What’s moving markets this week? + Futures Trading Levels for July 19th 2022

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

What’s moving markets this week?

By John Thorpe, Senior Broker

The most salient measure of a recession may be the accumulated results of corporate profits or the lack of during this earnings season. Q-2 earnings reports are picking up steam, Monday we will see 20 with a notable 19:1 split for both Alphabet symbols. GOOGL and GOOG. After market close we have IBM. Before todays open we had mixed numbers relative to estimates with B of A BAC underperforming expectations and Goldman Sachs GS besting by 10% the pre report earnings estimates . Tuesday we’ll see 50 reports Wednesday 80, Thursday 81 and Friday only 30 with a MEME stock Gamestop GME 3;1 split. Netflix NFLX will be Tuesday’s big name reporting after the close with lower expectations of 2.90 per share , if the actual comes in much lower then the “streaming recession” will be in full force. Watchout below NQ and MNQ Wednesday after the close Tesla TSLA reports along with Alcoa AA as additional thermostats for the state of our economy. Estimates are 1.91 and 2.88 per share respectively. Economic numbers

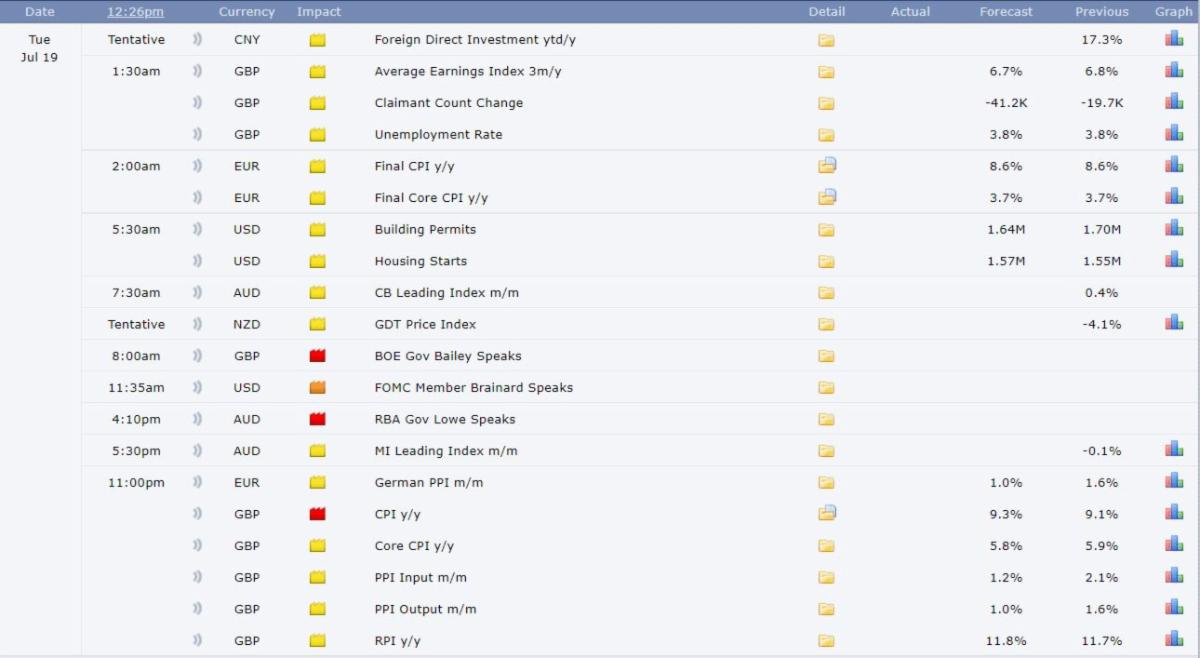

Economic numbers for the week of importance :

Tuesday morning 7:30 CDT am US: Housing starts and permits

Wednesday 9:00am CDT US: Existing Home Sales 9:30 CDT am US: EIA Petroleum Status BOJ Rate announcement @ 9:30 PM CDT

Thursday EuroZone: ECB Rate announcement 7:15 CDT US: Jobless Claims 7:30 CDT

Friday a slew of EuroZone Retail sales and PMI numbers between 1 am CDT and 7:30 CDT with the US:PMI flash number due out at 8:45 CDT.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

07-19-2022

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.