Weekly Newsletter 1110: Economic Reports Course + Futures Support Resistance Levels for the Week Ahead

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

Cannon Futures Weekly Newsletter Issue # 1110

Dear Traders,

Trading Key Economic Reports

Every trader has done it. You’ve done it, your friends have done it, even your broker has done it at one point early in their career.

Here’s the scenario:

You’ve finally finished your futures education at Cannon Trading Company. You’ve done you’re homework on stops, limits, indicators and price movements for the market you’re trading. You’re ready to go, you enter your limit order and you wait.

**DING**

You get filled. Your heart rate picks up, a wry smile crosses your face and you begin to imagine the possibilities of the one trade you’re in: How much can I make? How much can I lose before it’s too much? You’ve waited through months of technical trading and deep meditation to get here, and now it’s finally paying off with one of your first trades in the live market. Sayonara paper trading; aloha live futures.

Then, all of a sudden, the top of the hour hits and the market starts acting up. It’s getting more volatile and more volatile; it’s picking up speed and taking an unforgiving turn against you. You can’t think straight, all you can think about is your losing position that could get worse and worse as the seconds go by. You race to put in a stop order, but you finally have to settle for a market order just to stop the bleeding. You stare.

**DING**

You’re out of the market. What the hell just happened? You stare at the screen; did your indicators lie to you? Is your system faulty? Did you not listen to your broker? Well, probably not. But you’re down several handles, you’ve lost some money and your pride is aching.

CME Group’s free online course “Learn About Key Economic Events” is a valuable tool that can help you understand:

Gross Domestic Product (GDP)

The Retail Sales Report

The Non-Farm Payroll Report

The Consumer Price Index and Producer Price Index

U.S. Housing Data

The European Central Bank

The FOMC Report

The Oil Data Report

The Importance of Consumer Confidence Surveys

Start learning about the key economic events that will impact your trading.

Take the Short FREE Online Course and Learn about GDP, NFP, FOMC and what it means for your trading!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

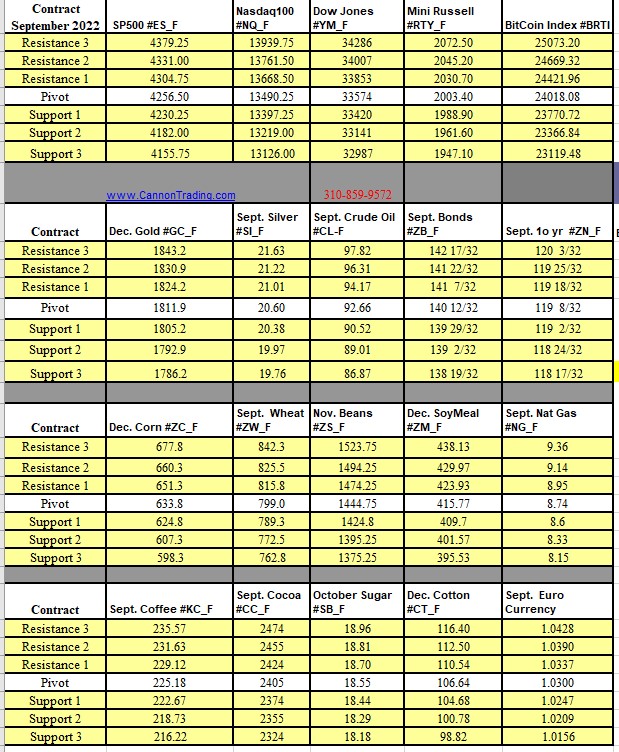

Futures Trading Levels

08-15-2022

Weekly Levels

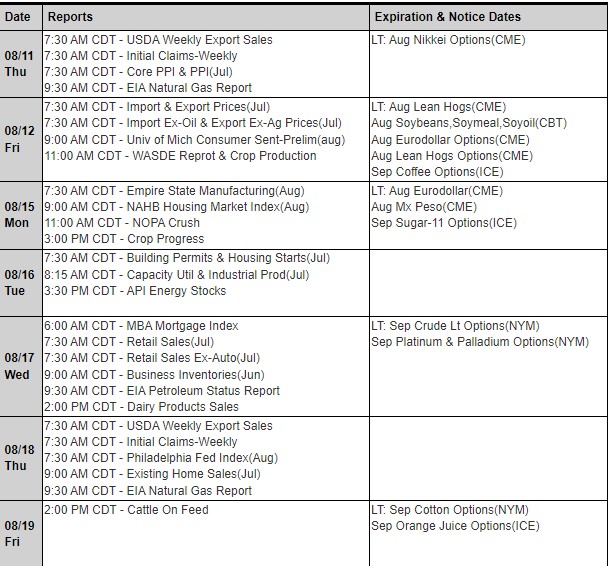

Reports, First Notice (FN), Last trading (LT) Days for the Week:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading