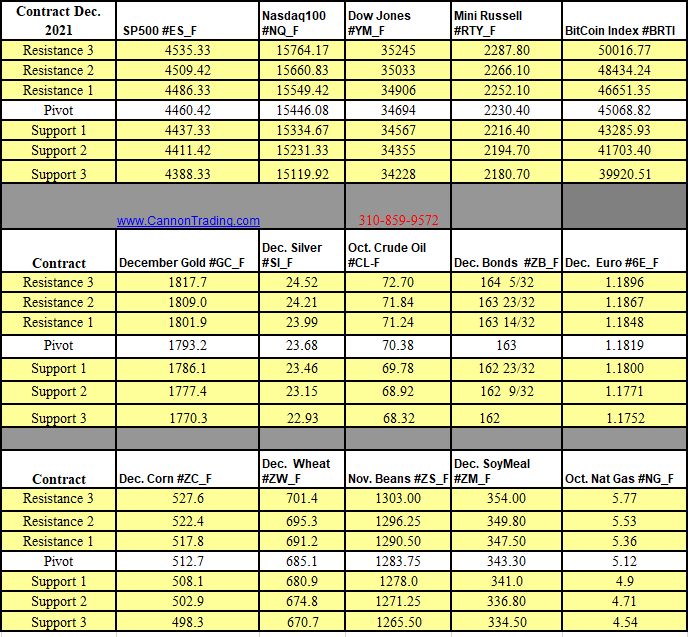

Futures Trading Levels

9-14-2021

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.

Posted in: Future Trading News | Index Futures | Indices