Keyword is CPI….. 02.14.2023 Trading Levels

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Today’s Keyword is CPI

By John Thorpe, Senior Broker

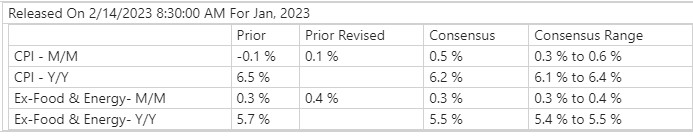

Get Ready! not 1, Not 2 not even 3 CPI reports this week. Tis’ the season for western Govt CPI reporting and none more impactful than the US CPI number to be released at 7:30 PST Tuesday Morning. The Swiss did it Monday morning. The Brits are doing it Wednesday morning, The French release on Friday afternoon. Here is Econoday.com’s Consensus for the U.S. number . Remember, Deviations from consensus drive volatility because the assumption is, consensus is already baked into the market.

Outlook

January’s monthly core rate is expected to hold at December’s as-expected and moderate 0.3 percent. Overall prices are expected to rise 0.5 percent to offset December’s 0.1 percent decline. Annual rates, at 6.5 percent overall in December and 5.7 percent for

The core, are expected to moderate to 6.2 and 5.5 percent. These data releases have roiled the markets in near unprecedented fashion recently directly tied to the interest rate tightening cycle we have been in for 3 quarters. The rest of the week we have a full slate of economic releases, anyone of which will move markets, some longer than others. For example US Retail sales and Industrial Production, Thursday Housing Starts, Jobless claims, Philly Fed and US:PPI Final demand. be alert!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

02-14-2023

#ES, #NQ, #YM, #RTY, #XBT, #GC, #SI, #CL, #ZB, #6E, #ZC, #ZW, #ZS, #ZM, #NG

Improve Your Trading Skills

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.